Discovering Asia's Hidden Stock Opportunities with Strong Fundamentals

As global markets experience varied performances, with U.S. indices reaching new highs and Asian markets showing signs of cautious optimism, investors are increasingly looking to Asia for unique opportunities amid evolving economic landscapes. In this context, identifying stocks with strong fundamentals becomes crucial, as these companies often possess the resilience and potential to thrive even when broader market conditions fluctuate.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 23.58% | 25.60% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 34.28% | 60.52% | ★★★★★★ |

| Orient Pharma | NA | 26.94% | 72.62% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| CTCI Advanced Systems | 28.70% | 17.79% | 19.38% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 33.54% | 10.14% | 9.90% | ★★★★★☆ |

| Tibet TourismLtd | 21.50% | 10.05% | 27.69% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Yangzhou Seashine New MaterialsLtd (SZSE:300885)

Simply Wall St Value Rating: ★★★★★★

Overview: Yangzhou Seashine New Materials Co., Ltd. specializes in the research, design, development, production, and sale of powder metallurgy products in China with a market capitalization of CN¥8.38 billion.

Operations: Yangzhou Seashine generates revenue primarily from the sale of powder metallurgy products. The company's net profit margin is noted at 15.5%, reflecting its efficiency in managing costs relative to its sales.

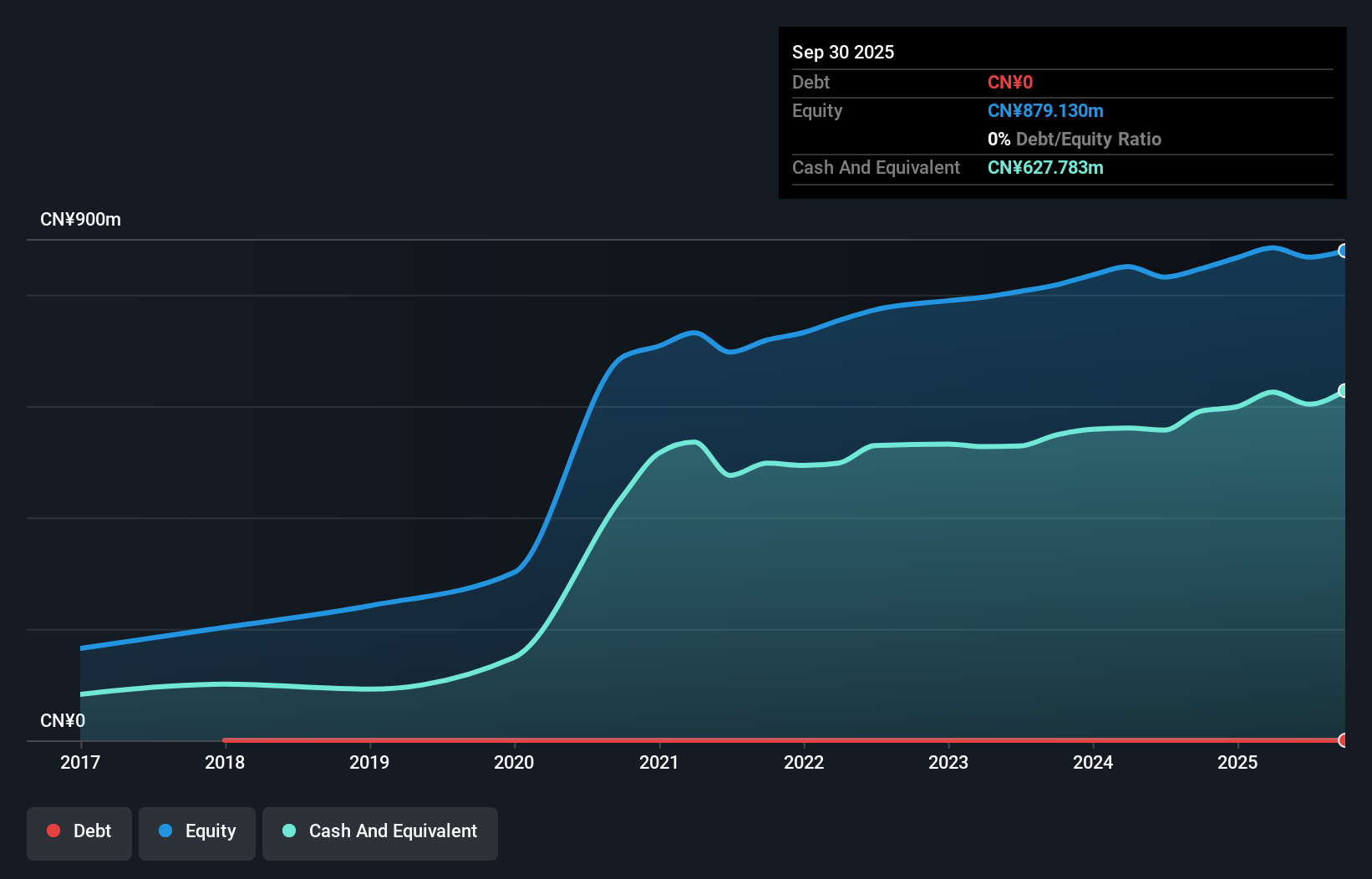

Yangzhou Seashine, a nimble player in the materials sector, has seen its earnings grow by 6.6% over the past year, outpacing the Consumer Durables industry which saw a -3.4% shift. Despite this positive momentum, earnings have decreased by 4.1% annually over five years. Recent financials highlight sales of CNY 202 million for nine months ending September 2025, down from CNY 217 million previously, with net income at CNY 42 million compared to last year's CNY 46 million. The company is debt-free and boasts high-quality past earnings but faces volatility in share price recently noted over three months.

Beijing Waluer Information Technology (SZSE:301380)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Waluer Information Technology Co., Ltd. operates in the information technology sector, focusing on providing innovative tech solutions, with a market cap of CN¥3.83 billion.

Operations: The company generates revenue primarily from its tech solutions, contributing significantly to its financial performance. It has a market capitalization of CN¥3.83 billion.

Beijing Waluer Information Technology, a small player in the tech space, showcases a satisfactory net debt to equity ratio of 1.1%, indicating prudent financial management. Despite earnings declining by 2.8% annually over five years, recent growth of 8.4% outpaces the IT industry's -12.9%. The company reported CNY 793.86 million in sales for the first nine months of 2025, up from CNY 678.55 million last year, though net income dropped to CNY 26.72 million from CNY 34.87 million previously. With a price-to-earnings ratio of 65.8x below industry norms and high-quality past earnings, it remains profitable with free cash flow positive status and well-covered interest payments at an EBIT coverage of 16.8x.

Innostar Service (TPEX:7828)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innostar Service, Inc. engages in the design, manufacturing, and sale of automation equipment and semiconductor probe card related machinery in China with a market capitalization of NT$19.55 billion.

Operations: Innostar Service generates revenue primarily from its semiconductor equipment and services segment, which reported NT$643.68 million. The company's market capitalization stands at NT$19.55 billion.

Innostar Service has shown impressive growth, with earnings surging by 143% over the past year, outpacing the semiconductor industry's modest 2.5% rise. For the third quarter of 2025, sales jumped to TWD 157.02 million from TWD 2.75 million a year earlier, while net income reached TWD 49.75 million compared to a previous loss of TWD 40.55 million. Despite its volatile share price recently, Innostar's high level of non-cash earnings and sufficient cash relative to debt indicate solid financial health and potential for further growth in an evolving market landscape.

- Delve into the full analysis health report here for a deeper understanding of Innostar Service.

Assess Innostar Service's past performance with our detailed historical performance reports.

Make It Happen

- Unlock our comprehensive list of 2494 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报