Middle Eastern Dividend Stocks To Watch In January 2026

In 2025, the Middle Eastern markets showcased a dynamic landscape with Egypt's stock exchange outperforming its Gulf counterparts and regional tensions easing following the UAE's troop withdrawal from Yemen. As we step into January 2026, investors are keenly observing dividend stocks that can offer stability and growth potential amidst fluctuating oil prices and evolving economic conditions.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.46% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.14% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.34% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.15% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.12% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.34% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.47% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.45% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.02% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.92% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Middle Eastern Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

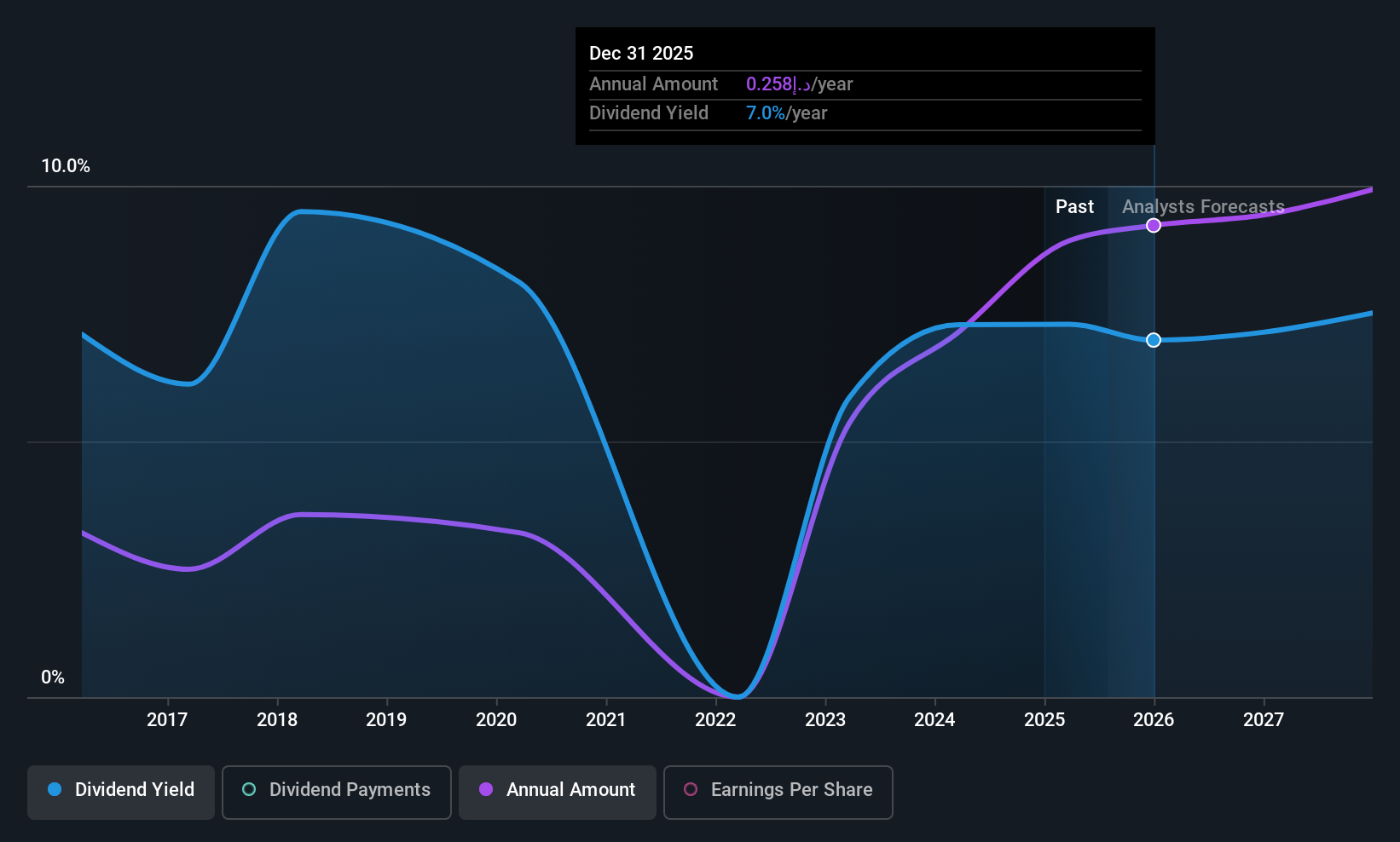

Air Arabia PJSC (DFM:AIRARABIA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Air Arabia PJSC, along with its subsidiaries, offers air travel services and has a market cap of AED21.75 billion.

Operations: Air Arabia PJSC generates revenue primarily from its airline segment, which accounts for AED6.70 billion.

Dividend Yield: 5.4%

Air Arabia PJSC's dividend payments are covered by both earnings and cash flows, with payout ratios of 75.4% and 70.2%, respectively, indicating sustainability despite a volatile track record over the past decade. The company's dividends have increased over this period but remain below top-tier yields in the AE market. Recent financial results show growth, with Q3 sales at AED 2.04 billion and net income at AED 582.5 million, reflecting solid operational performance that supports its dividend strategy.

- Click to explore a detailed breakdown of our findings in Air Arabia PJSC's dividend report.

- Our valuation report unveils the possibility Air Arabia PJSC's shares may be trading at a discount.

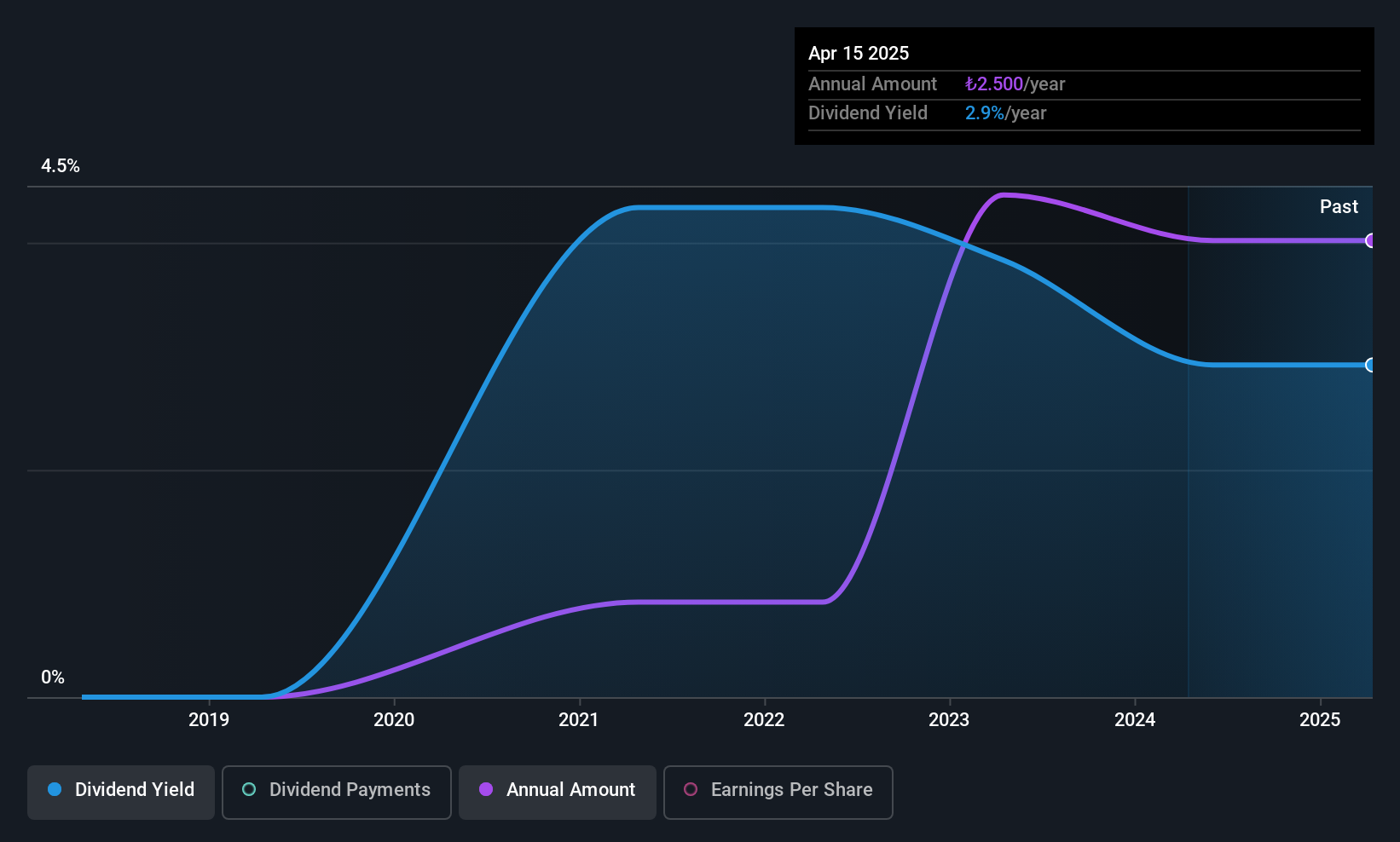

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. operates in the textile and ready-to-wear clothing industry, with a market capitalization of TRY9.14 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. generates revenue primarily from its Apparel segment, which accounts for TRY14.94 billion.

Dividend Yield: 4.4%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri has maintained reliable dividend payments, supported by low payout ratios of 17% for earnings and 25.9% for cash flows, ensuring sustainability despite a short five-year history. Its dividend yield of 4.38% ranks it among the top in Turkey's market. However, recent financial results reveal challenges, with Q3 net income dropping to TRY 0.22 million from TRY 9.36 million last year, impacting future dividend prospects.

- Navigate through the intricacies of Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri is priced higher than what may be justified by its financials.

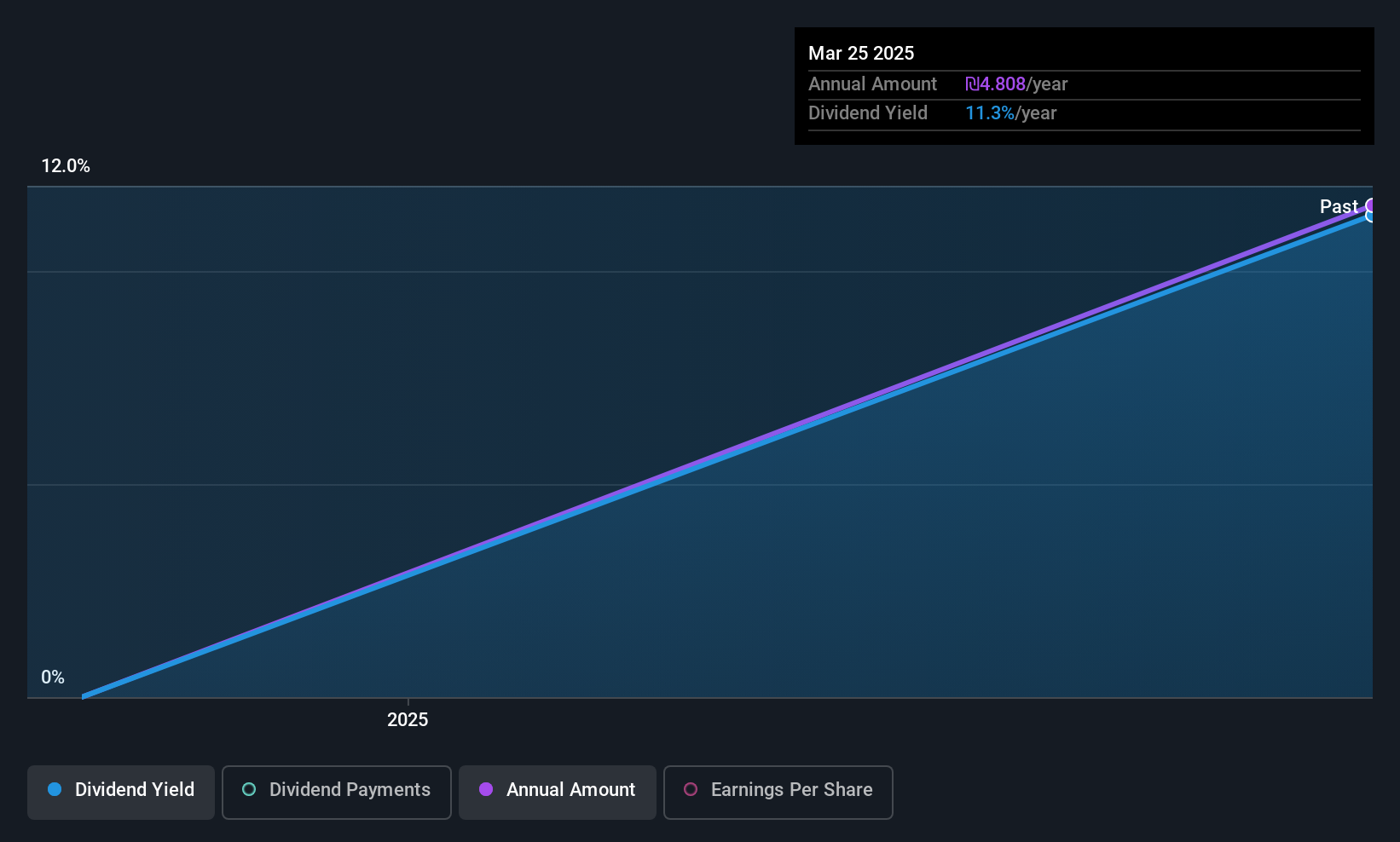

Ayalon Insurance (TASE:AYAL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪2.37 billion, operates in Israel through its subsidiaries offering a range of insurance products.

Operations: Ayalon Insurance Company Ltd generates revenue from several segments including Health (₪707.66 million), General Insurance - Compulsory Vehicle Insurance (₪328.46 million), General Insurance - Property Branches and Others (₪503.66 million), General Insurance - Automobile Property Insurance (₪712.74 million), and Life Insurance and Long-Term Savings - Life Insurance (₪1.22 billion).

Dividend Yield: 5.6%

Ayalon Insurance's dividends are well-supported by earnings and cash flows, with payout ratios of 56.5% and 65.1%, respectively. Its dividend yield of 5.56% ranks it in the top quartile of Israeli payers, though its dividend history is nascent, making long-term stability unclear. Recent earnings growth is robust; Q3 net income rose to ILS 118.87 million from ILS 91.5 million year-over-year, reflecting solid financial performance that could underpin future payouts.

- Delve into the full analysis dividend report here for a deeper understanding of Ayalon Insurance.

- The analysis detailed in our Ayalon Insurance valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Reveal the 58 hidden gems among our Top Middle Eastern Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报