3 Asian Stocks Estimated To Be Undervalued In January 2026

As we enter January 2026, Asian markets are navigating a landscape marked by optimism around artificial intelligence and cautious economic growth forecasts, particularly in China and Japan. In such an environment, identifying undervalued stocks can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19887.98 | 49.7% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1580.06 | 49.7% |

| Nan Juen International (TPEX:6584) | NT$347.00 | NT$687.14 | 49.5% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3163.27 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11032.70 | 49.9% |

| Innovent Biologics (SEHK:1801) | HK$76.25 | HK$151.11 | 49.5% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.21 | 48.7% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1581.79 | 49.4% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's dive into some prime choices out of the screener.

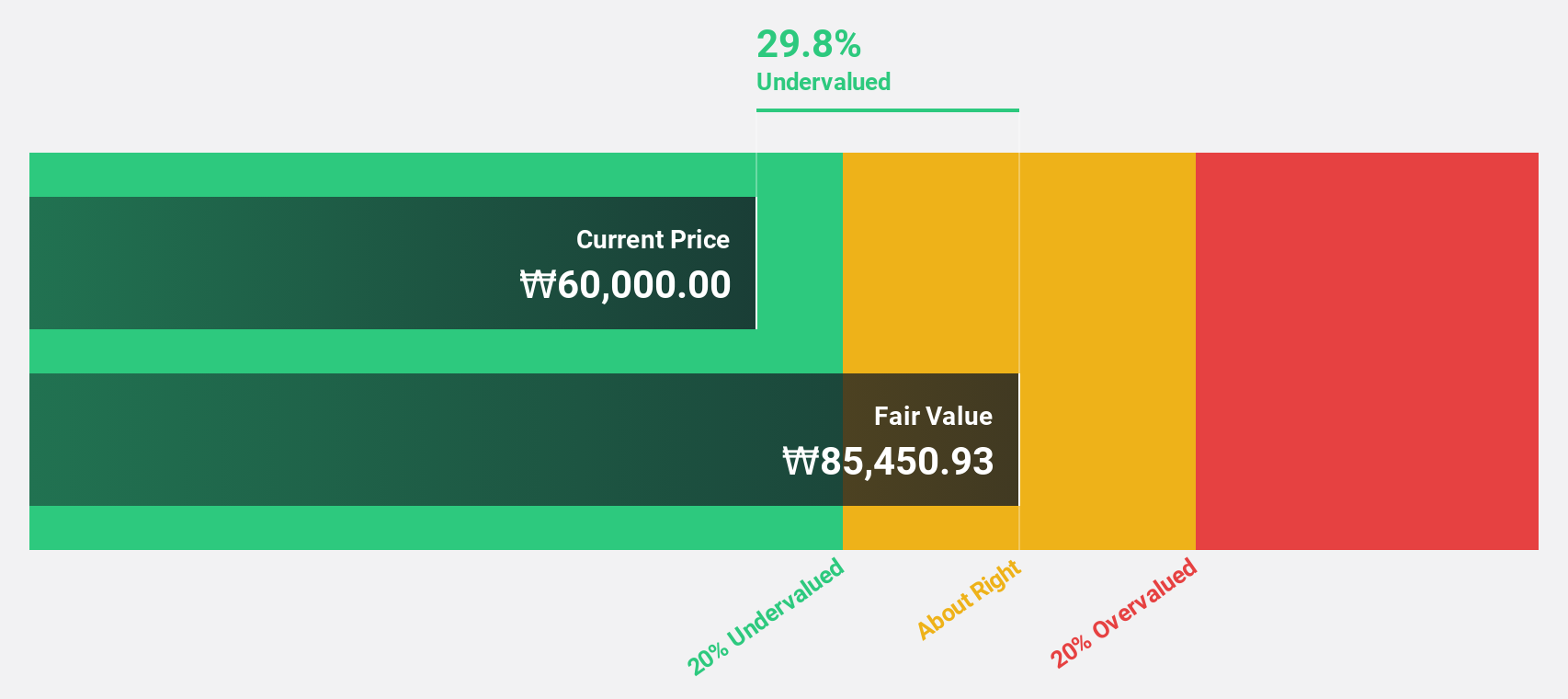

CLASSYS (KOSDAQ:A214150)

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market capitalization of ₩3.56 trillion.

Operations: The company generates revenue primarily from its Surgical & Medical Equipment segment, amounting to ₩317.80 billion.

Estimated Discount To Fair Value: 42%

CLASSYS is trading at a significant discount, 42% below its estimated fair value of ₩94,028.53. Despite a slight decline in sales for the third quarter of 2025, net income more than doubled compared to the previous year. Earnings have grown by 39.1% over the past year and are expected to continue growing significantly at an annual rate of 30.9%. Analysts agree on a potential price increase of about 33.8%.

- According our earnings growth report, there's an indication that CLASSYS might be ready to expand.

- Dive into the specifics of CLASSYS here with our thorough financial health report.

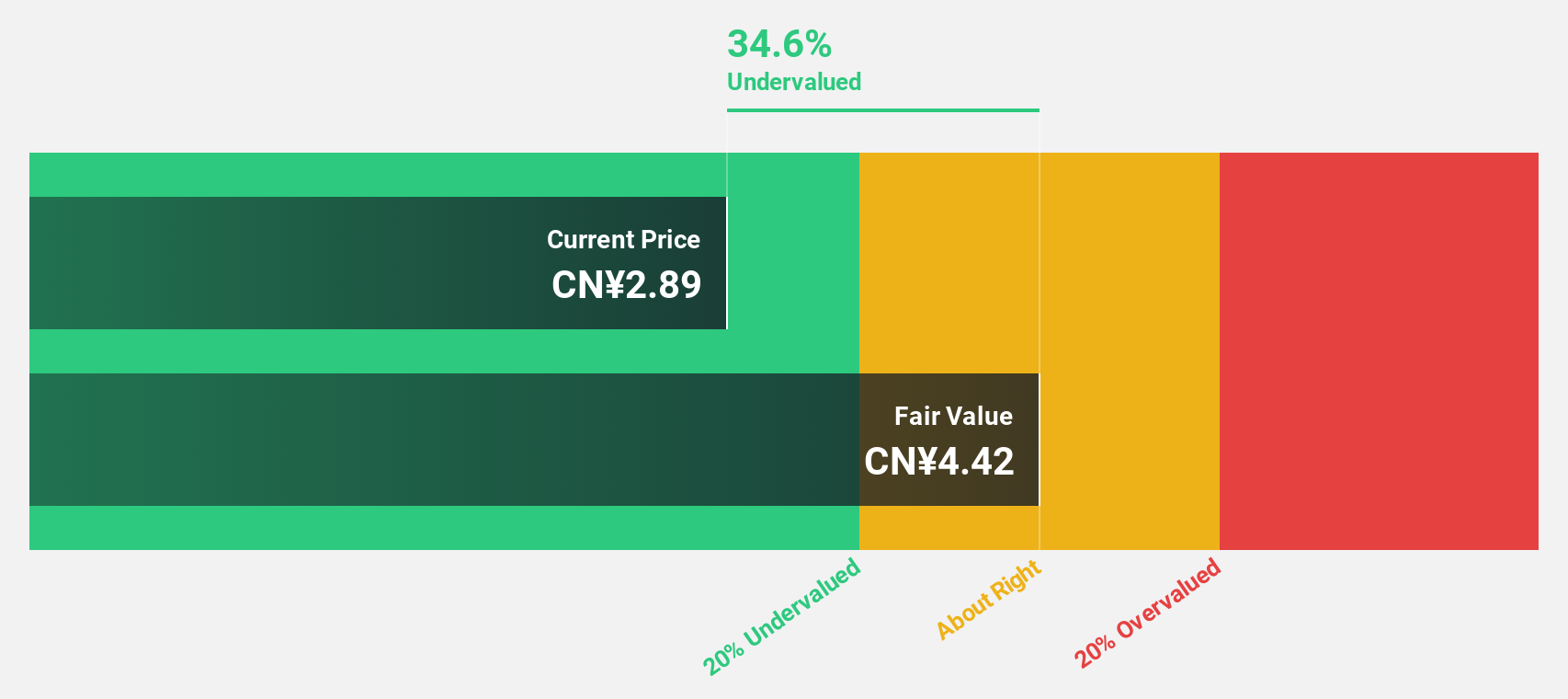

Beiqi Foton MotorLtd (SHSE:600166)

Overview: Beiqi Foton Motor Co., Ltd. is involved in the manufacture and sale of commercial vehicles globally, with a market cap of CN¥23.12 billion.

Operations: Beiqi Foton Motor Co., Ltd. generates revenue through its global operations in the commercial vehicle manufacturing and sales sector.

Estimated Discount To Fair Value: 34%

Beiqi Foton Motor Ltd. is trading at CN¥2.92, significantly below its estimated fair value of CN¥4.43, indicating a potential undervaluation based on cash flows. The company's earnings have grown by 37.6% over the past year and are forecast to grow at 39.14% annually, outpacing the Chinese market's average growth rate of 27.5%. Recent innovations in new energy vehicle platforms highlight Foton's strategic focus on sustainable logistics solutions, potentially enhancing future cash flows and profitability.

- The analysis detailed in our Beiqi Foton MotorLtd growth report hints at robust future financial performance.

- Get an in-depth perspective on Beiqi Foton MotorLtd's balance sheet by reading our health report here.

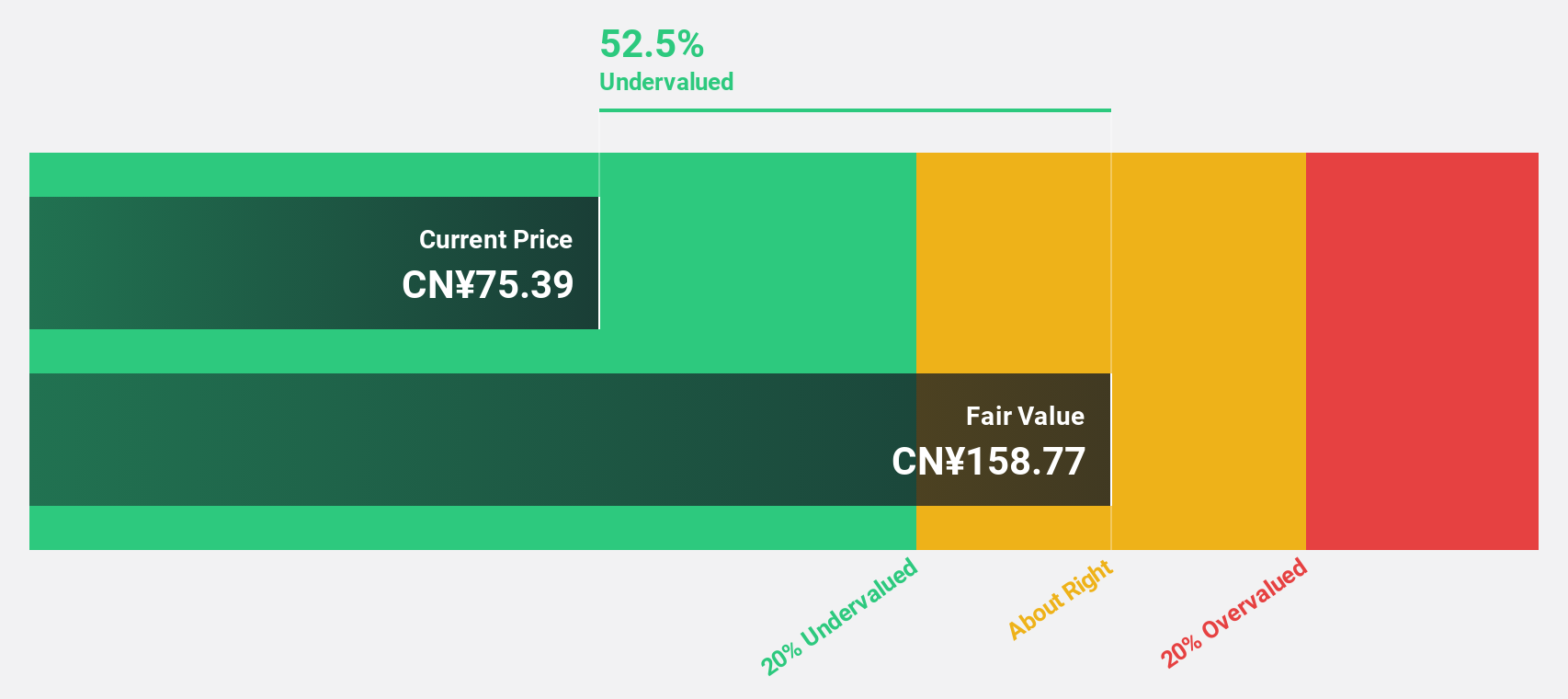

Xiamen Amoytop Biotech (SHSE:688278)

Overview: Xiamen Amoytop Biotech Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs both in China and internationally, with a market cap of CN¥34.16 billion.

Operations: The company's revenue is primarily derived from its biologics segment, which generated CN¥3.34 billion.

Estimated Discount To Fair Value: 48.5%

Xiamen Amoytop Biotech is trading at CN¥83.68, well below its estimated fair value of CN¥162.36, suggesting it is undervalued based on cash flows. The company's earnings have grown by 26.9% over the past year and are forecast to grow significantly at 34.1% annually, surpassing the Chinese market's average growth rate of 27.5%. Despite high non-cash earnings, strong revenue growth projections and a high return on equity forecast support its potential for improved financial performance.

- The growth report we've compiled suggests that Xiamen Amoytop Biotech's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Xiamen Amoytop Biotech stock in this financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 260 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报