3 Stocks That May Be Trading Below Estimated Value

As the U.S. stock market wraps up 2025 with significant gains despite a late-year dip, investors are keenly observing opportunities that may arise from stocks trading below their estimated value. In this environment, identifying undervalued stocks involves analyzing companies that demonstrate strong fundamentals and potential for growth relative to their current market price, particularly as several technology firms have driven substantial index gains this year.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $11.68 | $23.04 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $30.94 | $60.79 | 49.1% |

| Investar Holding (ISTR) | $26.72 | $52.60 | 49.2% |

| Horizon Bancorp (HBNC) | $16.96 | $33.83 | 49.9% |

| Hims & Hers Health (HIMS) | $32.47 | $63.39 | 48.8% |

| Heritage Financial (HFWA) | $23.65 | $46.41 | 49% |

| Gaotu Techedu (GOTU) | $2.32 | $4.56 | 49.1% |

| Dime Community Bancshares (DCOM) | $30.09 | $60.09 | 49.9% |

| CNB Financial (CCNE) | $26.17 | $50.84 | 48.5% |

| BillionToOne (BLLN) | $81.84 | $160.13 | 48.9% |

We'll examine a selection from our screener results.

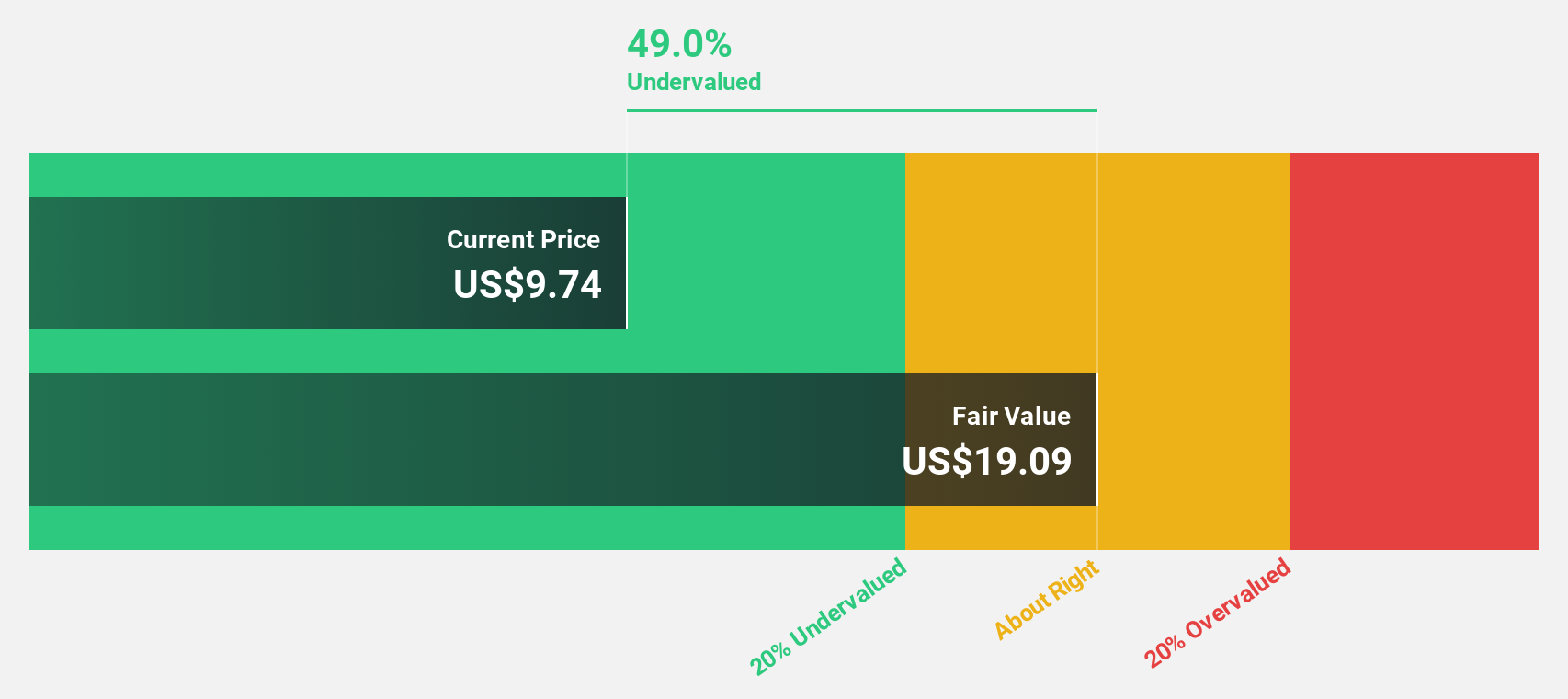

Eagle Bancorp (EGBN)

Overview: Eagle Bancorp, Inc. is the bank holding company for EagleBank, offering commercial and consumer banking services mainly in the United States, with a market cap of $640.83 million.

Operations: Eagle Bancorp generates its revenue primarily from its banking segment, which amounts to $3.97 million.

Estimated Discount To Fair Value: 33%

Eagle Bancorp is trading at US$21.42, significantly below its estimated fair value of US$31.99, indicating it may be undervalued based on cash flows. Despite recent financial challenges, including a net loss of US$67.51 million in Q3 2025 and substantial net charge-offs, the company is expected to become profitable within three years with revenue growth projected at 42.3% annually—outpacing the broader U.S. market's growth rate of 10.5%.

- The growth report we've compiled suggests that Eagle Bancorp's future prospects could be on the up.

- Click here to discover the nuances of Eagle Bancorp with our detailed financial health report.

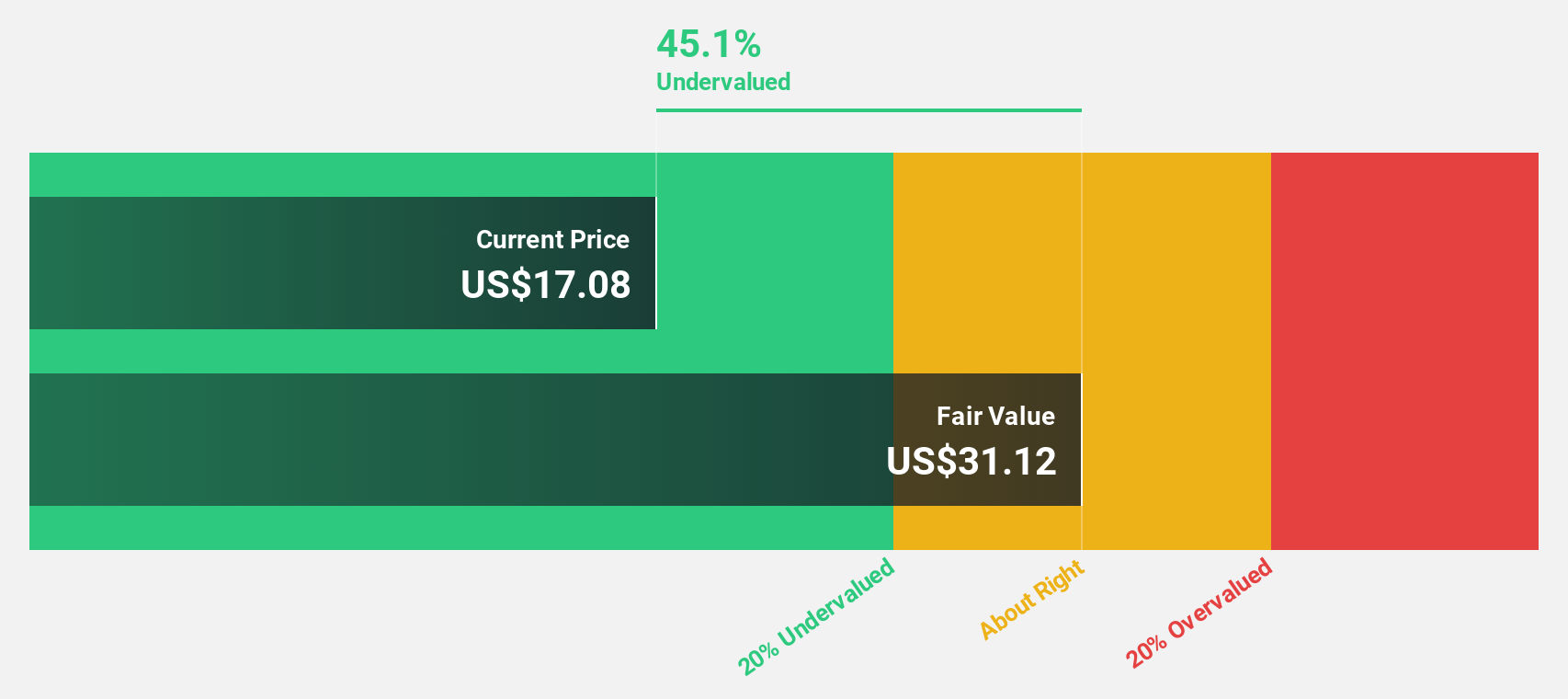

Inter & Co (INTR)

Overview: Inter & Co, Inc. operates in banking and spending, investments, insurance brokerage, and inter shop sectors in Brazil and the United States with a market cap of $3.74 billion.

Operations: The company's revenue segments include Banking & Spending at R$4.62 billion, Inter Shop at R$396.43 million, Investments at R$276.33 million, and Insurance Brokerage at R$232.73 million.

Estimated Discount To Fair Value: 10.1%

Inter & Co is trading at $8.48, slightly below its estimated fair value of $9.43, suggesting potential undervaluation based on cash flows. The company has demonstrated robust earnings growth, with a net income increase to BRL 336.35 million in Q3 2025 from BRL 242.67 million the previous year. However, it faces challenges with a high bad loans ratio of 8.8%, which could impact future profitability despite strong projected revenue and earnings growth rates exceeding market averages.

- Insights from our recent growth report point to a promising forecast for Inter & Co's business outlook.

- Dive into the specifics of Inter & Co here with our thorough financial health report.

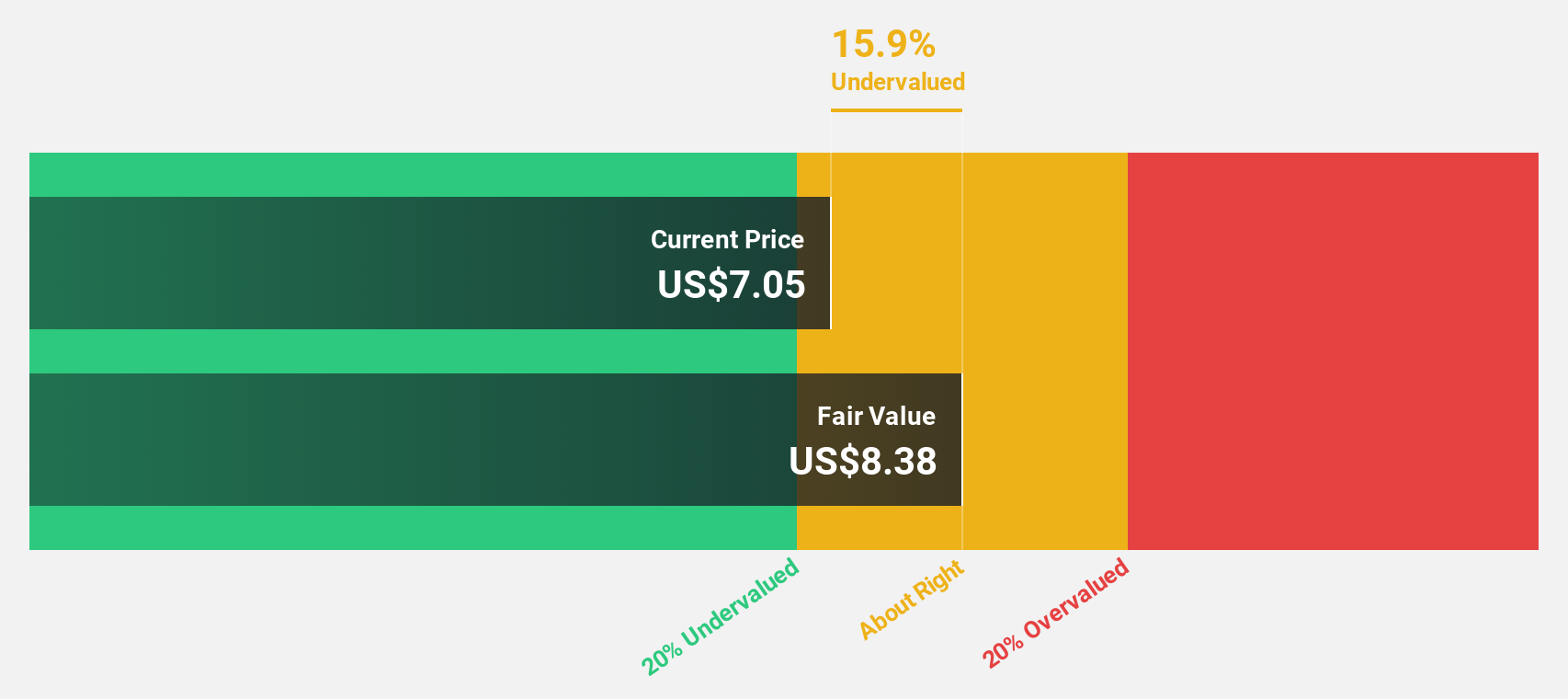

Semrush Holdings (SEMR)

Overview: Semrush Holdings, Inc. develops an online visibility management software-as-a-service platform operating in the United States, the United Kingdom, and internationally with a market cap of approximately $1.77 billion.

Operations: The company's revenue is primarily derived from its software and programming segment, totaling $428.63 million.

Estimated Discount To Fair Value: 15.5%

Semrush Holdings is trading at US$11.89, below its estimated fair value of US$14.08, indicating potential undervaluation based on cash flows. Despite a recent net loss of US$2.14 million in Q3 2025, the company forecasts significant profit growth over the next three years and expects revenue to grow faster than the U.S. market average at 13.6% annually. The recent Adobe acquisition offer for $2 billion underscores its strategic value amidst expanding AI-driven product offerings like Semrush One and ChatGPT integration.

- Upon reviewing our latest growth report, Semrush Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Semrush Holdings.

Key Takeaways

- Access the full spectrum of 188 Undervalued US Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报