Top Growth Companies With High Insider Ownership In January 2026

As the U.S. stock market wraps up 2025 with impressive double-digit gains despite a late-year dip, investors are increasingly focused on companies that not only demonstrate robust growth potential but also have significant insider ownership. In this environment, high insider ownership can be a positive indicator of confidence in a company's future prospects, aligning insiders' interests with those of shareholders and potentially offering added stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.8% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 43.3% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

Let's explore several standout options from the results in the screener.

monday.com (MNDY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: monday.com Ltd. develops software applications across various regions including the United States, Europe, the Middle East, Africa, and the United Kingdom, with a market cap of approximately $7.49 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, which generated $1.17 billion.

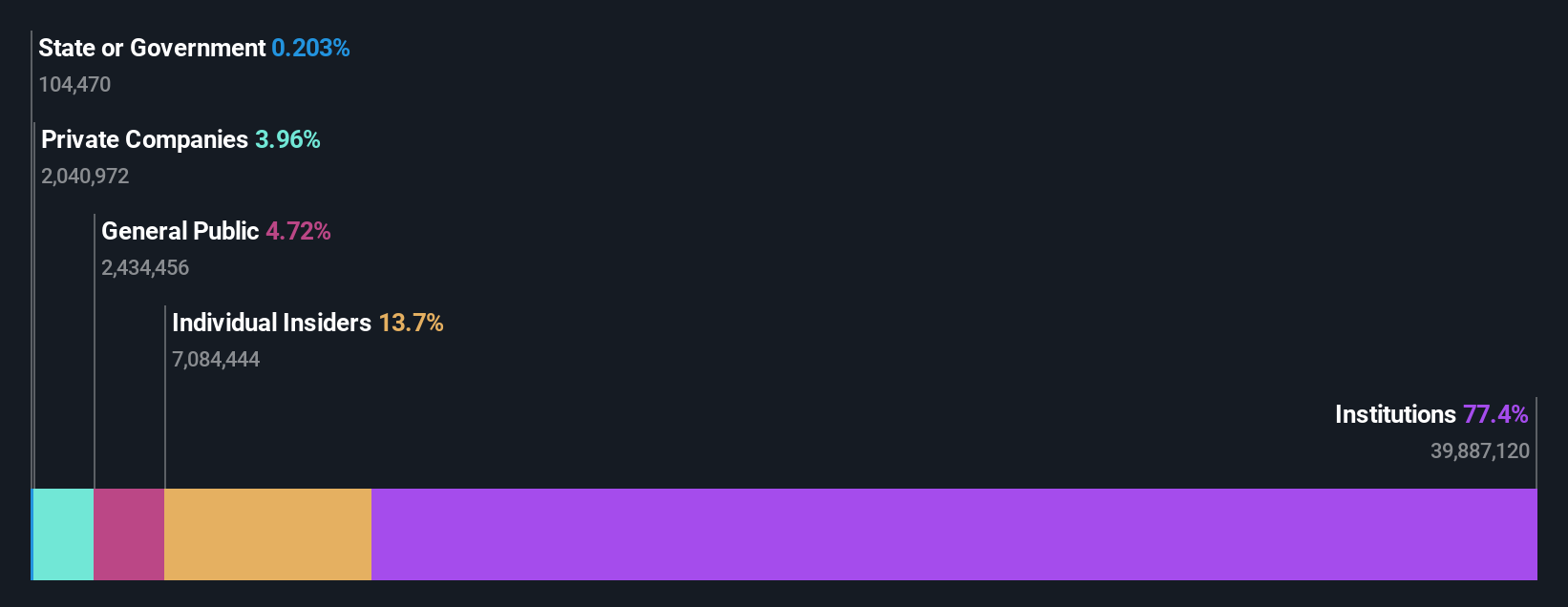

Insider Ownership: 13.7%

monday.com demonstrates robust growth potential, with earnings forecasted to grow significantly at 41.5% annually, outpacing the US market average. Recent Q3 results show a transition from a net loss to a net income of US$13.05 million year-over-year, alongside strong revenue growth. The company is trading below its estimated fair value and has formed strategic partnerships like the one with Bonds Flying Roos, enhancing its global presence and operational capabilities.

- Dive into the specifics of monday.com here with our thorough growth forecast report.

- Our valuation report here indicates monday.com may be undervalued.

New Fortress Energy (NFE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: New Fortress Energy Inc. is an integrated gas-to-power energy infrastructure company offering energy and development services globally, with a market cap of approximately $313 million.

Operations: The company generates revenue through its Ships segment, contributing $145.03 million, and its Terminals and Infrastructure segment, which brings in $1.53 billion.

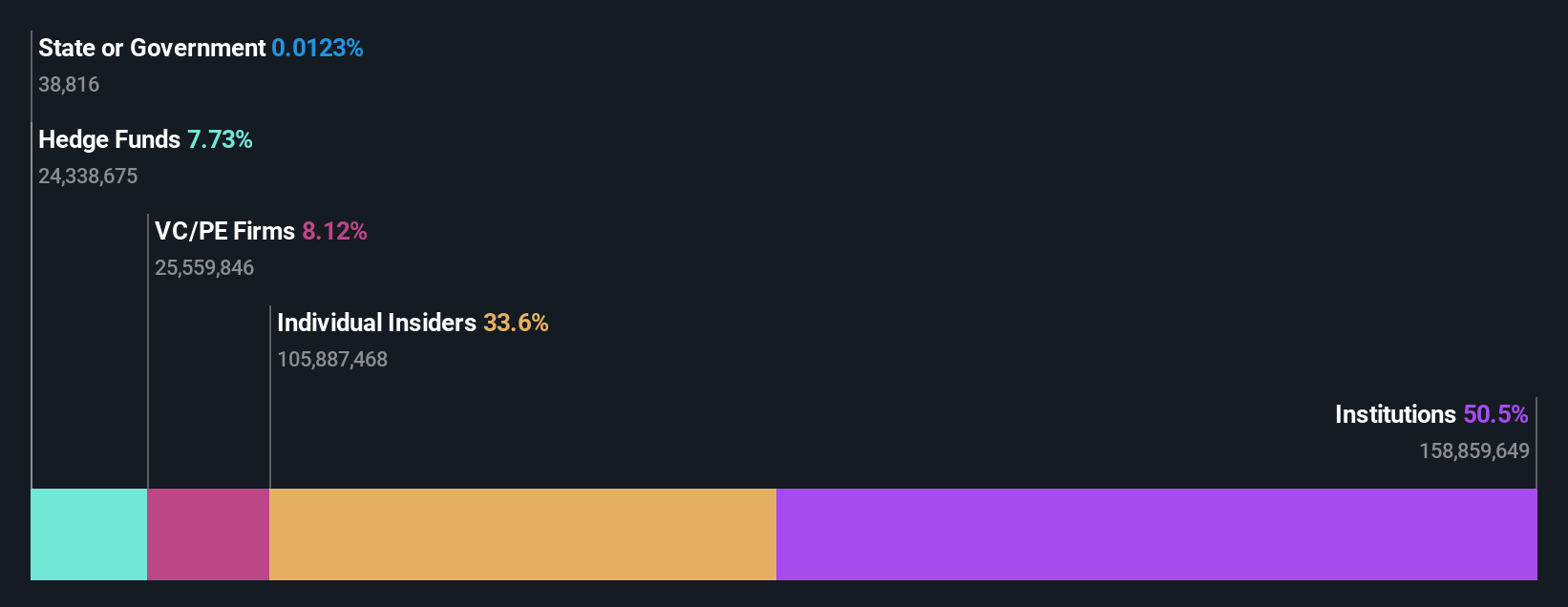

Insider Ownership: 36.9%

New Fortress Energy is poised for substantial growth, with revenue expected to increase at 24.7% annually, significantly surpassing the US market average. However, recent financial challenges have emerged as the company entered forbearance agreements due to missed debt payments totaling over US$32 million. Despite these setbacks, NFE secured a 7-year Gas Supply Agreement in Puerto Rico and achieved operational milestones in Brazil, reflecting strategic expansion efforts amidst financial restructuring initiatives.

- Unlock comprehensive insights into our analysis of New Fortress Energy stock in this growth report.

- Our valuation report unveils the possibility New Fortress Energy's shares may be trading at a discount.

Pattern Group (PTRN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pattern Group Inc. leverages proprietary technology and AI to accelerate brands on ecommerce marketplaces, with a market cap of $2.09 billion.

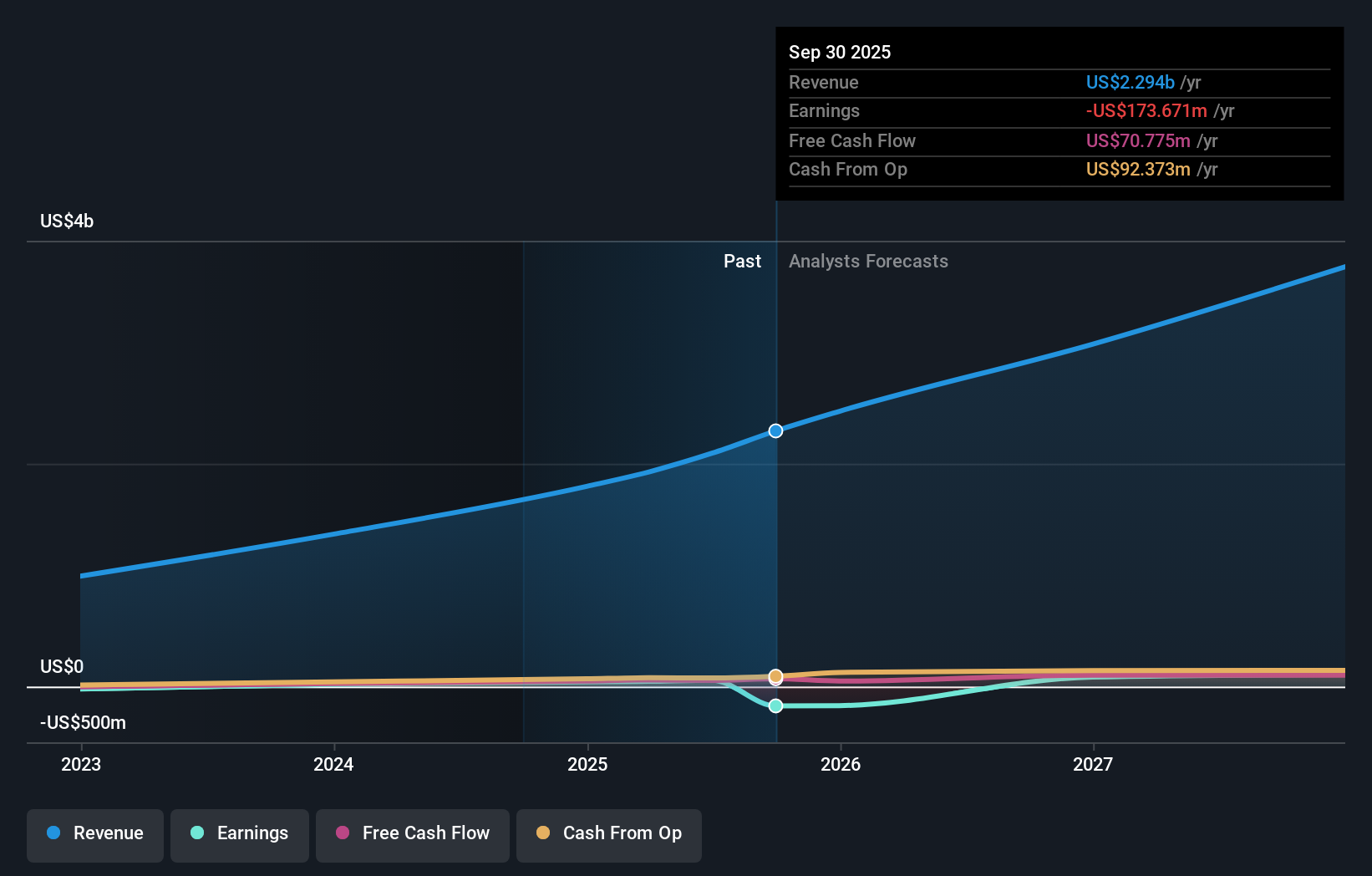

Operations: The company's revenue segment from online retailers amounts to $2.29 billion.

Insider Ownership: 28.2%

Pattern Group is expected to achieve profitability within three years, with earnings projected to grow 56.4% annually. Revenue growth forecasts of 17.9% per year outpace the US market average, while trading at a significant discount to its estimated fair value suggests potential upside. Recent expansions in logistics services enhance operational capabilities but recent financial results showed a net loss despite sales growth, reflecting ongoing challenges in achieving sustainable profitability.

- Click here and access our complete growth analysis report to understand the dynamics of Pattern Group.

- The valuation report we've compiled suggests that Pattern Group's current price could be quite moderate.

Summing It All Up

- Get an in-depth perspective on all 211 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报