Top Dividend Stocks To Consider For Your Portfolio

As 2025 comes to a close, major U.S. stock indexes have experienced a strong year overall despite ending with several consecutive sessions of losses. With the Nasdaq, S&P 500, and Dow Jones Industrial Average posting significant gains driven by advances in technology stocks, investors may find it timely to consider dividend stocks that can offer stability and income in such an environment.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.86% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.46% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.81% | ★★★★★★ |

| OceanFirst Financial (OCFC) | 4.46% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.43% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.11% | ★★★★★★ |

| Ennis (EBF) | 5.55% | ★★★★★★ |

| Dillard's (DDS) | 5.15% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.15% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.55% | ★★★★★★ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

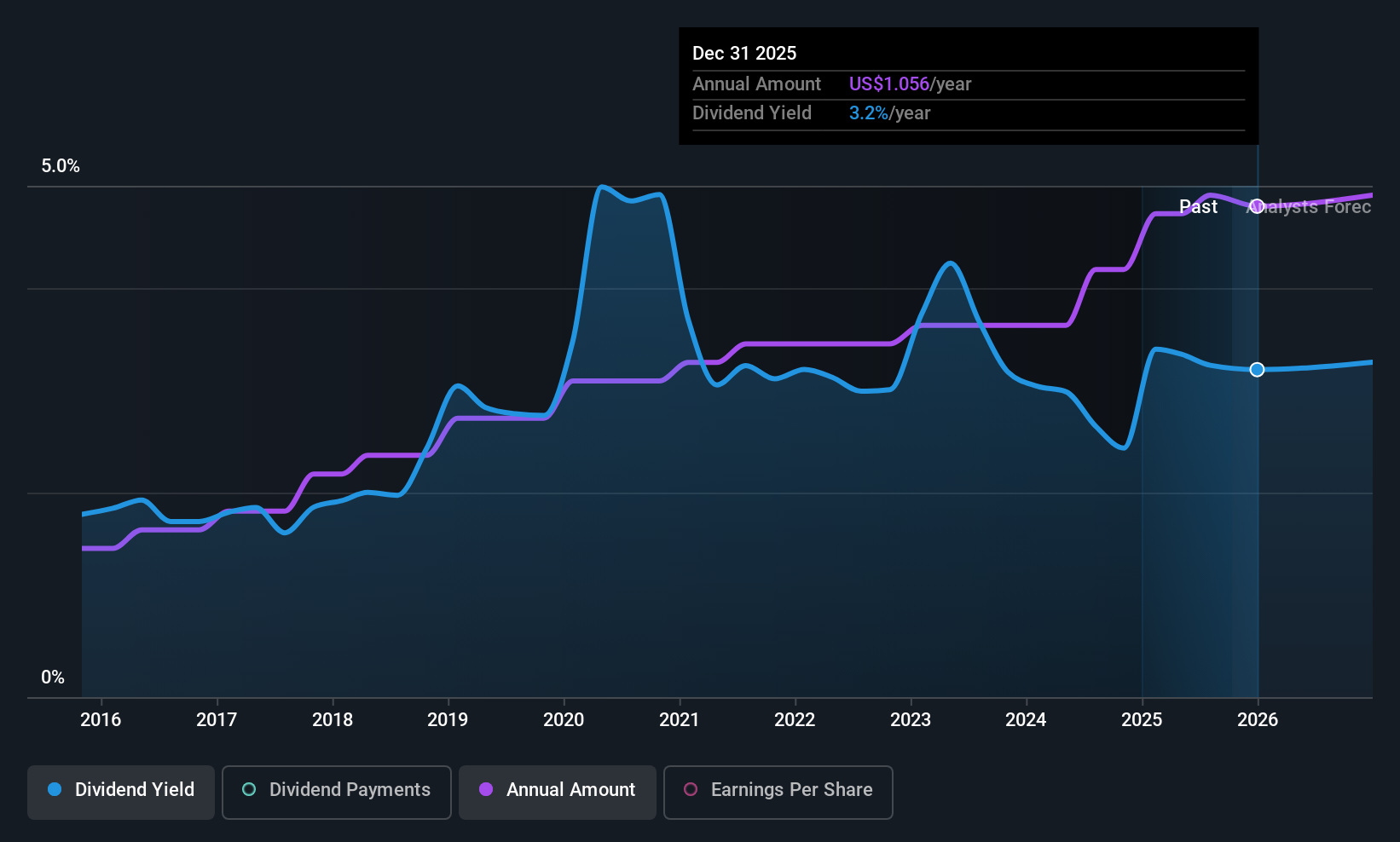

Orrstown Financial Services (ORRF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Orrstown Financial Services, Inc. is the financial holding company for Orrstown Bank, offering commercial banking and financial advisory services to a diverse range of clients in the United States, with a market cap of $692.01 million.

Operations: Orrstown Financial Services, Inc. generates revenue primarily through its Community Banking segment, which accounts for $247.30 million.

Dividend Yield: 3%

Orrstown Financial Services offers a stable dividend, currently at US$0.27 per share, with a payout ratio of 26.8%, indicating strong coverage by earnings. The company's dividends have grown consistently over the past decade and are projected to remain well-covered in the coming years. Despite trading below estimated fair value, its dividend yield of 3.05% is lower than top-tier payers in the U.S., but it remains reliable and sustainable amidst recent earnings growth.

- Get an in-depth perspective on Orrstown Financial Services' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Orrstown Financial Services is trading behind its estimated value.

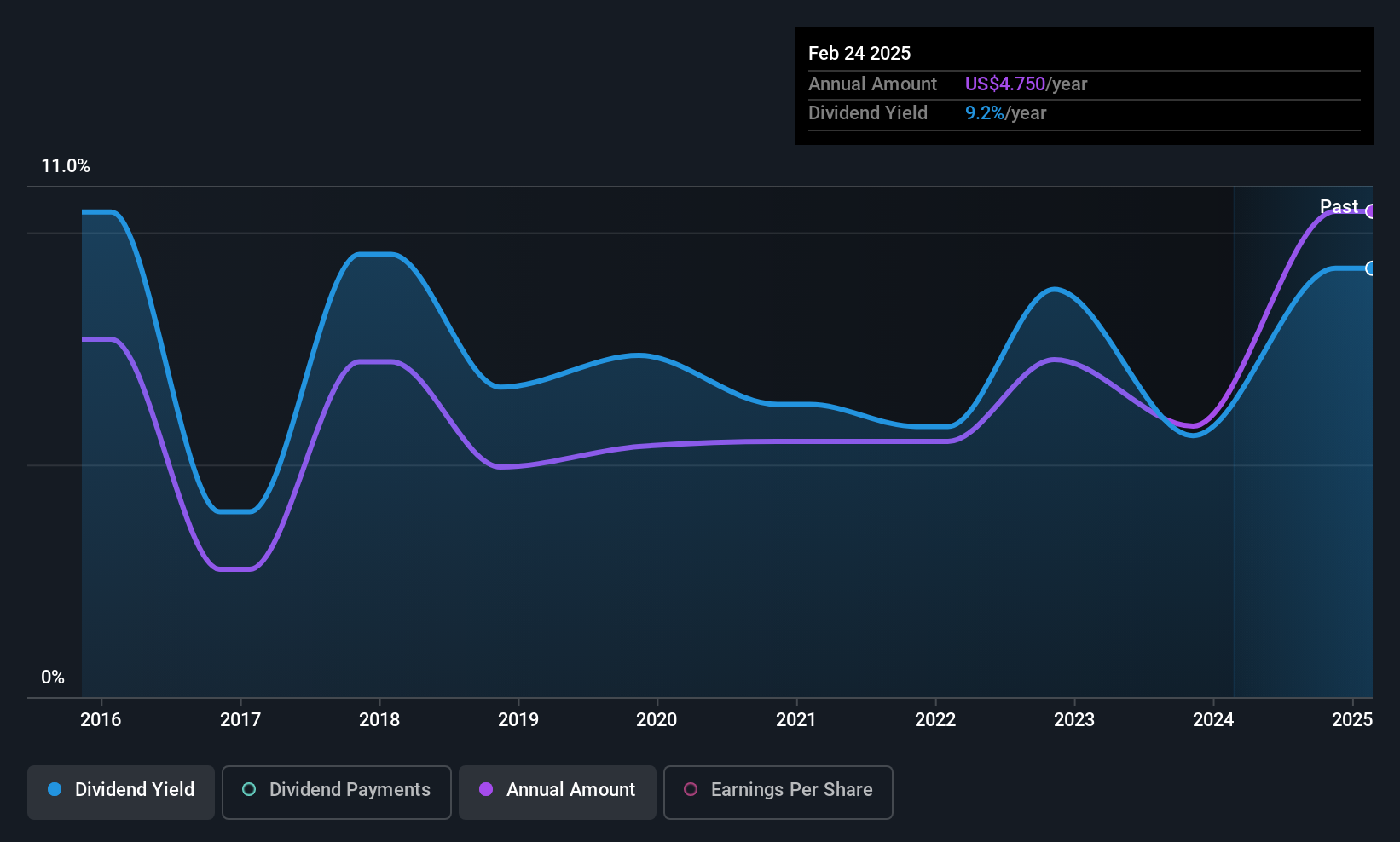

General American Investors Company (GAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: General American Investors Company, Inc. is a publicly owned investment manager with a market cap of approximately $1.37 billion.

Operations: General American Investors Company, Inc. generates its revenue primarily from Financial Services - Closed End Funds, amounting to $27.65 million.

Dividend Yield: 8.1%

General American Investors Company recently announced a special dividend of US$5.95 per share, alongside a regular dividend of US$0.45 per share, both payable in December 2025. While its current yield is among the top 25% in the U.S., its dividend history shows volatility with occasional drops over 20%. The payout ratio sits at a reasonable 58%, suggesting coverage by earnings, though past payments have been unreliable and impacted by large one-off items.

- Delve into the full analysis dividend report here for a deeper understanding of General American Investors Company.

- Insights from our recent valuation report point to the potential undervaluation of General American Investors Company shares in the market.

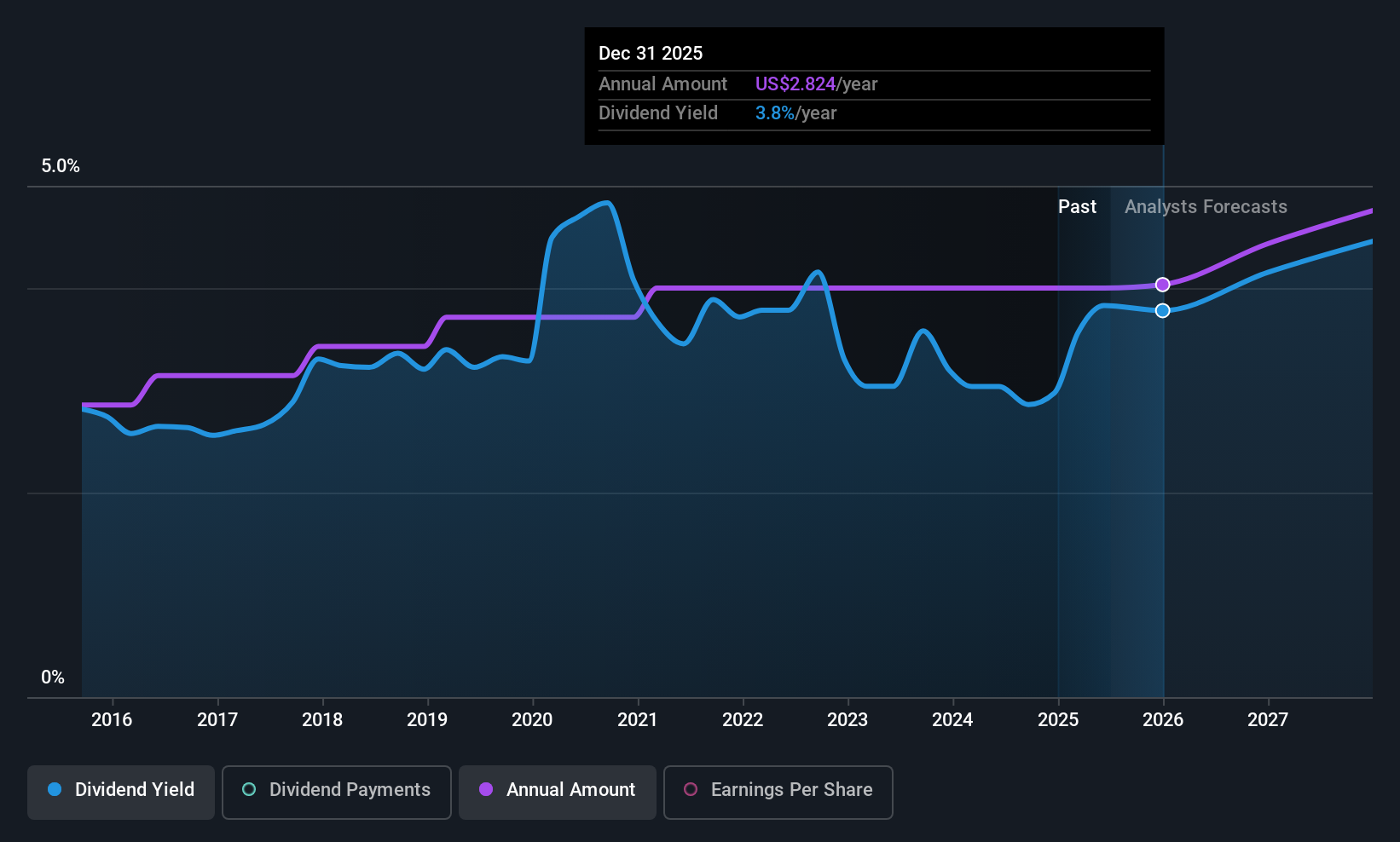

Omnicom Group (OMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Omnicom Group Inc., along with its subsidiaries, provides advertising, marketing, and corporate communications services and has a market cap of approximately $25.40 billion.

Operations: Omnicom Group Inc. generates $16.07 billion in revenue from its advertising, marketing, and corporate communications services segment.

Dividend Yield: 4%

Omnicom Group's dividend yield of 3.96% is below the top quartile in the U.S., but its dividends are well-covered by a 41% payout ratio and stable cash flows. The company has consistently increased dividends over the past decade, with a recent quarterly rise to US$0.80 per share. Despite high debt levels, Omnicom's recent merger with Interpublic Group and fixed-income offerings totaling US$2.76 billion reflect strategic financial maneuvers to support its operations and commitments.

- Navigate through the intricacies of Omnicom Group with our comprehensive dividend report here.

- According our valuation report, there's an indication that Omnicom Group's share price might be on the cheaper side.

Next Steps

- Take a closer look at our Top US Dividend Stocks list of 121 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报