3 European Dividend Stocks Offering Up To 15.3% Yield

As the European markets edge closer to record highs, buoyed by optimism around future earnings and economic prospects, investors are increasingly looking towards dividend stocks for stable returns. In this environment of cautious optimism, identifying stocks that offer robust dividend yields can be a strategic approach to enhancing portfolio income.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.44% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.38% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.31% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.81% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.18% | ★★★★★★ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

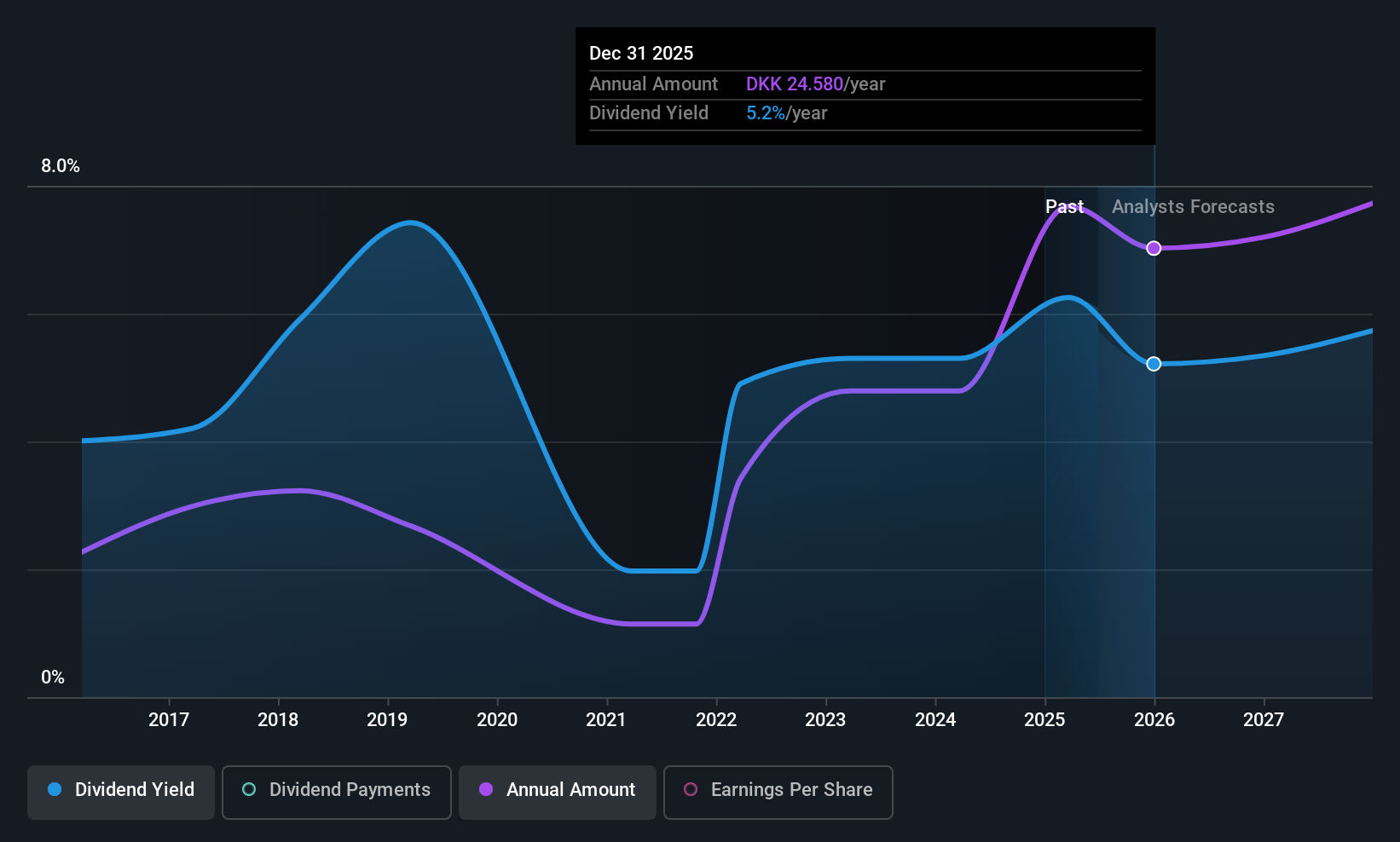

AL Sydbank (CPSE:ALSYDB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: AL Sydbank A/S, along with its subsidiaries, offers a range of banking products and services to corporate, private, retail, and institutional clients both in Denmark and internationally, with a market cap of DKK27.95 billion.

Operations: AL Sydbank A/S generates revenue from several segments, including Banking (DKK5.51 billion), Treasury (DKK77 million), Sydbank Markets (DKK373 million), and Asset Management (DKK509 million).

Dividend Yield: 4.7%

Sydbank's dividend is notably in the top 25% of Danish dividend payers, with a yield of 4.72%. Despite its volatile dividend history, current payouts are covered by earnings with a payout ratio of 61.1%, and future dividends are projected to be well-covered at a lower payout ratio of 49.8%. However, recent corporate guidance lowered profit expectations due to merger-related costs, which may impact future financial stability and potentially affect dividends.

- Unlock comprehensive insights into our analysis of AL Sydbank stock in this dividend report.

- Upon reviewing our latest valuation report, AL Sydbank's share price might be too pessimistic.

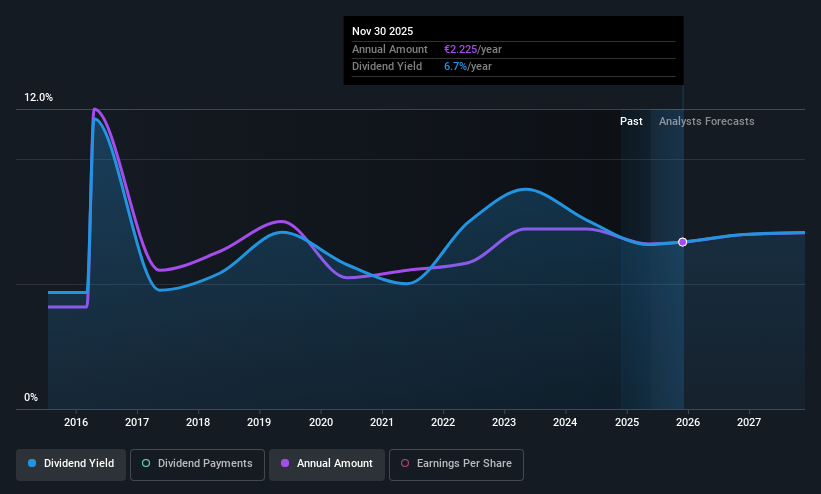

Kaufman & Broad (ENXTPA:KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kaufman & Broad S.A. is a property developer and builder operating in France, with a market cap of €586.40 million.

Operations: Kaufman & Broad S.A. generates its revenue through property development and construction activities in France.

Dividend Yield: 7.4%

Kaufman & Broad offers a high dividend yield of 7.36%, placing it among the top 25% in France, yet its dividends have been volatile over the past decade. The current payout ratio is high at 91.2%, indicating dividends are not well-covered by earnings despite low cash payout ratios suggesting coverage by cash flow. Recent earnings guidance confirmed revenue growth expectations of around 5% for 2025, with stable operating income projections between €7.5 billion and €8 billion.

- Take a closer look at Kaufman & Broad's potential here in our dividend report.

- According our valuation report, there's an indication that Kaufman & Broad's share price might be on the cheaper side.

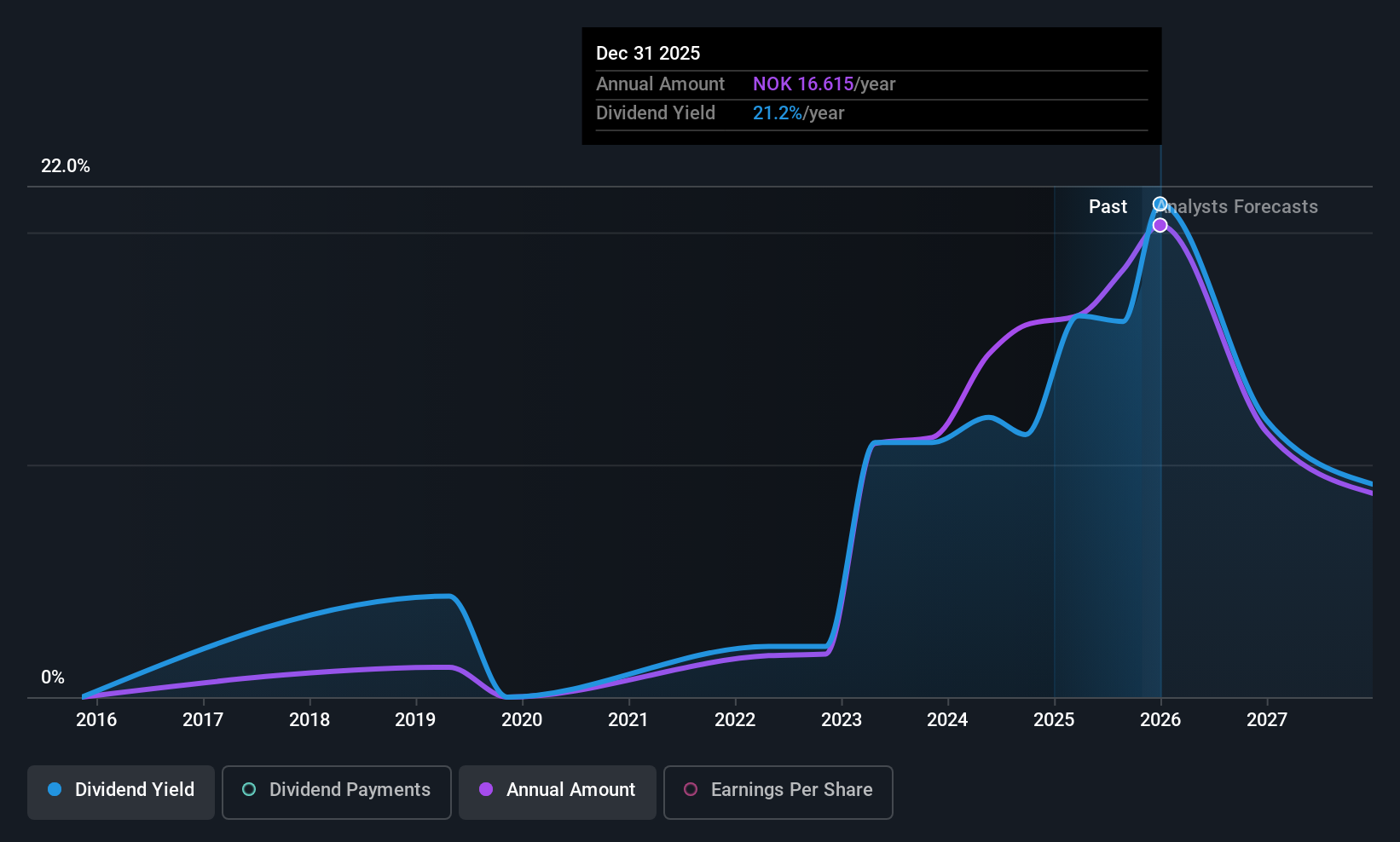

Wallenius Wilhelmsen (OB:WAWI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wallenius Wilhelmsen ASA, along with its subsidiaries, operates in the global logistics and transportation sector, with a market cap of NOK42.70 billion.

Operations: Wallenius Wilhelmsen ASA generates revenue through its Shipping Services at $4.01 billion, Logistics Services at $1.12 billion, and Government Services at $437 million.

Dividend Yield: 15.4%

Wallenius Wilhelmsen's dividend yield is notably high, ranking in the top 25% within Norway. Despite a volatile and unreliable dividend history, current payouts are well-covered by earnings (53.6% payout ratio) and cash flow (41.2% cash payout ratio). Recent strategic contract extensions worth approximately US$650 million may support future financial stability, though earnings are projected to decline annually by 27.9% over the next three years, posing potential challenges for sustained dividend growth.

- Dive into the specifics of Wallenius Wilhelmsen here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Wallenius Wilhelmsen is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Unlock our comprehensive list of 191 Top European Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报