3 European Stocks Estimated To Be Up To 35.3% Undervalued

As the pan-European STOXX Europe 600 Index edges closer to record highs, investors are navigating a landscape marked by cautious optimism about future earnings and economic recovery. In this environment, identifying undervalued stocks can provide opportunities for those seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.58 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €72.80 | €142.60 | 48.9% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.31 | 48.9% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| Gesco (XTRA:GSC1) | €14.25 | €27.96 | 49% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Exail Technologies (ENXTPA:EXA) | €81.50 | €159.03 | 48.8% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Allcore (BIT:CORE) | €1.35 | €2.66 | 49.3% |

Let's take a closer look at a couple of our picks from the screened companies.

BE Semiconductor Industries (ENXTAM:BESI)

Overview: BE Semiconductor Industries N.V. is a company that develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries globally, with a market cap of €10.55 billion.

Operations: The company's revenue for semiconductor equipment and services amounts to €578.39 million.

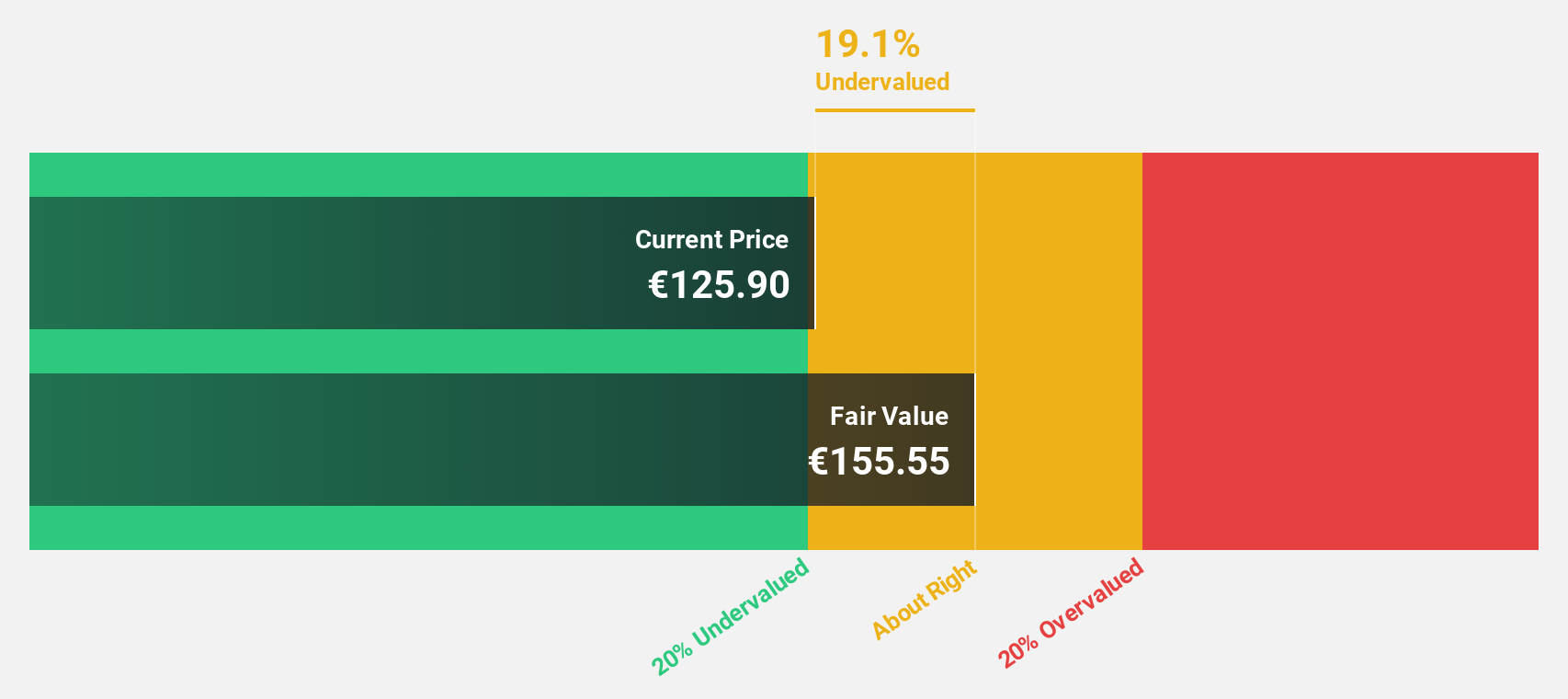

Estimated Discount To Fair Value: 18.2%

BE Semiconductor Industries is trading at €133.75, below its estimated fair value of €163.46, indicating potential undervaluation based on cash flows. Despite a recent dip in earnings and revenue, the company forecasts significant growth with earnings expected to increase by 28.4% annually over the next three years. The firm has initiated a substantial share buyback program funded by available cash resources, which may further support its valuation by offsetting dilution from convertible notes and employee stock plans.

- Insights from our recent growth report point to a promising forecast for BE Semiconductor Industries' business outlook.

- Click here to discover the nuances of BE Semiconductor Industries with our detailed financial health report.

Airbus (ENXTPA:AIR)

Overview: Airbus SE, along with its subsidiaries, is involved in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions globally, with a market cap of approximately €156.61 billion.

Operations: The company's revenue segments consist of Airbus Helicopters generating €8.72 billion, Airbus Defence and Space contributing €13.35 billion, and the primary Airbus segment, which includes holding function and bank activities, accounting for €51.65 billion.

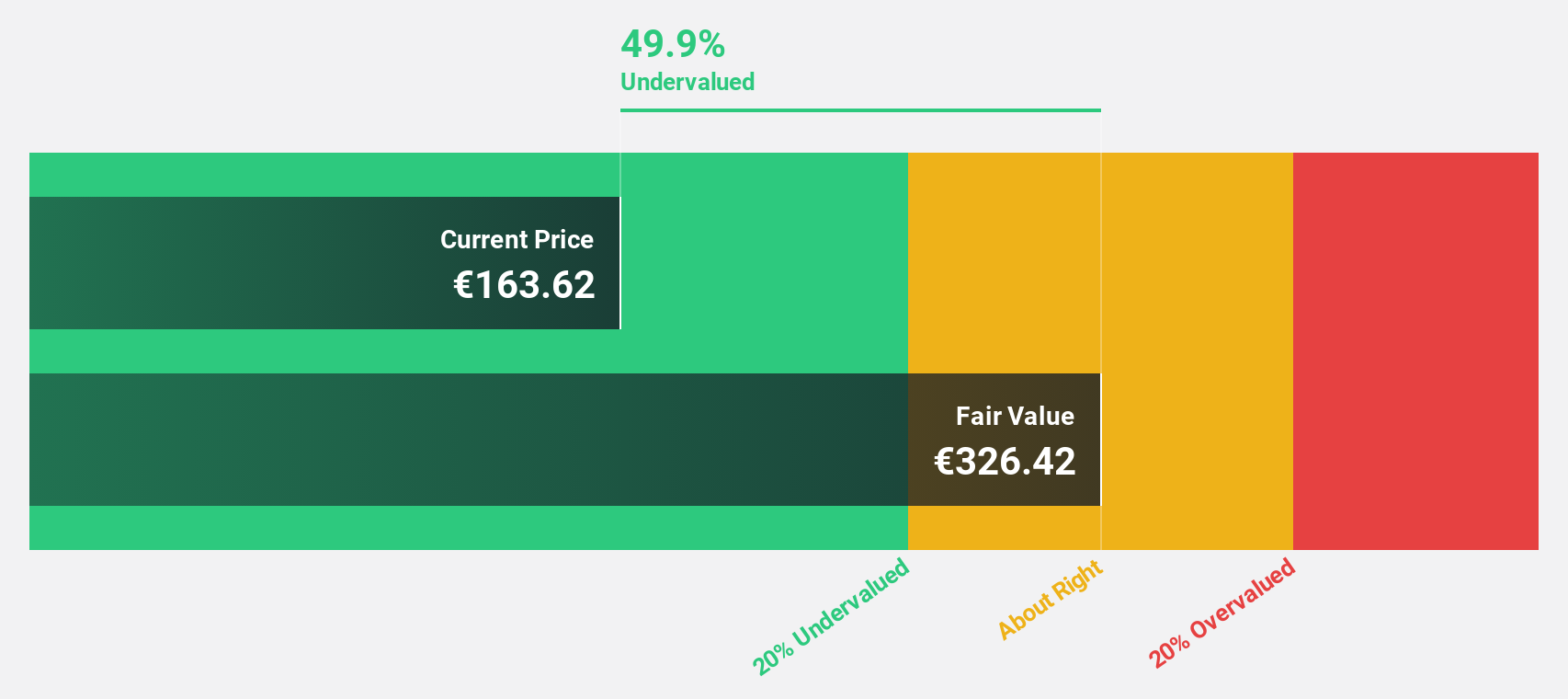

Estimated Discount To Fair Value: 29.7%

Airbus is trading at €198.4, significantly below its estimated fair value of €282.39, suggesting potential undervaluation based on cash flows. Recent earnings demonstrated robust growth, with a net income increase to €2.64 billion for the nine months ending September 2025 from €1.81 billion a year prior. The strategic rescheduling of aircraft deliveries with Wizz Air and the proposed merger of space activities with Thales and Leonardo could enhance operational efficiency and market positioning in Europe’s aerospace sector.

- In light of our recent growth report, it seems possible that Airbus' financial performance will exceed current levels.

- Dive into the specifics of Airbus here with our thorough financial health report.

Rheinmetall (XTRA:RHM)

Overview: Rheinmetall AG is a company that offers mobility and security technologies across various regions including Germany, Europe, the Americas, Asia, and the Near East, with a market cap of €71.62 billion.

Operations: Rheinmetall's revenue is primarily derived from its Vehicle Systems segment (€4.49 billion), followed by Weapon and Ammunition (€3.24 billion), Electronic Solutions (€2.15 billion), and Power Systems (€1.95 billion).

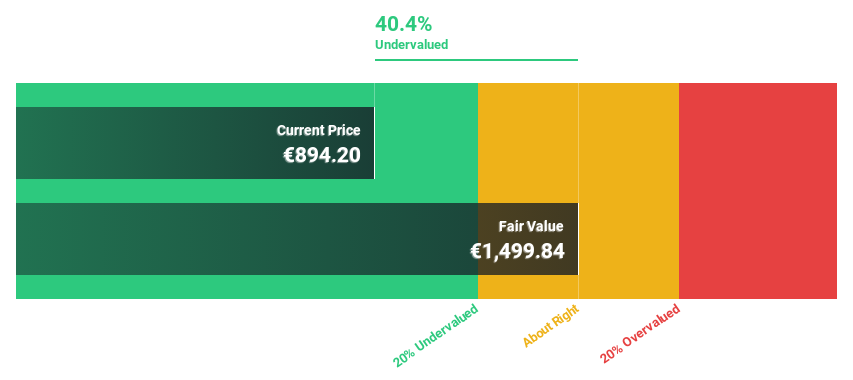

Estimated Discount To Fair Value: 35.3%

Rheinmetall, trading at €1561, is substantially below its estimated fair value of €2410.94, indicating undervaluation based on cash flows. The recent €1.7 billion contract with the German Armed Forces for space-based reconnaissance data could bolster revenue streams and strategic positioning in defense technology. With earnings and revenues forecast to grow significantly above market averages, Rheinmetall's financial performance highlights its potential as an undervalued investment opportunity in Europe’s defense sector.

- Upon reviewing our latest growth report, Rheinmetall's projected financial performance appears quite optimistic.

- Take a closer look at Rheinmetall's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 193 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报