Discovering Three Hidden Asian Stocks with Strong Potential

As global markets navigate a landscape marked by record highs in major indices and fluctuating economic indicators, small-cap stocks in Asia present intriguing opportunities for discerning investors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential is key to uncovering hidden gems that can thrive amid broader market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 26.71% | 37.25% | ★★★★★★ |

| Hangzhou Xili Intelligent TechnologyLtd | NA | 7.65% | 10.10% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 34.28% | 60.52% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| ABICO Asia Capital | NA | 69.30% | 115.18% | ★★★★★★ |

| Tibet Rhodiola Pharmaceutical Holding | 24.54% | 12.67% | 25.39% | ★★★★★☆ |

| Huasi Holding | 6.89% | 4.80% | 41.72% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 68.65% | 15.68% | 14.93% | ★★★★☆☆ |

| Spectrum Electrics | 87.60% | 46.02% | 71.22% | ★★★★☆☆ |

| Guangdong Brandmax MarketingLtd | 20.75% | -9.15% | -24.70% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Qinchuan Machine Tool & Tool Group Share (SZSE:000837)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qinchuan Machine Tool & Tool Group Share Co., Ltd. operates in the machinery industry, focusing on the production of machine tools and related equipment, with a market cap of CN¥13.18 billion.

Operations: The company generates revenue primarily from the sale of machine tools and related equipment. It has a market cap of CN¥13.18 billion, reflecting its scale in the machinery industry.

Qinchuan Machine Tool & Tool Group, a smaller player in the machinery sector, has shown notable financial shifts. Over five years, its debt to equity ratio impressively dropped from 128.7% to 13.5%, indicating improved financial health. Earnings surged by 97% last year, outpacing the industry average of 6%. However, recent results reveal net income at CN¥47.56M for nine months ending September 2025 compared to CN¥56.18M previously, with earnings per share dipping slightly from CN¥0.0556 to CN¥0.0472 due partly to a one-off gain of CN¥134M affecting quality earnings perception this period.

Suzhou Hesheng Special Material (SZSE:002290)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hesheng Special Material Co., Ltd. operates in the specialty materials industry and has a market capitalization of CN¥11.34 billion.

Operations: The company generates revenue primarily from its operations in the specialty materials sector. It has a market capitalization of CN¥11.34 billion, reflecting its scale within the industry.

Suzhou Hesheng Special Material, a relatively small player in the industry, has shown impressive financial health with an 86% earnings growth over the past year, significantly outpacing the broader Metals and Mining sector's 8.4%. The company has successfully reduced its debt to equity ratio from 137.5% to 20.3% over five years, indicating prudent financial management. Recent earnings reports for the nine months ending September 2025 reveal net income of CNY144 million compared to CNY86 million previously, reflecting strong profitability. With high-quality earnings and a forecasted annual growth rate of 35.7%, Suzhou Hesheng appears well-positioned for future expansion.

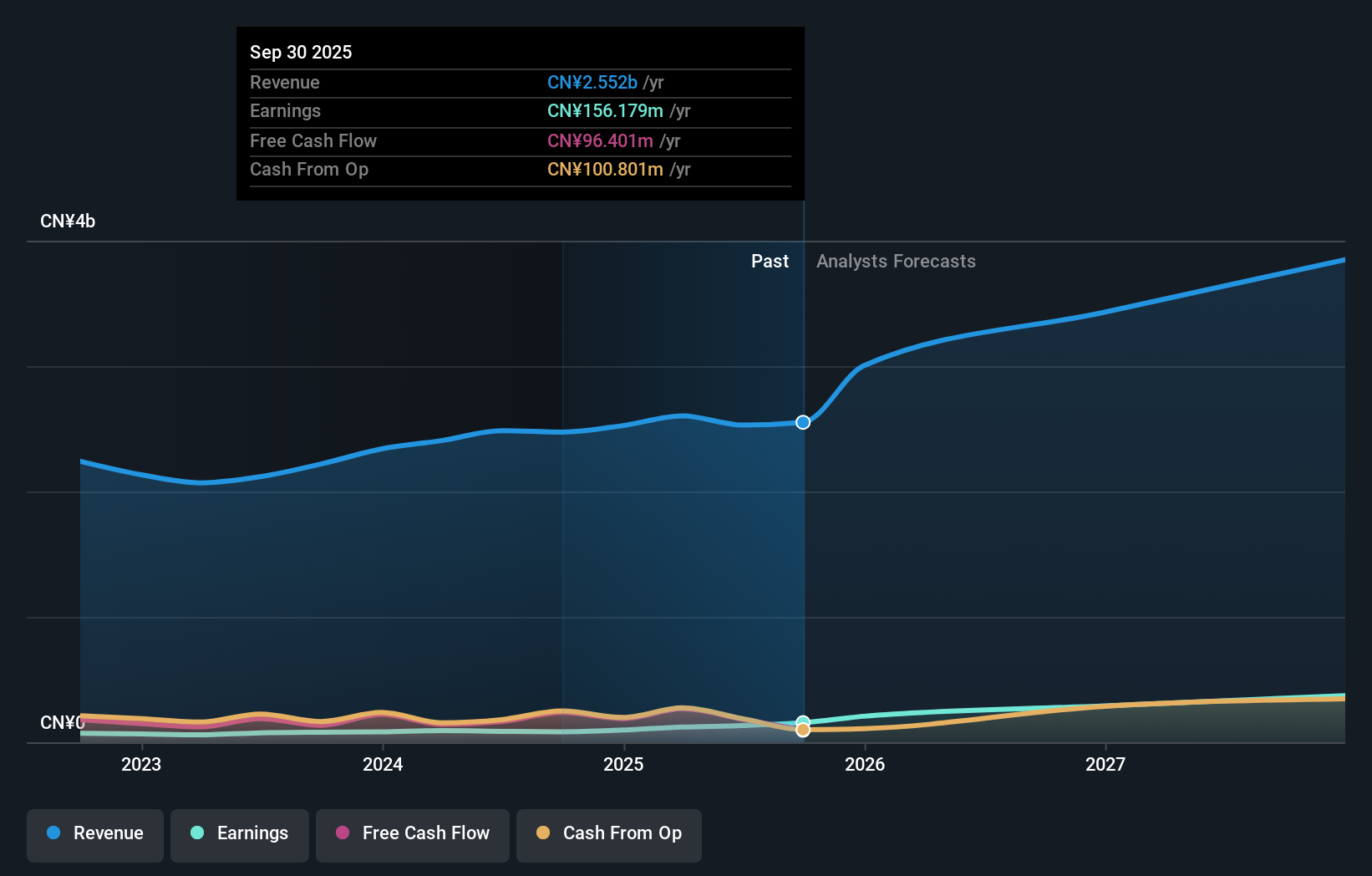

Suzhou Xianglou New Material (SZSE:301160)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Xianglou New Material Co., Ltd. specializes in the research, development, production, and sales of customized precision stamping special steel materials with a market cap of CN¥7.67 billion.

Operations: Xianglou New Material generates revenue primarily from the Auto Parts & Accessories segment, amounting to CN¥1.52 billion.

Xianglou New Material, a promising player in the Asian market, reported CNY 1.11 billion in sales for the first nine months of 2025, up from CNY 1.07 billion the previous year. Net income reached CNY 151.48 million compared to last year's CNY 138.81 million, reflecting solid growth with basic earnings per share rising to CNY 1.35 from CNY 1.24. The company's net debt to equity ratio stands at a satisfactory level of just 4%, and its interest payments are well covered by EBIT at an impressive multiple of over two hundred times, indicating robust financial health despite negative free cash flow figures recently observed.

- Click here and access our complete health analysis report to understand the dynamics of Suzhou Xianglou New Material.

Understand Suzhou Xianglou New Material's track record by examining our Past report.

Seize The Opportunity

- Reveal the 2494 hidden gems among our Asian Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报