Asian Dividend Stocks To Consider In January 2026

As global markets continue to react to economic shifts and policy changes, Asia's stock markets have shown resilience, with notable gains in regions like Japan and China driven by optimism around technological advancements and strategic monetary policies. In this dynamic environment, dividend stocks can offer a stable income stream for investors seeking to balance growth potential with regular returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.42% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.21% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.43% | ★★★★★★ |

Click here to see the full list of 1026 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

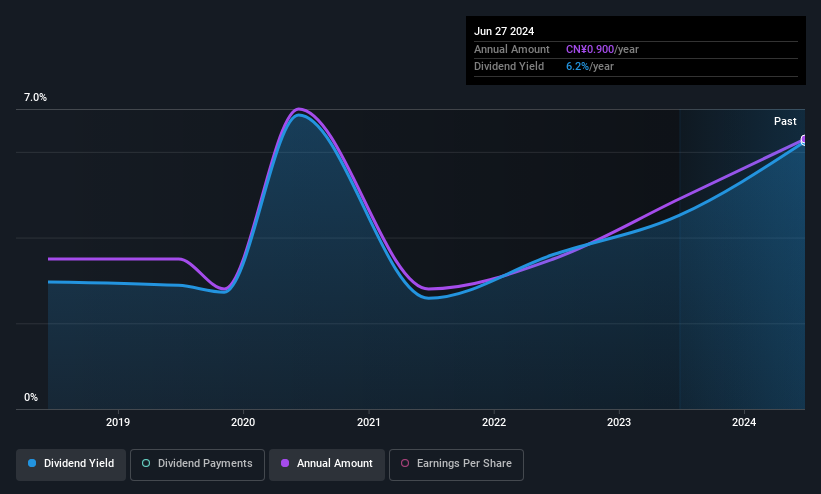

Shanghai Shuixing Home Textile (SHSE:603365)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Shuixing Home Textile Co., Ltd. engages in the research, development, design, production, and sale of home textile products in China with a market cap of CN¥5.45 billion.

Operations: Shanghai Shuixing Home Textile Co., Ltd. generates revenue primarily from its textile manufacturing segment, which amounts to CN¥4.49 billion.

Dividend Yield: 4.3%

Shanghai Shuixing Home Textile offers a compelling dividend profile with a payout ratio of 60.8% and cash payout ratio of 56.9%, indicating dividends are well-covered by earnings and cash flows. Despite an attractive yield in the top 25% of CN market payers, its dividend history is less than ten years old and marked by volatility, including drops over 20%. Recent earnings growth to CNY 232.22 million supports potential future stability.

- Navigate through the intricacies of Shanghai Shuixing Home Textile with our comprehensive dividend report here.

- According our valuation report, there's an indication that Shanghai Shuixing Home Textile's share price might be on the cheaper side.

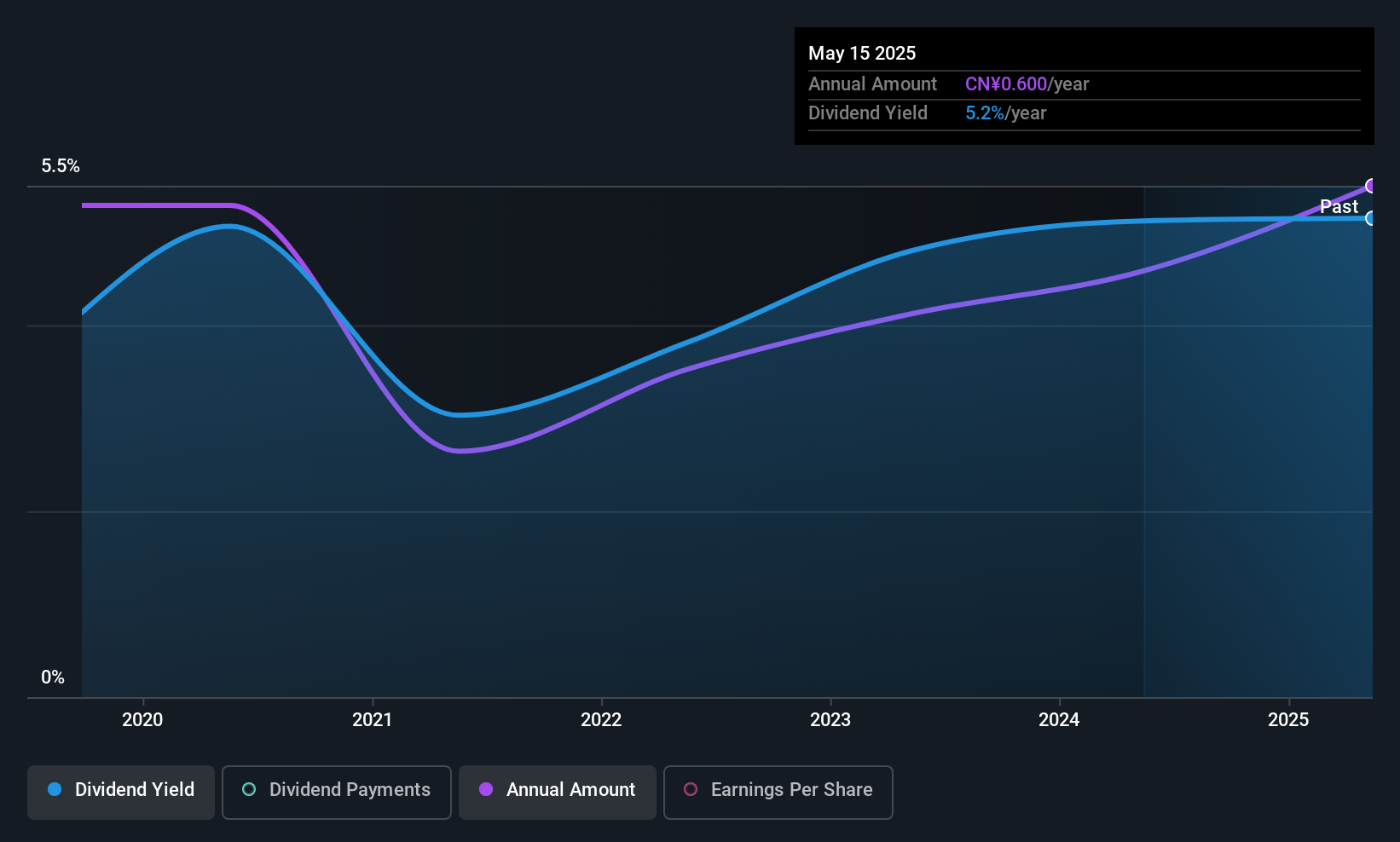

China Master Logistics (SHSE:603967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Master Logistics Co., Ltd. operates as an integrated logistics company in China with a market cap of CN¥4.76 billion.

Operations: China Master Logistics Co., Ltd. generates revenue through its operations as an integrated logistics provider in China.

Dividend Yield: 4.4%

China Master Logistics shows potential for dividend investors, trading 85.2% below its estimated fair value. Despite a relatively high payout ratio of 80%, dividends are well-covered by cash flows at a cash payout ratio of 38.9%. However, the company's dividend history is short and marked by volatility, with payments only made for six years. Recent earnings reports show stable growth in net income to CNY 206.58 million over nine months despite declining sales figures.

- Unlock comprehensive insights into our analysis of China Master Logistics stock in this dividend report.

- In light of our recent valuation report, it seems possible that China Master Logistics is trading behind its estimated value.

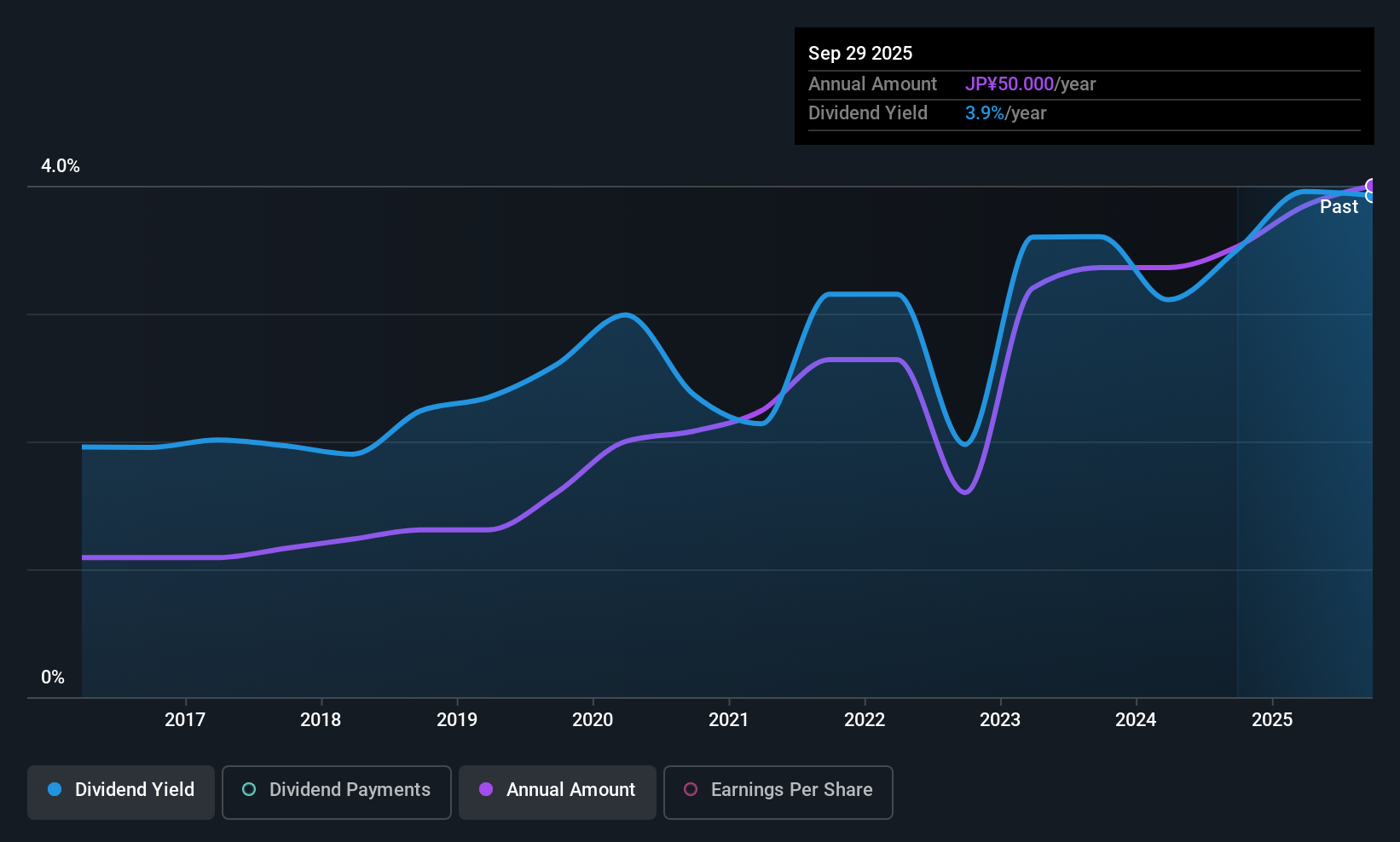

Hashimoto Sogyo HoldingsLtd (TSE:7570)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hashimoto Sogyo Holdings Co., Ltd. operates in Japan, focusing on the processing, manufacturing, and sale of plumbing and housing equipment, with a market cap of ¥25.45 billion.

Operations: Hashimoto Sogyo Holdings Co., Ltd.'s revenue is primarily derived from its segments in Piping Materials (¥47.41 billion), Housing Equipment (¥30.21 billion), Air Conditioning & Pumps (¥42.55 billion), and Sanitary Ware and Metal Fittings (¥46.39 billion).

Dividend Yield: 3.8%

Hashimoto Sogyo Holdings Ltd. offers a stable dividend history with consistent growth over the past decade. Despite a relatively attractive dividend yield of 3.82%, which is above the JP market average, sustainability concerns arise due to dividends not being covered by cash flows, as indicated by a high cash payout ratio of 109.4%. While earnings have grown recently, large one-off items affect financial results. The company's low price-to-earnings ratio suggests potential undervaluation in the market.

- Get an in-depth perspective on Hashimoto Sogyo HoldingsLtd's performance by reading our dividend report here.

- Our valuation report here indicates Hashimoto Sogyo HoldingsLtd may be overvalued.

Next Steps

- Get an in-depth perspective on all 1026 Top Asian Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报