Asian Growth Companies With High Insider Ownership In December 2025

As 2025 draws to a close, Asian markets have been navigating a complex landscape marked by mixed economic signals and cautious investor sentiment. In this environment, growth companies with high insider ownership often stand out as attractive prospects due to their potential for strong alignment between management and shareholder interests, which can be particularly beneficial in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

West China Cement (SEHK:2233)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: West China Cement Limited is an investment holding company that manufactures and sells cement and cement products in the People's Republic of China, several African countries, and internationally, with a market cap of HK$16.93 billion.

Operations: The company generates revenue from two main segments: CN¥5.98 billion from the People's Republic of China and CN¥4.19 billion from its overseas operations.

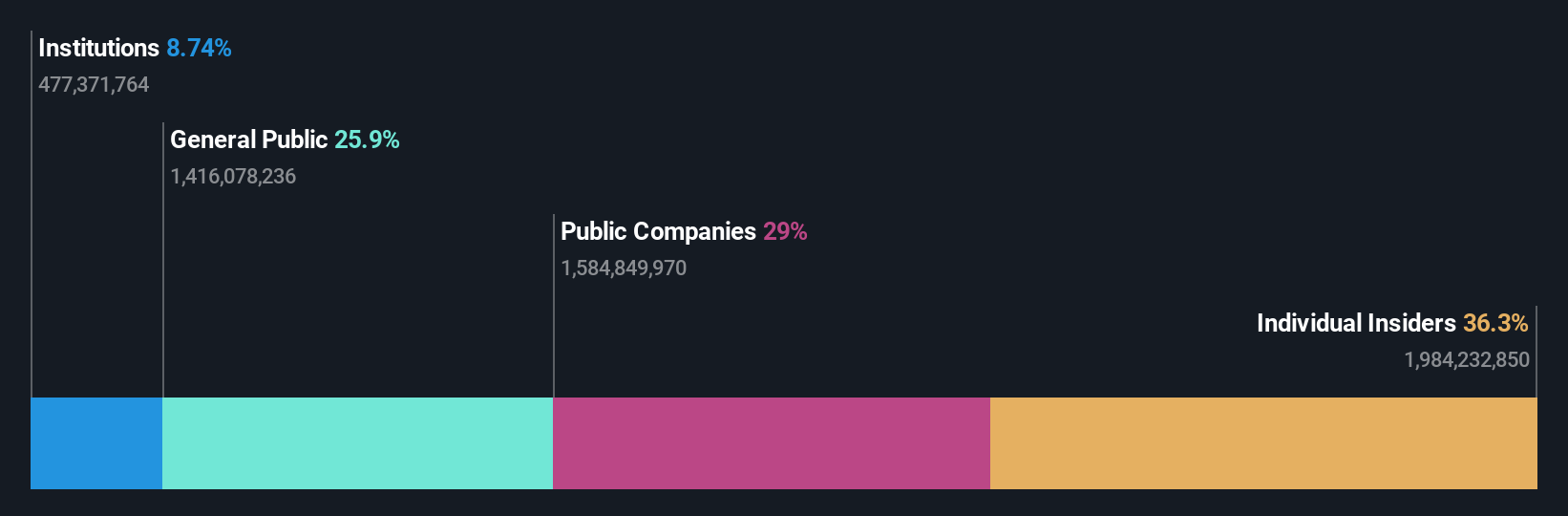

Insider Ownership: 36.3%

Earnings Growth Forecast: 30.2% p.a.

West China Cement is positioned for significant earnings growth, with forecasts predicting a 30.18% annual increase over the next three years, surpassing the Hong Kong market's average. Despite its debt not being well covered by operating cash flow, it trades at 20.1% below estimated fair value. Recent financial maneuvers include settling part of its US$200 million 2026 Notes, indicating active debt management while maintaining no substantial insider trading activity recently.

- Dive into the specifics of West China Cement here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, West China Cement's share price might be too pessimistic.

IKD (SHSE:600933)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IKD Co., Ltd. specializes in the research, development, production, and sale of automotive aluminum alloy precision die casting parts across the United States, Europe, and Asia with a market capitalization of CN¥20.60 billion.

Operations: The company's revenue primarily comes from its Auto Parts & Accessories segment, generating CN¥7.08 billion.

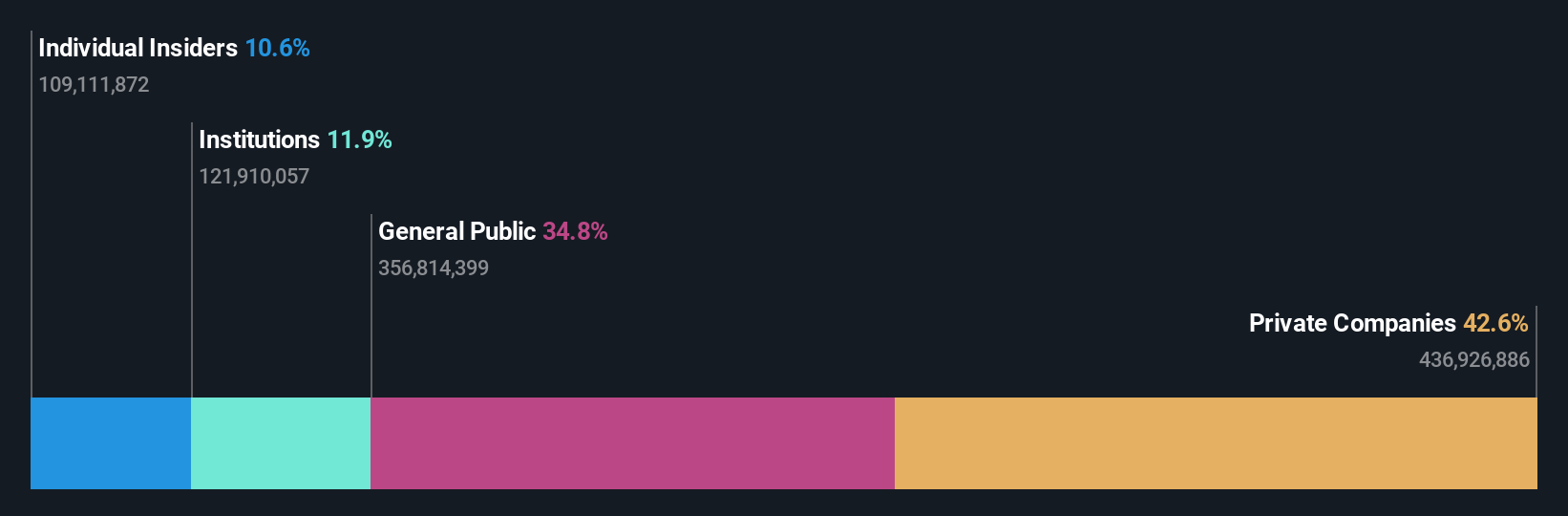

Insider Ownership: 10.6%

Earnings Growth Forecast: 20.4% p.a.

IKD Co., Ltd. demonstrates solid growth potential, with earnings and revenue expected to grow annually by 20.4% and 21%, respectively, outpacing the CN market's revenue growth rate. The company trades at a favorable P/E ratio of 18.8x compared to the broader market's 45x, indicating good relative value. Recent financials show increased sales and net income for the nine months ending September 2025, alongside a completed share buyback worth CNY 92.07 million, enhancing shareholder value without substantial insider trading activity recently noted.

- Delve into the full analysis future growth report here for a deeper understanding of IKD.

- The analysis detailed in our IKD valuation report hints at an deflated share price compared to its estimated value.

Piesat Information Technology (SHSE:688066)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Piesat Information Technology Co., Ltd. offers satellite internet services in China and has a market cap of CN¥8.47 billion.

Operations: The company's revenue primarily comes from its Satellite Application segment, totaling CN¥633.01 million.

Insider Ownership: 21.6%

Earnings Growth Forecast: 116.8% p.a.

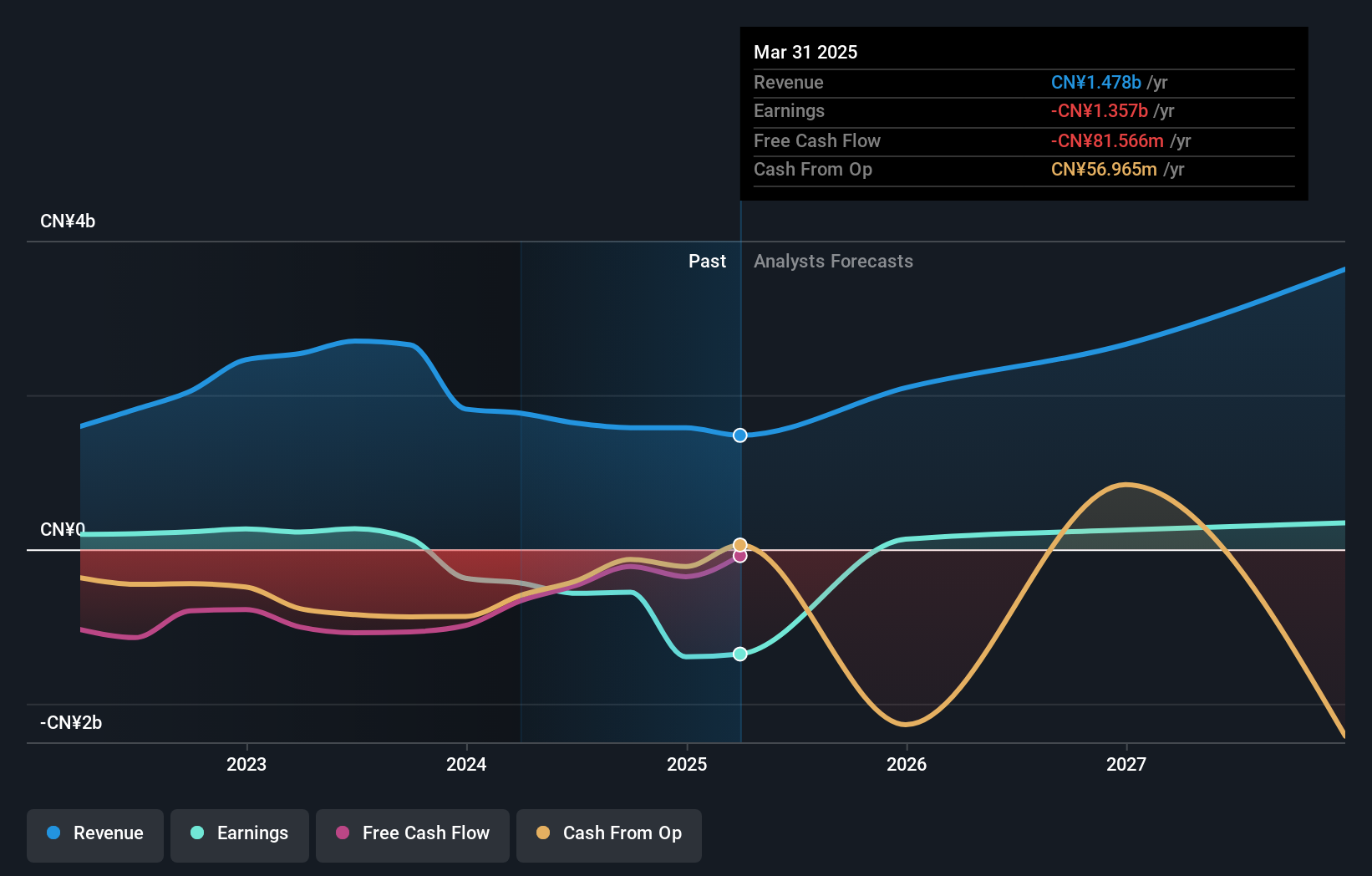

Piesat Information Technology is poised for significant growth, with revenue expected to increase by 44.8% annually, surpassing the CN market's rate of 14.6%. Despite a volatile share price and current losses—CNY 366.49 million net loss for the nine months ending September 2025—the company is forecasted to achieve profitability within three years. Recent earnings revealed a decline in sales from CNY 1.34 billion to CNY 402.62 million year-over-year, highlighting challenges amidst promising growth forecasts.

- Unlock comprehensive insights into our analysis of Piesat Information Technology stock in this growth report.

- The valuation report we've compiled suggests that Piesat Information Technology's current price could be inflated.

Where To Now?

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 628 companies by clicking here.

- Ready To Venture Into Other Investment Styles? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报