Exploring Undiscovered Gems in Asia This December 2025

As we enter December 2025, the Asian markets are capturing attention with a notable rise in optimism around artificial intelligence and technology stocks, mirroring trends seen in Japan where the Nikkei 225 Index has surged. Amid this backdrop of technological enthusiasm and economic anticipation, identifying promising small-cap stocks can be crucial for investors looking to capitalize on growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Asian Terminals | 25.82% | 12.05% | 17.00% | ★★★★★★ |

| VICOM | NA | 6.95% | 4.06% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| JiangXi BaiSheng Intelligent Technology | NA | -8.48% | -19.51% | ★★★★★★ |

| Suzhou Sepax Technologies | 1.11% | 20.70% | 32.08% | ★★★★★★ |

| China Post Technology | NA | -13.06% | 30.00% | ★★★★★★ |

| House of Investments | 18.23% | 14.46% | 47.47% | ★★★★★☆ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 4.59% | 17.51% | 3.97% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 21.58% | 19.96% | -4.28% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Zhejiang Yuejian Intelligent EquipmentLtd (SHSE:603095)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Yuejian Intelligent Equipment Co., Ltd. (ticker: SHSE:603095) is a company engaged in the design and manufacture of industrial machinery and equipment, with a market capitalization of CN¥4.59 billion.

Operations: The primary revenue stream for Zhejiang Yuejian Intelligent Equipment comes from its Machinery & Industrial Equipment segment, generating CN¥1.26 billion.

Zhejiang Yuejian, a small cap in the machinery sector, has shown impressive growth with earnings surging 101.8% over the past year, outpacing the industry average of 6.1%. Despite this, its debt to equity ratio has climbed from 0.8% to 1.7% over five years, suggesting a cautious approach may be necessary regarding leverage management. The company reported CNY 872 million in sales for nine months ending September 2025 compared to CNY 903 million previously, yet net income improved to CNY 80 million from CNY 72 million last year. With a price-to-earnings ratio of 42.9x below the market's average of 45x and positive free cash flow trends recently observed at CNY164 million as of June this year, it seems positioned for continued financial stability amidst competitive pressures.

Shanghai Unison Aluminium Products (SHSE:603418)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Unison Aluminium Products Co., Ltd. (SHSE:603418) specializes in the manufacturing and distribution of aluminum products, with a market capitalization of CN¥11.68 billion.

Operations: Shanghai Unison Aluminium Products generates its revenue primarily from the sale of aluminum products. The company's cost structure includes expenses related to raw materials, manufacturing, and distribution. Notably, its net profit margin has shown a trend of fluctuation over recent periods.

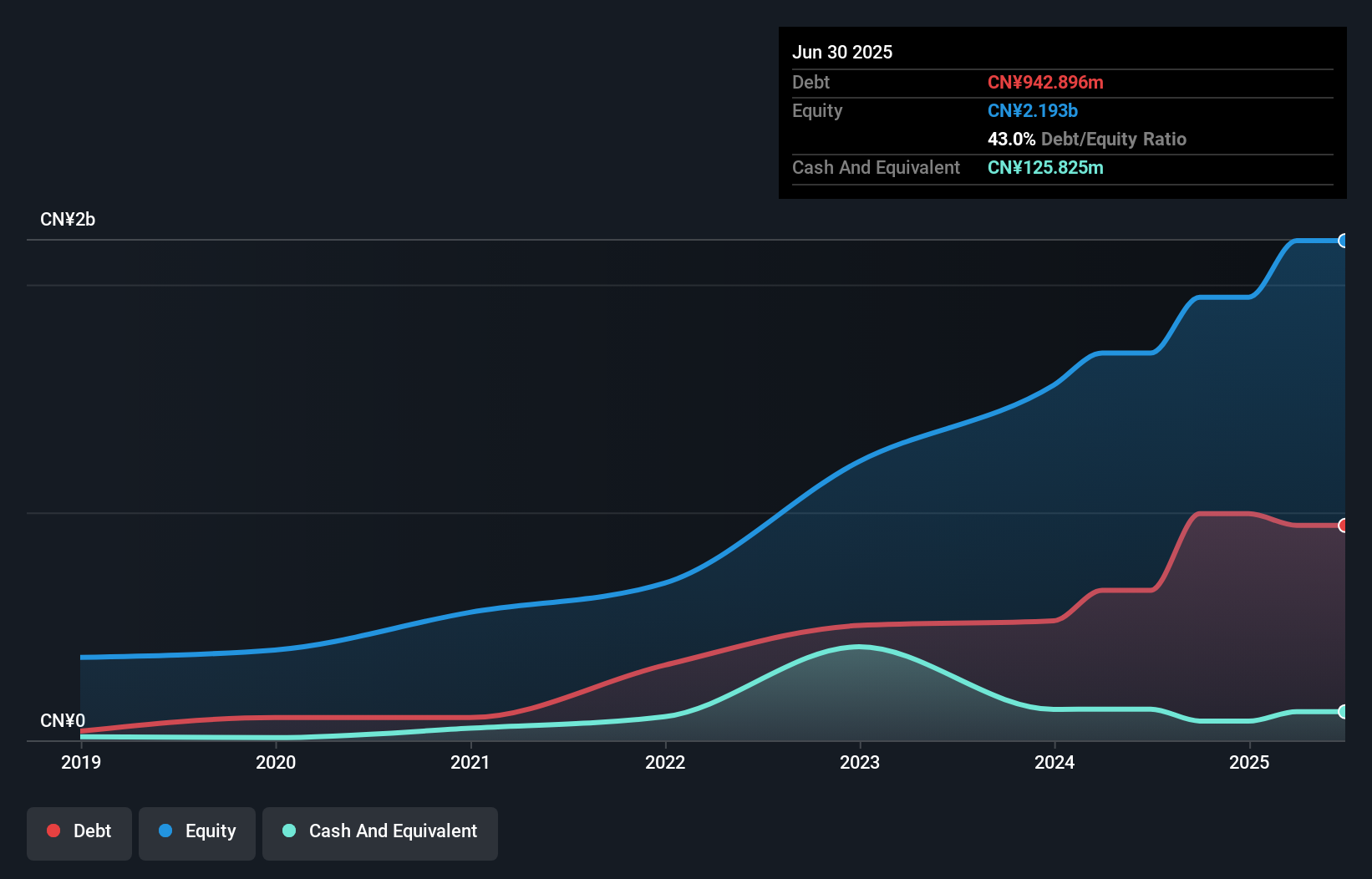

Shanghai Unison Aluminium Products has shown impressive earnings growth of 33.7% over the past year, outpacing the Auto Components industry average of 8%. The company's price-to-earnings ratio stands at 24.4x, which is attractive compared to the broader Chinese market's 45x. Despite a rise in its debt to equity ratio from 20.8% to 43% over five years, it remains satisfactory at a net debt level of 37.3%. While not free cash flow positive, interest payments are well covered by EBIT with a coverage ratio of 14.8x, reflecting solid financial management amidst industry challenges.

Teemsun TechnologyLtd (SZSE:301571)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Teemsun Technology Co., Ltd, with a market cap of CN¥10.35 billion, is involved in the research and development, production, sale, and service of infrared thermal imaging and other optoelectronics equipment as a weapons and equipment company.

Operations: Teemsun Technology generates revenue primarily from the sale of infrared thermal imaging and optoelectronics equipment. The company focuses on research and development to support its product offerings.

Teemsun Technology, a small player in the tech arena, reported notable growth with earnings up 20.9% over the past year, outpacing its industry peers who saw a -10.3% change. The company's debt to equity ratio rose from 9.5% to 45.5% over five years, yet remains satisfactory at 29.6%. Teemsun's interest payments are well-covered by EBIT at 18.9x coverage, reflecting strong financial health despite free cash flow challenges with figures like -CNY 401 million recently recorded. Recent earnings reveal CNY 716 million in sales and net income of CNY 126 million for nine months ending September, showcasing resilience amidst market fluctuations.

- Get an in-depth perspective on Teemsun TechnologyLtd's performance by reading our health report here.

Understand Teemsun TechnologyLtd's track record by examining our Past report.

Where To Now?

- Click this link to deep-dive into the 2494 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报