3 Asian Penny Stocks With Market Caps Up To US$500M

As global markets continue to navigate a landscape marked by optimism around artificial intelligence and robust economic data, Asian stocks have also been capturing investor attention. Penny stocks, though often seen as a term from past market cycles, remain relevant due to the unique opportunities they present for growth at lower price points. In this article, we explore three Asian penny stocks that stand out for their financial strength and potential upside in today's evolving market conditions.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$132.9M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.46 | HK$51.78B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cosmo Lady (China) Holdings (SEHK:2298)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cosmo Lady (China) Holdings Company Limited is an investment holding company involved in the design, research, development, and sale of branded intimate wear products in China with a market cap of HK$697.39 million.

Operations: The company's revenue is primarily generated from the People's Republic of China, amounting to CN¥2.93 billion.

Market Cap: HK$697.39M

Cosmo Lady (China) Holdings, with a market cap of HK$697.39 million, primarily generates revenue from China totaling CN¥2.93 billion. The company has shown stable weekly volatility at 9% and possesses high-quality earnings with a Price-To-Earnings ratio of 6.2x, which is below the Hong Kong market average of 12.1x, indicating potential value. Although its earnings growth over the past year (2.8%) lags behind its five-year average of 70.7%, it remains profitable and maintains strong financial health with more cash than debt and well-covered interest payments by EBIT at 8.8x coverage.

- Navigate through the intricacies of Cosmo Lady (China) Holdings with our comprehensive balance sheet health report here.

- Understand Cosmo Lady (China) Holdings' track record by examining our performance history report.

Powerwin Tech Group (SEHK:2405)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Powerwin Tech Group Limited offers digital marketing services in Hong Kong and the Chinese mainland, with a market capitalization of HK$1.04 billion.

Operations: The company's revenue is derived from its Direct Marketing segment, totaling $9.34 million.

Market Cap: HK$1.04B

Powerwin Tech Group, with a market cap of HK$1.04 billion, derives revenue from its Direct Marketing segment totaling US$9.34 million. Despite being unprofitable with losses increasing by 33.5% annually over the past five years, it maintains financial resilience as its cash exceeds total debt and short-term assets cover both short and long-term liabilities. The company's debt to equity ratio has significantly improved over five years, reducing from a very high level to a more manageable 56.7%. However, its share price remains highly volatile and interest payments are not well covered by EBIT, indicating potential risks for investors in this penny stock space.

- Click here to discover the nuances of Powerwin Tech Group with our detailed analytical financial health report.

- Learn about Powerwin Tech Group's historical performance here.

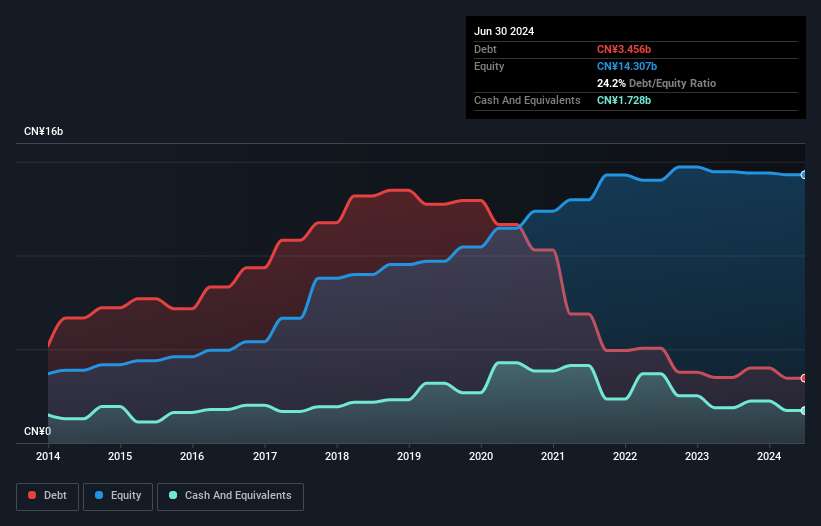

China Yongda Automobiles Services Holdings (SEHK:3669)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Yongda Automobiles Services Holdings Limited is an investment holding company that operates as a retailer and service provider for luxury and ultra-luxury passenger vehicles in China, with a market cap of HK$3.24 billion.

Operations: The company's revenue is primarily derived from Passenger Vehicle Sales and Services, which generated CN¥59.06 billion, and Automobile Operating Lease Services, contributing CN¥441.73 million.

Market Cap: HK$3.24B

China Yongda Automobiles Services Holdings, with a market cap of HK$3.24 billion, primarily generates revenue from Passenger Vehicle Sales and Services (CN¥59.06 billion) and Automobile Operating Lease Services (CN¥441.73 million). Despite being unprofitable with increasing losses over the past five years, the company's financial structure is relatively stable; short-term assets exceed both short and long-term liabilities. Debt management has improved significantly, with a reduction in the debt to equity ratio from 101.7% to 33% over five years. However, interest coverage remains weak at 1.4x EBIT, posing potential risks for investors seeking stability in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of China Yongda Automobiles Services Holdings.

- Assess China Yongda Automobiles Services Holdings' future earnings estimates with our detailed growth reports.

Taking Advantage

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 960 more companies for you to explore.Click here to unveil our expertly curated list of 963 Asian Penny Stocks.

- Interested In Other Possibilities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报