3 TSX Stocks Estimated To Be Trading Below Intrinsic Value By Up To 48.3%

As the Canadian market navigates a complex landscape characterized by sector-specific opportunities and the need for diversification, investors are advised to strategically overweight sectors like energy, industrials, and materials. In this context, identifying stocks trading below their intrinsic value can be an effective strategy for capitalizing on undervalued opportunities while maintaining a balanced portfolio.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$126.43 | CA$224.61 | 43.7% |

| Neo Performance Materials (TSX:NEO) | CA$15.55 | CA$30.91 | 49.7% |

| kneat.com (TSX:KSI) | CA$4.99 | CA$9.38 | 46.8% |

| Kinaxis (TSX:KXS) | CA$173.95 | CA$325.18 | 46.5% |

| GURU Organic Energy (TSX:GURU) | CA$4.99 | CA$8.91 | 44% |

| EQB (TSX:EQB) | CA$103.61 | CA$184.82 | 43.9% |

| Endeavour Mining (TSX:EDV) | CA$71.08 | CA$123.06 | 42.2% |

| Dexterra Group (TSX:DXT) | CA$11.84 | CA$22.89 | 48.3% |

| Black Diamond Group (TSX:BDI) | CA$14.72 | CA$28.49 | 48.3% |

| Almonty Industries (TSX:AII) | CA$12.12 | CA$23.43 | 48.3% |

We're going to check out a few of the best picks from our screener tool.

Almonty Industries (TSX:AII)

Overview: Almonty Industries Inc. is involved in the mining, processing, and shipping of tungsten concentrate, with a market cap of CA$3.17 billion.

Operations: Almonty Industries Inc. generates its revenue through the extraction, refinement, and distribution of tungsten concentrate.

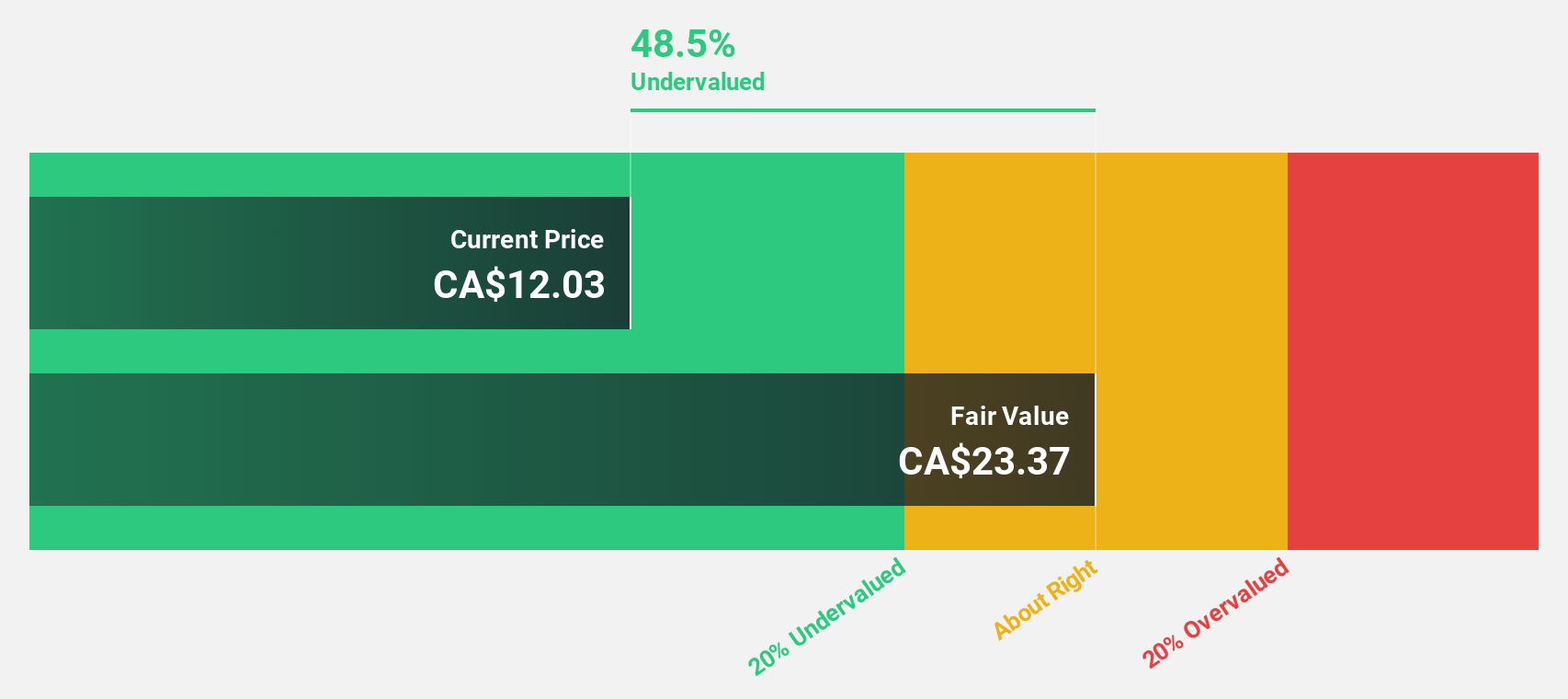

Estimated Discount To Fair Value: 48.3%

Almonty Industries is trading at CA$12.12, significantly below its estimated fair value of CA$23.43, suggesting it may be undervalued based on cash flows. The company's revenue is expected to grow rapidly at 41.8% per year, outpacing the Canadian market's growth rate. Recent developments include transitioning the Sangdong Mine to active operations and acquiring a U.S.-based tungsten project, which could enhance future cash flow potential and strengthen its market position in critical minerals supply chains.

- According our earnings growth report, there's an indication that Almonty Industries might be ready to expand.

- Navigate through the intricacies of Almonty Industries with our comprehensive financial health report here.

Aecon Group (TSX:ARE)

Overview: Aecon Group Inc. is a construction and infrastructure development company serving both private and public sector clients in Canada, the United States, and internationally, with a market cap of CA$1.98 billion.

Operations: Aecon Group Inc.'s revenue is primarily derived from its Construction segment, which accounts for CA$5.14 billion, with an additional contribution of CA$9.99 million from its Concessions segment.

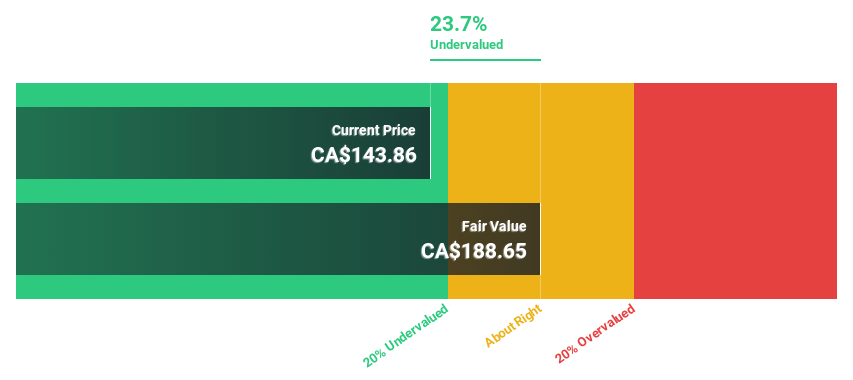

Estimated Discount To Fair Value: 17.4%

Aecon Group, trading at CA$31.21, is valued below its estimated fair value of CA$37.81, reflecting potential undervaluation based on cash flows. Despite a recent decline in net income to CA$40 million for Q3 2025 from the previous year, revenue growth remains robust with a record backlog of $10.8 billion bolstering future prospects. However, significant insider selling and dividends not fully covered by earnings may pose concerns for investors evaluating its financial health and sustainability.

- Our expertly prepared growth report on Aecon Group implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Aecon Group's balance sheet by reading our health report here.

Topicus.com (TSXV:TOI)

Overview: Topicus.com Inc. offers vertical market software and platforms in the Netherlands and internationally, with a market cap of CA$10.54 billion.

Operations: The company generates revenue of €1.48 billion from its software and programming segment.

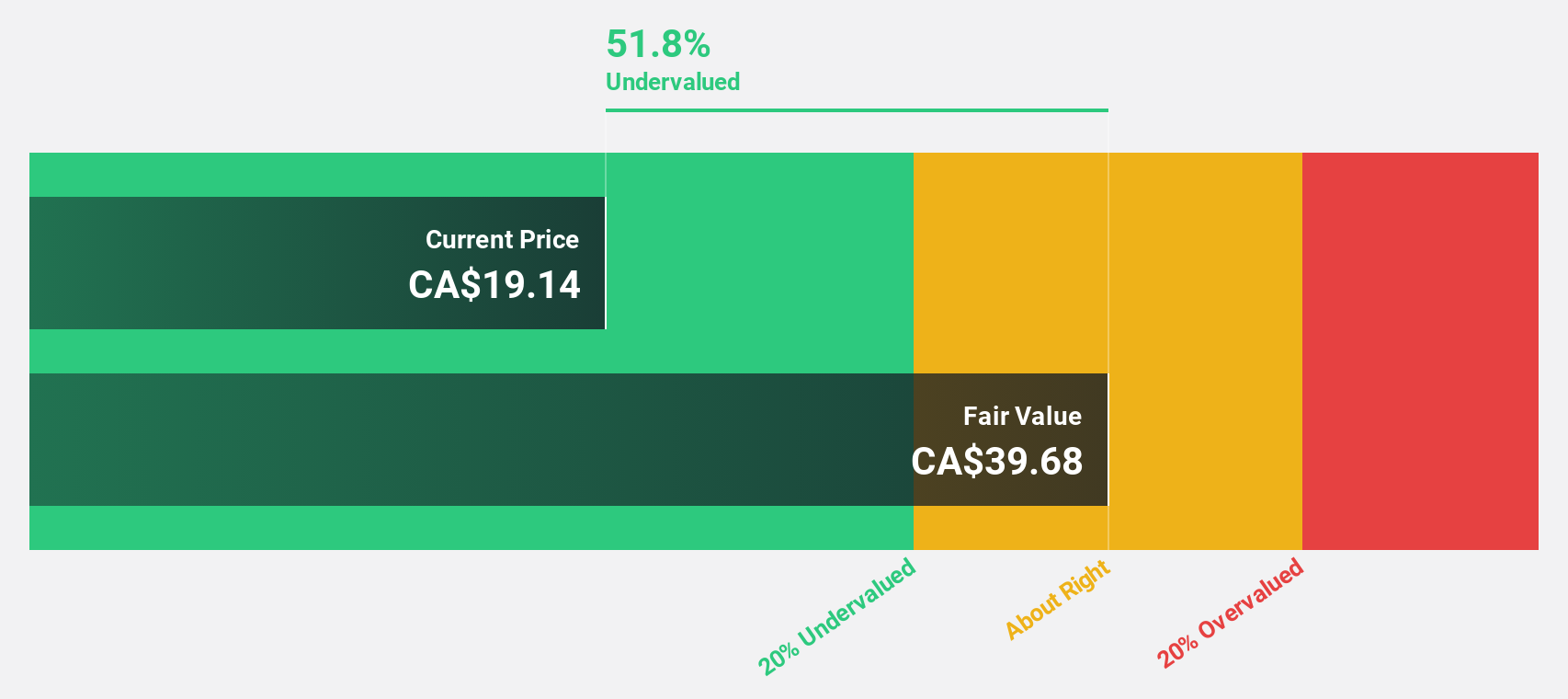

Estimated Discount To Fair Value: 43.7%

Topicus.com, trading at CA$126.43, appears undervalued with an estimated fair value of CA$224.61. Despite recent losses and a decline in profit margins from 6.8% to 1.8%, the company is expected to see significant earnings growth of over 85% annually, outpacing the Canadian market's 11.5%. While revenue is forecasted to grow at 16.2% annually, a high debt level may warrant caution for investors focusing on cash flow valuation.

- In light of our recent growth report, it seems possible that Topicus.com's financial performance will exceed current levels.

- Click here to discover the nuances of Topicus.com with our detailed financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 29 Undervalued TSX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报