3 Promising Penny Stocks With Under $2B Market Cap

As the year draws to a close, major U.S. stock indexes have seen slight declines for three consecutive sessions, reflecting ongoing market volatility and investor caution. In such times, identifying promising investment opportunities can be challenging yet rewarding. Penny stocks, despite their historical connotations, continue to offer potential value by highlighting smaller or emerging companies that may not yet be on the radar of larger investors. By focusing on those with strong financials and a clear path to growth, investors can uncover opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $574.34M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $679.93M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8343 | $142.68M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.29 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.14 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.24 | $556.91M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.72 | $50.16M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.98 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.97 | $89.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 341 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Cricut (CRCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform that helps users create professional-looking handmade goods across various regions globally, with a market cap of approximately $1.06 billion.

Operations: The company's revenue is primarily derived from its platform segment, generating $322.83 million.

Market Cap: $1.06B

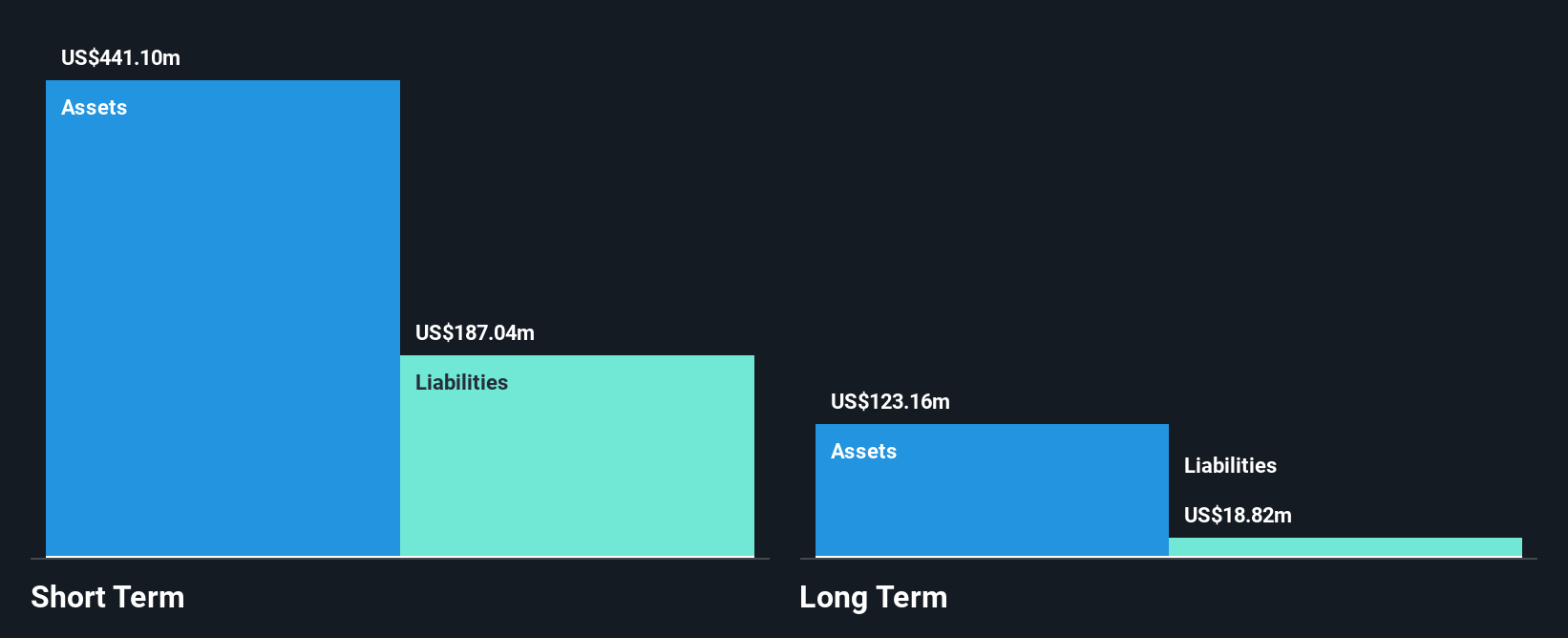

Cricut, Inc. has demonstrated a robust financial standing with no debt and strong short-term asset coverage over liabilities. Recent earnings show an increase in net income to US$20.51 million for Q3 2025, reflecting a significant growth of 30% from the previous year, surpassing industry averages. Despite a high Return on Equity at 22.6%, Cricut's dividend sustainability is questionable due to inadequate free cash flow coverage. Share repurchases indicate shareholder value initiatives, while stable weekly volatility suggests consistent performance amidst market fluctuations. However, past five-year earnings have declined annually by 24.1%, highlighting potential long-term challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Cricut.

- Gain insights into Cricut's outlook and expected performance with our report on the company's earnings estimates.

SOPHiA GENETICS (SOPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SOPHiA GENETICS SA is a cloud-native software technology company focused on the healthcare sector, with a market cap of $320.92 million.

Operations: The company's revenue is primarily derived from its healthcare software segment, totaling $73.30 million.

Market Cap: $320.92M

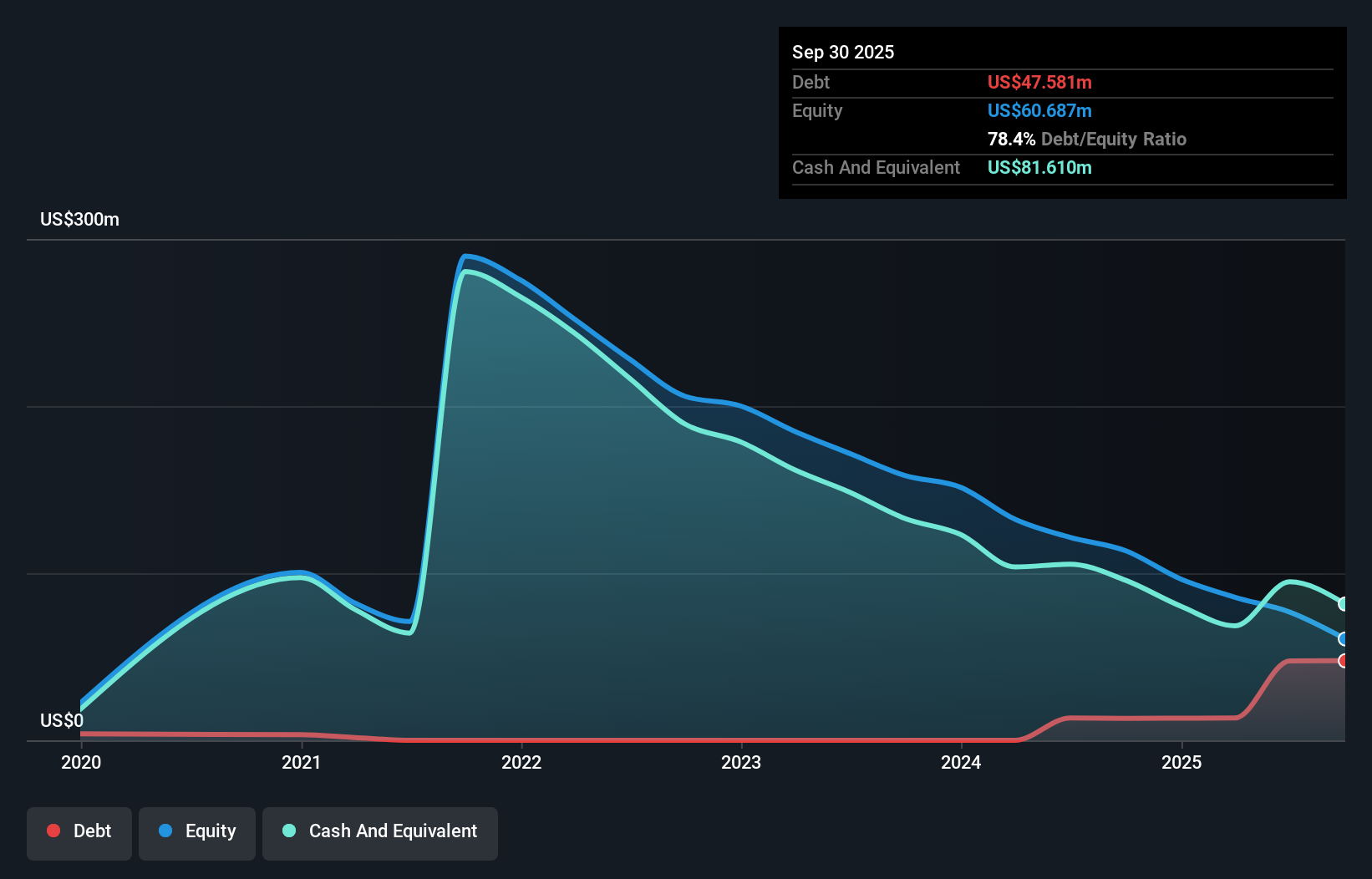

SOPHiA GENETICS, with a market cap of US$320.92 million, is navigating the penny stock landscape with a focus on healthcare software. Despite being unprofitable and reporting increased net losses over recent years, its revenue is growing faster than the industry average, projected to rise 17.6% annually. Recent collaborations, like those with Complete Genomics for precision oncology testing and A.D.A.A.M Innovations in Japan for liquid biopsy applications, highlight strategic expansions into new markets. The company maintains sufficient cash runway to cover liabilities and has not seen significant shareholder dilution recently despite high share price volatility.

- Unlock comprehensive insights into our analysis of SOPHiA GENETICS stock in this financial health report.

- Assess SOPHiA GENETICS' future earnings estimates with our detailed growth reports.

VTEX (VTEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $660.99 million.

Operations: The company generates $234.12 million in revenue from its Internet Software & Services segment.

Market Cap: $660.99M

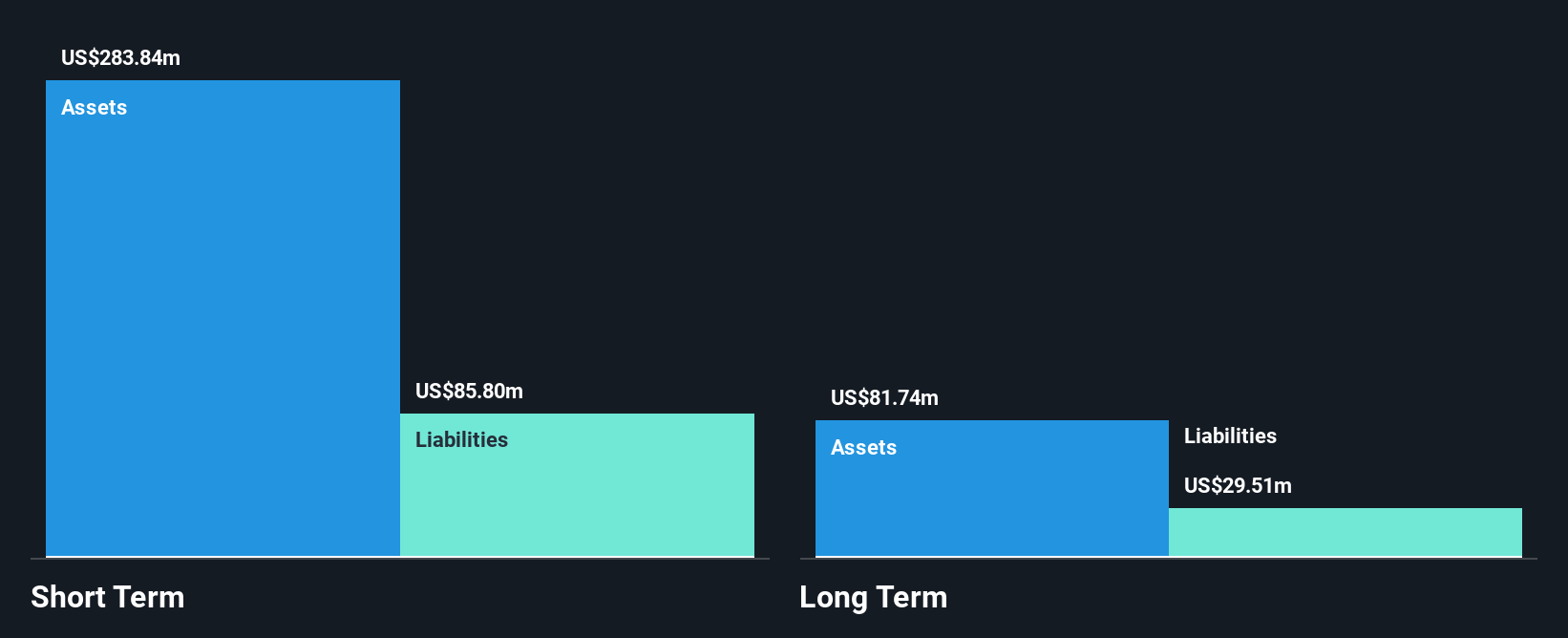

VTEX, with a market cap of US$660.99 million, stands out in the penny stock realm by maintaining profitability and generating US$234.12 million in annual revenue from its digital commerce platform. The company is debt-free and has strong financial health, with short-term assets significantly exceeding liabilities. Despite a recent one-off loss impacting earnings, VTEX's net income grew to US$6.35 million for Q3 2025 from US$3.37 million a year prior, reflecting steady growth. Recent strategic moves include completing a share buyback worth $27.59 million and providing optimistic revenue guidance for the upcoming quarter and full year 2025.

- Take a closer look at VTEX's potential here in our financial health report.

- Evaluate VTEX's prospects by accessing our earnings growth report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 341 US Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报