European Penny Stocks To Watch In December 2025

The European market has shown resilience, with the STOXX Europe 600 Index nearing record highs amid optimism about future earnings and economic growth. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to offer intriguing opportunities for investors when backed by strong financials. In this article, we'll explore three penny stocks that stand out for their potential to deliver substantial returns while offering a unique blend of affordability and growth prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.54B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €221.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.08 | SEK192.25M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.28 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 288 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK286.31 million, operates in the rental and sale of energy service equipment across Norway, Europe, Asia, and Australia.

Operations: The company generates revenue of $55.55 million from its energy service segment, focusing on the rental and sale of equipment in Norway, Europe, Asia, and Australia.

Market Cap: NOK286.31M

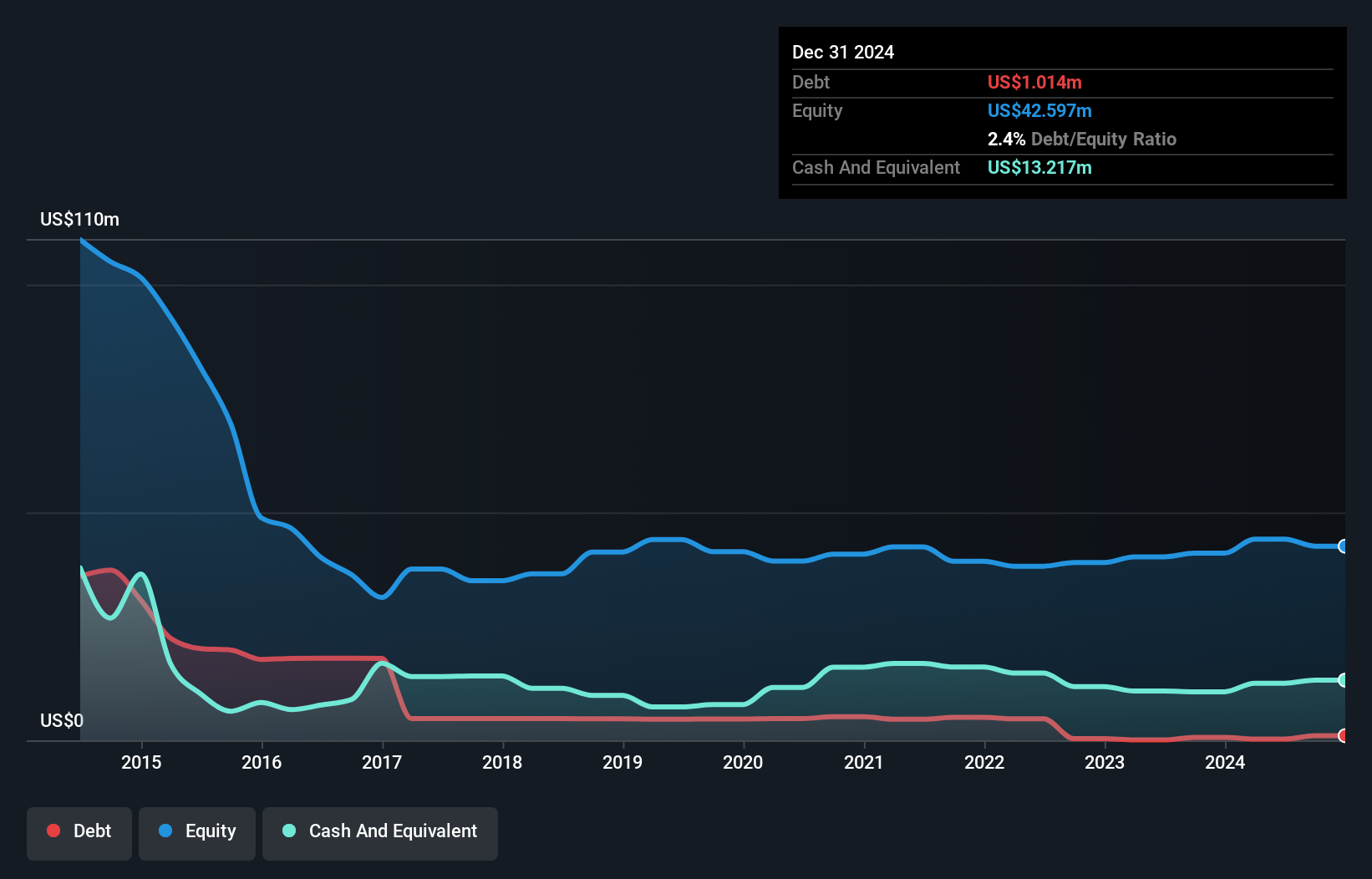

Petrolia SE, with a market cap of NOK286.31 million, operates in the energy services sector across multiple regions. Despite negative earnings growth over the past year, Petrolia has grown profits by 46.1% annually over five years and maintains high-quality earnings. The company is trading significantly below its estimated fair value and has reduced its debt-to-equity ratio to 0.5% over five years while covering debt well with operating cash flow. Its short-term assets exceed both short- and long-term liabilities, but share price volatility remains high compared to most Norwegian stocks, reflecting potential risks for investors in this segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Petrolia.

- Explore historical data to track Petrolia's performance over time in our past results report.

MAX Automation (XTRA:MXHN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: MAX Automation SE, along with its subsidiaries, provides automation solutions across various industries including automotive, electrical, recycling, raw materials recovery, packaging and medical technology sectors with a market cap of €166.21 million.

Operations: The company's revenue is primarily generated from its Vecoplan Group at €161.45 million, followed by the Bdtronic Group with €73.95 million, NSM + Jücker contributing €41.29 million, Elwema at €56.01 million, and AIM Micro with €5.69 million.

Market Cap: €166.21M

MAX Automation SE, with a market cap of €166.21 million, has shown significant financial restructuring, reducing its debt-to-equity ratio from 260.3% to 19.1% over five years while maintaining satisfactory net debt levels at 14%. The company’s short-term assets exceed both short- and long-term liabilities, indicating solid liquidity management. Despite recent losses reported for the third quarter of 2025 and a decline in nine-month sales compared to the previous year, MAX Automation remains profitable over five years with earnings growth driven by automation solutions across diverse sectors. Analysts expect further stock price appreciation amid stable board and management tenure averages above industry norms.

- Navigate through the intricacies of MAX Automation with our comprehensive balance sheet health report here.

- Gain insights into MAX Automation's outlook and expected performance with our report on the company's earnings estimates.

Vidinext (XTRA:VXT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vidinext AG is a media company operating in Germany and Austria with a market cap of €7.03 million.

Operations: No revenue segments have been reported for this media company operating in Germany and Austria.

Market Cap: €7.03M

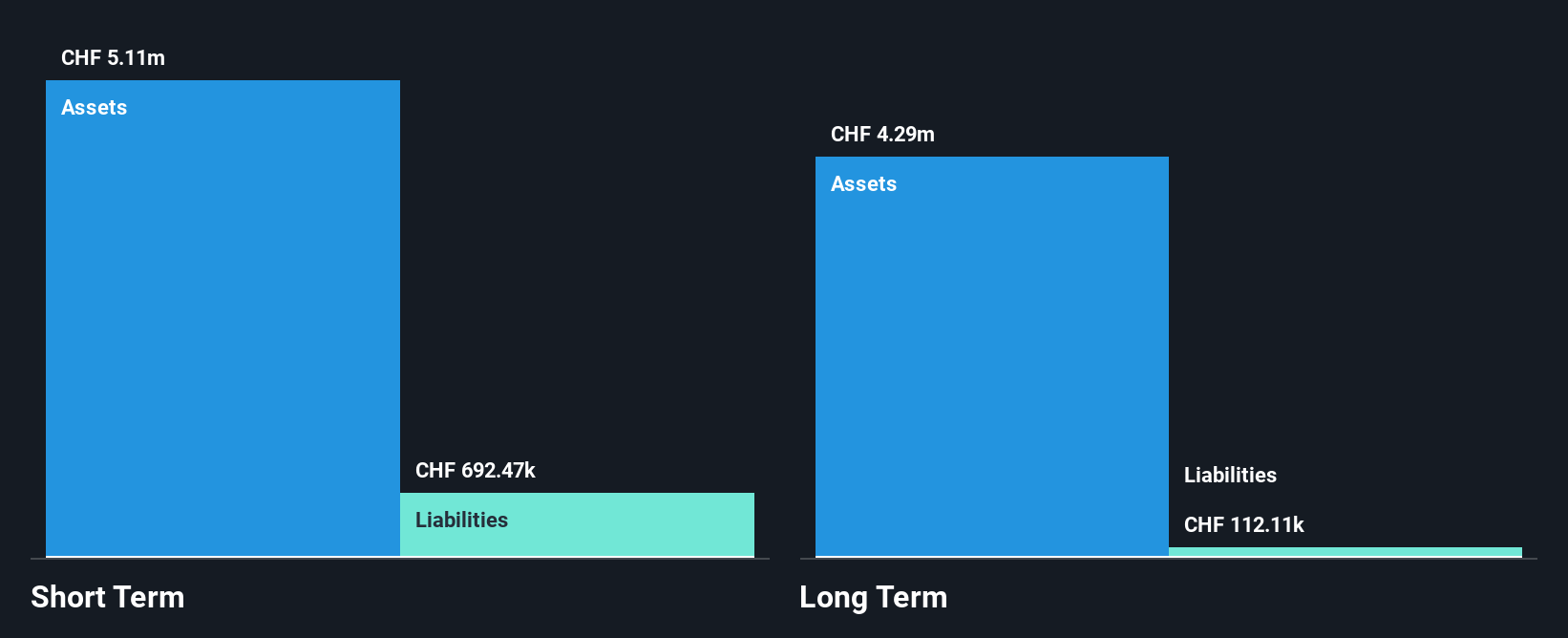

Vidinext AG, a media company in Germany and Austria with a market cap of €7.03 million, is currently pre-revenue and unprofitable but has managed to reduce its losses by 14.9% annually over the past five years. Despite its unprofitability, Vidinext benefits from being debt-free and having short-term assets of CHF5.1 million that exceed both short- and long-term liabilities, ensuring financial stability. The board's average tenure of 6.7 years suggests experienced oversight, although the management team's experience is unclear. The stock is highly volatile but hasn't seen significant shareholder dilution recently, offering some stability amidst fluctuations.

- Take a closer look at Vidinext's potential here in our financial health report.

- Gain insights into Vidinext's historical outcomes by reviewing our past performance report.

Taking Advantage

- Dive into all 288 of the European Penny Stocks we have identified here.

- Interested In Other Possibilities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报