Undiscovered Gems in Europe 3 Promising Stocks for December 2025

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive economic sentiment, investors are keenly observing the gradual recovery forecasted for Germany and mixed signals from the UK economy. In this dynamic environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and potential growth catalysts that can outperform broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Atea (OB:ATEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atea ASA specializes in delivering IT infrastructure and solutions to businesses and public sector entities across the Nordic countries and Baltic regions, with a market capitalization of NOK 17.58 billion.

Operations: Atea ASA's revenue primarily comes from its operations in Sweden (NOK 13.73 billion), Norway (NOK 9.27 billion), and Denmark (NOK 8.56 billion). The company incurs a Group Cost of NOK -12.06 billion, impacting its overall financial performance.

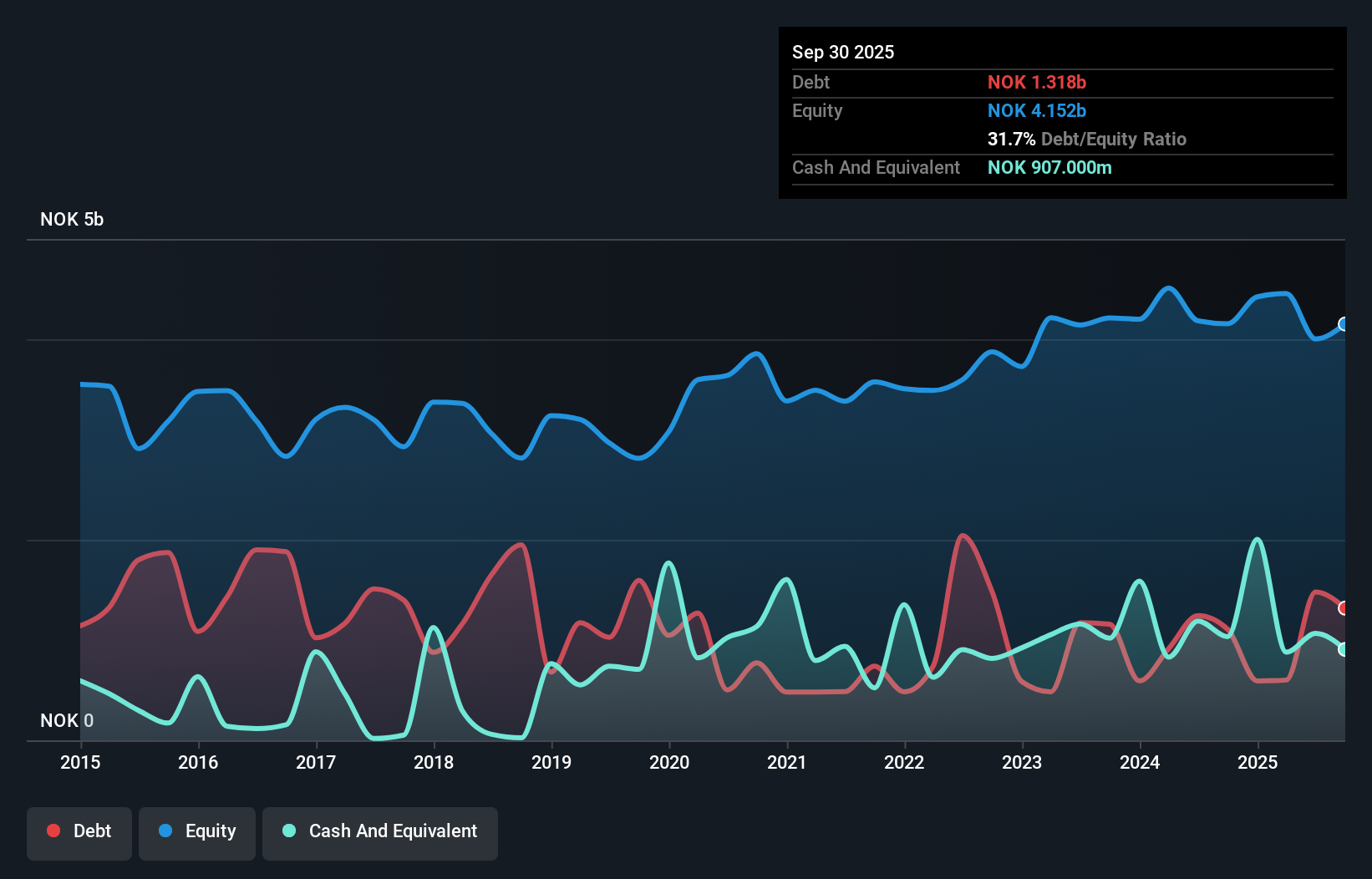

Atea, a notable player in the European IT sector, has shown resilience with earnings growth of 3.5% over the past year, outpacing the industry average of -3.6%. The company's interest payments are well covered by EBIT at 8x coverage, reflecting sound financial management. Its net debt to equity ratio stands at a satisfactory 9.9%, though it has risen from 20% to 31.7% over five years. Recent wins include a significant NOK 500 million annual contract with Tradebroker and a €130 million agreement with NATO's NCIA, highlighting its competitive edge and potential for continued growth in the region.

- Click here to discover the nuances of Atea with our detailed analytical health report.

Gain insights into Atea's past trends and performance with our Past report.

B2 Impact (OB:B2I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: B2 Impact ASA, with a market cap of NOK6.74 billion, operates through its subsidiaries to offer a range of debt solutions.

Operations: B2 Impact generates revenue primarily from its Investments segment, contributing NOK3.22 billion, and the Servicing segment, adding NOK1.34 billion. The company's financial performance is influenced by these segments' contributions to overall revenue.

B2 Impact ASA stands out with its robust earnings growth, posting a 51.7% rise last year, outpacing the Consumer Finance industry average of 27.1%. Despite a high net debt to equity ratio at 173.5%, it has improved from 255.2% over five years, suggesting better debt management. The company reported Q3 revenue of NOK 977 million and net income of NOK 137 million, reversing a prior loss. With earnings per share expected to exceed NOK 1.5-1.7 and dividends projected at NOK 1.7 per share for the year, B2I's financial health and strategic moves indicate promising potential in the Norwegian market.

- Get an in-depth perspective on B2 Impact's performance by reading our health report here.

Gain insights into B2 Impact's historical performance by reviewing our past performance report.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Storytel AB (publ) is a company that offers streaming services for audiobooks and e-books, with a market capitalization of approximately SEK6.48 billion.

Operations: Storytel generates revenue primarily from its Streaming segment, contributing SEK3.48 billion, and its Publishing segment, adding SEK1.24 billion. The company's cost structure includes Group-Wide Items and Eliminations amounting to -SEK764.96 million.

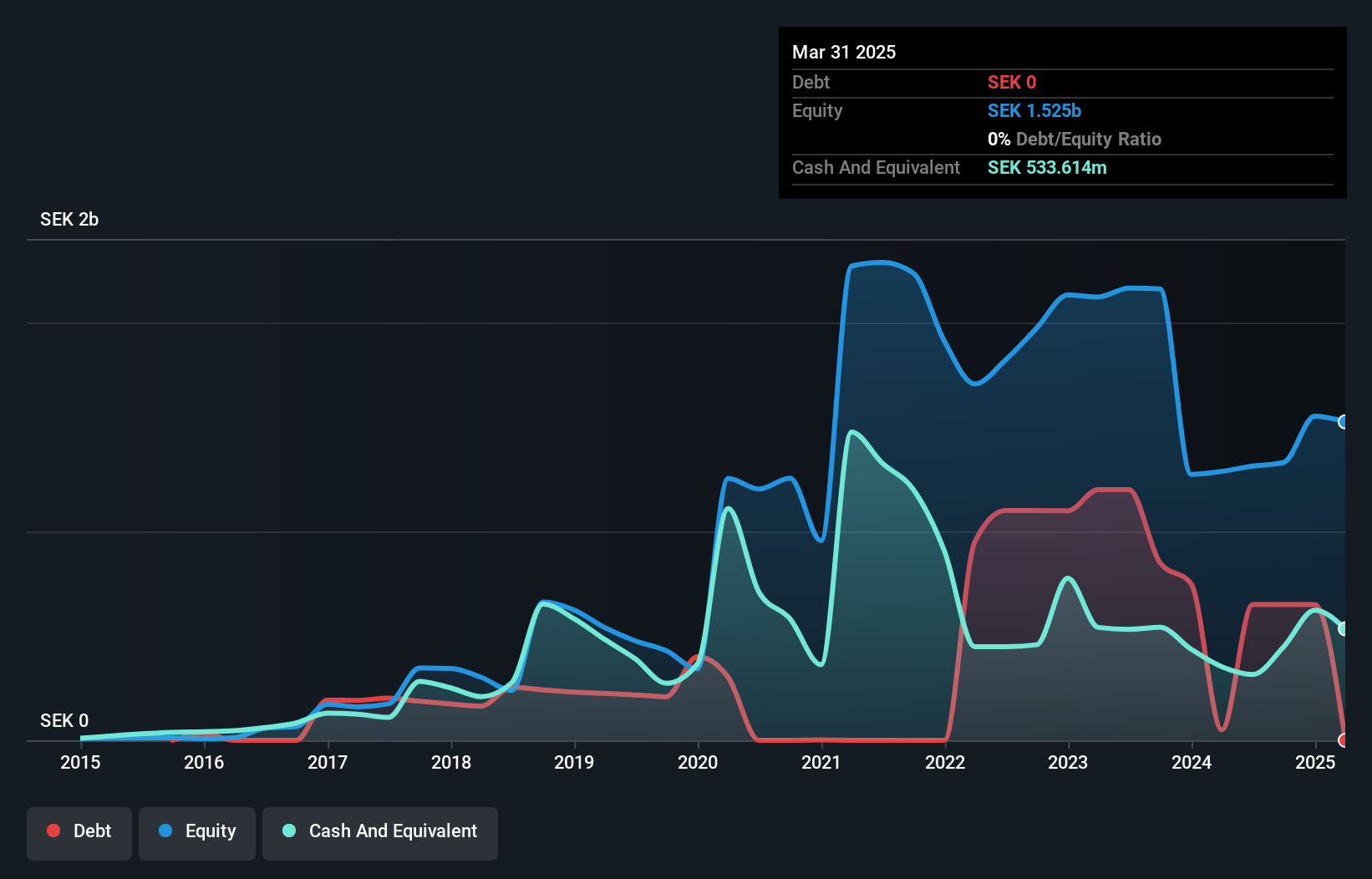

Storytel is making waves with its audiobook and e-book streaming services, showing a robust 18% subscriber growth outside the Nordic region. This expansion is fueled by improved smartphone access and internet connectivity, enhancing revenue prospects. The company has significantly boosted its net income to SEK131 million from SEK51 million year-on-year for Q3 2025, reflecting strong financial health. With earnings per share rising to SEK1.7 from SEK0.67, Storytel's strategic investments in personalized content are paying off by reducing churn rates and elevating user engagement. Despite competitive pressures from major players like Spotify, Storytel's low leverage ratio allows continued investment in market expansion and original content creation while trading at a significant discount to its estimated fair value of SEK126.5 per share suggests potential upside for investors considering the current price of SEK75.25.

Key Takeaways

- Access the full spectrum of 302 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报