Global's December 2025 Stocks Priced Below Estimated Value

As global markets continue to experience a mix of record highs and cautious optimism, investors are navigating an environment shaped by robust U.S. economic growth and AI-driven enthusiasm, juxtaposed with concerns about consumer confidence and employment conditions. In this context, identifying undervalued stocks can be particularly appealing as they offer potential opportunities for value appreciation amidst fluctuating market sentiment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19879.01 | 49.6% |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.36 | 49.5% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1575.22 | 49.5% |

| Nan Juen International (TPEX:6584) | NT$346.00 | NT$686.72 | 49.6% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3161.17 | 49.8% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.05 | 49.5% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11017.42 | 49.8% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK202.98 | 49.7% |

| Allcore (BIT:CORE) | €1.35 | €2.67 | 49.4% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Here's a peek at a few of the choices from the screener.

Hangzhou Onechance Tech Crop (SZSE:300792)

Overview: Hangzhou Onechance Tech Crop. specializes in brand online marketing and management services, with a market cap of CN¥6.47 billion.

Operations: The company's revenue is primarily derived from its advertising segment, which amounts to CN¥1.12 billion.

Estimated Discount To Fair Value: 39.5%

Hangzhou Onechance Tech Corp. is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on cash flows. Despite a decline in sales to CN¥762.95 million from the previous year, net income rose slightly to CN¥98.46 million, indicating improved profitability. Earnings are expected to grow at 32.24% annually, outpacing the Chinese market's average growth rate of 27.6%. However, return on equity is forecasted to remain low at 5.6%.

- The analysis detailed in our Hangzhou Onechance Tech Crop growth report hints at robust future financial performance.

- Get an in-depth perspective on Hangzhou Onechance Tech Crop's balance sheet by reading our health report here.

Taiwan Speciality Chemicals (TPEX:4772)

Overview: Taiwan Speciality Chemicals Corporation manufactures and sells specialty electronic-grade gases and chemicals in Taiwan, with a market cap of NT$44.01 billion.

Operations: The company generates revenue from the production and sale of specialty electronic-grade gases and chemicals within Taiwan.

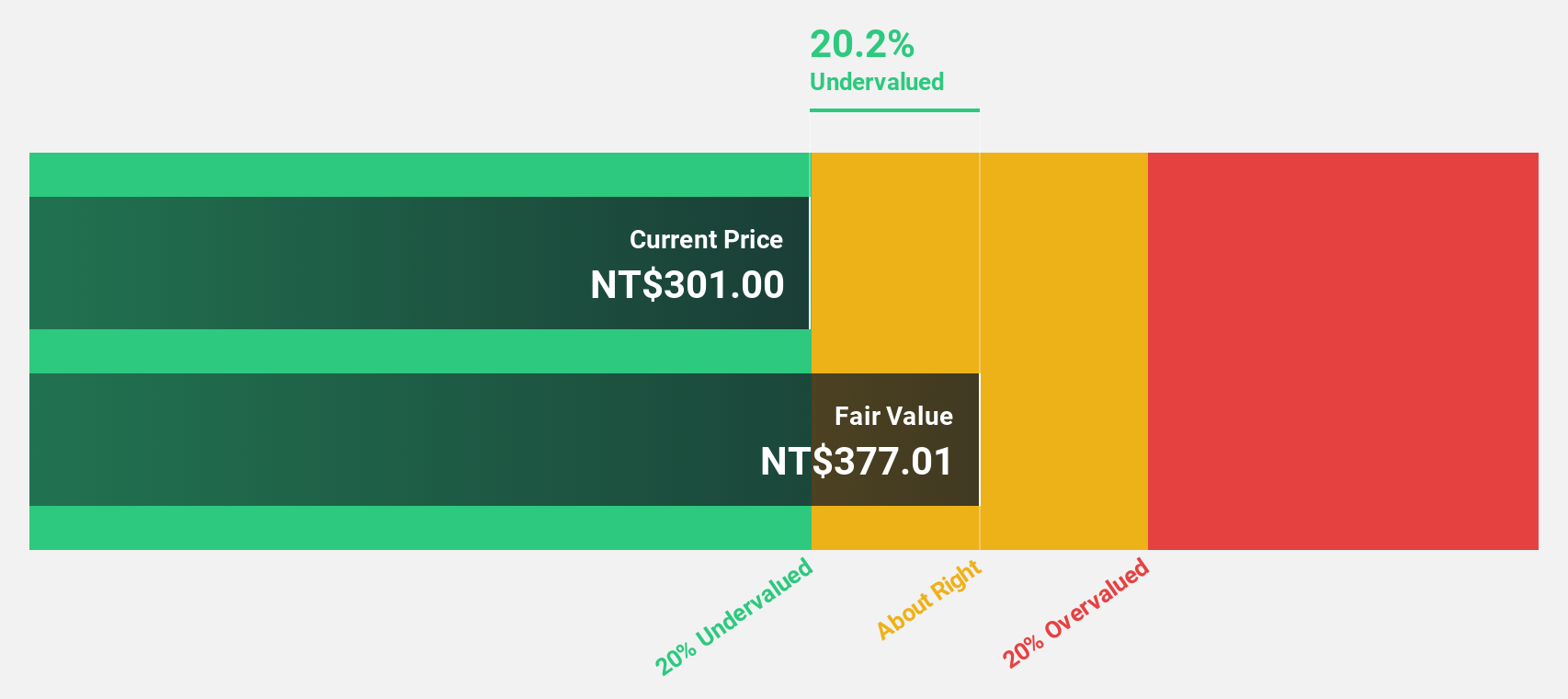

Estimated Discount To Fair Value: 29.9%

Taiwan Speciality Chemicals is trading 29.9% below its estimated fair value, offering potential for cash flow-focused investors. The company reported third-quarter sales of NT$639.51 million, up from NT$213.97 million last year, with net income rising to NT$178.23 million from NT$99.56 million. Earnings are projected to grow significantly at 48.8% annually, surpassing the Taiwanese market's average growth rate of 20.4%, while revenue is expected to increase by a very large margin yearly.

- In light of our recent growth report, it seems possible that Taiwan Speciality Chemicals' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Taiwan Speciality Chemicals.

ASMedia Technology (TWSE:5269)

Overview: ASMedia Technology Inc. designs, develops, and sells high-speed switch, PCIe bridge, and USB controller integrated circuits across various regions including the Americas and Asia, with a market cap of NT$87.86 billion.

Operations: The company's revenue primarily comes from its High-Speed Analogy Electric Circuit segment, generating NT$11.79 billion.

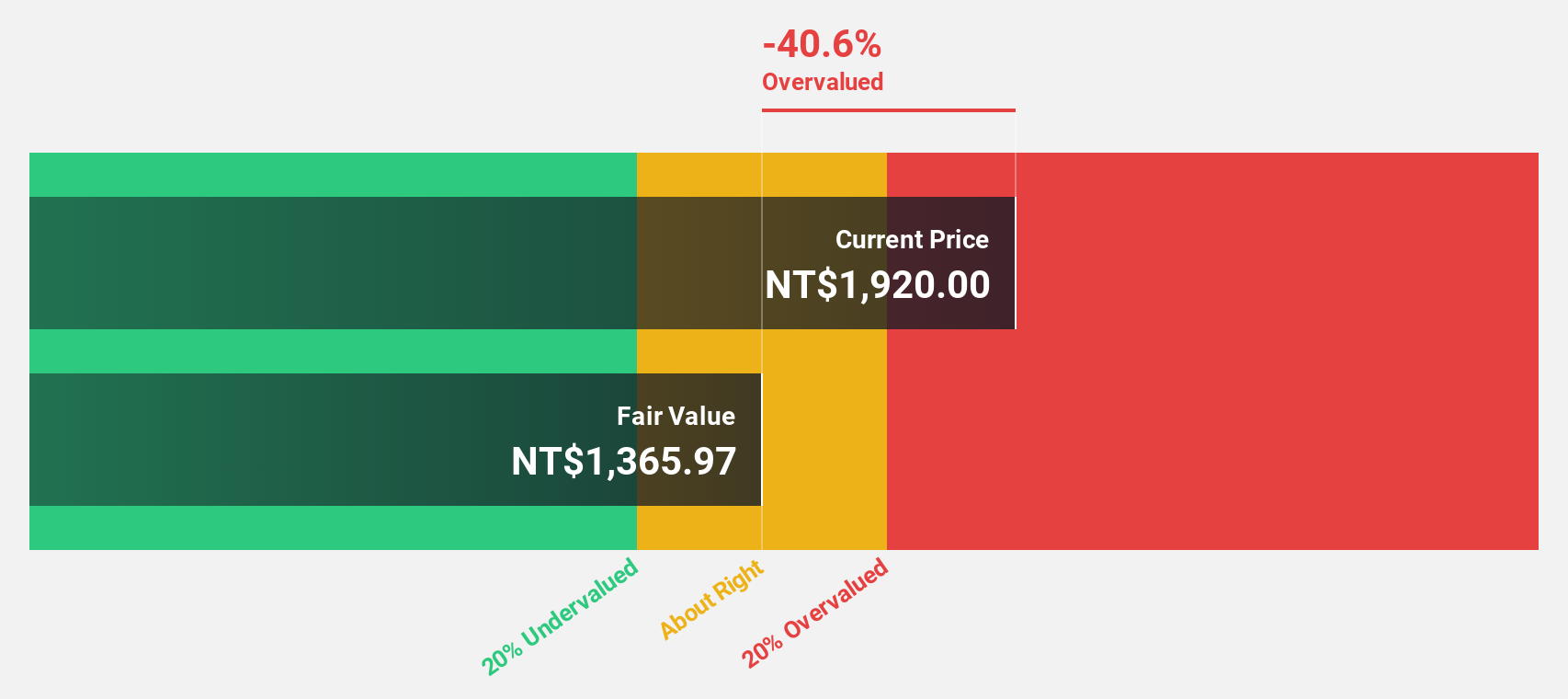

Estimated Discount To Fair Value: 15.2%

ASMedia Technology is trading at NT$1,215, below its estimated fair value of NT$1,432.37, appealing to cash flow-focused investors. Recent earnings show strong growth with third-quarter sales reaching TWD 3.99 billion and net income at TWD 1.58 billion compared to TWD 2.13 billion and TWD 974 million last year respectively. Earnings are forecast to grow significantly by 24.81% annually over the next three years, outpacing the Taiwanese market's average growth rate of 20.4%.

- Our expertly prepared growth report on ASMedia Technology implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of ASMedia Technology.

Summing It All Up

- Unlock our comprehensive list of 478 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报