Exploring High Growth Tech Stocks In December 2025

As global markets continue to navigate a landscape marked by record highs in major U.S. indices and mixed economic signals, the tech sector remains a focal point for investors seeking growth opportunities. With AI optimism buoying sentiment, identifying high-growth tech stocks involves assessing companies that demonstrate robust innovation capabilities and resilience amidst fluctuating market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Knowmerce | 35.50% | 33.23% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

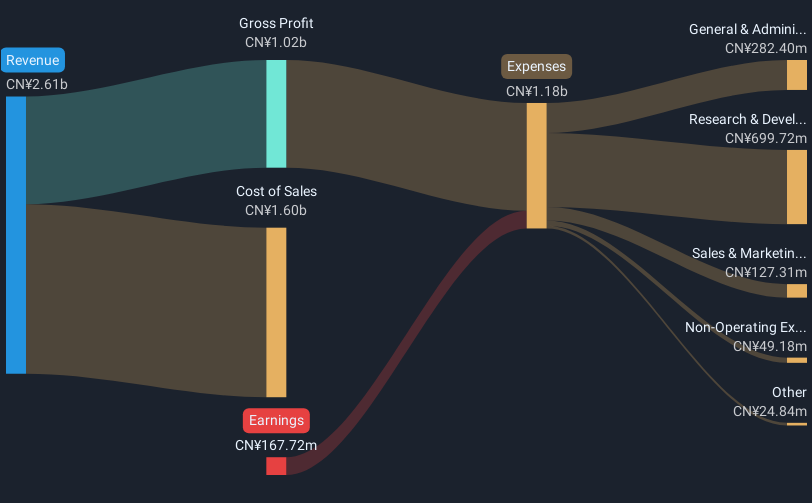

Overview: Wuhan Guide Infrared Co., Ltd. specializes in the design, manufacture, marketing, and sale of infrared thermal imaging detectors and modules as well as electro-optical systems both in China and internationally, with a market cap of CN¥63.08 billion.

Operations: The company generates revenue primarily through the sale of infrared thermal imaging detectors, modules, and electro-optical systems. It operates both domestically and internationally, leveraging its expertise in advanced imaging technology.

Wuhan Guide Infrared has demonstrated robust growth, with a reported 27.4% annual increase in revenue and an impressive 61.3% surge in earnings per year, outpacing the CN market's average. This growth trajectory is supported by strategic amendments to its governance structures and bylaws, ensuring agility in corporate management. The company's recent financial performance reveals a significant leap with net income escalating to CN¥581.94 million from CN¥50.21 million year-over-year, underscoring its potential amidst a competitive electronic industry landscape where it has recently turned profitable.

- Click here to discover the nuances of Wuhan Guide Infrared with our detailed analytical health report.

Explore historical data to track Wuhan Guide Infrared's performance over time in our Past section.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

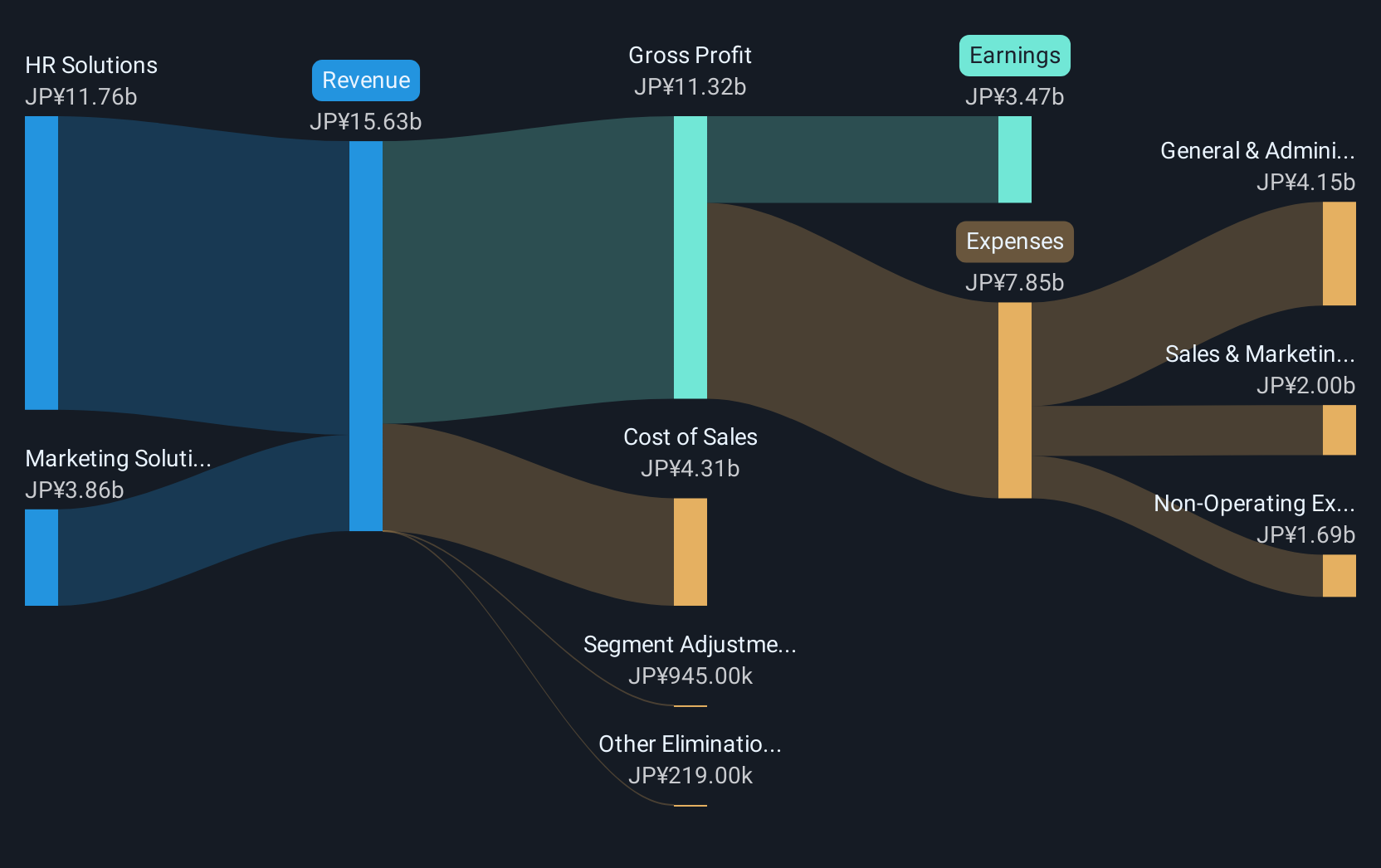

Overview: Plus Alpha Consulting Co.,Ltd. offers marketing and HR solutions in Japan with a market cap of ¥102.20 billion.

Operations: The company specializes in marketing and HR solutions within Japan. It focuses on providing tailored services to enhance business operations and workforce management.

Plus Alpha ConsultingLtd. has demonstrated a notable uptick in financial performance, with revenue and earnings growth outstripping the JP market's average. In the fiscal year ending September 2025, the company announced a revenue of JPY 17.08 billion and net income of JPY 3.26 billion, reflecting an earnings growth of 18.7% per year, which is forecasted to continue surpassing market growth rates. The firm's commitment to innovation is evident from its R&D expenses that are strategically aligned with its long-term objectives, ensuring sustained advancements in its consulting solutions amidst evolving market demands. This approach not only secures a competitive edge but also enhances shareholder value through increased dividends and strategic alliances like that with RAKUS Co., Ltd., aiming for broader market penetration and enriched service offerings.

- Click to explore a detailed breakdown of our findings in Plus Alpha ConsultingLtd's health report.

Learn about Plus Alpha ConsultingLtd's historical performance.

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★☆☆

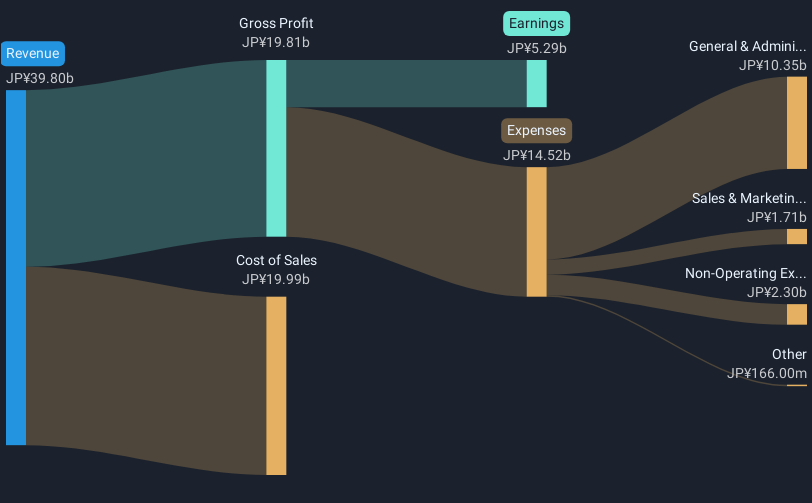

Overview: COVER Corporation operates a platform for distributing videos and music through virtual YouTubers (VTubers) in Japan, with a market cap of ¥99.07 billion.

Operations: The company generates revenue by distributing videos and music via a VTuber platform in Japan.

COVER's recent strategic maneuvers and financial metrics underscore its potential within the high-growth tech sector. With a revenue growth rate of 12.7% annually, surpassing the JP market average of 4.6%, and an earnings increase of 19.3% per year—exceeding market expectations of 8.6%—the company is positioned for robust future performance. Notably, its commitment to innovation is reflected in substantial R&D investments, which have supported a consistent earnings growth of 28.7% over the past five years, signaling a strong focus on long-term value creation through technological advancements. Despite not outperforming the Entertainment industry's growth last year, COVER's forward-looking initiatives indicate promising prospects, especially with an anticipated high Return on Equity at 26.1%.

- Delve into the full analysis health report here for a deeper understanding of COVER.

Examine COVER's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Embark on your investment journey to our 240 Global High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报