Global Growth Companies With Up To 34% Insider Ownership

As global markets continue to exhibit mixed signals, with U.S. stocks reaching record highs amid AI optimism and economic growth, investors are navigating a landscape of both opportunities and challenges. In this environment, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them intriguing prospects for those seeking growth-oriented investments.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's dive into some prime choices out of the screener.

Fibocom Wireless (SZSE:300638)

Simply Wall St Growth Rating: ★★★★★☆

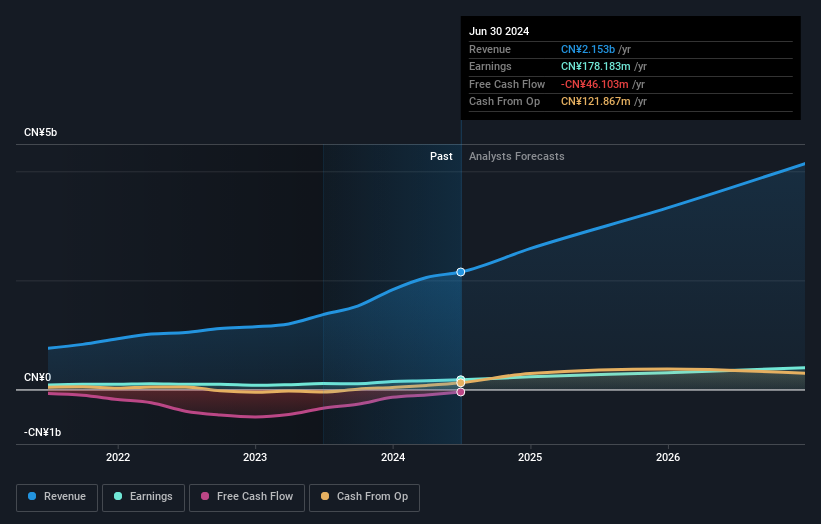

Overview: Fibocom Wireless Inc. designs, develops, and sells wireless communication modules and solutions both in China and internationally with a market cap of CN¥23.58 billion.

Operations: Fibocom Wireless Inc. generates revenue through the design, development, and sale of wireless communication modules and solutions across domestic and international markets.

Insider Ownership: 34.1%

Fibocom Wireless is poised for growth with its revenue expected to outpace the market at 20.8% annually, despite recent earnings declines and shareholder dilution. The company's innovative product launches, such as AI dongles and 5G solutions, highlight its commitment to advancing digital transformation across industries. However, Fibocom's volatile share price and low profit margins signal caution for investors prioritizing stability. Recent strategic meetings indicate a focus on governance improvements and capital restructuring.

- Dive into the specifics of Fibocom Wireless here with our thorough growth forecast report.

- Our valuation report unveils the possibility Fibocom Wireless' shares may be trading at a premium.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd specializes in the research, development, production, sales, and service of automotive parts both in China and internationally, with a market cap of CN¥12.70 billion.

Operations: The company's revenue primarily stems from its activities in the automotive parts sector, serving both domestic and international markets.

Insider Ownership: 34.7%

Wuxi Longsheng Technology's growth trajectory is underscored by its forecasted earnings and revenue expansion, both exceeding 28% annually, outpacing the broader Chinese market. Recent financial results reflect this momentum, with net income rising to CNY 210.27 million for the nine months ending September 2025. Despite trading below fair value and having a volatile share price, insider ownership remains high without significant recent trading activity. The company's low future return on equity and large one-off items warrant cautious optimism.

- Navigate through the intricacies of Wuxi Longsheng TechnologyLtd with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Wuxi Longsheng TechnologyLtd is priced higher than what may be justified by its financials.

Easy Click Worldwide Network Technology (SZSE:301171)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Easy Click Worldwide Network Technology Co., Ltd. (SZSE:301171) operates in the technology sector with a focus on network solutions and has a market cap of CN¥17.31 billion.

Operations: The company's primary revenue segment is Advertising and Promotion Services, which generated CN¥3.51 billion.

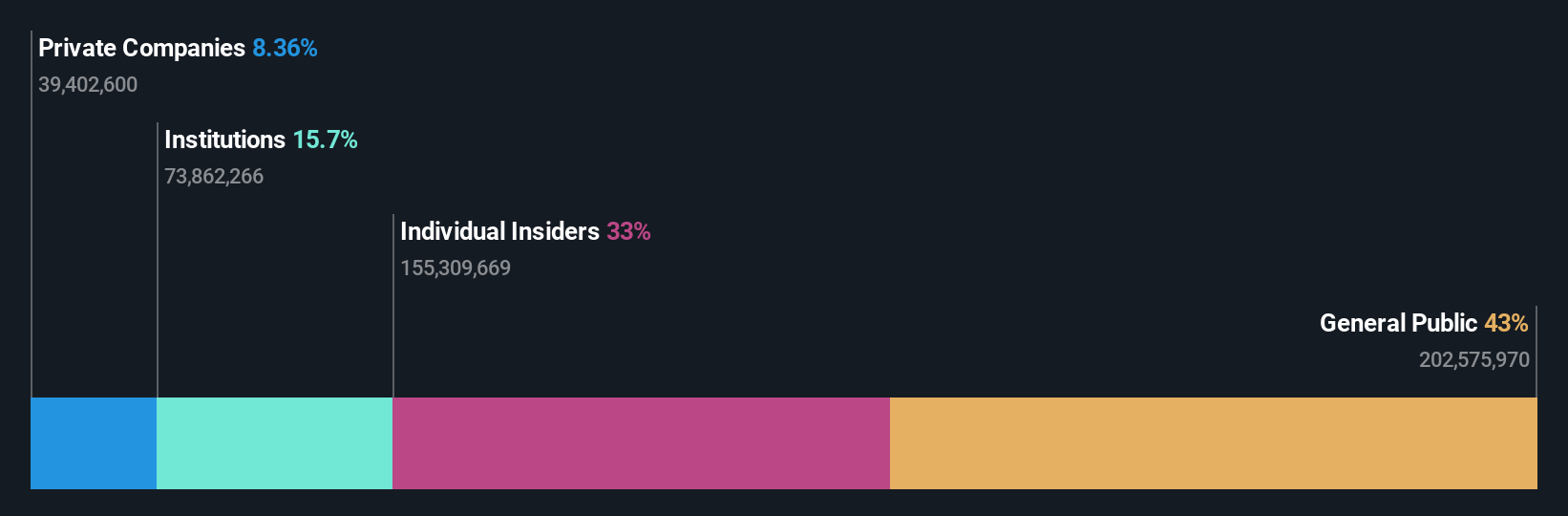

Insider Ownership: 31.9%

Easy Click Worldwide Network Technology is poised for robust growth, with revenue expected to rise 21.7% annually, surpassing the broader Chinese market's average. However, its earnings growth lags behind the market at 21.74%. Recent financials show sales climbing to CNY 2.72 billion for nine months ending September 2025, yet profit margins have decreased from last year. The share price has been highly volatile recently and insider trading activity remains minimal, suggesting a mixed outlook on stability and confidence.

- Click here to discover the nuances of Easy Click Worldwide Network Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Easy Click Worldwide Network Technology is trading beyond its estimated value.

Seize The Opportunity

- Dive into all 855 of the Fast Growing Global Companies With High Insider Ownership we have identified here.

- Ready To Venture Into Other Investment Styles? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报