Exploring Three Undiscovered Gems in the Middle East Market

In recent times, Middle Eastern markets have experienced a retreat, with major Gulf indices such as those in Saudi Arabia and the UAE declining amid geopolitical tensions over Yemen. However, Bahrain's market showed resilience with a slight rise following fiscal reform announcements, highlighting the region's dynamic economic landscape. In this context of fluctuating markets, identifying promising stocks requires an understanding of how companies can navigate regional challenges while capitalizing on opportunities for growth and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 31.20% | 44.24% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

IZDEMIR Enerji Elektrik Uretim (IBSE:IZENR)

Simply Wall St Value Rating: ★★★★★☆

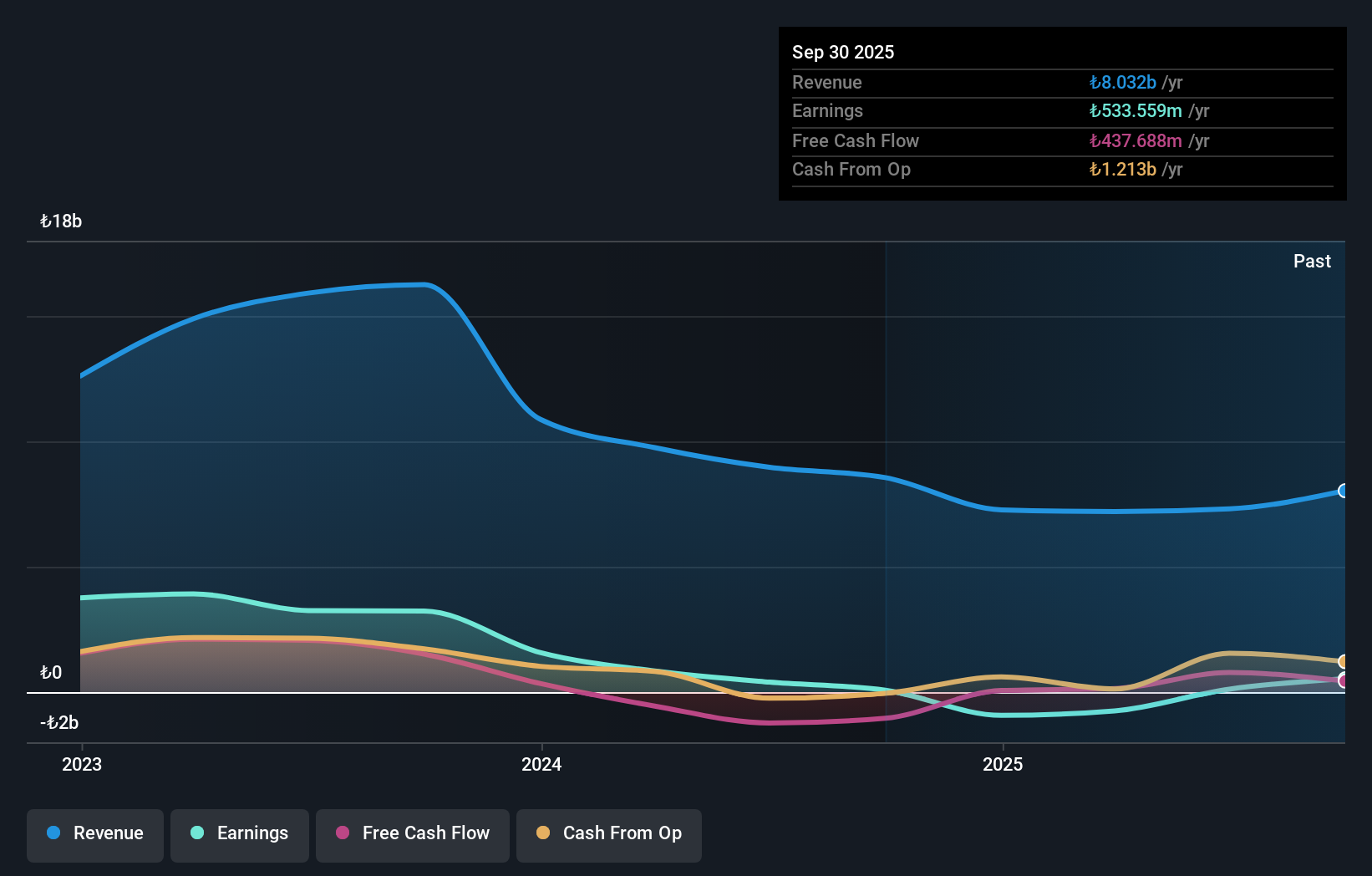

Overview: IZDEMIR Enerji Elektrik Uretim A.S. is engaged in the production and sale of electricity generated from coal, with a market capitalization of TRY23.46 billion.

Operations: IZDEMIR Enerji Elektrik Uretim generates revenue primarily from its non-regulated utility segment, amounting to TRY7.08 billion. The company focuses on coal-based electricity production and sales.

IZDEMIR Enerji Elektrik Uretim has experienced a notable turnaround with its earnings skyrocketing by 3183.8% over the past year, significantly outpacing the Electric Utilities industry's growth of 15%. Despite a one-off loss of TRY239.2 million impacting recent financials, the company's net debt to equity ratio stands at a satisfactory 3.8%, indicating sound financial health. Recent results show net income for Q3 at TRY548.85 million, up from TRY154.71 million last year, with EPS rising to TRY0.22 from TRY0.0635, highlighting improved profitability and operational efficiency amidst fluctuating sales figures.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★☆

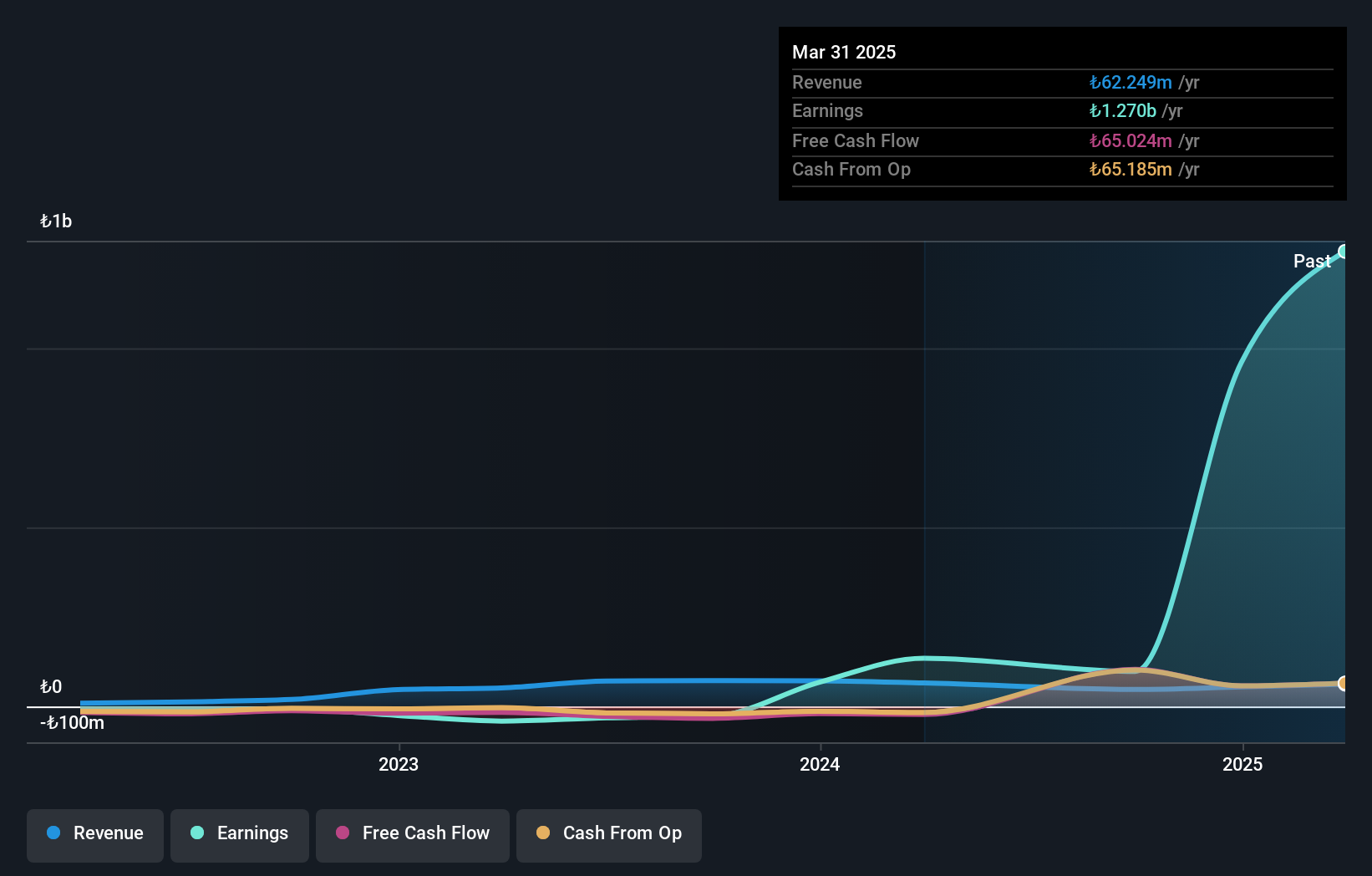

Overview: Lydia Yesil Enerji Kaynaklari A.S. is a Turkish company involved in the production and sale of electricity and heat energy, with a market capitalization of TRY26.21 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from the production and sale of electricity and heat energy in Turkey. The company has a market capitalization of TRY26.21 billion, with its financial performance reflected in its revenue segments.

Lydia Yesil Enerji Kaynaklari, a small player in the renewable energy sector, has been making waves with an impressive earnings growth of 967.6% over the past year, outpacing the industry average of -24.9%. Despite its lack of significant revenue at TRY43 million and high volatility in share price recently, LYDYE boasts no debt and high-quality non-cash earnings. However, recent reports show a net loss of TRY125.81 million for Q3 2025 compared to TRY52.25 million last year, though nine-month figures reveal a substantial net income increase to TRY518.31 million from TRY58.02 million previously.

Almasar Alshamil Education Company JSC (SASE:6019)

Simply Wall St Value Rating: ★★★★★☆

Overview: Almasar Alshamil Education Company JSC is engaged in offering education services across Saudi Arabia and the United Arab Emirates, with a market capitalization of SAR2.52 billion.

Operations: Almasar Alshamil generates revenue primarily from its education services, totaling SAR501.45 million. The company has a market capitalization of SAR2.52 billion.

Almasar Alshamil Education Company JSC, a small player in the education sector, recently completed an IPO worth SAR 599.05 million at SAR 19.5 per share. The company stands out with its earnings growth of 114% over the past year, significantly outperforming its industry peers who saw a -4.4% change. With cash exceeding total debt and interest payments well-covered by EBIT (24x), financial stability seems strong despite highly illiquid shares. Trading at nearly half of its estimated fair value suggests potential upside for investors, with revenue expected to grow by about 14% annually moving forward.

Taking Advantage

- Dive into all 179 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报