AJ Bell Leads The Charge With 2 Other UK Penny Stocks

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting concerns about global economic recovery. In such fluctuating markets, investors often seek stocks that combine affordability with growth potential. Penny stocks, though an old term, continue to capture attention as they typically involve smaller or newer companies that can offer significant opportunities when backed by strong financials. This article explores three noteworthy penny stocks in the UK market that may present intriguing prospects for investors.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.28 | £498.41M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £155.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.995 | £15.93M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £28.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.715 | $435.99M | ✅ 3 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.53 | £184.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.53 | £73.64M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

AJ Bell (LSE:AJB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: AJ Bell plc operates investment platforms in the United Kingdom and has a market cap of approximately £1.78 billion.

Operations: The company generates revenue of £316.92 million from its Investment Services segment.

Market Cap: £1.78B

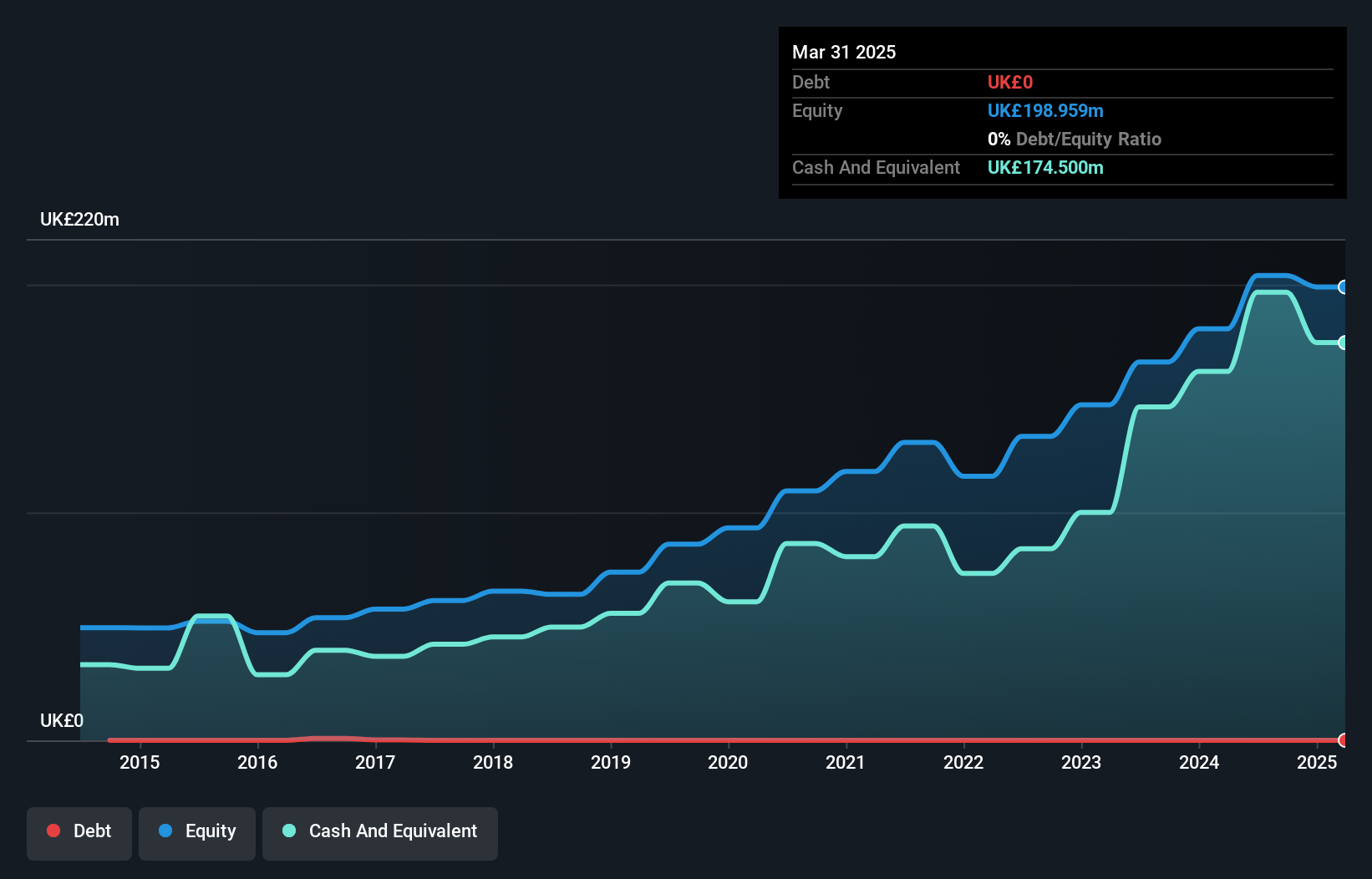

AJ Bell plc, with a market cap of £1.78 billion and revenue of £316.92 million, has demonstrated strong financial health and growth potential. The company reported net income of £105.12 million for the year ended September 30, 2025, marking a significant increase from the previous year. AJ Bell's earnings have grown at an impressive rate over the past five years and continue to exceed industry averages. The company is debt-free and has initiated a share buyback program worth up to £50 million while increasing its dividend for the 21st consecutive year, reflecting robust shareholder returns and capital management strategies.

- Navigate through the intricacies of AJ Bell with our comprehensive balance sheet health report here.

- Understand AJ Bell's earnings outlook by examining our growth report.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, along with its subsidiaries, offers financial management software both in the United Kingdom and internationally, with a market cap of £162.96 million.

Operations: The company generates £67.61 million in revenue from its financial management software offerings across the UK and international markets.

Market Cap: £162.96M

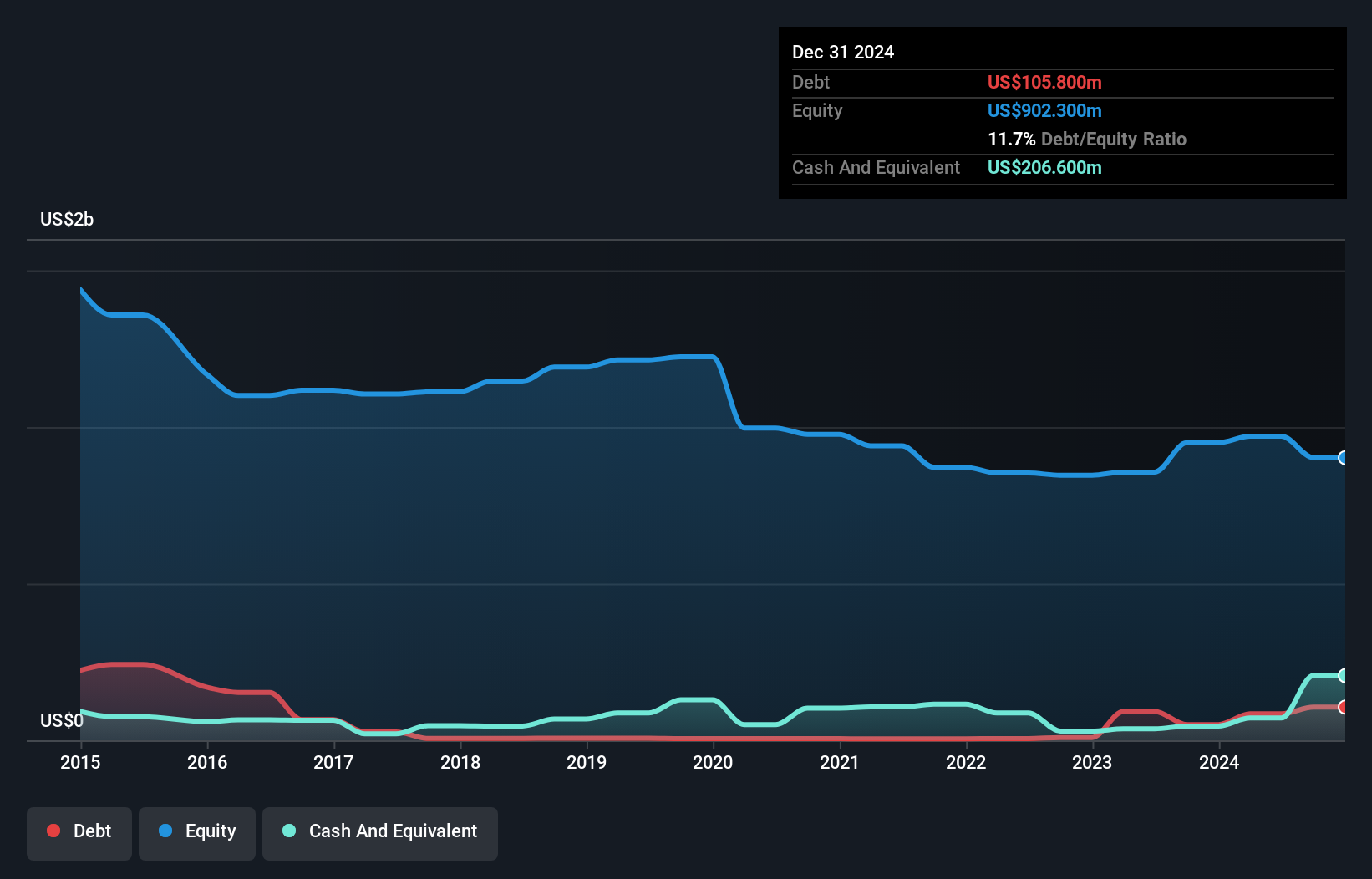

Aptitude Software Group, with a market cap of £162.96 million and revenue of £67.61 million, faces challenges such as negative earnings growth and declining profit margins over the past year. However, it has maintained financial stability with short-term assets exceeding long-term liabilities and cash surpassing total debt. Recent developments include a significant contract renewal worth £7.6 million for its Fynapse platform with a US-based client, highlighting its capability in finance automation and data management. This renewal underscores Aptitude's potential to expand its market reach by serving both large enterprises and growing mid-market firms effectively.

- Get an in-depth perspective on Aptitude Software Group's performance by reading our balance sheet health report here.

- Gain insights into Aptitude Software Group's future direction by reviewing our growth report.

Hunting (LSE:HTG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hunting PLC, with a market cap of £551.69 million, operates globally by manufacturing components, technology systems, and precision parts.

Operations: The company's revenue is derived from several segments: Asia Pacific ($316.6 million), Hunting Titan ($212.9 million), Subsea Technologies ($127.4 million), North America excluding Subsea Technologies ($384.7 million), and Europe, Middle East, and Africa (EMEA) with $80.4 million in revenue.

Market Cap: £551.69M

Hunting PLC, with a market cap of £551.69 million, is navigating the penny stock landscape by leveraging its global operations and strategic initiatives. Despite being unprofitable, Hunting has managed to reduce losses over the past five years and maintains a strong cash position with short-term assets exceeding liabilities. The company recently secured a significant contract in Brazil for its enhanced oil recovery technology, marking an important geographic expansion into South America. With $336.5 million in liquidity as of September 2025, Hunting is actively pursuing acquisitions to bolster growth across key product groups while maintaining stable weekly volatility and positive free cash flow.

- Click to explore a detailed breakdown of our findings in Hunting's financial health report.

- Evaluate Hunting's prospects by accessing our earnings growth report.

Taking Advantage

- Take a closer look at our UK Penny Stocks list of 301 companies by clicking here.

- Curious About Other Options? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报