Three European High Growth Tech Stocks To Watch

As the pan-European STOXX Europe 600 Index edges closer to record highs amid optimism about future earnings and economic prospects, investors are keenly observing the high-growth tech sector, which remains a focal point of innovation and potential. In such an environment, identifying promising stocks often involves looking for companies with robust growth trajectories and adaptability to evolving technological trends, making them standouts in a dynamic market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.75% | 49.66% | ★★★★★★ |

| Pharma Mar | 19.32% | 41.01% | ★★★★★☆ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Kitron | 21.22% | 32.49% | ★★★★★★ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Gapwaves | 32.48% | 72.52% | ★★★★★☆ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 17.38% | 66.50% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

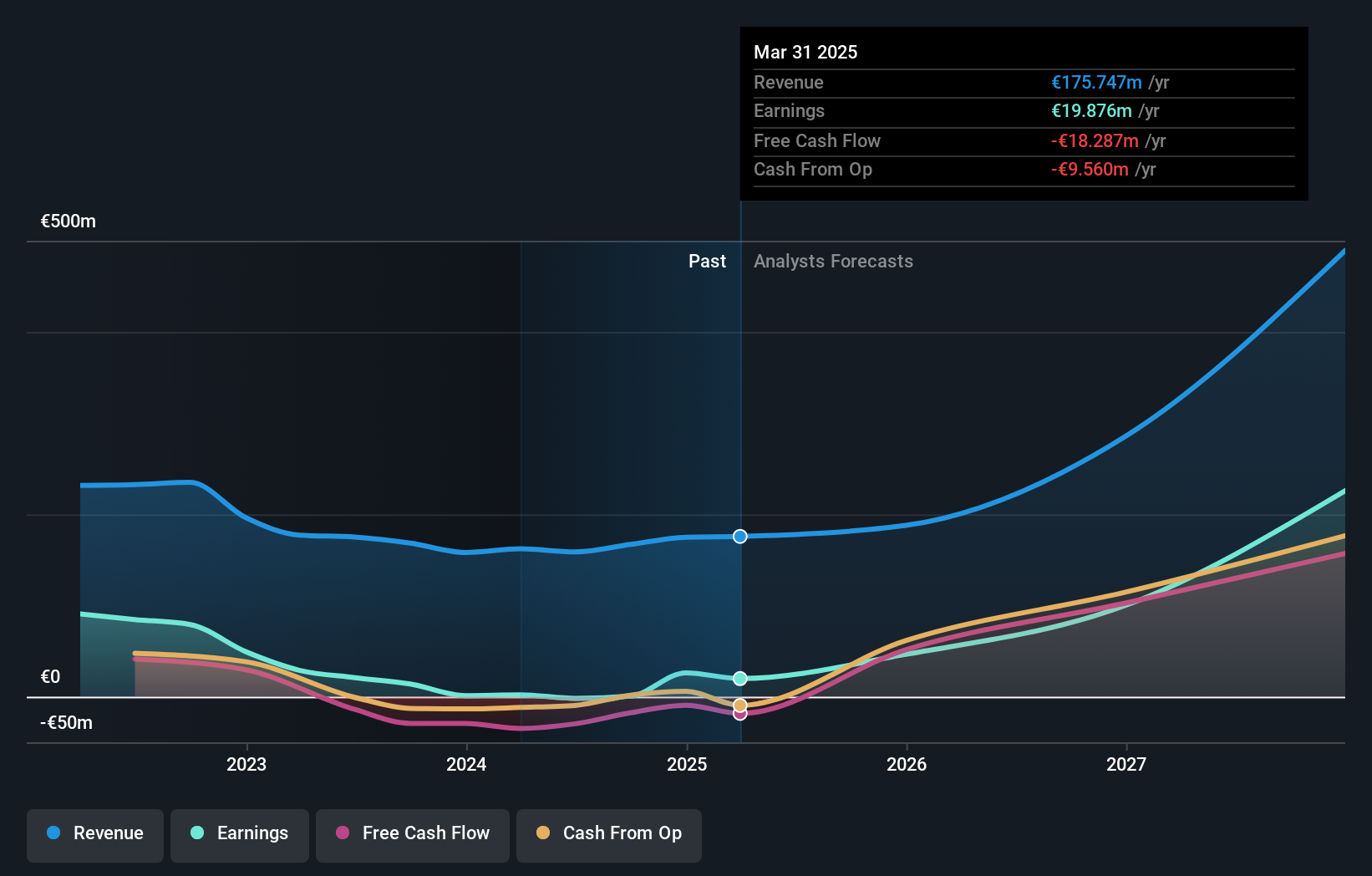

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharma Mar, S.A. is a biopharmaceutical company that specializes in the research, development, production, and commercialization of bio-active principles for oncology across various international markets; it has a market cap of €1.28 billion.

Operations: The company generates revenue primarily from its oncology segment, amounting to €179.94 million. Operating across multiple international markets, it focuses on the development and commercialization of bio-active principles for cancer treatment.

Pharma Mar has demonstrated remarkable financial dynamics, with earnings skyrocketing by 5367% over the past year, significantly outpacing the Biotechs industry's growth of 118.6%. This surge is underpinned by robust revenue growth projections at 19.3% annually, surpassing Spain's market average of 4.7%. Looking ahead, Pharma Mar's earnings are expected to continue their upward trajectory at an annual rate of 41%, well above the broader Spanish market forecast of 7%. These figures reflect not just short-term gains but a promising outlook for sustained financial health and innovation leadership in biotechnology.

- Click here to discover the nuances of Pharma Mar with our detailed analytical health report.

Explore historical data to track Pharma Mar's performance over time in our Past section.

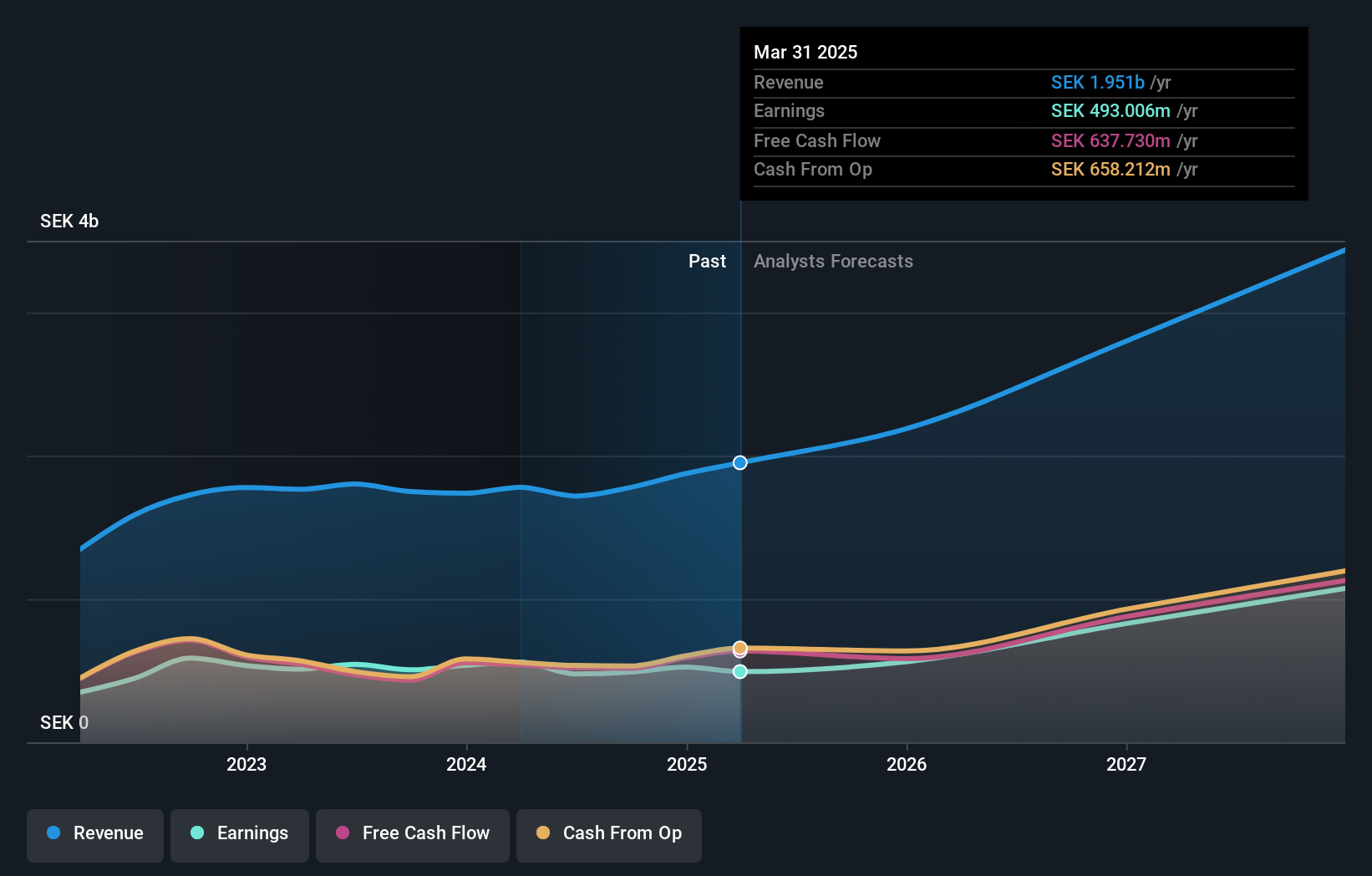

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Truecaller AB (publ) is a company that creates mobile caller ID applications for both individuals and businesses across India, the Middle East, Africa, and other international markets, with a market capitalization of approximately SEK6.58 billion.

Operations: Truecaller AB (publ) generates revenue primarily through its communications software segment, which contributed SEK2.02 billion. The company operates in India, the Middle East, Africa, and other international markets.

Truecaller's recent strategic initiatives underscore its commitment to enhancing user engagement and revenue growth. The launch of the Family Protection feature, which integrates safety tools for family members, aligns with Truecaller's focus on expanding its suite of communication security products. This feature not only fosters a safer communication environment but also opens avenues for premium subscription models, potentially boosting the company’s recurring revenue streams. Additionally, Truecaller's collaboration with SmartBuy through the Customer Experience Solution Suite exemplifies its push towards improving transparency and trust in business communications, setting a new standard in customer interactions. These developments reflect Truecaller’s proactive approach in leveraging technology to secure and streamline communication solutions in diverse markets.

- Get an in-depth perspective on Truecaller's performance by reading our health report here.

Evaluate Truecaller's historical performance by accessing our past performance report.

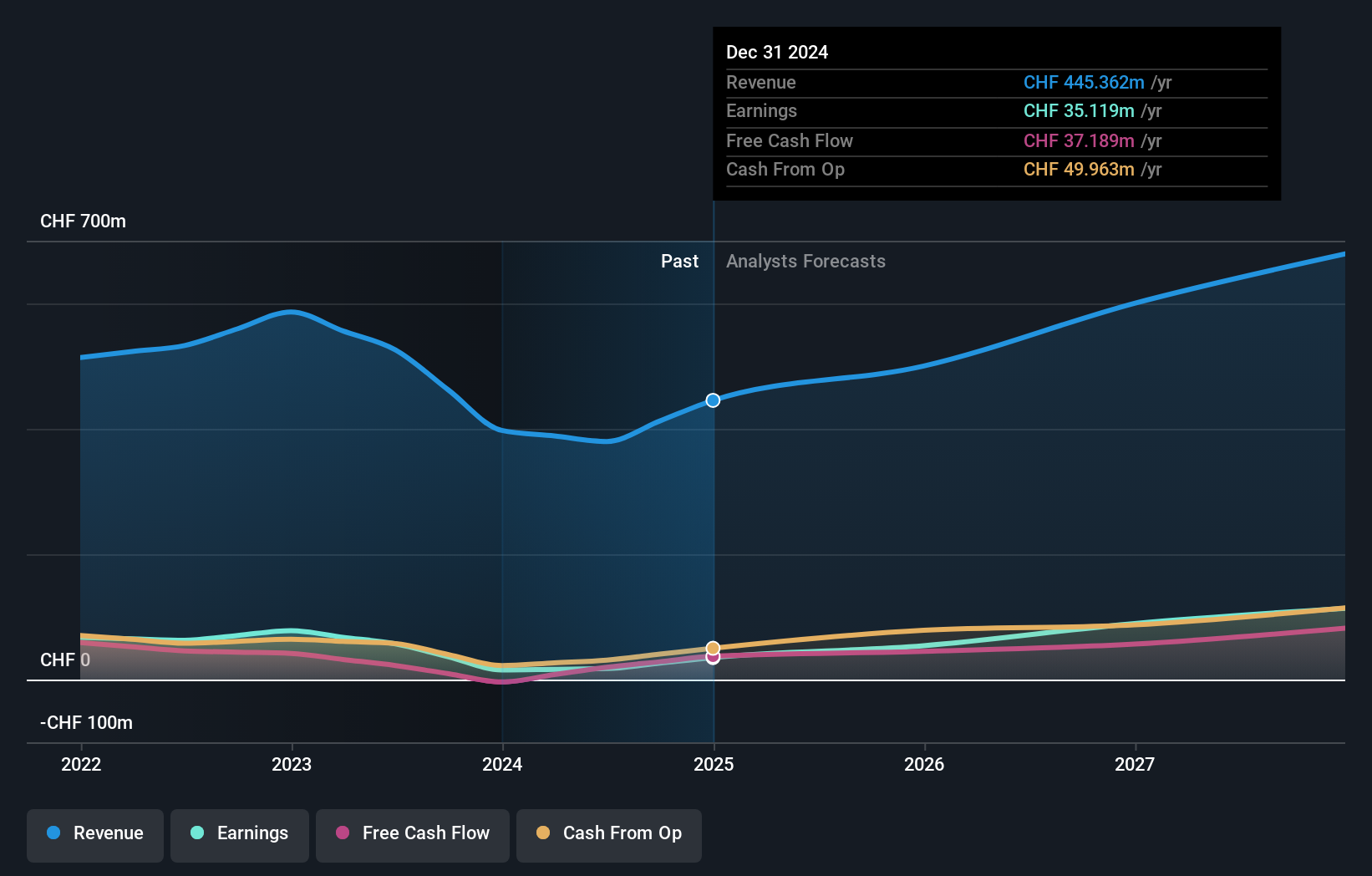

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Comet Holding AG, along with its subsidiaries, offers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets, with a market capitalization of CHF1.75 billion.

Operations: The company's revenue is primarily driven by its Plasma Control Technologies (PCT) segment, generating CHF287.40 million, followed by X-Ray Systems (IXS) at CHF109.40 million and Industrial X-Ray Modules (IXM) at CHF96.50 million.

Comet Holding AG's strategic focus on R&D has significantly bolstered its market position, with a notable 122.3% surge in earnings over the past year, outpacing the electronic industry's average. This investment in innovation is pivotal as Comet's R&D expenses are robustly aligned with its revenue growth of 11.5% per year, showcasing a commitment to advancing technology that exceeds typical market performance. Despite a volatile share price recently, Comet's forward-looking earnings guidance anticipates substantial growth at 37.2% annually, underpinned by high-quality earnings and positive free cash flow dynamics. This trajectory is supported by refined corporate guidance projecting net sales towards CHF 460 million for 2025, indicating cautious optimism in their financial strategy amidst challenging market conditions.

- Dive into the specifics of Comet Holding here with our thorough health report.

Understand Comet Holding's track record by examining our Past report.

Key Takeaways

- Investigate our full lineup of 47 European High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报