European Market Insights: 3 Penny Stocks With At Least €10M Market Cap

The European market has shown resilience, with the STOXX Europe 600 Index ending slightly higher amid optimism about earnings and economic prospects. As investors seek opportunities in this evolving landscape, penny stocks continue to draw attention for their potential value and growth. Although the term "penny stocks" may seem outdated, these smaller or newer companies can offer compelling investment opportunities when backed by solid financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.54B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €221.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.08 | SEK192.25M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.28 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 288 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Guillemot (ENXTPA:GUI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guillemot Corporation S.A. designs, manufactures, and sells interactive entertainment equipment and accessories across the European Union, the United Kingdom, North America, and internationally with a market cap of €70.08 million.

Operations: The company generates revenue through its Hercules segment, which accounts for €12.25 million, and its Thrustmaster segment, contributing €108.57 million.

Market Cap: €70.08M

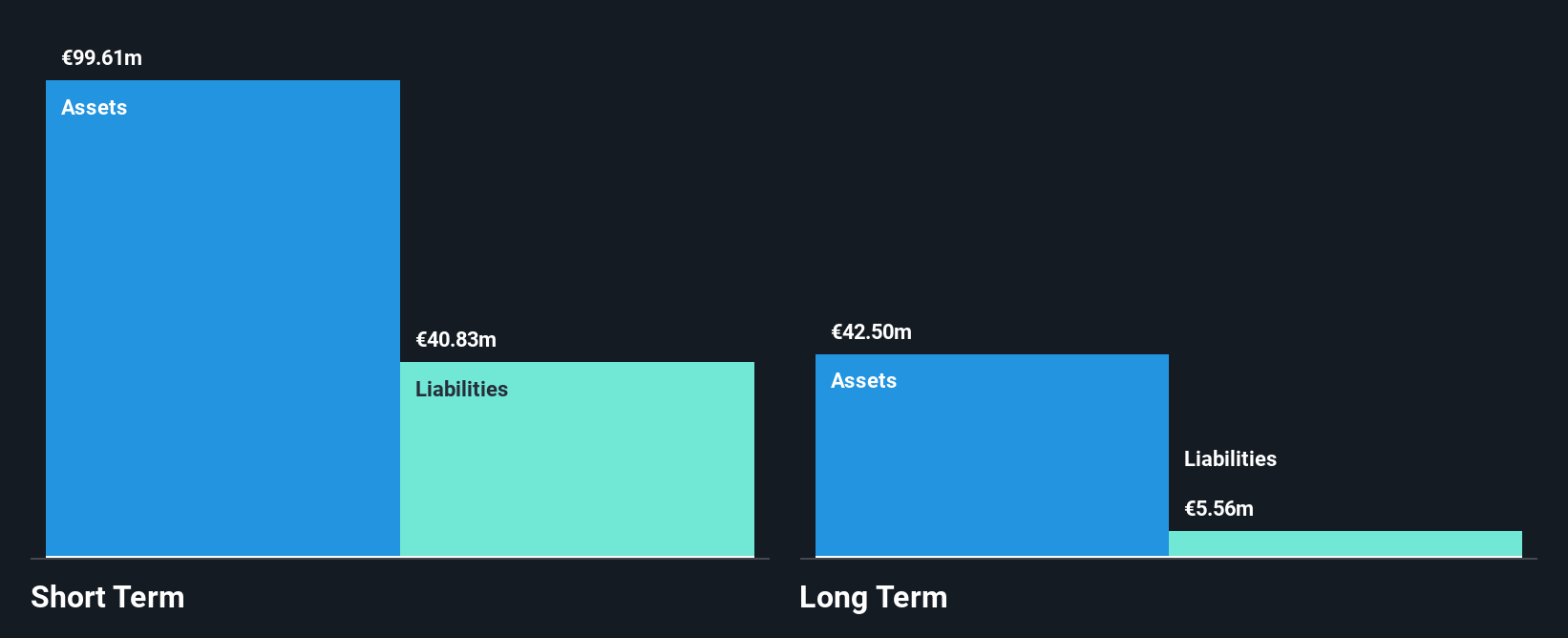

Guillemot Corporation S.A., with a market cap of €70.08 million, operates primarily through its Thrustmaster segment, generating €108.57 million in revenue. Despite being currently unprofitable and having a negative return on equity, the company has reduced its debt to equity ratio significantly over the past five years and maintains more cash than total debt. Guillemot's short-term assets comfortably cover both short- and long-term liabilities. The management team is highly experienced, with an average tenure of 28 years. The company forecasts earnings growth of 106.97% annually and anticipates exceeding €120 million turnover in 2025 with a net operating profit expected for fiscal 2026.

- Click here and access our complete financial health analysis report to understand the dynamics of Guillemot.

- Review our growth performance report to gain insights into Guillemot's future.

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien (XTRA:BVB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien, along with its subsidiaries, operates in the football business in Germany and has a market cap of approximately €364.25 million.

Operations: Borussia Dortmund GmbH & Co. KGaA has not reported any specific revenue segments.

Market Cap: €364.25M

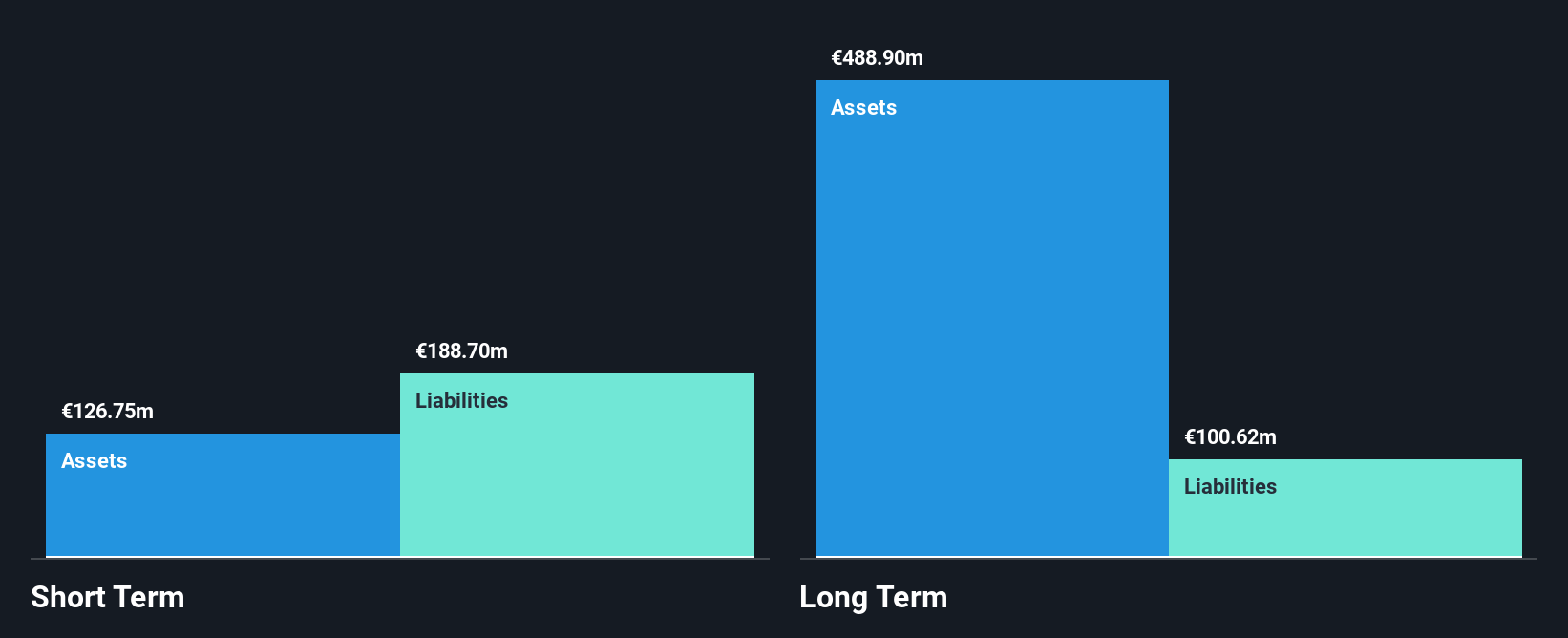

Borussia Dortmund GmbH & Co. KGaA, with a market cap of €364.25 million, has become profitable this year, reporting significant earnings growth in its recent quarter—sales rose to €159.93 million from €126.65 million the previous year, and net income increased substantially to €22.94 million from €1.57 million. The company maintains more cash than total debt and covers interest payments well with EBIT 17 times over interest repayments, although short-term assets do not cover short-term liabilities (€142.8M vs €202.1M). Despite low return on equity (8%), analysts expect stock price appreciation of 56.8%.

- Unlock comprehensive insights into our analysis of Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien stock in this financial health report.

- Learn about Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's future growth trajectory here.

FORIS (XTRA:FRS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: FORIS AG offers legal financial services in Germany and has a market cap of €16.17 million.

Operations: The company's revenue is primarily generated from Stock Companies (€18.38 million), followed by Litigation Financing (€4.78 million), with smaller contributions from GO AHEAD (€0.48 million) and Asset Management Service (€0.37 million).

Market Cap: €16.17M

FORIS AG, with a market cap of €16.17 million, primarily generates revenue from Stock Companies (€18.38 million) and Litigation Financing (€4.78 million). The company offers high-quality earnings without significant shareholder dilution over the past year. However, its interest payments are not well covered by EBIT (1.2x), and recent earnings growth has been negative (-88.5%). Despite trading at 31.4% below estimated fair value, net profit margins have declined to 1.1% from 8.4%. While short-term assets exceed liabilities (€13.3M vs €3.3M), the dividend is unsustainably covered by earnings, and return on equity remains low at 1.6%.

- Dive into the specifics of FORIS here with our thorough balance sheet health report.

- Assess FORIS' previous results with our detailed historical performance reports.

Make It Happen

- Gain an insight into the universe of 288 European Penny Stocks by clicking here.

- Searching for a Fresh Perspective? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报