Tortilla Mexican Grill plc (LON:MEX) Shares Fly 27% But Investors Aren't Buying For Growth

Tortilla Mexican Grill plc (LON:MEX) shareholders have had their patience rewarded with a 27% share price jump in the last month. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.0% over the last year.

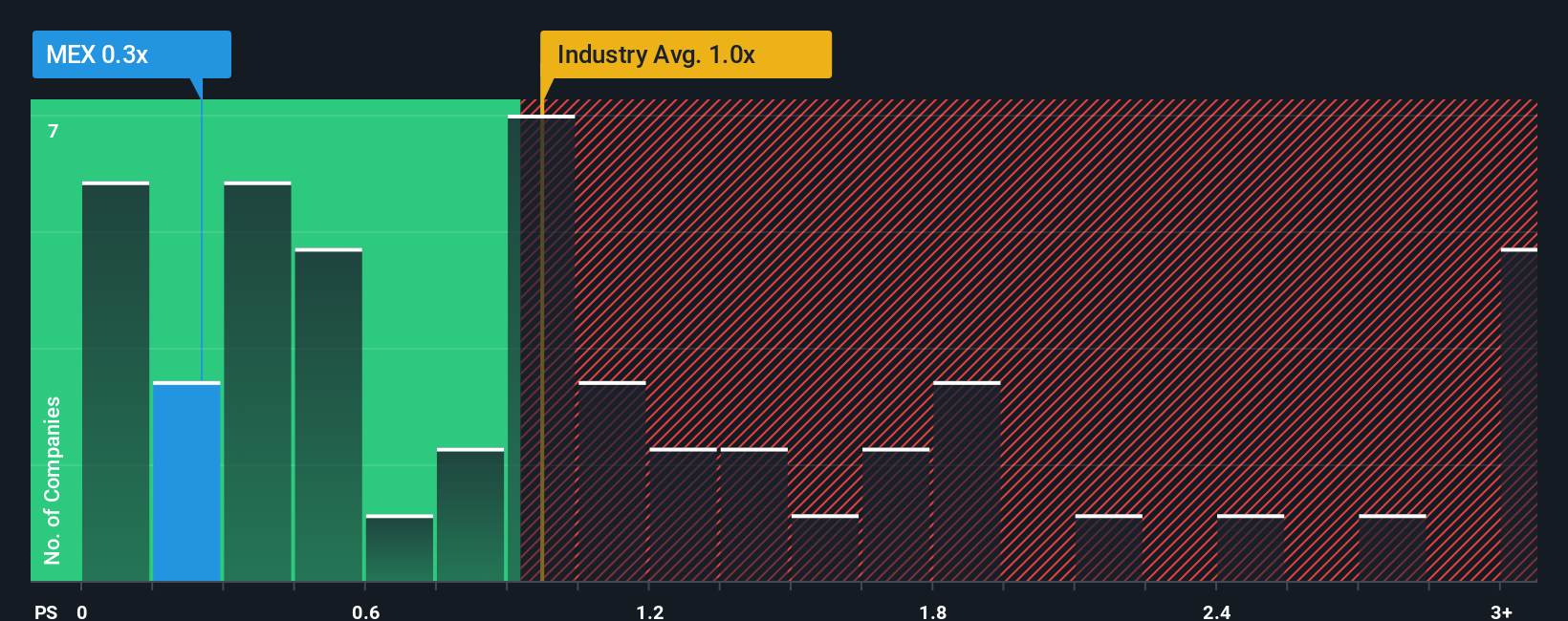

Although its price has surged higher, when close to half the companies operating in the United Kingdom's Hospitality industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Tortilla Mexican Grill as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Tortilla Mexican Grill

How Tortilla Mexican Grill Has Been Performing

With revenue growth that's superior to most other companies of late, Tortilla Mexican Grill has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Tortilla Mexican Grill's future stacks up against the industry? In that case, our free report is a great place to start.How Is Tortilla Mexican Grill's Revenue Growth Trending?

Tortilla Mexican Grill's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 5.1% over the next year. Meanwhile, the rest of the industry is forecast to expand by 7.7%, which is noticeably more attractive.

With this information, we can see why Tortilla Mexican Grill is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Tortilla Mexican Grill's P/S?

The latest share price surge wasn't enough to lift Tortilla Mexican Grill's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Tortilla Mexican Grill's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Tortilla Mexican Grill (1 makes us a bit uncomfortable!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Tortilla Mexican Grill, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 华尔街日报

华尔街日报