Undervalued European Small Caps With Insider Buying For December 2025

As the pan-European STOXX Europe 600 Index approaches record highs amid positive sentiment about future earnings and economic conditions, small-cap stocks in Europe present intriguing opportunities for investors looking to capitalize on potential growth. In this environment, identifying promising small-cap companies often involves assessing factors such as insider buying activities, which can signal confidence in a company's prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.3x | 1.6x | 48.47% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.52% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.8x | 0.3x | 39.27% | ★★★★★☆ |

| Norcros | 14.4x | 0.8x | 38.67% | ★★★★☆☆ |

| Eurocell | 16.5x | 0.3x | 39.46% | ★★★★☆☆ |

| Eastnine | 12.3x | 7.8x | 48.39% | ★★★★☆☆ |

| Senior | 25.1x | 0.8x | 25.33% | ★★★★☆☆ |

| Gooch & Housego | 47.5x | 1.1x | 21.05% | ★★★☆☆☆ |

| Kendrion | 29.5x | 0.7x | 41.47% | ★★★☆☆☆ |

| CVS Group | 47.8x | 1.3x | 23.54% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

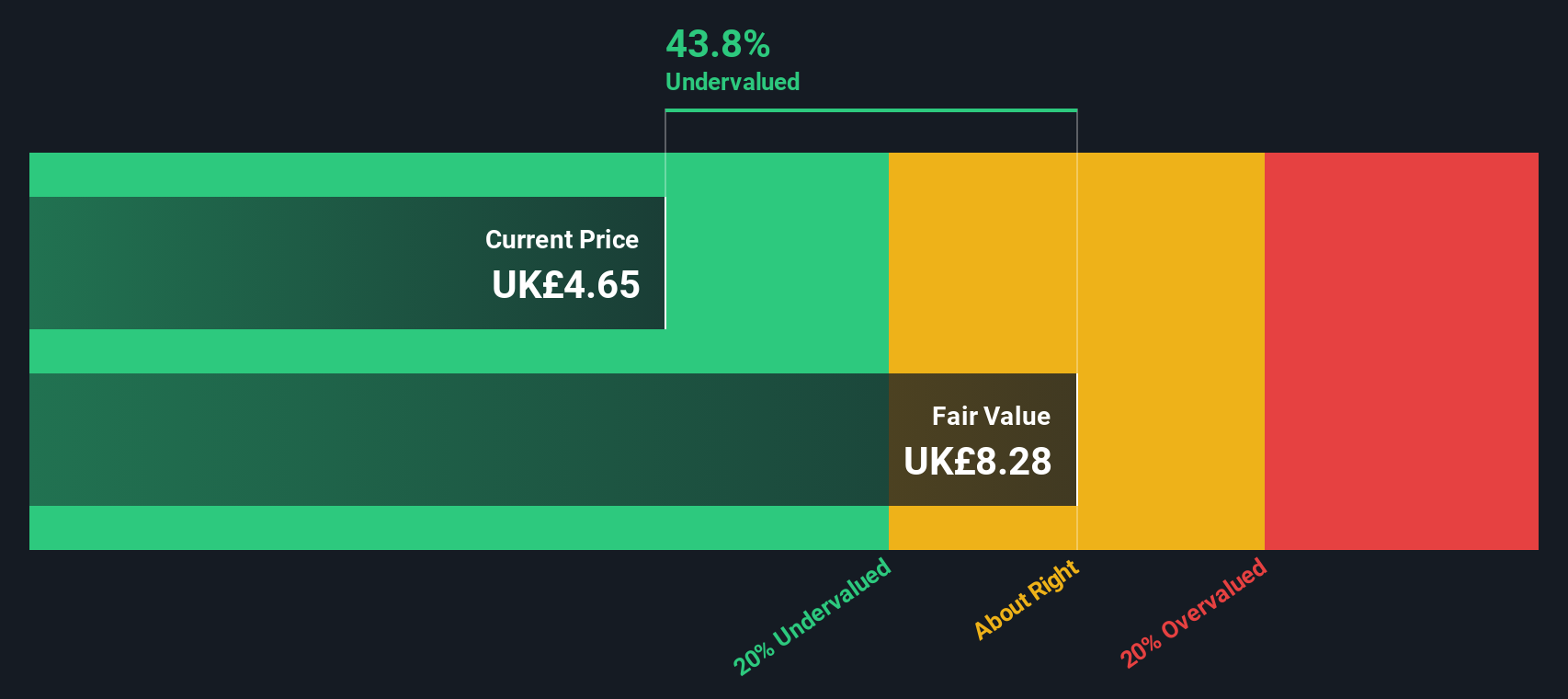

PayPoint (LSE:PAY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: PayPoint is a company that operates in the UK, providing payment services and retail technology solutions, with a market cap of approximately £0.46 billion.

Operations: PayPoint generates revenue primarily through two segments: Love2shop and Pay Point, with recent figures showing £152.89 million and £166.96 million respectively. The company's gross profit margin has shown a decline from 64.38% in March 2021 to 40.58% by September 2025, indicating increased cost pressures or pricing changes over time. Operating expenses have been consistently significant, impacting net income margins which have also seen fluctuations, most recently recorded at 5.30% in September 2025.

PE: 17.9x

PayPoint, a smaller European stock, recently dropped from several FTSE indices, highlighting potential market concerns. Despite this, insider confidence is evident with share purchases in 2025. Their half-year revenue grew to £144.14 million from £135.01 million the previous year; however, net income decreased to £14.59 million from £17.31 million due to large one-off items impacting results and high debt levels. They declared an increased interim dividend and announced a special dividend following strategic investment in Collect+.

- Delve into the full analysis valuation report here for a deeper understanding of PayPoint.

Gain insights into PayPoint's past trends and performance with our Past report.

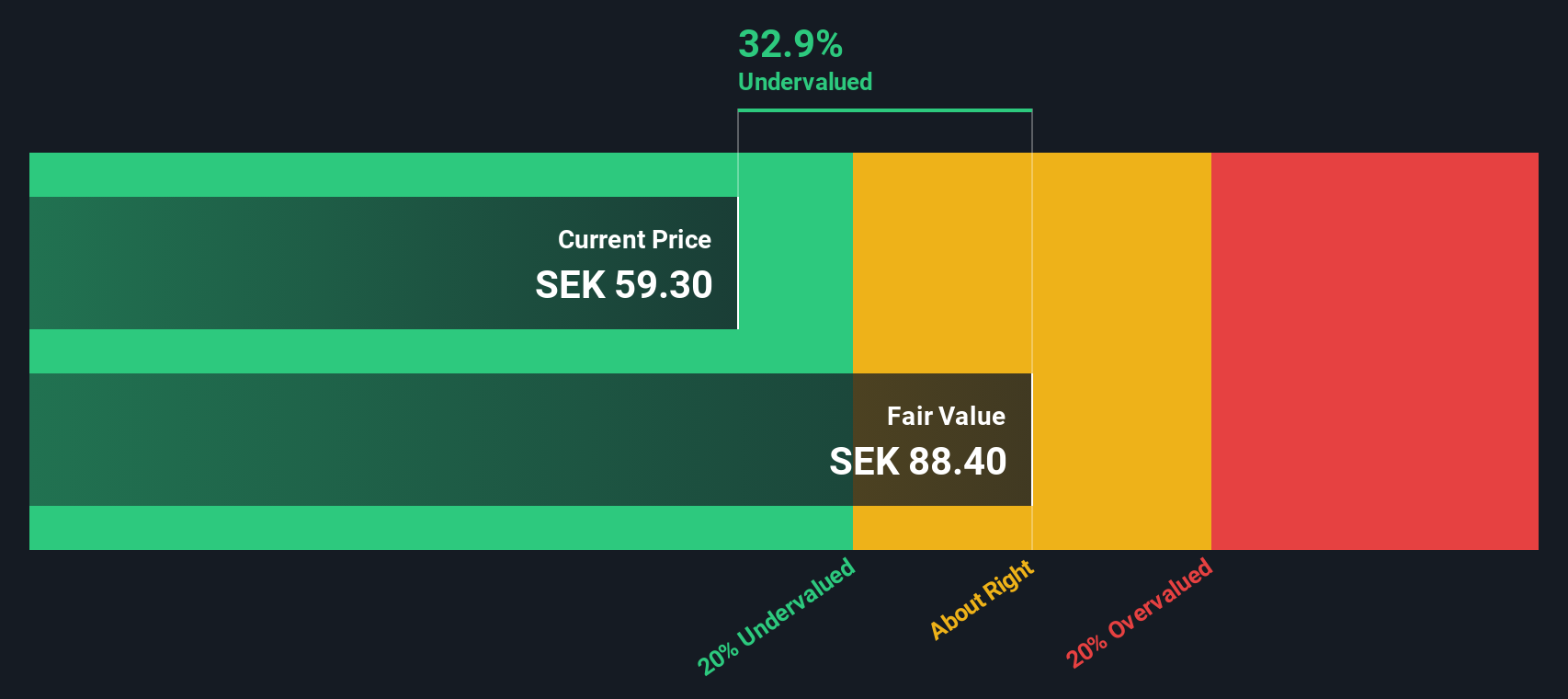

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Nolato is a Swedish company specializing in providing polymer product solutions across its Medical Solutions and Engineered Solutions segments, with a market cap of approximately SEK 14.97 billion.

Operations: Medical Solutions and Engineered Solutions are the primary revenue streams, contributing SEK 5.42 billion and SEK 4.17 billion respectively, with a minor adjustment from the parent company. The gross profit margin has shown variability over time, reaching 17.85% in June 2025. Operating expenses predominantly include general and administrative costs along with sales and marketing expenses, impacting net income margins that have fluctuated throughout the periods analyzed.

PE: 20.9x

Nolato, a European small-cap company, has caught attention with its insider confidence as Klas Forsstrom recently purchased 4,300 shares for SEK 270,900. Despite relying entirely on external borrowing for funding, Nolato's earnings are projected to grow by over 10% annually. In the third quarter of 2025, Nolato reported a net income increase to SEK 215 million from SEK 164 million the previous year. This blend of growth potential and insider activity positions Nolato as an intriguing prospect in the market.

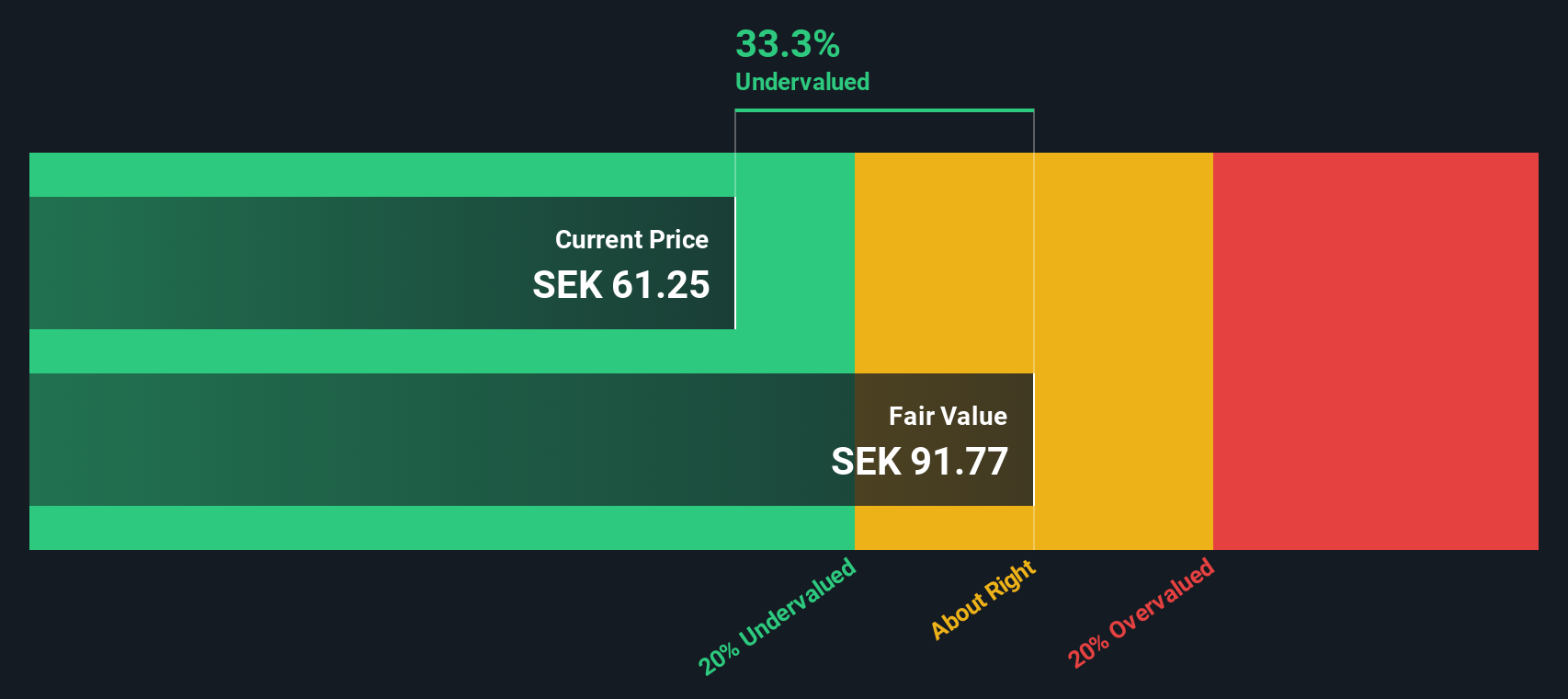

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company that primarily focuses on providing caller identification, spam blocking, and other related services, with a market capitalization of SEK 13.5 billion.

Operations: Truecaller generates revenue primarily from its communications software segment, with the latest reported revenue reaching SEK 2.02 billion. The company's gross profit margin has shown a trend of being above 75% in recent periods, indicating efficient cost management relative to its revenue generation. Operating expenses include significant allocations towards general and administrative expenses and sales & marketing efforts.

PE: 13.6x

Truecaller, a European company, is making strides with its innovative features like Family Protection and strategic partnerships such as the one with SmartBuy. These initiatives aim to enhance user engagement and communication safety. Despite a slight dip in net income for Q3 2025, sales showed growth compared to the previous year. Insider confidence is evident as their CEO acquired 22,500 shares recently. This activity suggests potential optimism about future prospects despite volatile share prices and reliance on external funding sources.

- Navigate through the intricacies of Truecaller with our comprehensive valuation report here.

Assess Truecaller's past performance with our detailed historical performance reports.

Summing It All Up

- Investigate our full lineup of 70 Undervalued European Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报