Maxone Semiconductor (Suzhou) Leads These 3 Undiscovered Gems in Asia

As global markets continue to experience varied performances, with the Russell 2000 Index showing modest gains and Asian indices like Japan's Nikkei 225 and China's CSI 300 posting stronger weekly advances, investors are increasingly turning their attention to small-cap stocks in Asia. In this dynamic environment, identifying promising companies such as Maxone Semiconductor (Suzhou) can be crucial for those looking to capitalize on emerging opportunities in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hangzhou Fortune Gas Cryogenic Group | NA | 17.03% | 23.40% | ★★★★★★ |

| Xiamen Jihong | 17.57% | 6.86% | -18.83% | ★★★★★★ |

| Shandong Link Science and TechnologyLtd | 7.07% | 15.69% | 19.39% | ★★★★★★ |

| Shandong Sinoglory Health Food | NA | 4.47% | 5.27% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Hangzhou Hirisun Technology | NA | -9.43% | -21.49% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 12.63% | 1.31% | -43.22% | ★★★★★☆ |

| Zhongyeda Electric | 0.41% | -0.88% | -14.90% | ★★★★★☆ |

| Tibet TourismLtd | 21.50% | 10.05% | 27.69% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Maxone Semiconductor (Suzhou) (SHSE:688809)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maxone Semiconductor (Suzhou) Co., Ltd. specializes in the research, development, design, and manufacturing of semiconductor test solution products with a market cap of CN¥11.02 billion.

Operations: Maxone Semiconductor generates revenue primarily from its semiconductor segment, amounting to CN¥818.23 million. The company's financial performance is influenced by its ability to manage costs associated with research, development, and manufacturing processes within this segment.

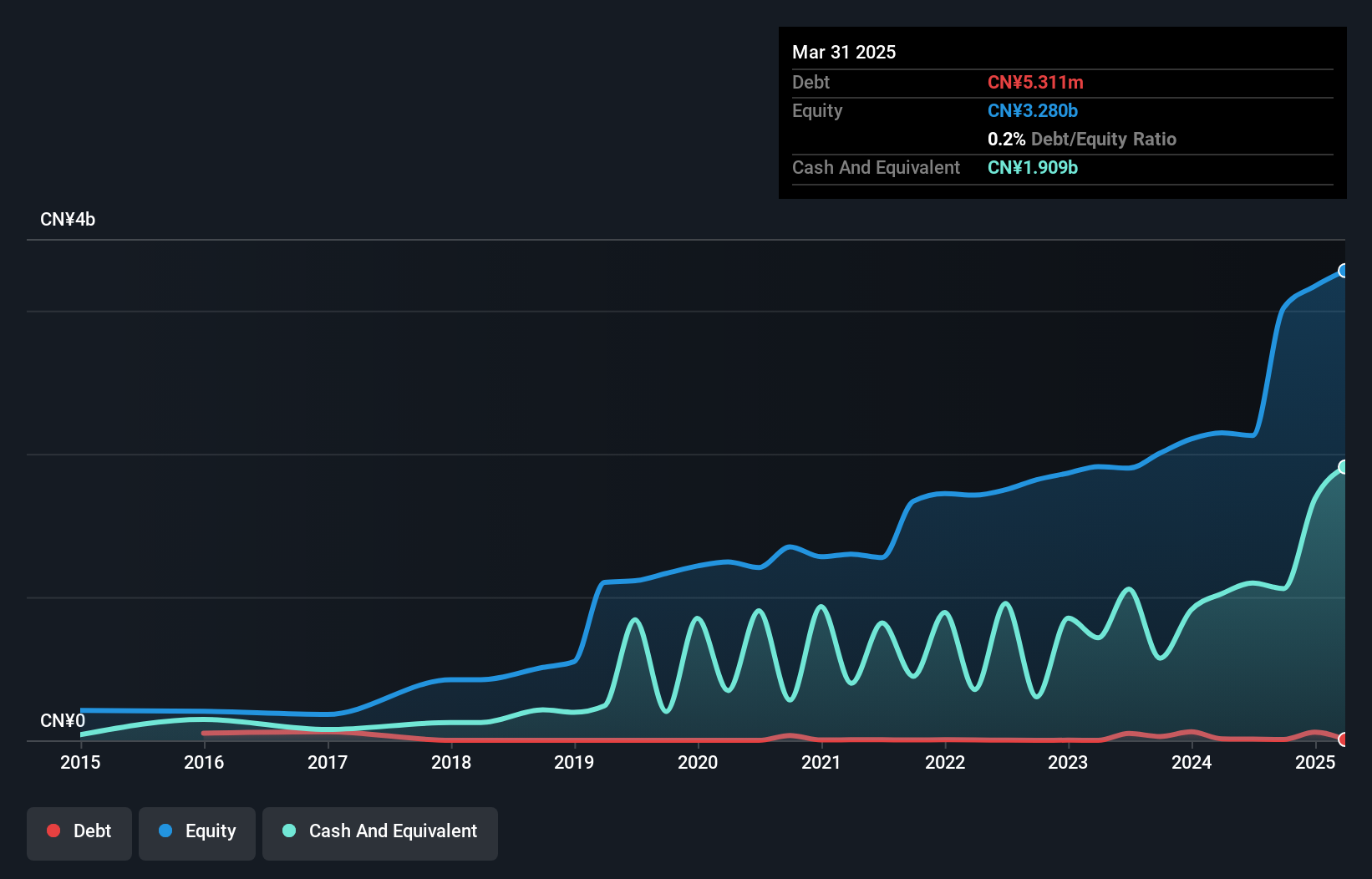

Maxone Semiconductor, a promising player in the semiconductor industry, recently completed an IPO raising CNY 2.76 billion, offering shares at CNY 85.09 each with a discount of CNY 5.87 per security. The company has outpaced its peers with earnings growth of 163% over the past year, significantly higher than the industry's average of 11%. Despite having more cash than total debt and no concerns over interest coverage, free cash flow remains negative. With a price-to-earnings ratio of 33x below the CN market average, this stock could offer value to discerning investors seeking opportunities in Asia's tech sector.

- Dive into the specifics of Maxone Semiconductor (Suzhou) here with our thorough health report.

Learn about Maxone Semiconductor (Suzhou)'s historical performance.

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. operates in the electronic technology sector and has a market capitalization of CN¥13.13 billion.

Operations: The company generates revenue primarily from its electronic technology operations. It has a market capitalization of CN¥13.13 billion, reflecting its scale in the sector.

Suzhou Hengmingda Electronic Technology, a promising player in the electronics sector, has shown robust growth with earnings climbing 39.5% over the past year, outpacing the industry average of 9.4%. The company's recent earnings report for nine months ending September 2025 revealed sales of CNY 1.96 billion and net income of CNY 407.9 million, indicating strong financial health. Trading at a significant discount to its estimated fair value by about 51%, it appears undervalued relative to peers. Additionally, a share repurchase program worth up to CNY 400 million is set to boost investor confidence and stabilize operations further.

V5 Technologies (TPEX:7822)

Simply Wall St Value Rating: ★★★★★★

Overview: V5 Technologies Co., Ltd. specializes in offering AI solutions for semiconductor manufacturing and health and medical care, with a market cap of NT$32.63 billion.

Operations: The primary revenue stream for V5 Technologies comes from its Semiconductor Equipment and Services segment, generating NT$1.66 billion.

V5 Technologies, a nimble player in the semiconductor space, has been making waves with its impressive financial performance. Over the past year, earnings surged by 427%, outpacing industry growth of 2.5%. The company reported third-quarter sales of TWD 565 million, a significant increase from TWD 228 million last year. Net income also rose to TWD 150 million from TWD 74 million previously. Notably debt-free for five years, V5 is trading at a substantial discount to its estimated fair value and boasts high-quality earnings. However, recent share price volatility could be a consideration for potential investors.

- Unlock comprehensive insights into our analysis of V5 Technologies stock in this health report.

Review our historical performance report to gain insights into V5 Technologies''s past performance.

Summing It All Up

- Delve into our full catalog of 2490 Asian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报