Top Asian Dividend Stocks For December 2025

As Asian markets navigate a landscape marked by cautious optimism and economic challenges, investors are increasingly drawn to dividend stocks as a reliable means of generating income. In this environment, identifying stocks with consistent dividend payouts and strong fundamentals can be an effective strategy for those seeking stability amid market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.32% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.72% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1010 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Startia HoldingsInc (TSE:3393)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Startia Holdings, Inc. operates in the IT sector both in Japan and internationally, with a market cap of ¥27.40 billion.

Operations: Startia Holdings, Inc. generates revenue primarily from its IT Infrastructure Related Business, including business applications, which accounts for ¥18.64 billion, and its Digital Marketing Related Business contributing ¥4.42 billion.

Dividend Yield: 4%

Startia Holdings, Inc. recently increased its dividend to ¥54.00 per share, up from ¥46.00 last year, reflecting a positive trend in dividend growth over the past decade despite historical volatility. The company's dividends are well-covered by earnings and cash flows with payout ratios of 61.1% and 48.9%, respectively, indicating sustainability. While trading slightly below estimated fair value and offering a competitive yield in Japan's market, the dividend track record remains unstable due to past fluctuations.

- Delve into the full analysis dividend report here for a deeper understanding of Startia HoldingsInc.

- Our valuation report here indicates Startia HoldingsInc may be undervalued.

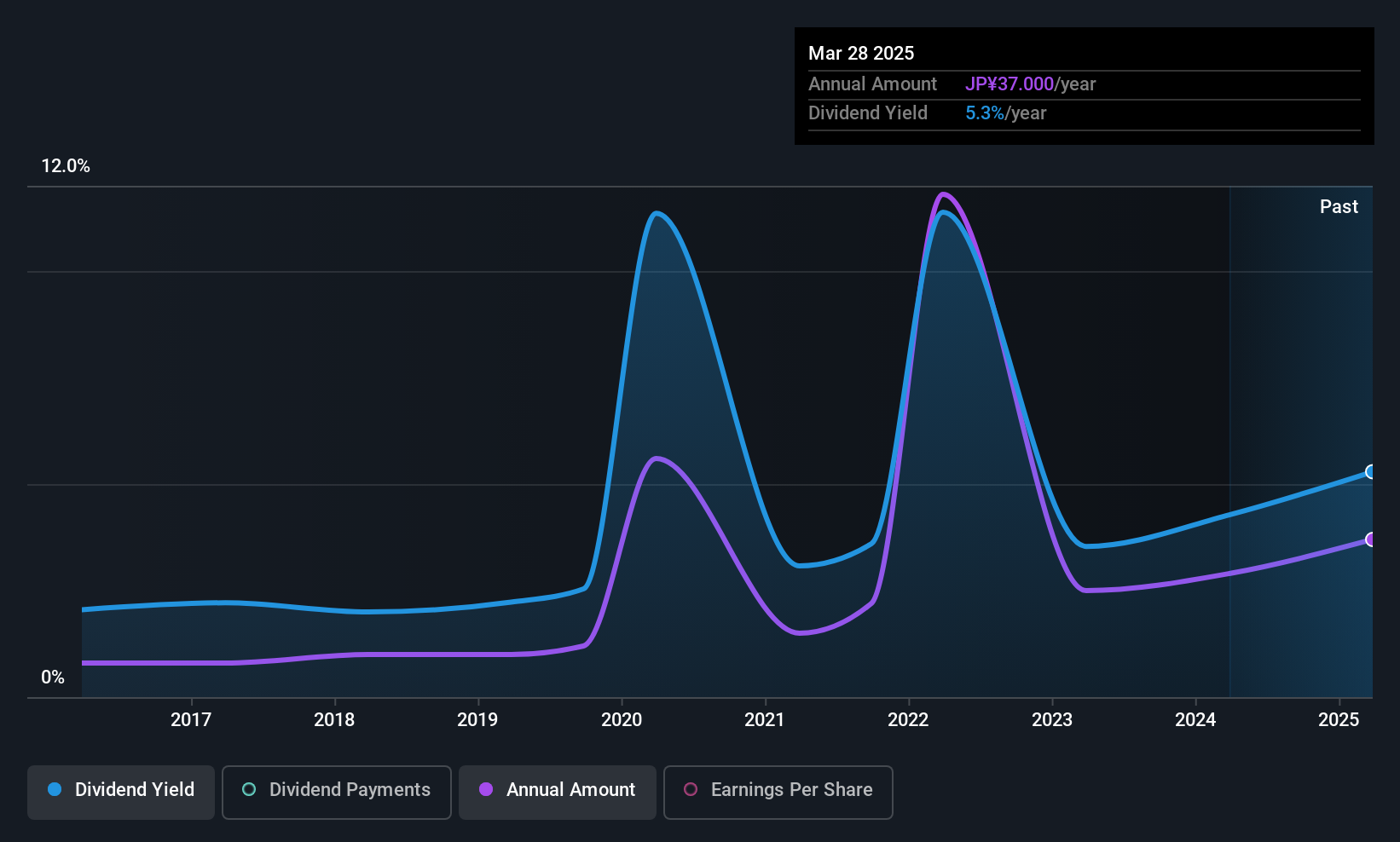

Meiwa (TSE:8103)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiwa Corporation operates in the chemicals, lubricants, battery materials, automotive and mineral resources, and environmental sectors both in Japan and internationally with a market cap of ¥38.11 billion.

Operations: Meiwa Corporation's revenue is segmented as follows: First Business ¥43.96 billion, Third Business ¥60.23 billion, Second Business ¥42.51 billion, and Automobile/Battery Materials Business ¥9.23 billion.

Dividend Yield: 4%

Meiwa's dividend yield of 4.01% ranks in the top 25% within Japan, supported by a low price-to-earnings ratio of 10.7x against the market average of 14.4x, suggesting good value. Dividends are well-covered by earnings and cash flows with payout ratios at 47.4% and 69.7%, respectively, indicating sustainability despite a volatile track record over the past decade that underscores some risk for investors seeking reliable income streams.

- Unlock comprehensive insights into our analysis of Meiwa stock in this dividend report.

- Our valuation report here indicates Meiwa may be overvalued.

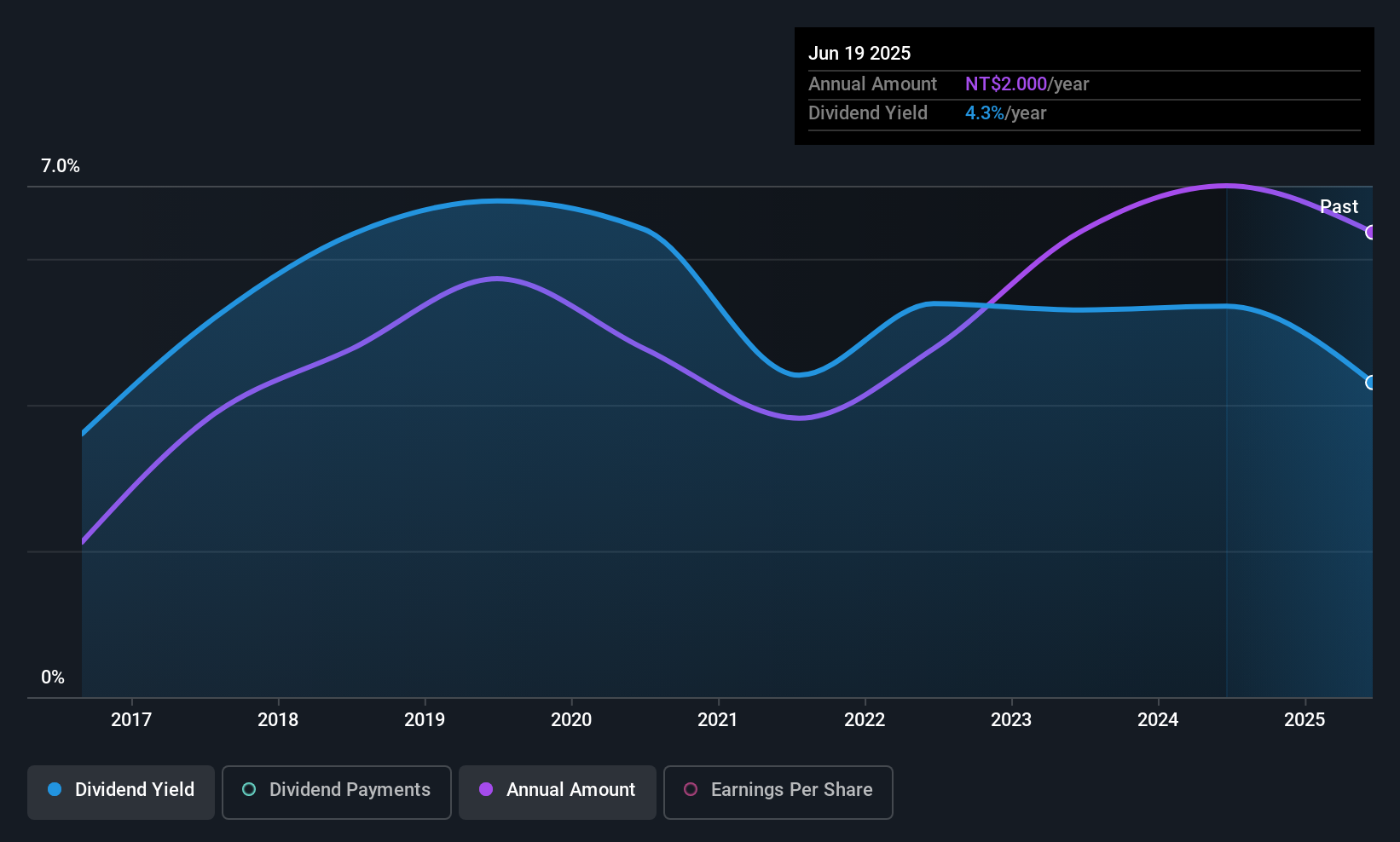

Good Will Instrument (TWSE:2423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Good Will Instrument Co., Ltd. manufactures and markets electrical test and measurement instruments for educational and industrial manufacturing markets, with a market cap of NT$8.63 billion.

Operations: Good Will Instrument Co., Ltd.'s revenue primarily comes from its Electronic Test & Measurement Instruments segment, which generated NT$2.87 billion.

Dividend Yield: 3.4%

Good Will Instrument's dividend yield of 3.36% is below the top tier in Taiwan, and while dividends have been stable and growing over the past decade, they are not well-covered by free cash flows, with a high cash payout ratio of 108.4%. Recent earnings growth, evidenced by a net income increase to TWD 115.04 million in Q3 2025 from TWD 83.28 million a year ago, supports its reasonable earnings payout ratio of 70.6%.

- Get an in-depth perspective on Good Will Instrument's performance by reading our dividend report here.

- The analysis detailed in our Good Will Instrument valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Reveal the 1010 hidden gems among our Top Asian Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报