3 Promising Penny Stocks With Market Caps Over $80M

As the holiday-shortened week begins, major U.S. stock indexes have slipped slightly, with precious metals retreating from record highs and no significant corporate earnings on the horizon. Despite these broader market fluctuations, penny stocks remain an intriguing segment for investors seeking potential growth opportunities. While the term "penny stocks" may seem outdated, these smaller or newer companies can offer a mix of affordability and growth potential when backed by strong financials. In this article, we will explore three promising penny stocks that stand out for their financial strength and potential for future gains.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.88 | $617.2M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8707 | $148.91M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.45 | $580.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.34 | $563.4M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $360.73M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $1.0075 | $7.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.06 | $91.98M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 339 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PLAYSTUDIOS (MYPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PLAYSTUDIOS, Inc. develops and publishes free-to-play casual games for mobile and social platforms in the United States and internationally, with a market cap of approximately $85.30 million.

Operations: The company's revenue is primarily generated from its Playgames segment, which accounts for $246.77 million, while the Playawards segment contributes $0.70 million.

Market Cap: $85.3M

PLAYSTUDIOS, Inc., with a market cap of US$85.30 million, faces challenges typical of penny stocks, including recent non-compliance with Nasdaq's minimum bid price rule. Despite being debt-free and having sufficient cash runway for over three years due to positive free cash flow, the company remains unprofitable without forecasted profitability in the near term. Recent earnings reports show declining revenue and increased net losses compared to the previous year. While trading at a significant discount to estimated fair value and maintaining stable weekly volatility, PLAYSTUDIOS must address its listing compliance issues by May 2026 to avoid delisting risks.

- Click here to discover the nuances of PLAYSTUDIOS with our detailed analytical financial health report.

- Gain insights into PLAYSTUDIOS' outlook and expected performance with our report on the company's earnings estimates.

Agora (API)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Agora, Inc. operates a real-time engagement platform-as-a-service across the United States, China, and other international markets with a market cap of $353.01 million.

Operations: The company generates revenue from its Internet Telephone segment, totaling $137.36 million.

Market Cap: $353.01M

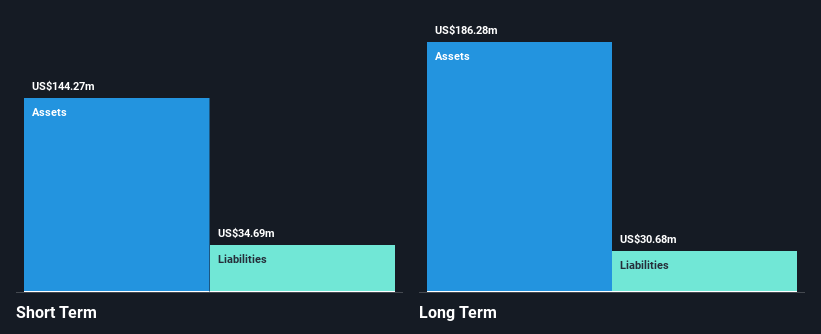

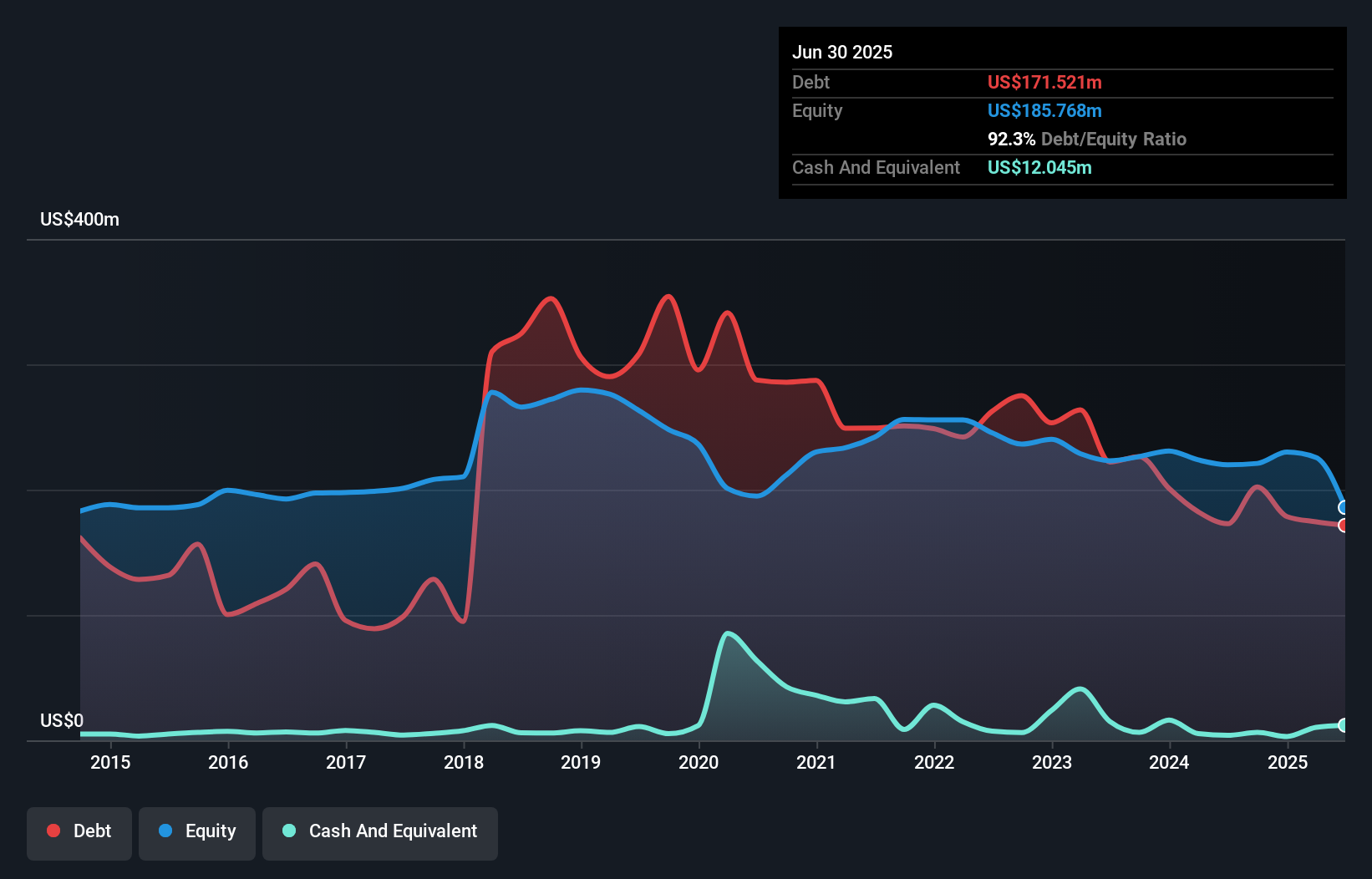

Agora, Inc., with a market cap of US$353.01 million, has transitioned to profitability this year, reporting a net income of US$2.74 million for Q3 2025 compared to a loss the previous year. The company boasts high-quality earnings and strong asset coverage over liabilities, with short-term assets at US$210.7 million surpassing both short- and long-term liabilities. Recently, Agora announced its integration with Agnes AI for enhanced real-time collaboration tools across Southeast Asia's rapidly growing AI platform. Despite an increased debt-to-equity ratio from 0% to 13%, Agora maintains more cash than total debt, supporting its financial stability amidst growth prospects in the real-time engagement sector.

- Jump into the full analysis health report here for a deeper understanding of Agora.

- Explore Agora's analyst forecasts in our growth report.

Lifetime Brands (LCUT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lifetime Brands, Inc. designs, sources, and sells branded kitchenware and tableware products for home use both in the United States and internationally, with a market cap of $91.98 million.

Operations: The company's revenue is primarily derived from the U.S. (Including Retail Direct) at $601.94 million, with an additional contribution of $57.12 million from international markets.

Market Cap: $91.98M

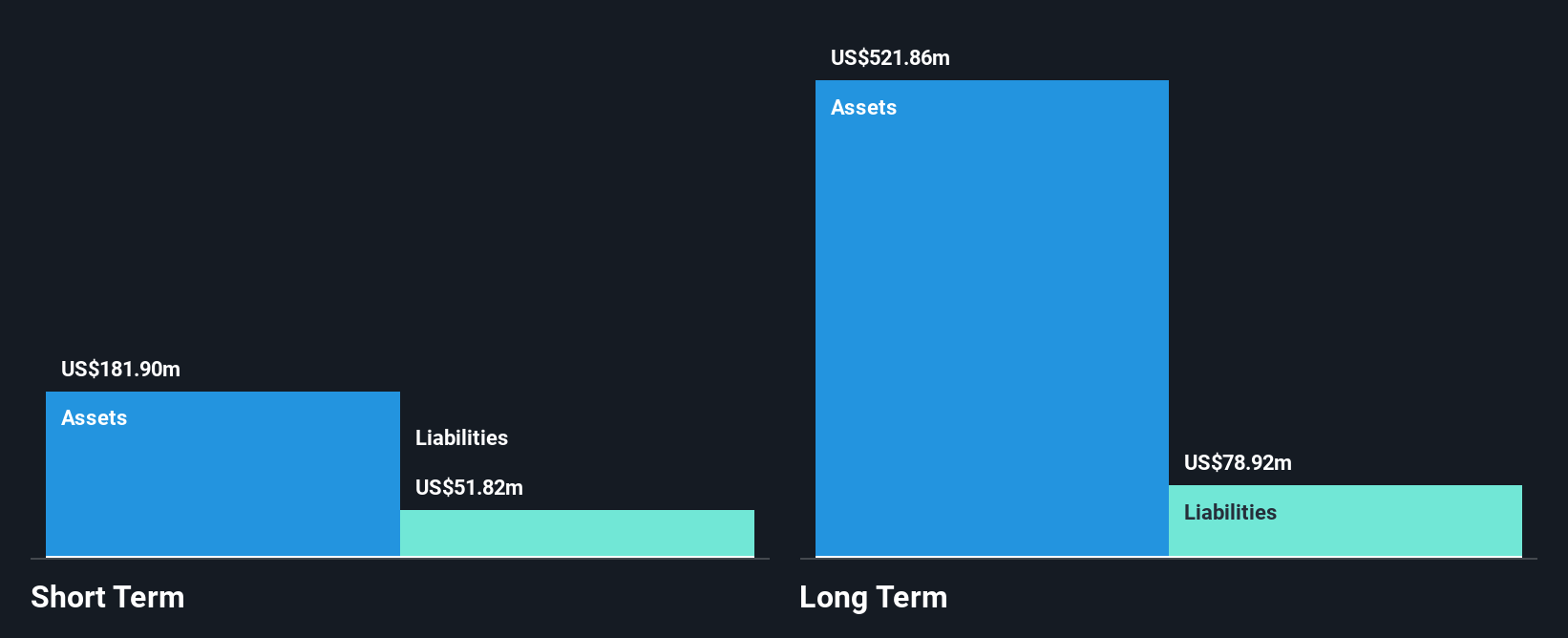

Lifetime Brands, Inc., with a market cap of US$91.98 million, is trading significantly below its estimated fair value but remains unprofitable. Despite this, it has stable weekly volatility and a seasoned management team with over 10 years of average tenure. The company's short-term assets exceed both its short- and long-term liabilities, providing some financial stability despite high net debt to equity ratio at 99.1%. Recent earnings reports show declining sales and increased net losses compared to the previous year. The company continues to pay dividends; however, they are not well covered by earnings due to ongoing losses.

- Dive into the specifics of Lifetime Brands here with our thorough balance sheet health report.

- Learn about Lifetime Brands' future growth trajectory here.

Summing It All Up

- Get an in-depth perspective on all 339 US Penny Stocks by using our screener here.

- Contemplating Other Strategies? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报