Top 3 TSX Growth Stocks With Strong Insider Ownership

As the Canadian market navigates a landscape of sector-specific opportunities and challenges, diversification remains a key strategy for investors looking to capitalize on growth in 2026. In this context, identifying growth companies with high insider ownership can be particularly appealing, as strong insider stakes often signal confidence in the company's potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Zedcor (TSXV:ZDC) | 19.2% | 122.6% |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.9% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 29.8% | 30.6% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 34.3% | 33.8% |

| Electrovaya (TSX:ELVA) | 28.1% | 38.1% |

| CEMATRIX (TSX:CEMX) | 10.7% | 58.3% |

| Almonty Industries (TSX:AII) | 11.2% | 63.5% |

We'll examine a selection from our screener results.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

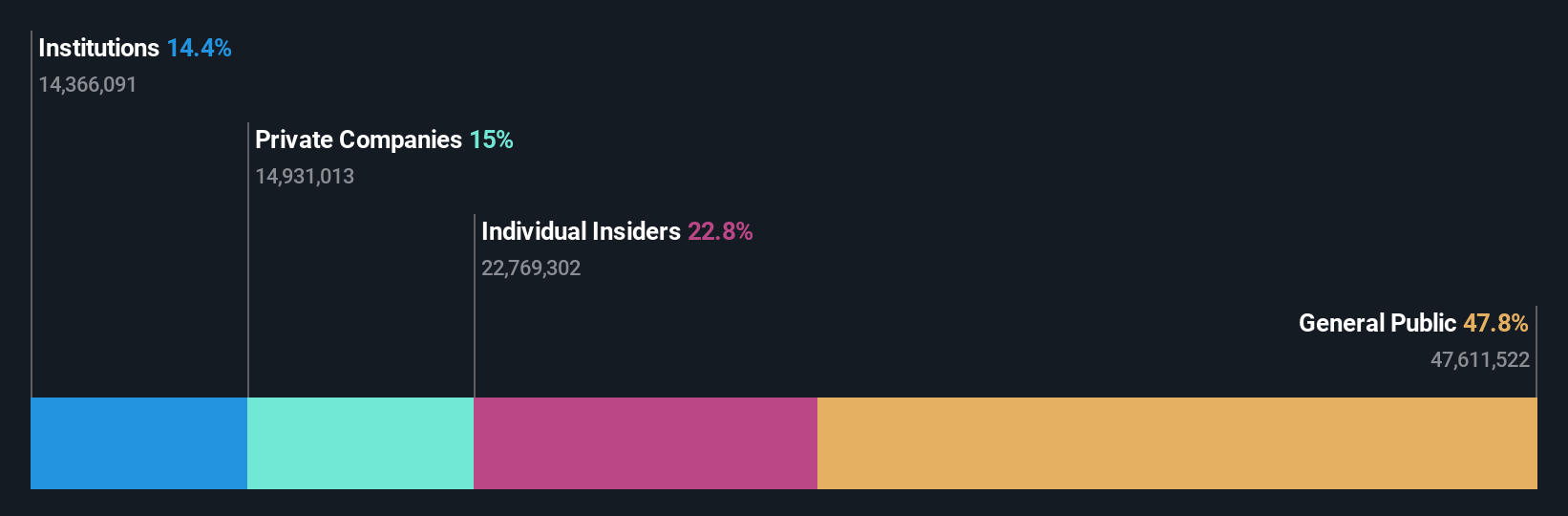

Overview: Knight Therapeutics Inc. is engaged in acquiring, in-licensing, out-licensing, marketing, and commercializing prescription pharmaceutical products in Canada and Latin America with a market cap of CA$592.76 million.

Operations: Knight Therapeutics generates revenue from its pharmaceuticals segment, amounting to CA$413.85 million.

Insider Ownership: 22.9%

Earnings Growth Forecast: 68.9% p.a.

Knight Therapeutics, with growing insider ownership and strategic acquisitions like Paladin Pharma, is poised for growth in Canada's pharmaceutical sector. Recent Health Canada approval of WYNZORA and the launch of JORNAY PM highlight product expansion efforts. Despite a net loss reported for Q3 2025, revenue increased to CAD 121.55 million from CAD 92.26 million year-on-year. A USD 100 million credit facility supports its growth strategy, while insider buying suggests confidence in future prospects amidst expected profitability within three years.

- Get an in-depth perspective on Knight Therapeutics' performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Knight Therapeutics' current price could be quite moderate.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Growth Rating: ★★★★☆☆

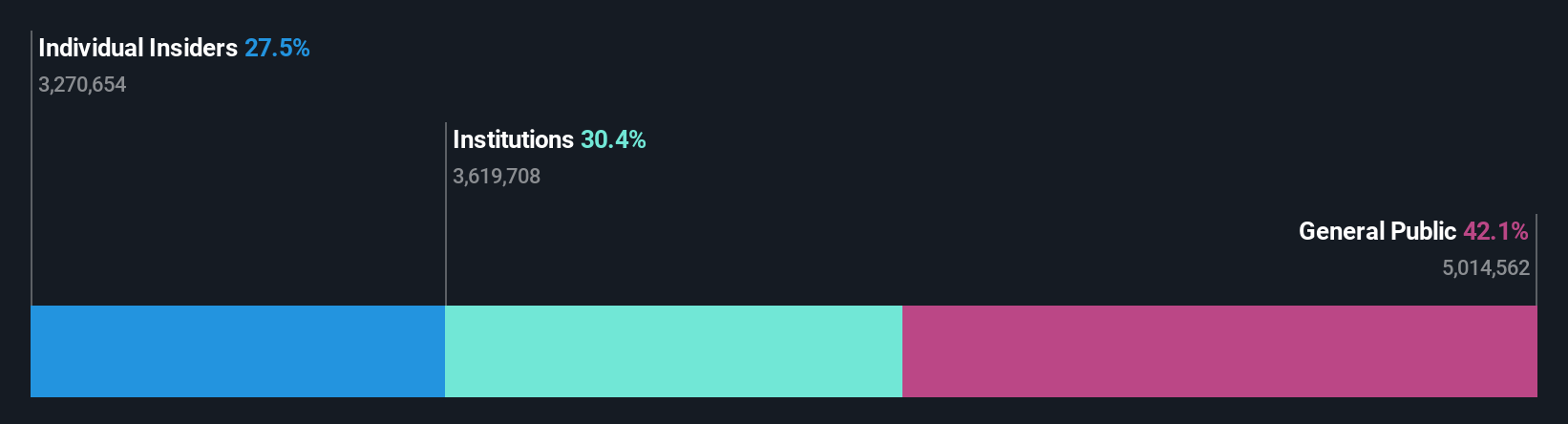

Overview: Hammond Power Solutions Inc., along with its subsidiaries, designs, manufactures, and sells various transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.91 billion.

Operations: The company's revenue segment primarily consists of the manufacture and sale of transformers, generating CA$852.64 million.

Insider Ownership: 27.4%

Earnings Growth Forecast: 15.4% p.a.

Hammond Power Solutions, with increasing insider buying, is strategically positioned for growth in the electrical industry. The company's focus on acquisitions and production initiatives aligns with its robust earnings forecast of 15.4% annual growth, surpassing the Canadian market average. Recent Q3 results showed sales rising to C$218.34 million from C$191.97 million year-on-year, while maintaining a competitive P/E ratio of 23.7x below industry averages indicates good relative value for investors seeking growth opportunities in Canada.

- Dive into the specifics of Hammond Power Solutions here with our thorough growth forecast report.

- Our valuation report here indicates Hammond Power Solutions may be undervalued.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

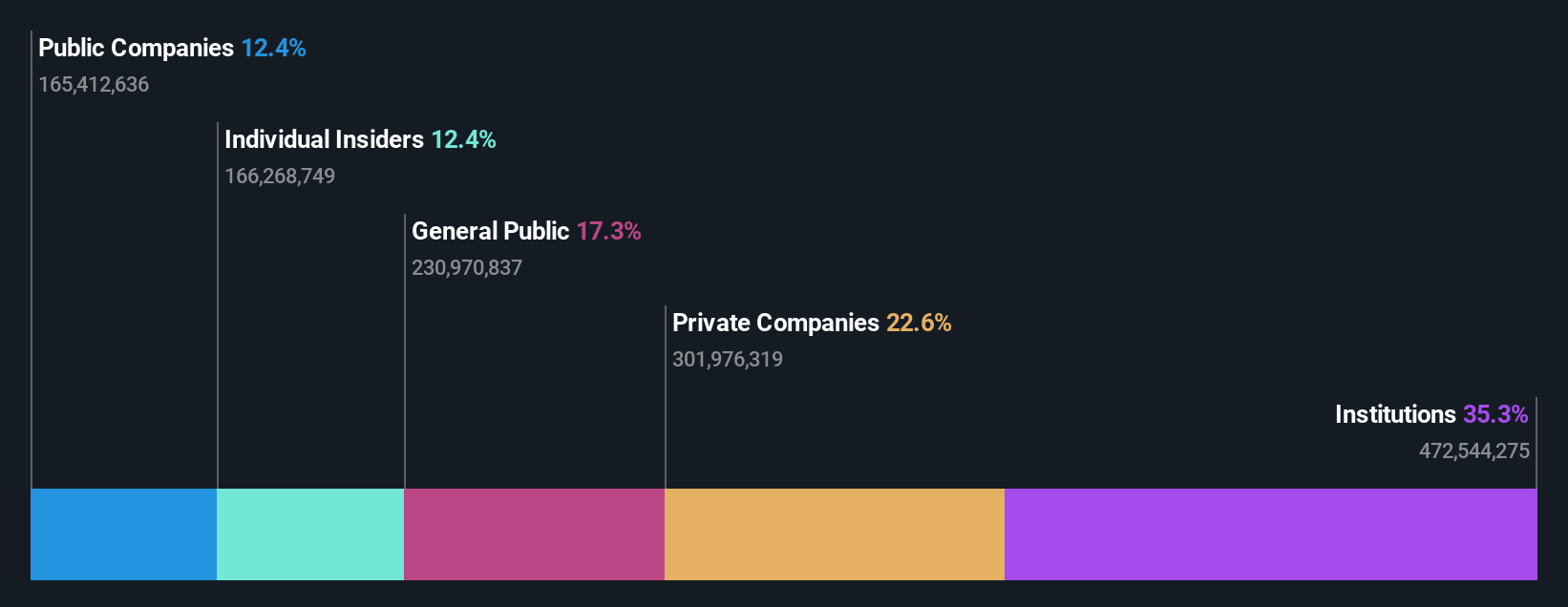

Overview: Ivanhoe Mines Ltd., along with its subsidiaries, focuses on the mining, development, and exploration of minerals and precious metals in Africa, with a market capitalization of CA$22.26 billion.

Operations: Ivanhoe Mines Ltd. operates in the mining, development, and exploration of minerals and precious metals across Africa.

Insider Ownership: 11.7%

Earnings Growth Forecast: 32.6% p.a.

Ivanhoe Mines is experiencing significant growth, with earnings forecasted to rise by 32.63% annually, surpassing the Canadian market average. Despite recent insider selling, the company maintains robust production guidance for its Kamoa-Kakula copper project and has secured a strategic alliance with Qatar Investment Authority, supporting its expansion efforts in critical minerals. Recent management changes aim to bolster operational excellence as Ivanhoe advances projects like Platreef and Western Forelands, enhancing its long-term growth trajectory.

- Navigate through the intricacies of Ivanhoe Mines with our comprehensive analyst estimates report here.

- The analysis detailed in our Ivanhoe Mines valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 48 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

- Curious About Other Options? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报