GoodRx Holdings And 2 Other Compelling Penny Stocks To Consider

As the U.S. stock market wraps up a holiday-shortened week with notable gains across major indexes, investors are taking stock of opportunities that may have flown under the radar. Penny stocks, while an old term, continue to intrigue due to their potential for growth at accessible price points. These smaller or newer companies can offer unique investment prospects when backed by strong financials and solid fundamentals; we'll explore several compelling options in this category that stand out for their promise and resilience in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.88 | $617.2M | ✅ 3 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8707 | $148.91M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.45 | $580.51M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.34 | $563.4M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.46 | $360.73M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $1.0075 | $7.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.06 | $91.98M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 339 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

GoodRx Holdings (GDRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoodRx Holdings, Inc. operates by providing consumers in the United States with information and tools to compare prices and save on prescription drug purchases, with a market cap of approximately $933.44 million.

Operations: The company generates revenue primarily from its Healthcare Software segment, amounting to $800.65 million.

Market Cap: $933.44M

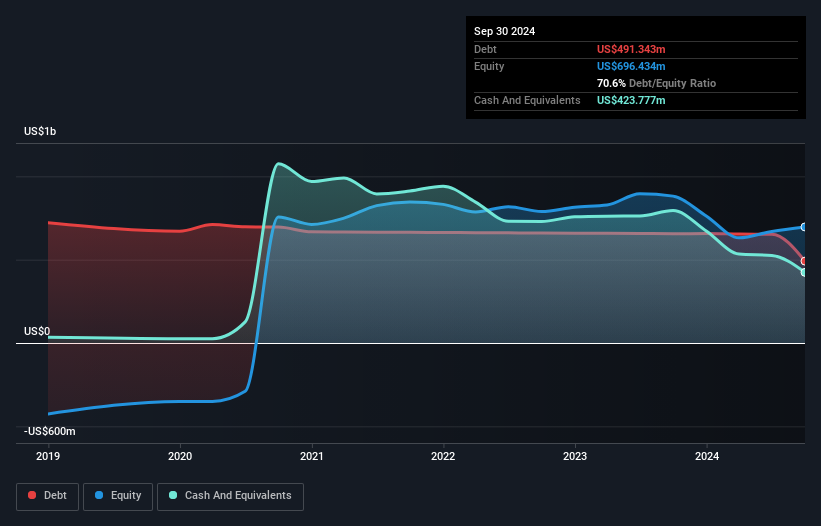

GoodRx Holdings, with a market cap of approximately US$933.44 million, has shown resilience in the penny stock segment by becoming profitable this year. The company reported US$602.07 million in sales for the first nine months of 2025 and net income growth to US$25.01 million from US$9.65 million a year prior, indicating robust earnings momentum despite a recent one-off loss impacting results. GoodRx's strategic initiatives like RxSmartSaver have expanded its reach across major pharmacy chains, enhancing consumer access to affordable medications and strengthening its value proposition amidst industry challenges. The company's debt level is satisfactory, with short-term assets exceeding liabilities significantly.

- Dive into the specifics of GoodRx Holdings here with our thorough balance sheet health report.

- Gain insights into GoodRx Holdings' future direction by reviewing our growth report.

Chegg (CHGG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Chegg, Inc. offers personalized learning assistance to students for academic and skill development both in the United States and internationally, with a market cap of approximately $108.42 million.

Operations: The company generates revenue primarily from its Educational Services segment, specifically in Education & Training Services, amounting to $447.73 million.

Market Cap: $108.42M

Chegg, Inc., with a market cap of US$108.42 million, is navigating challenges in the penny stock arena. The company remains unprofitable with a negative return on equity and shrinking free cash flow, though it has reduced its debt significantly over five years and maintains more cash than total debt. Recent earnings showed declining sales at US$304.25 million for the first nine months of 2025 compared to the previous year, alongside significant workforce reductions as part of restructuring efforts. Chegg faces potential delisting from NYSE due to low share prices but plans corrective measures including a possible reverse stock split.

- Click here to discover the nuances of Chegg with our detailed analytical financial health report.

- Understand Chegg's earnings outlook by examining our growth report.

Elite Pharmaceuticals (ELTP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elite Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing, manufacturing, and selling oral controlled-release and generic pharmaceuticals, with a market cap of $537.07 million.

Operations: The company's revenue is primarily generated from its Abbreviated New Drug Applications (ANDA) segment, amounting to $122.89 million.

Market Cap: $537.07M

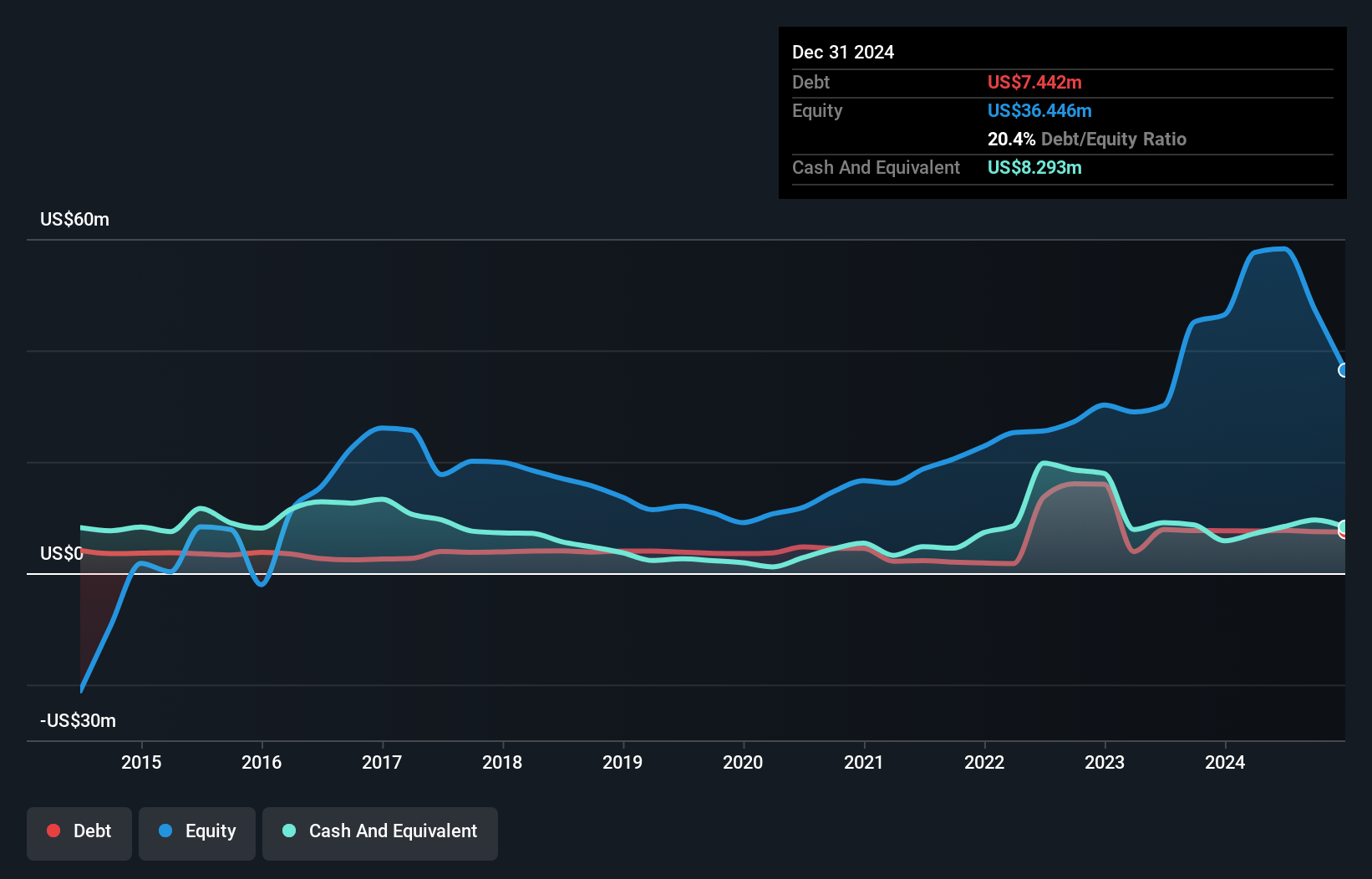

Elite Pharmaceuticals, Inc., with a market cap of US$537.07 million, has shown financial resilience in the penny stock sector. The company reported significant revenue growth to US$36.32 million for Q2 2025 and achieved profitability after years of losses, with net income reaching US$13.7 million compared to a net loss previously. Its short-term assets exceed both short and long-term liabilities significantly, indicating strong liquidity. Elite's debt is well-managed and covered by operating cash flow, while its Return on Equity is high at 22.6%. However, recent insider selling could be a point of concern for investors monitoring stability trends closely.

- Click here and access our complete financial health analysis report to understand the dynamics of Elite Pharmaceuticals.

- Gain insights into Elite Pharmaceuticals' past trends and performance with our report on the company's historical track record.

Key Takeaways

- Unlock our comprehensive list of 339 US Penny Stocks by clicking here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报