Undiscovered Gems Three US Stocks with Strong Potential

As the major U.S. stock indexes logged weekly gains in a holiday-shortened week, the market sentiment remains cautiously optimistic amidst fluctuating economic indicators and rising precious metal prices. In this environment, identifying stocks with strong potential often involves looking for companies that demonstrate resilience and adaptability to current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Liquidity Services (LQDT)

Simply Wall St Value Rating: ★★★★★★

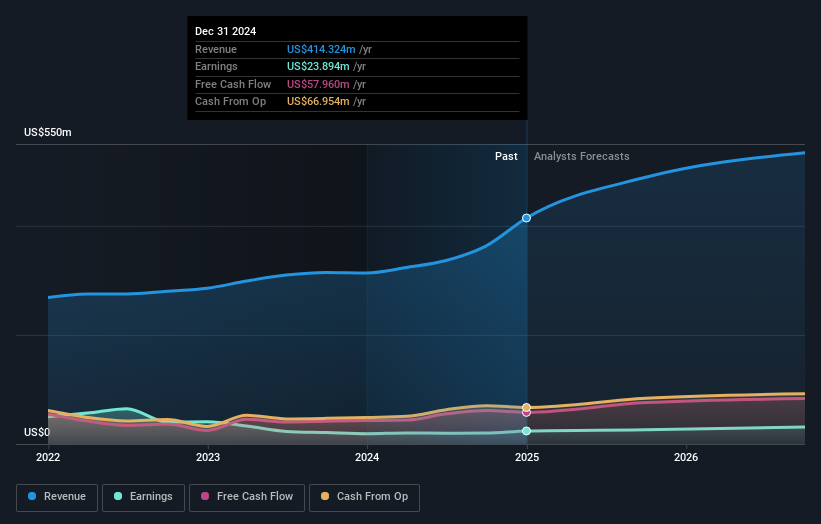

Overview: Liquidity Services, Inc. operates e-commerce marketplaces and offers auction tools and value-added services globally, with a market capitalization of approximately $954.43 million.

Operations: Liquidity Services generates revenue primarily from its Retail Supply Chain Group (RSCG) segment, contributing $330.29 million, followed by GovDeals at $87.40 million. The Capital Assets Group (CAG) and Machinio & Software Solutions segments add $39.30 million and $19.75 million, respectively, to the total revenue mix.

Liquidity Services, a notable player in the commercial services sector, has showcased impressive financial health with earnings growth of 40.5% over the past year, outpacing the industry's 5.2%. The company is debt-free for five years and trades at a significant discount of 56.3% below its estimated fair value, suggesting potential undervaluation. Recent buybacks saw Liquidity Services repurchase $10 million worth of shares, enhancing shareholder value. With high-quality earnings and positive free cash flow reported consistently, Liquidity Services seems well-positioned financially despite recent insider selling activity noted in the last quarter.

- Dive into the specifics of Liquidity Services here with our thorough health report.

Assess Liquidity Services' past performance with our detailed historical performance reports.

Interface (TILE)

Simply Wall St Value Rating: ★★★★★★

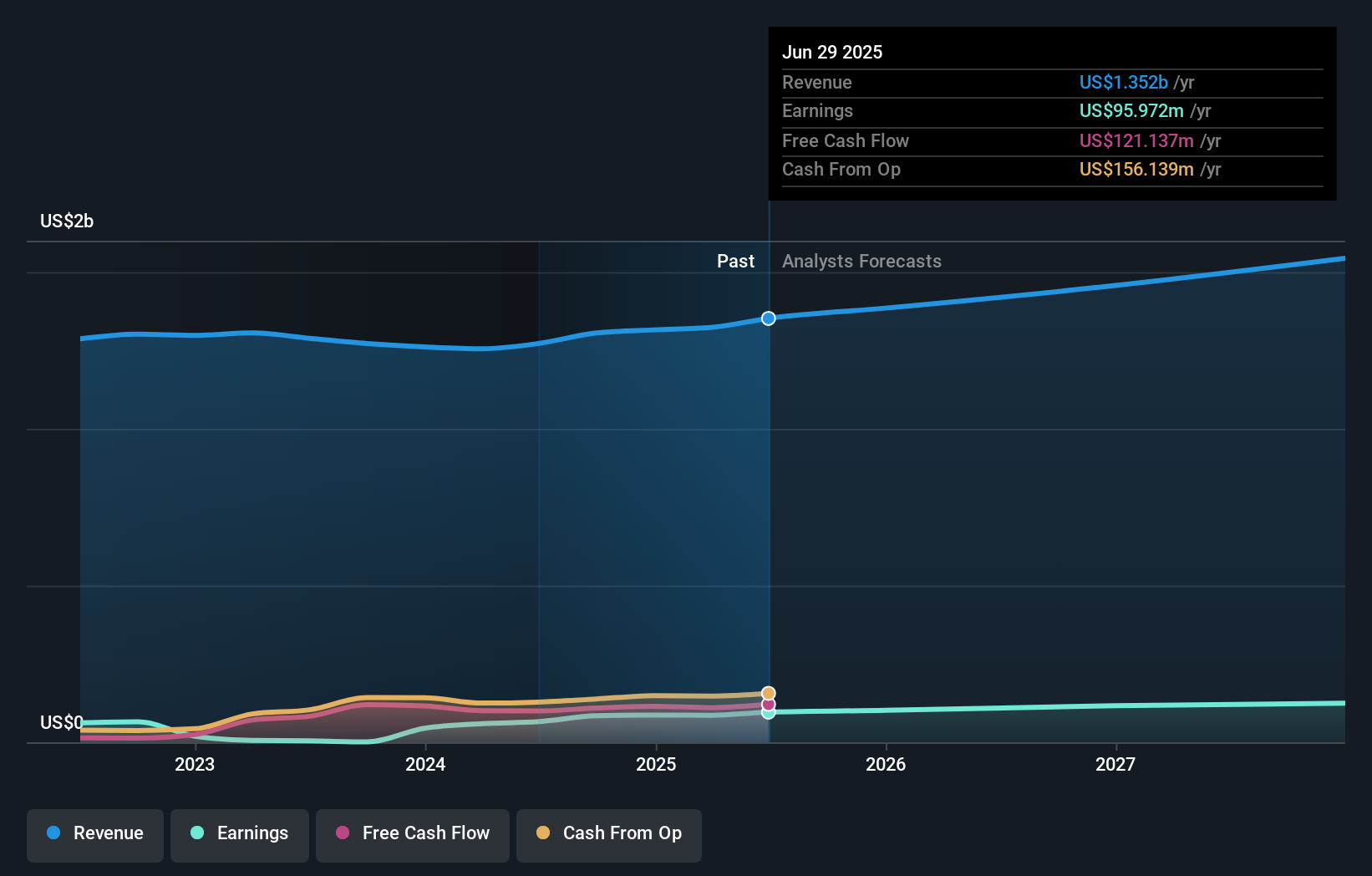

Overview: Interface, Inc. is a company that designs, produces, and sells modular carpet products across various regions including the United States, Canada, Latin America, Europe, Africa, Asia, and Australia with a market capitalization of approximately $1.66 billion.

Operations: Interface generates revenue primarily from two segments: Americas, contributing $843.72 million, and Europe, Africa, Asia, and Australia (EAAA), generating $528.75 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

Interface is making strides in the commercial flooring market with a focus on sustainable solutions and automation, enhancing its operational efficiency. Recent earnings show a net income of US$46 million for Q3 2025, up from US$28 million last year, reflecting robust growth. The company has repurchased over 1.63 million shares worth US$22.31 million since May 2022, indicating confidence in its valuation. Interface's debt management appears prudent with plans to redeem US$300 million in senior notes by December 2025, contingent on favorable financing conditions. Despite these positives, reliance on the U.S market and rising competition pose challenges ahead.

ATRenew (RERE)

Simply Wall St Value Rating: ★★★★★★

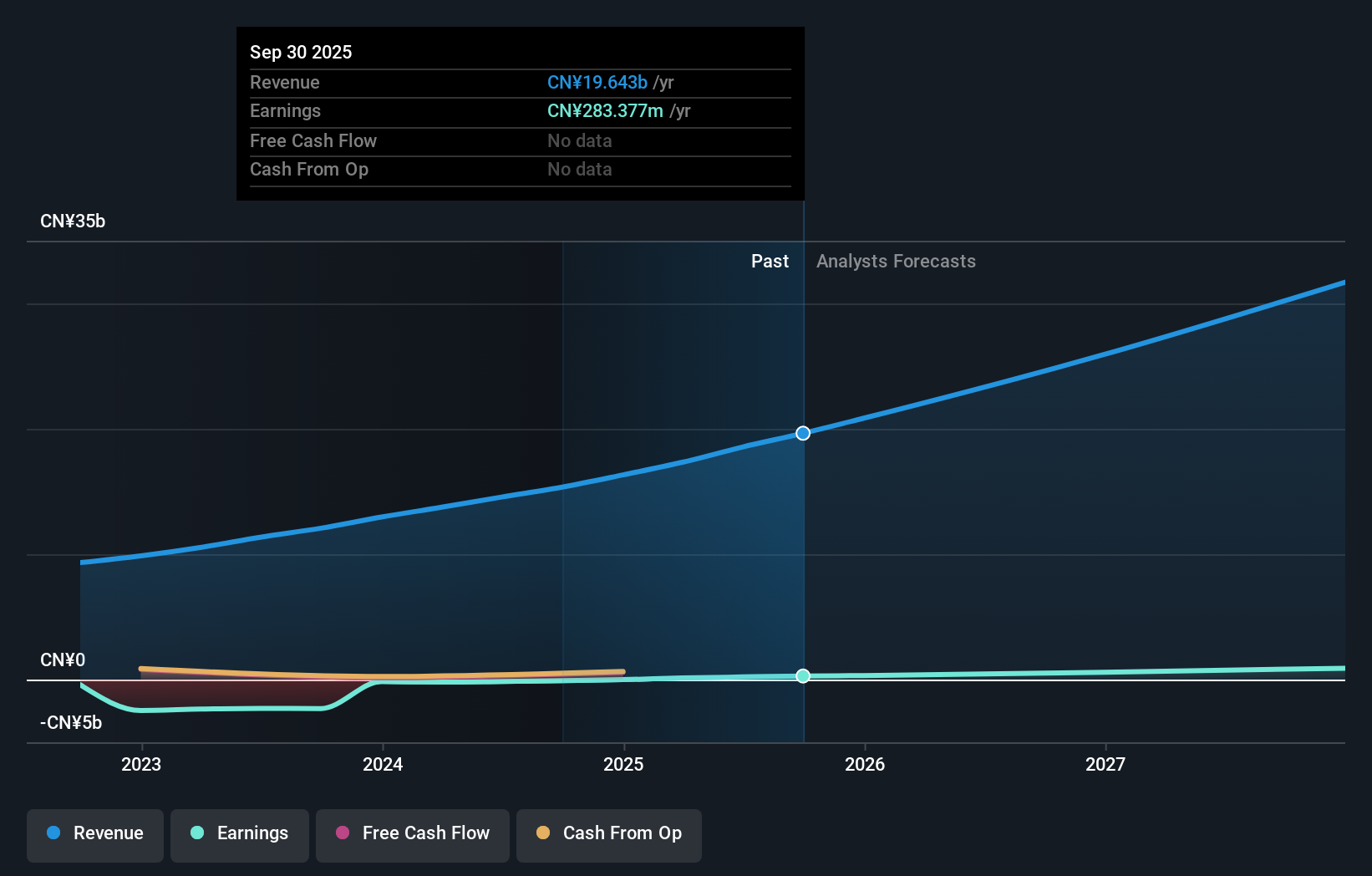

Overview: ATRenew Inc. operates a platform for pre-owned consumer electronics transactions and services in China, with a market cap of approximately $1.19 billion.

Operations: ATRenew generates revenue primarily from its retail electronics segment, which amounts to CN¥19.64 billion.

ATRenew is making strides in the electronics recommerce industry, driven by strategic partnerships and technology enhancements that improve supply quality and margins. The company reported a net income of CNY 90 million for Q3 2025, up from CNY 18 million the previous year, with basic earnings per share rising to CNY 0.37 from CNY 0.07. Over nine months, it achieved a net income of CNY 206 million compared to a loss of CNY 86 million last year. Despite challenges like high fixed costs and regulatory pressures, ATRenew's revenue guidance for Q4 suggests continued growth between RMB6 billion and RMB6.18 billion.

Turning Ideas Into Actions

- Dive into all 297 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报