Top UK Dividend Stocks For December 2025

As the UK market grapples with global economic challenges, including weak trade data from China impacting the FTSE 100, investors are increasingly turning their attention to dividend stocks as a source of stability and income. In this environment, selecting strong dividend-paying companies can provide a buffer against market volatility while offering potential for steady returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 4.16% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 7.17% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.58% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.83% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.10% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.98% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 3.60% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.64% | ★★★★★☆ |

| Begbies Traynor Group (AIM:BEG) | 3.84% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.55% | ★★★★★☆ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

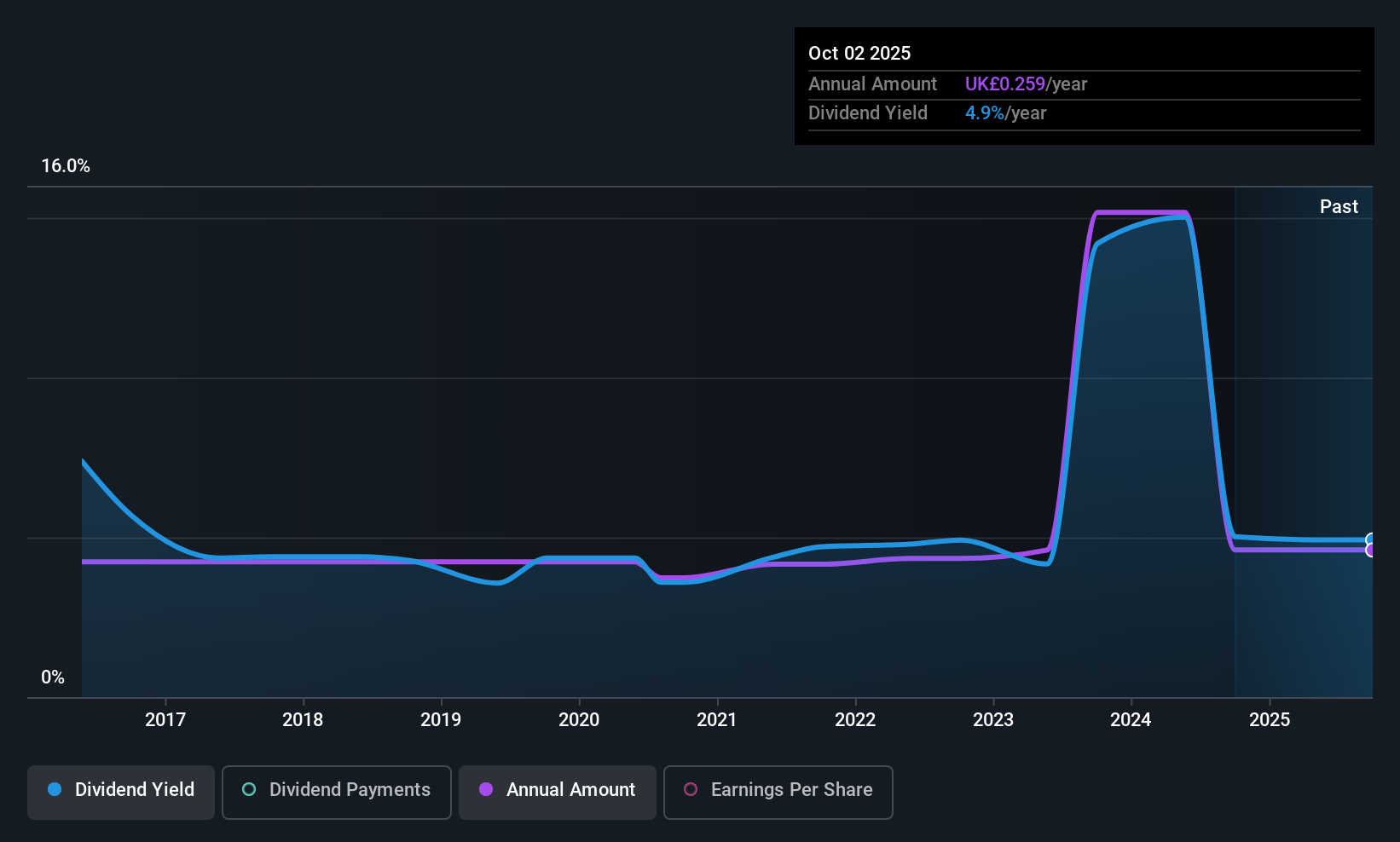

Andrews Sykes Group (AIM:ASY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andrews Sykes Group plc is an investment holding company that specializes in the hire, sale, and installation of environmental control equipment across the UK, Europe, the Middle East, Africa, and internationally with a market cap of £209.29 million.

Operations: Andrews Sykes Group plc generates revenue through its operations in the hire, sale, and installation of environmental control equipment across various regions including the UK, Europe, the Middle East, Africa, and globally.

Dividend Yield: 5.2%

Andrews Sykes Group's dividend payments have increased over the past decade, though they have been volatile with significant annual drops. Despite this, the dividends are covered by both earnings (63.2% payout ratio) and cash flows (74.8% cash payout ratio), suggesting sustainability in current conditions. Trading at 22.7% below estimated fair value, ASY offers a dividend yield of 5.18%, which is slightly lower than the top UK dividend payers' average of 5.62%.

- Click to explore a detailed breakdown of our findings in Andrews Sykes Group's dividend report.

- In light of our recent valuation report, it seems possible that Andrews Sykes Group is trading behind its estimated value.

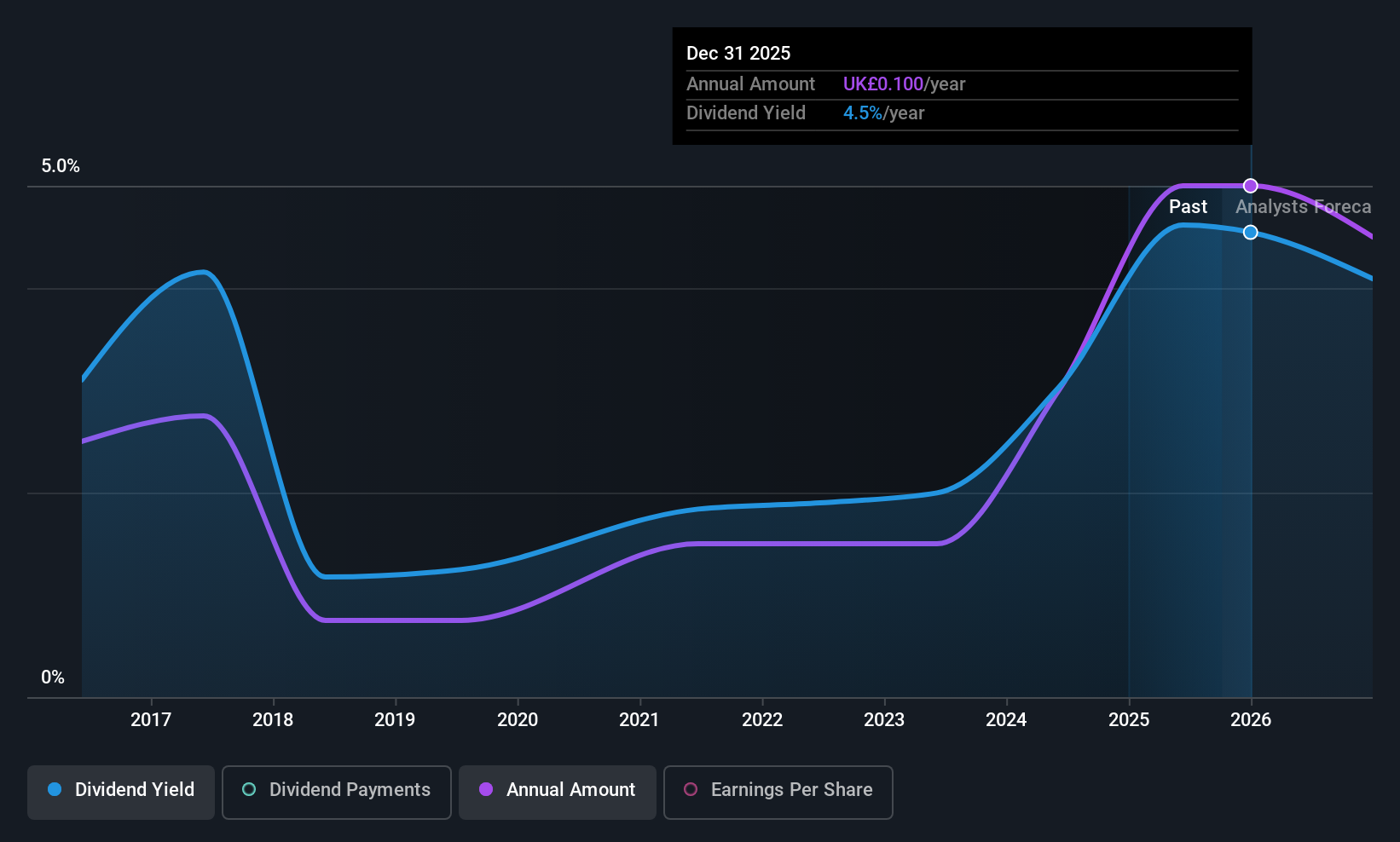

Helios Underwriting (AIM:HUW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Helios Underwriting plc, along with its subsidiaries, offers limited liability investment opportunities in the Lloyd’s insurance market in the UK and has a market cap of £151.81 million.

Operations: Helios Underwriting plc generates revenue by providing limited liability investment opportunities within the Lloyd’s insurance market in the UK.

Dividend Yield: 4.8%

Helios Underwriting's dividends are well-covered by earnings (29.8% payout ratio) and cash flows (32.3% cash payout ratio), despite a history of volatility over the past decade. The dividend yield of 4.78% is below the top UK payers' average, but payments have grown over ten years, indicating potential for stability if trends continue. Recent leadership changes may influence strategic direction, with new directors bringing extensive experience in financial oversight and capital advisory roles within regulated environments.

- Click here to discover the nuances of Helios Underwriting with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Helios Underwriting is priced lower than what may be justified by its financials.

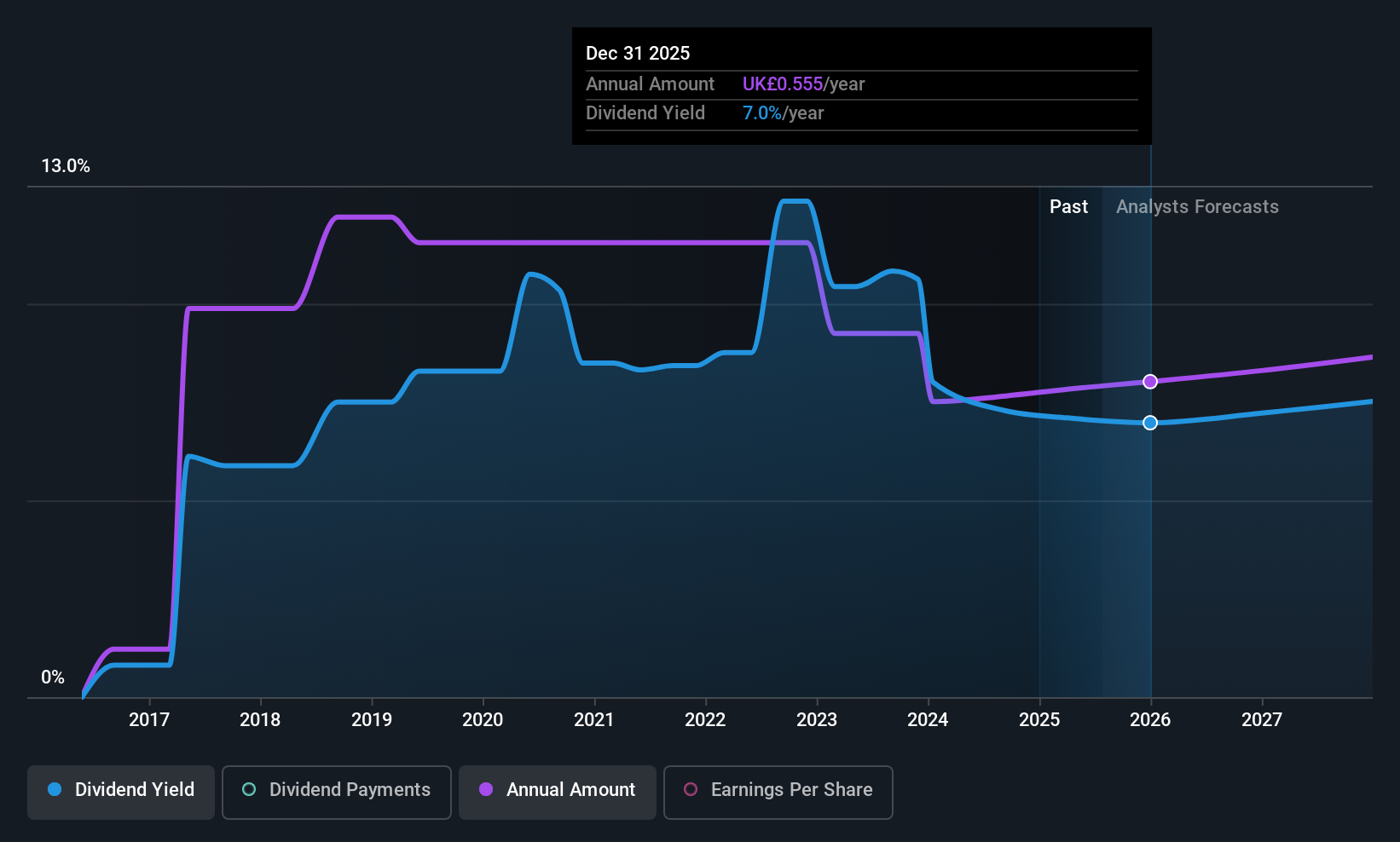

Pollen Street Group (LSE:POLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pollen Street Group, founded in 2015 and headquartered in London, operates as a financial services-focused investment manager with a market cap of £565.68 million.

Operations: Pollen Street Group generates revenue through its Asset Manager segment, contributing £81.40 million, and its Investment Company segment, which adds £55.33 million.

Dividend Yield: 5.8%

Pollen Street Group's dividends have been unreliable over the past decade, with payments showing volatility. Despite a reasonable payout ratio of 61.5%, dividends are not well-covered by free cash flows, as the company lacks them entirely. The dividend yield of 5.76% places it in the top 25% among UK payers, yet sustainability is questionable due to coverage issues. Trading at a favorable price-to-earnings ratio (10.5x) suggests good relative value compared to peers and industry averages.

- Delve into the full analysis dividend report here for a deeper understanding of Pollen Street Group.

- The analysis detailed in our Pollen Street Group valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Delve into our full catalog of 49 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报