Exploring 3 European Undervalued Small Caps With Insider Activity

In recent weeks, the European markets have shown resilience, with the pan-European STOXX Europe 600 Index inching closer to record highs amid positive sentiment about future economic growth and corporate earnings. Despite mixed performances in major indices like Germany's DAX and France's CAC 40, there remains a cautious optimism as investors navigate a landscape marked by gradual economic recovery forecasts and varied business sentiments across regions. In this environment, identifying promising small-cap stocks often involves looking for companies with strong fundamentals that can capitalize on potential market recoveries or sector-specific opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.4x | 0.7x | 42.29% | ★★★★★☆ |

| A.G. BARR | 14.3x | 1.6x | 48.80% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 42.69% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 40.62% | ★★★★★☆ |

| Eurocell | 16.3x | 0.3x | 39.94% | ★★★★☆☆ |

| Eastnine | 12.2x | 7.7x | 48.64% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 25.20% | ★★★★☆☆ |

| Gooch & Housego | 46.8x | 1.1x | 22.14% | ★★★☆☆☆ |

| Kendrion | 29.2x | 0.7x | 41.96% | ★★★☆☆☆ |

| CVS Group | 47.6x | 1.3x | 23.76% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

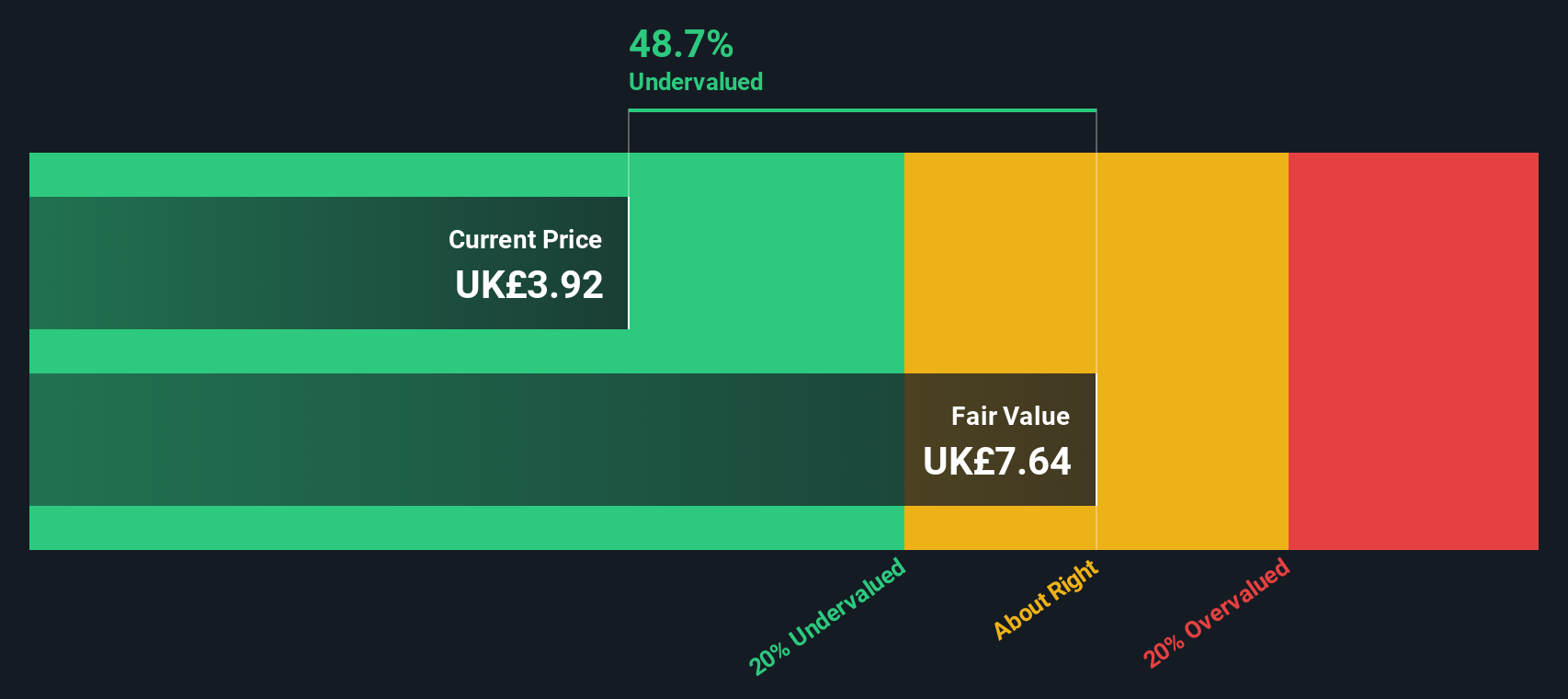

Breedon Group (LSE:BREE)

Simply Wall St Value Rating: ★★★★★★

Overview: Breedon Group is a construction materials company involved in the production and sale of cement, aggregates, asphalt, and ready-mixed concrete with operations primarily in Great Britain, Ireland, and the United States.

Operations: The company's revenue streams are primarily derived from Great Britain, Cement, and Ireland segments. Over the periods observed, the gross profit margin reached a high of 82.31% by December 2024. Operating expenses have shown an upward trend with significant allocations towards general and administrative costs.

PE: 12.7x

Breedon Group, a European construction materials company, stands out in the investment landscape for its potential value. Despite navigating high debt levels due to reliance on external borrowing, Breedon exhibits growth prospects with earnings expected to increase by 11% annually. Insider confidence is evident from recent share purchases made this year. The November sales statement highlighted steady operations through October 2025, suggesting resilience amidst industry challenges and indicating possible future growth opportunities in the sector.

- Delve into the full analysis valuation report here for a deeper understanding of Breedon Group.

Evaluate Breedon Group's historical performance by accessing our past performance report.

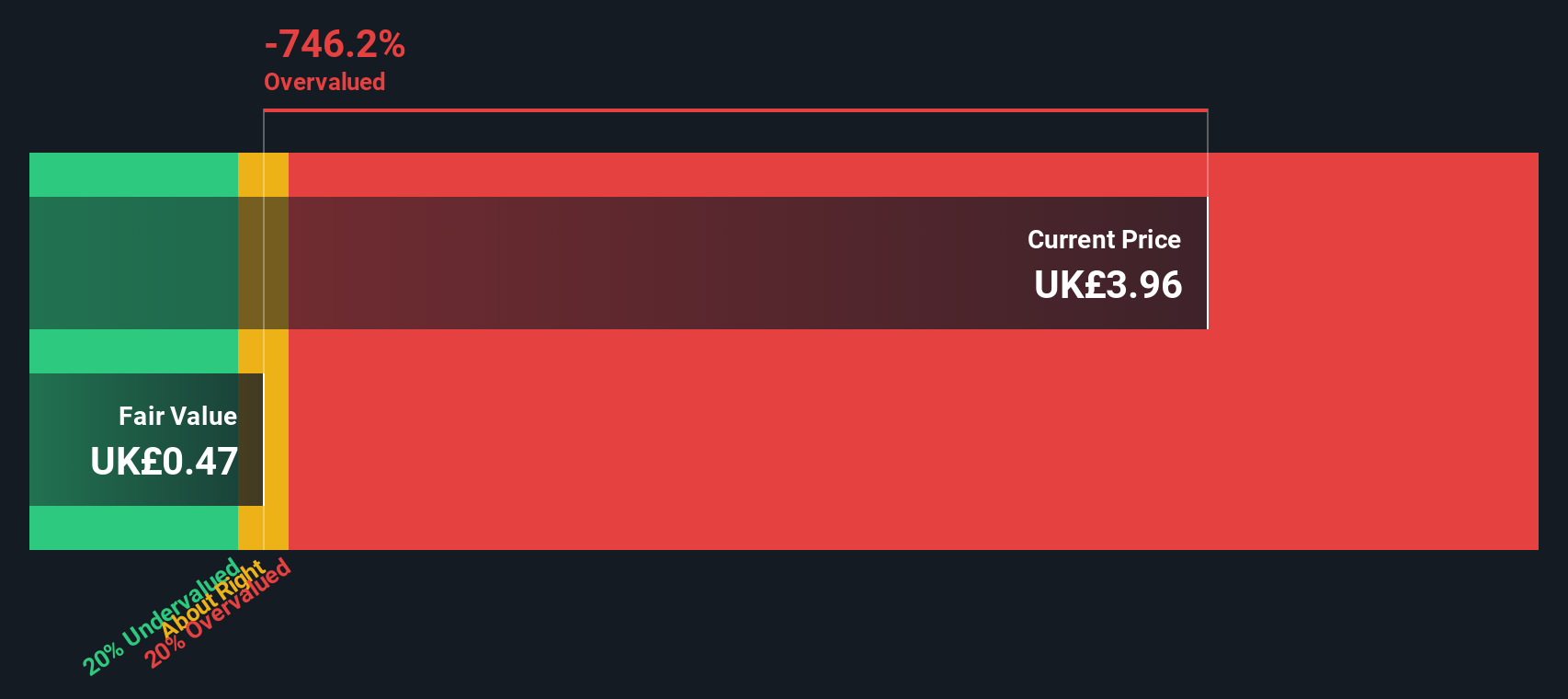

Workspace Group (LSE:WKP)

Simply Wall St Value Rating: ★★★★★★

Overview: Workspace Group is a company that provides business accommodation for rent, with a market capitalization of £0.94 billion.

Operations: The primary revenue stream is from providing business accommodation for rent, with recent quarterly revenues reaching £182.9 million. The gross profit margin has shown fluctuations, peaking at 75.59% and more recently recorded at 65.77%. Operating expenses have varied, impacting net income significantly, with the latest figures showing a net loss of £75.9 million and a net income margin of -0.41%.

PE: -9.9x

Workspace Group, a flexible office space provider, is attracting attention for its potential value in the market. Despite reporting a net loss of £71.1 million for the half-year ending September 2025, the company is strategically expanding with new leases and partnerships. Recent insider confidence was demonstrated by share purchases between October and December 2025, suggesting belief in future growth prospects. Additionally, Workspace's focus on London's creative sectors aligns well with their recent strategic investment in Qube, enhancing their specialized offerings across London.

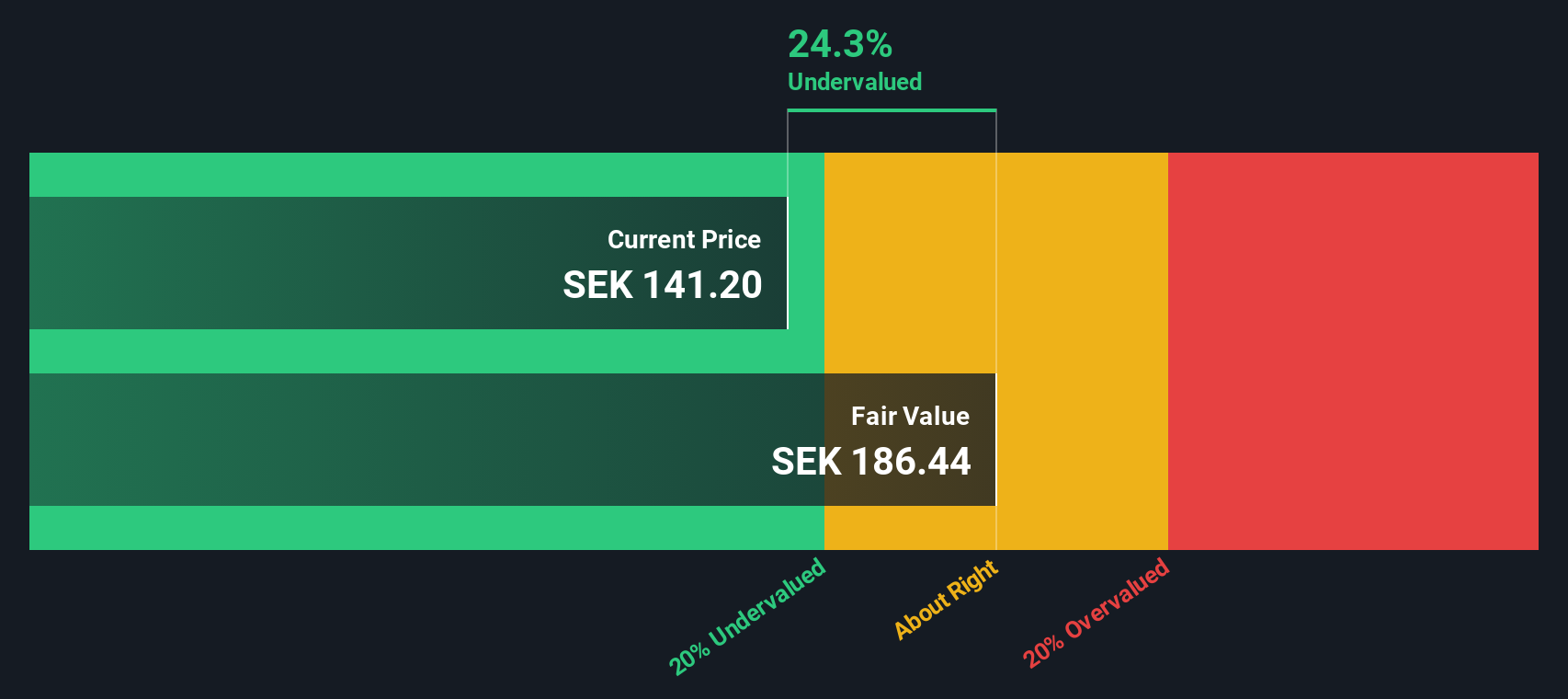

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alimak Group specializes in providing vertical access solutions for various industries including wind, construction, industrial, and facade access with a market cap of approximately SEK 5.92 billion.

Operations: The company's revenue is primarily driven by its Construction and Facade Access segments, contributing significantly to its total revenue. Recent data indicates a gross profit margin of 40.41%, reflecting the efficiency in managing production costs relative to sales. Operating expenses, including substantial allocations for sales & marketing and general & administrative activities, impact net income margins which reached 10.11% recently.

PE: 21.8x

Alimak Group, a player in the European market, shows potential as an undervalued stock with insider confidence reflected by President Ole Jodahl's purchase of 9,830 shares valued at SEK 1.45 million. Despite facing higher risk due to external borrowing and a slight dip in third-quarter sales to SEK 1,658 million from SEK 1,742 million the previous year, earnings per share for nine months improved to SEK 4.73 from SEK 4.05. Earnings are projected to grow at an annual rate of over 12%, suggesting promising future prospects amidst current challenges.

- Unlock comprehensive insights into our analysis of Alimak Group stock in this valuation report.

Examine Alimak Group's past performance report to understand how it has performed in the past.

Summing It All Up

- Navigate through the entire inventory of 73 Undervalued European Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报