Asian Penny Stocks To Watch In December 2025

As global markets continue to experience varied performances, with the U.S. economy growing at its fastest pace in two years and Asian indices showing resilience amid economic challenges, investors are exploring diverse opportunities. Penny stocks, a term that might seem outdated yet remains relevant, offer intriguing prospects particularly within smaller or newer companies across Asia. These stocks can provide unique growth opportunities when backed by strong financial health, making them appealing for those seeking potential long-term success in under-the-radar investments.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.103 | SGD53.92M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.92 | THB876M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.71 | HK$20.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$53.4B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$238.83M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 966 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development, as well as financial services across Hong Kong, the People's Republic of China, Europe, and internationally, with a market cap of HK$8.33 billion.

Operations: The company's revenue is primarily derived from property development (HK$7.61 billion), consumer finance (HK$3.18 billion), healthcare services (HK$1.54 billion), property investment (HK$891.3 million), investment and finance (HK$715.1 million), property management (HK$376.5 million), and elderly care services (HK$249.3 million).

Market Cap: HK$8.33B

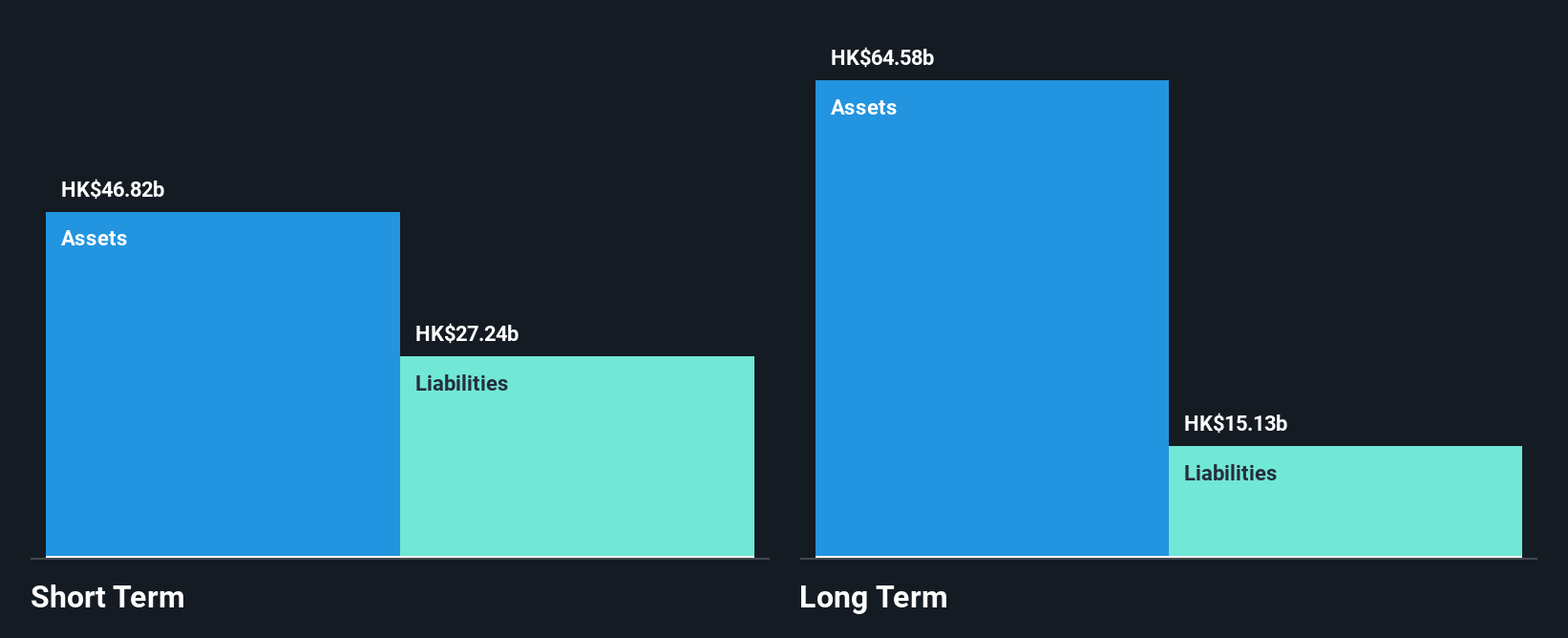

Allied Group Limited, with a market cap of HK$8.33 billion, has recently become profitable after years of earnings decline. The company shows financial stability with short-term assets (HK$46.8 billion) exceeding both short and long-term liabilities, though its Return on Equity remains low at 3.3%. Its net debt to equity ratio is satisfactory at 2%, and the board and management team are experienced, boasting average tenures of over 14 years. However, operating cash flow covers only 12.4% of its debt obligations, indicating potential liquidity concerns despite high-quality earnings and a favorable Price-To-Earnings ratio of 7.4x compared to the broader Hong Kong market.

- Click to explore a detailed breakdown of our findings in Allied Group's financial health report.

- Learn about Allied Group's historical performance here.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bosideng International Holdings Limited operates in the apparel industry within the People's Republic of China, with a market cap of approximately HK$53.40 billion.

Operations: The company's revenue is primarily derived from Down Related Apparels at CN¥22.24 billion, followed by Original Equipment Manufacturing (OEM) Management at CN¥3.14 billion, Ladieswear Apparels at CN¥593.96 million, and Diversified Apparels at CN¥172.46 million.

Market Cap: HK$53.4B

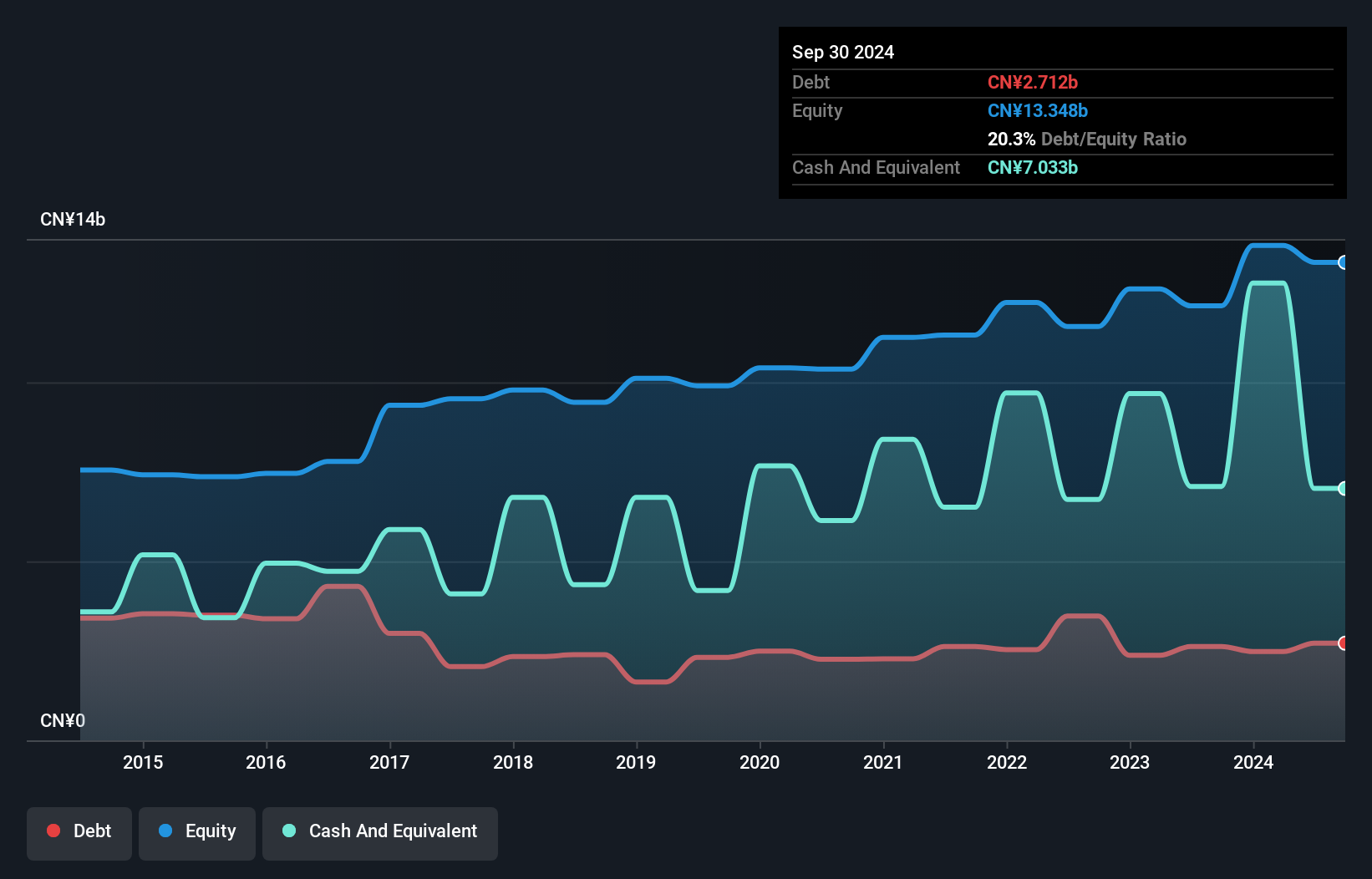

Bosideng International Holdings Limited, with a market cap of HK$53.40 billion, demonstrates robust financial health as its short-term assets (CN¥20.2 billion) surpass both short and long-term liabilities. The company benefits from a seasoned management team and board with average tenures of 8.7 and 18.3 years, respectively. Bosideng's debt is well-covered by operating cash flow at 652.7%, and it has more cash than total debt, reflecting strong liquidity management despite recent insider selling activity. Earnings growth outpaced the luxury industry last year at 8.8%, though profit growth has decelerated compared to its five-year average of 18.4%.

- Take a closer look at Bosideng International Holdings' potential here in our financial health report.

- Examine Bosideng International Holdings' earnings growth report to understand how analysts expect it to perform.

Oiltek International (SGX:HQU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Oiltek International Limited is an investment holding company involved in supplying and providing engineering design and commissioning services for oil extraction equipment and plants across Asia, the United States, and Africa, with a market cap of SGD293.87 million.

Operations: The company generates revenue from three main segments: Edible & Non-Edible Oil Refinery (MYR177.51 million), Renewable Energy (MYR37.61 million), and Product Sales and Trading (MYR15.53 million).

Market Cap: SGD293.87M

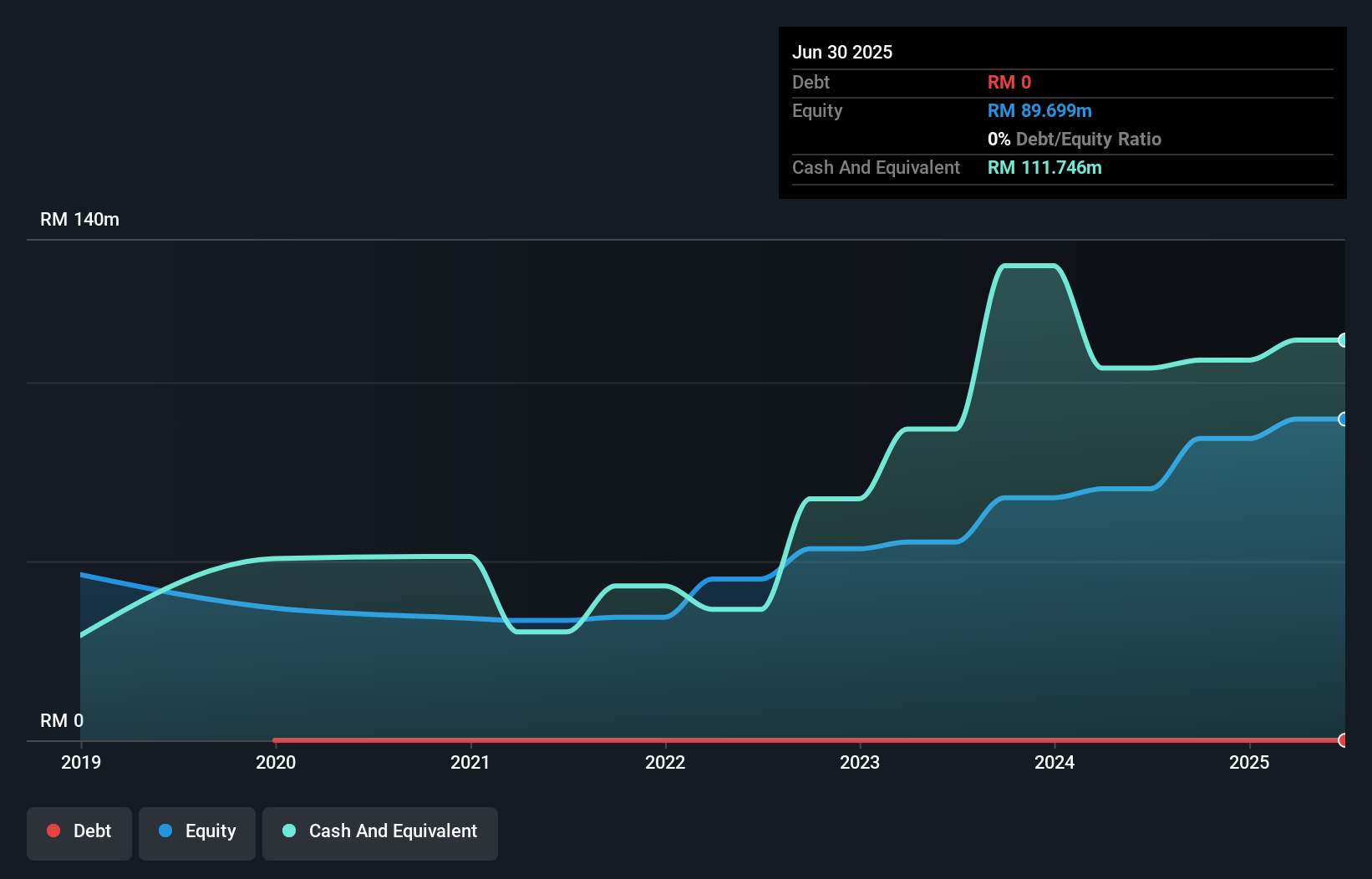

Oiltek International, with a market cap of SGD293.87 million, benefits from a diversified revenue stream across Edible & Non-Edible Oil Refinery (MYR177.51 million), Renewable Energy (MYR37.61 million), and Product Sales and Trading (MYR15.53 million). The company is debt-free, with short-term assets of MYR165.3M covering its liabilities of MYR81.0M comfortably, indicating strong financial stability for a penny stock. Despite significant insider selling recently, the absence of shareholder dilution over the past year is positive for investors. Its net profit margin improved to 14.5%, reflecting operational efficiency amidst competitive industry dynamics in Asia's penny stock landscape.

- Click here and access our complete financial health analysis report to understand the dynamics of Oiltek International.

- Assess Oiltek International's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Navigate through the entire inventory of 966 Asian Penny Stocks here.

- Contemplating Other Strategies? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报