Asian Growth Companies With High Insider Ownership In December 2025

As 2025 draws to a close, the Asian markets have shown resilience amid global economic shifts, with notable performances in China and Japan driven by technology optimism and strategic monetary policies. In this context, growth companies with high insider ownership can be attractive to investors seeking alignment of interests between management and shareholders, as these insiders often have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.9% | 54.3% |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Here we highlight a subset of our preferred stocks from the screener.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors and visual perception products with a market cap of CN¥34.60 billion.

Operations: Orbbec generates revenue through its 3D vision sensors and visual perception products.

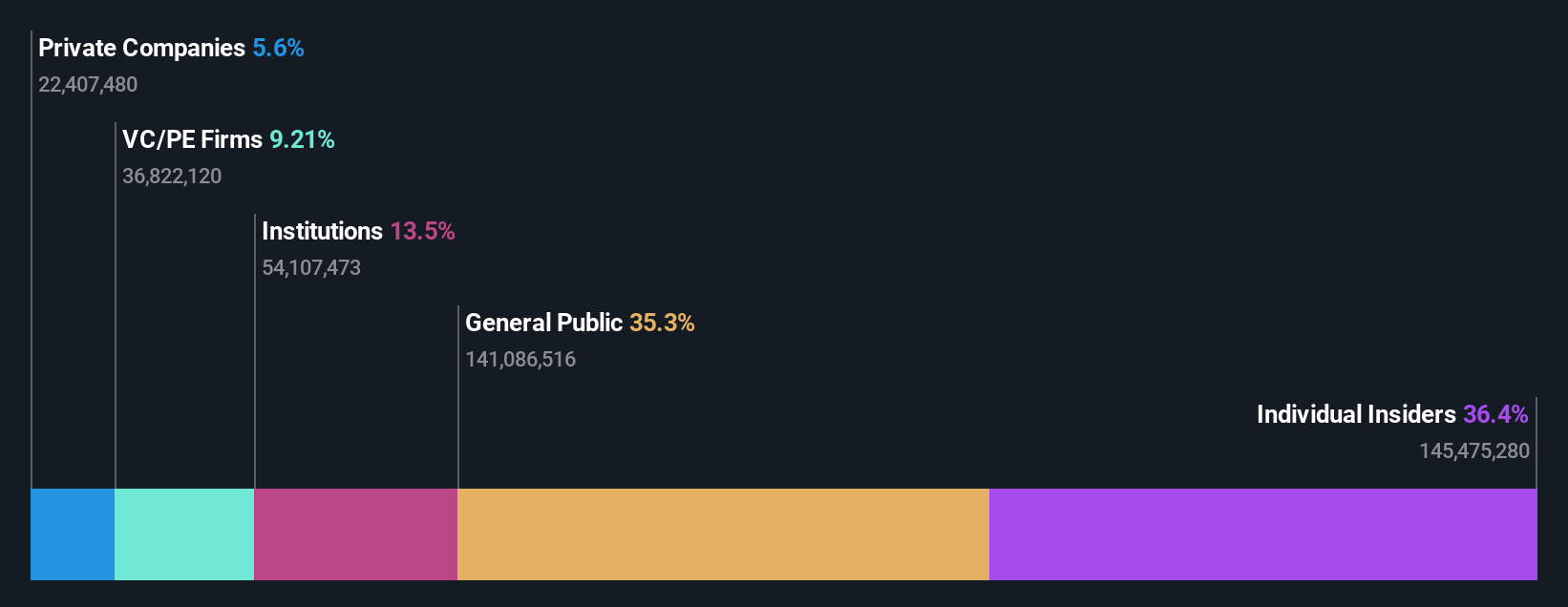

Insider Ownership: 36.4%

Revenue Growth Forecast: 36.4% p.a.

Orbbec's earnings are forecast to grow significantly at 63.25% annually, outpacing the CN market's 27.6%. Revenue growth is also robust at 36.4% per year, surpassing the market average of 14.6%. The company became profitable this year with net income reaching CNY 108.02 million for nine months ending September 2025, compared to a loss last year. A share repurchase program worth up to CNY 50 million underscores insider confidence and strategic growth initiatives.

- Click here to discover the nuances of Orbbec with our detailed analytical future growth report.

- Our valuation report here indicates Orbbec may be overvalued.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. designs, produces, and sells printed circuit boards both in China and internationally, with a market cap of CN¥36.58 billion.

Operations: Revenue Segments (in millions of CN¥):

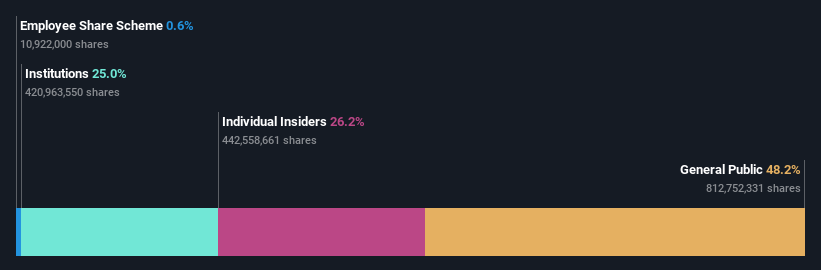

Insider Ownership: 25%

Revenue Growth Forecast: 19.2% p.a.

Shenzhen Fastprint Circuit Tech Ltd. is forecast to see earnings grow at 94.77% annually, becoming profitable within three years, surpassing average market growth expectations. Revenue is projected to rise by 19.2% per year, outpacing the Chinese market's 14.6%. Recent results show a shift from a net loss to CNY 131.49 million in profit for the first nine months of 2025, despite high share price volatility and low return on equity forecasts of 9.9%.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Fastprint Circuit TechLtd.

- Our expertly prepared valuation report Shenzhen Fastprint Circuit TechLtd implies its share price may be too high.

ASE Technology Holding (TWSE:3711)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ASE Technology Holding Co., Ltd. offers semiconductor manufacturing services across the United States, Taiwan, Asia, Europe, and globally, with a market cap of NT$10.49 billion.

Operations: The company's revenue is derived from three main segments: Packaging (NT$297.82 billion), Electronic Manufacturing Services (EMS) (NT$297.91 billion), and Testing (NT$67.29 billion).

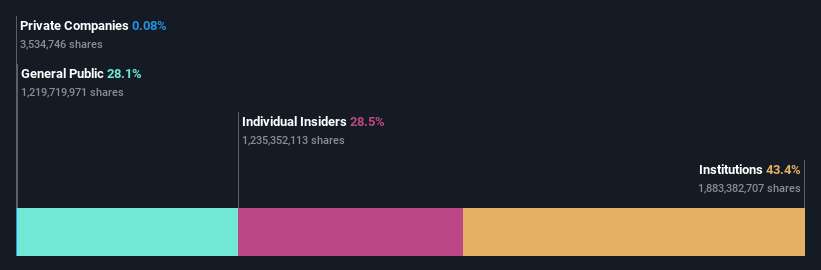

Insider Ownership: 28.4%

Revenue Growth Forecast: 11.9% p.a.

ASE Technology Holding's earnings are forecast to grow significantly at 28.9% annually, outpacing the Taiwan market's average. However, its revenue growth is expected to lag behind the market at 11.9%. The company's recent unaudited revenues for November showed a rise to TWD 58.82 billion from TWD 52.93 billion a year ago, indicating positive momentum despite high share price volatility and substantial debt levels.

- Unlock comprehensive insights into our analysis of ASE Technology Holding stock in this growth report.

- Upon reviewing our latest valuation report, ASE Technology Holding's share price might be too pessimistic.

Key Takeaways

- Dive into all 632 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报