Asian Dividend Stocks To Watch In December 2025

As Asian markets show signs of resilience amid global economic fluctuations, investors are increasingly looking towards dividend stocks as a stable income source. In this context, identifying strong dividend-paying companies can offer both income and potential growth opportunities, making them particularly appealing in the current market environment.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.71% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.77% | ★★★★★★ |

| NCD (TSE:4783) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.75% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.26% | ★★★★★★ |

Click here to see the full list of 1027 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

New Era Electronics (TPEX:4909)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Era Electronics Co., Ltd designs, manufactures, assembles, and sells printed circuit boards (PCBs) in Taiwan and internationally, with a market cap of NT$5.66 billion.

Operations: New Era Electronics Co., Ltd generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$812.86 million.

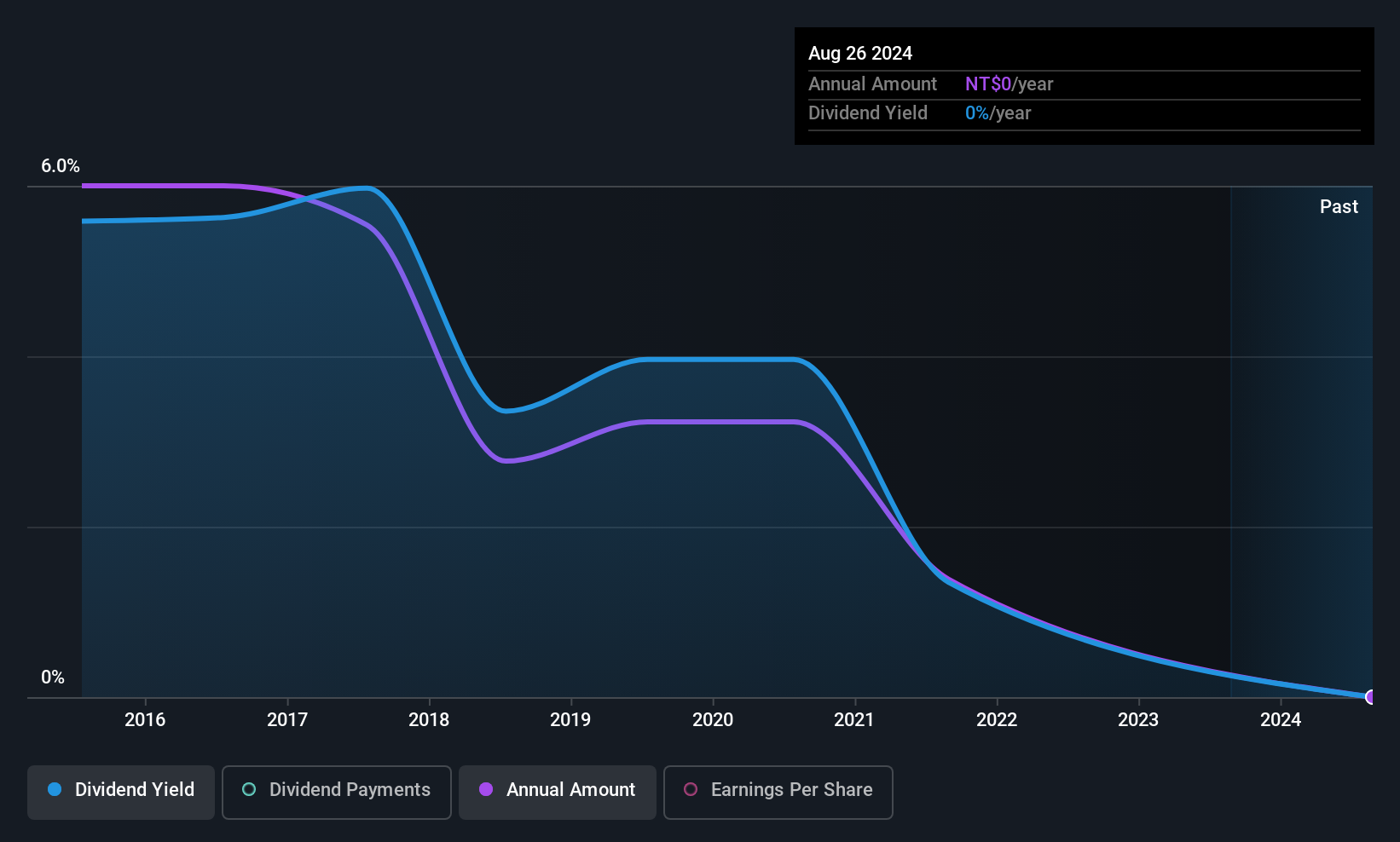

Dividend Yield: 9.9%

New Era Electronics offers a high dividend yield of 9.9%, placing it among the top payers in Taiwan. However, its dividends are not well covered by earnings, with a payout ratio of 2,553%. Although cash flows cover payouts at a reasonable ratio of 55.5%, dividends have been volatile and unreliable over the past decade. Recent financials show significant declines in sales and net income, raising concerns about sustainability despite improved profit margins from last year.

- Get an in-depth perspective on New Era Electronics' performance by reading our dividend report here.

- According our valuation report, there's an indication that New Era Electronics' share price might be on the expensive side.

INPAQ Technology (TPEX:6284)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INPAQ Technology Co., Ltd. specializes in providing circuit protection components and antenna products for various sectors including computing, communication, consumer electronics, and automotive electronics across Taiwan, China, Hong Kong, and internationally with a market cap of NT$11.46 billion.

Operations: INPAQ Technology Co., Ltd.'s revenue is primarily derived from its Protection Component Department, contributing NT$3.12 billion, and its High-Frequency Component Department, which accounts for NT$4.59 billion.

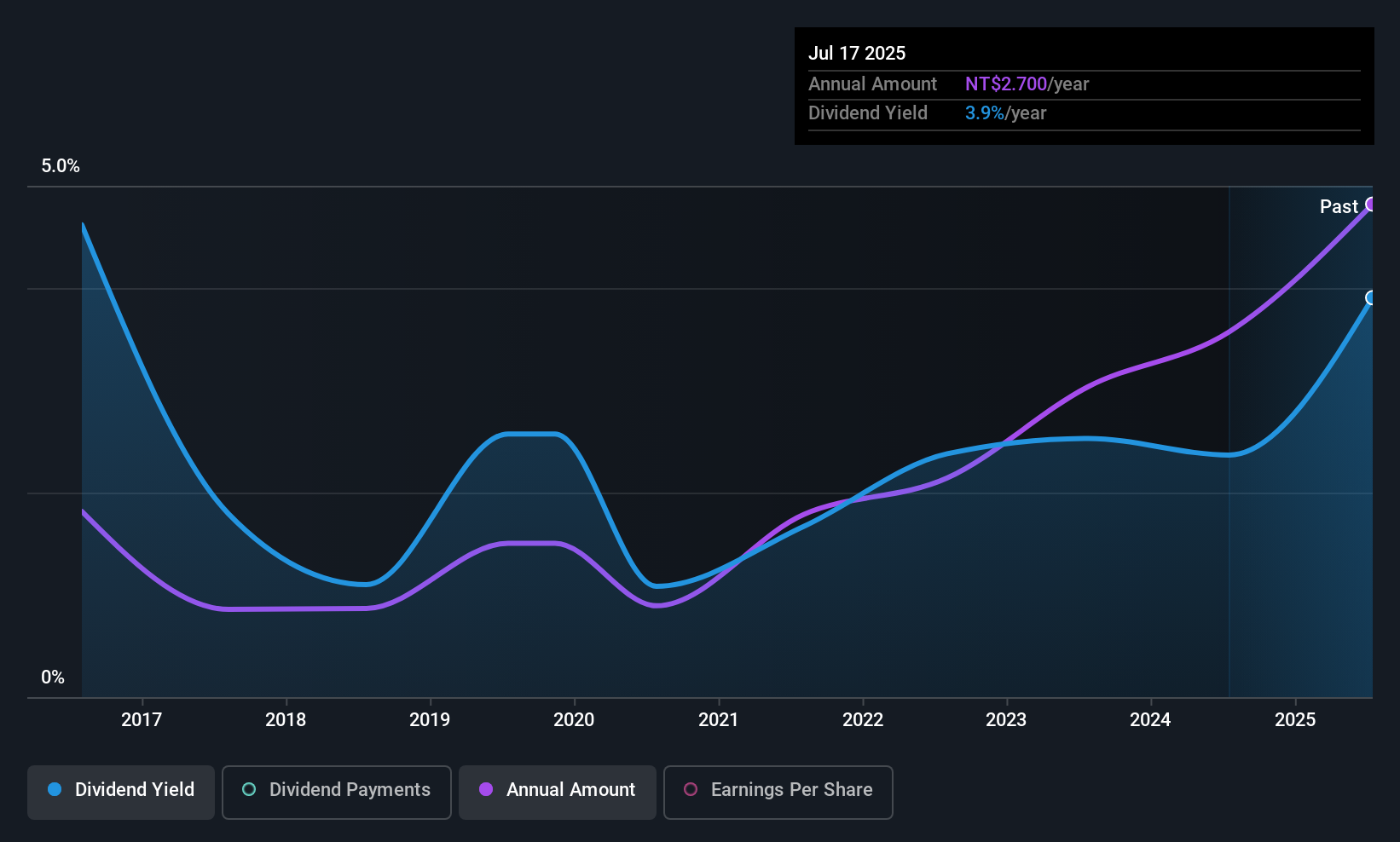

Dividend Yield: 3.4%

INPAQ Technology's dividend payments are well supported by both earnings, with a payout ratio of 53.6%, and free cash flows, at a cash payout ratio of 32.5%. However, its dividends have been volatile over the past decade and offer a yield of 3.42%, below Taiwan's top quartile payers. Recent earnings show improved quarterly net income to TWD 252.66 million, though nine-month figures reflect decreased profitability compared to the previous year.

- Take a closer look at INPAQ Technology's potential here in our dividend report.

- The analysis detailed in our INPAQ Technology valuation report hints at an deflated share price compared to its estimated value.

Tokyo Rope Mfg (TSE:5981)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokyo Rope Mfg. Co., Ltd. is a company that produces and distributes wire ropes, steel cords, and carbon fiber composite cables both in Japan and globally, with a market cap of ¥24.98 billion.

Operations: Tokyo Rope Mfg. Co., Ltd.'s revenue segments include Cable steel wire related at ¥28.88 billion, Product Development at ¥18.96 billion, Energy Real Estate at ¥7.59 billion, Steel Cord Related at ¥5.18 billion, and Industrial Machinery at ¥4.09 billion.

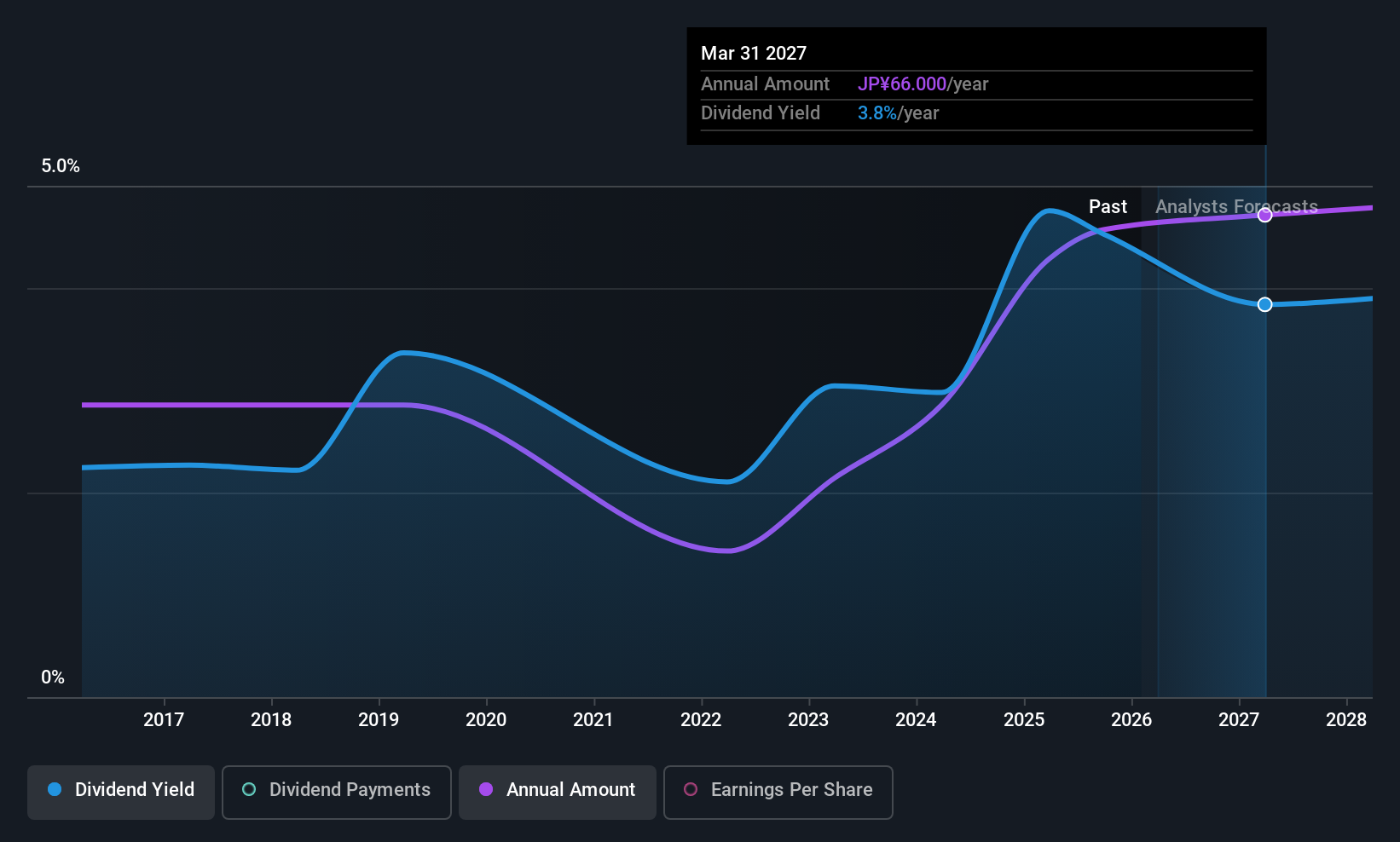

Dividend Yield: 5%

Tokyo Rope Mfg.'s recent dividend increase to ¥25 per share marks a significant change from the previous year, yet its sustainability is questionable due to a high cash payout ratio of 115.2%. Despite being among Japan's top dividend payers with a yield of 4.96%, dividends have been volatile historically. A share buyback program valued at ¥300 million aims to enhance shareholder returns and support strategic growth, though earnings are forecasted to decline slightly over the next three years.

- Unlock comprehensive insights into our analysis of Tokyo Rope Mfg stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Tokyo Rope Mfg shares in the market.

Key Takeaways

- Embark on your investment journey to our 1027 Top Asian Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报