Middle Eastern Penny Stocks To Consider In December 2025

As the Middle Eastern markets navigate a mix of geopolitical tensions and fluctuating oil prices, the UAE's stock indices have shown resilience, with Dubai marking its fifth consecutive weekly gain. For investors willing to explore beyond mainstream options, penny stocks—typically smaller or newer companies—still hold potential despite being an older market term. This article will highlight three such stocks that stand out for their financial strength, offering intriguing opportunities for those interested in under-the-radar companies with promising prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.33 | SAR1.33B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.512 | ₪180.15M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.58 | SAR916M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.66 | AED15.56B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.851 | AED517.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.614 | ₪205.19M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Commercial Bank International P.J.S.C (ADX:CBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

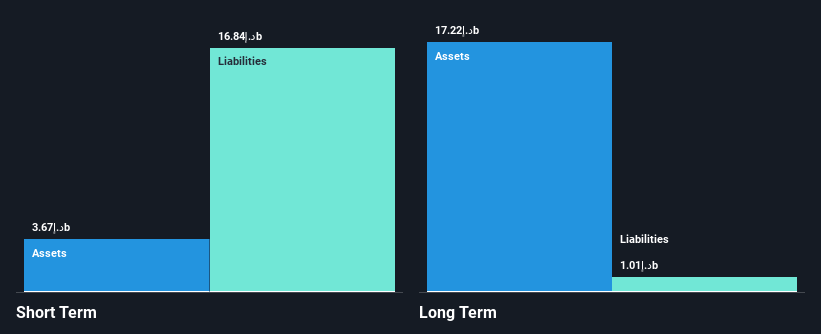

Overview: Commercial Bank International P.J.S.C., along with its subsidiaries, offers banking products and services to individuals and businesses in the UAE and internationally, with a market cap of AED1.54 billion.

Operations: The company's revenue is primarily derived from its Wholesale Banking (AED175.37 million), Real Estate (AED155.48 million), Retail Banking (AED54.08 million), and Treasury (AED53.88 million) segments.

Market Cap: AED1.54B

Commercial Bank International P.J.S.C. demonstrates a stable funding structure, with 94% of its liabilities sourced from customer deposits, reducing risk compared to external borrowing. Despite a seasoned management team and board, the bank faces challenges with declining net profit margins—currently at 9.4%, down from 39.6% last year—and negative earnings growth over the past year (-83.3%). While it maintains an appropriate Loans to Deposits ratio (83%), its high level of bad loans (14.6%) is concerning. Recent earnings reports show decreased net income despite increased net interest income, highlighting profitability pressures in the current environment.

- Jump into the full analysis health report here for a deeper understanding of Commercial Bank International P.J.S.C.

- Understand Commercial Bank International P.J.S.C's track record by examining our performance history report.

Elbit Medical Technologies (TASE:EMTC-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Elbit Medical Technologies Ltd is an investment holding company focused on the research, development, production, and marketing of therapeutic medical systems globally, with a market cap of ₪20.41 million.

Operations: Elbit Medical Technologies Ltd does not report specific revenue segments.

Market Cap: ₪20.41M

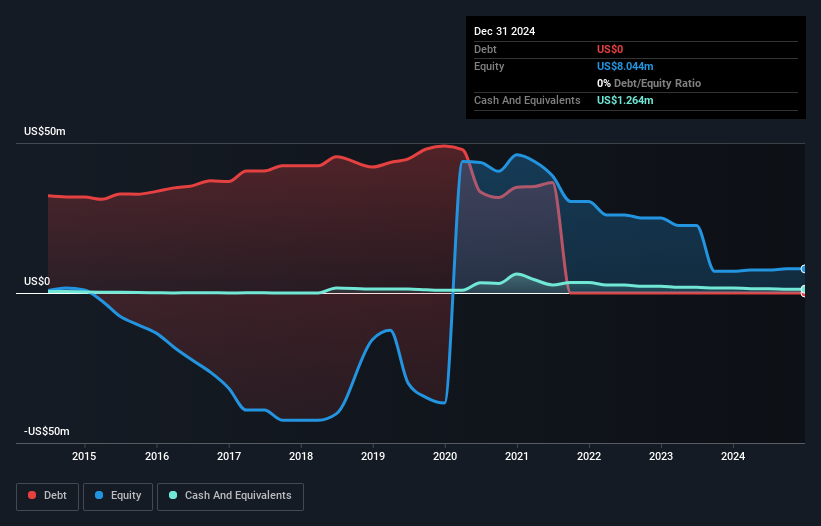

Elbit Medical Technologies Ltd, with a market cap of ₪20.41 million, operates as a pre-revenue entity in the medical systems sector. Despite becoming profitable recently, its earnings have been volatile, influenced by significant one-off gains. The company's share price has experienced high volatility over the past three months but has seen reduced weekly volatility compared to last year. Elbit Medical is debt-free and maintains strong short-term financial positioning with assets exceeding liabilities. A proposed acquisition of a 19.59% stake by Ortal Entreprise & Investments Ltd for ILS 4 million reflects investor interest despite its low revenue generation and modest return on equity at 3.5%.

- Click here and access our complete financial health analysis report to understand the dynamics of Elbit Medical Technologies.

- Assess Elbit Medical Technologies' previous results with our detailed historical performance reports.

Unicorn Technologies - Limited Partnership (TASE:UNCT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Unicorn Technologies - Limited Partnership is a principal investment firm based in Tel Aviv, Israel, with a market cap of ₪11.94 million.

Operations: Unicorn Technologies - Limited Partnership has not reported any specific revenue segments.

Market Cap: ₪11.94M

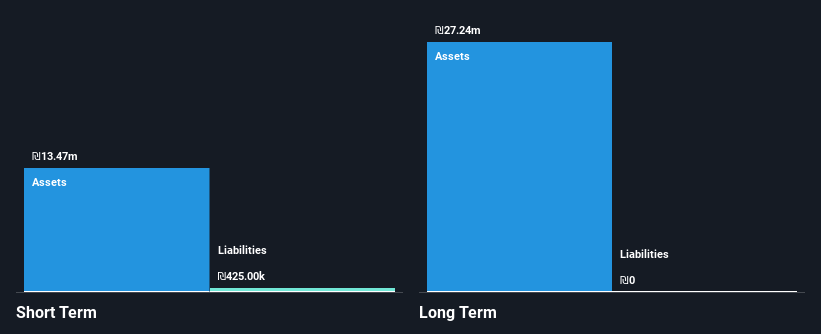

Unicorn Technologies - Limited Partnership, with a market cap of ₪11.94 million, operates as a pre-revenue entity and has seen its losses increase by 33.6% annually over the past five years. Despite this, the company maintains financial stability with no long-term liabilities and sufficient cash runway for over two years if current spending trends continue. The stock's price has been highly volatile recently, yet it remains debt-free and shareholders have not faced significant dilution in the past year. The board is experienced with an average tenure of 5.9 years, although management experience data is insufficient to assess fully.

- Unlock comprehensive insights into our analysis of Unicorn Technologies - Limited Partnership stock in this financial health report.

- Explore historical data to track Unicorn Technologies - Limited Partnership's performance over time in our past results report.

Next Steps

- Unlock our comprehensive list of 81 Middle Eastern Penny Stocks by clicking here.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报