Middle East's Undiscovered Gems And 2 Other Promising Small Caps

As the Middle Eastern markets navigate a landscape marked by fluctuating oil prices and geopolitical tensions, indices like Dubai's have shown resilience, logging consecutive weekly gains despite recent dips. In this environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate robust fundamentals and growth potential amidst these market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Europen Endustri Insaat Sanayi ve Ticaret (IBSE:EUREN)

Simply Wall St Value Rating: ★★★★★★

Overview: Europen Endustri Insaat Sanayi ve Ticaret A.S. operates in the construction and industrial sectors, focusing on products such as glass, PVC profiles, and doors and windows, with a market capitalization of TRY14.20 billion.

Operations: Europen generates revenue primarily from its glass and door and window segments, contributing TRY1.83 billion and TRY2.41 billion respectively. The PVC profile segment adds TRY473.69 million to the revenue stream.

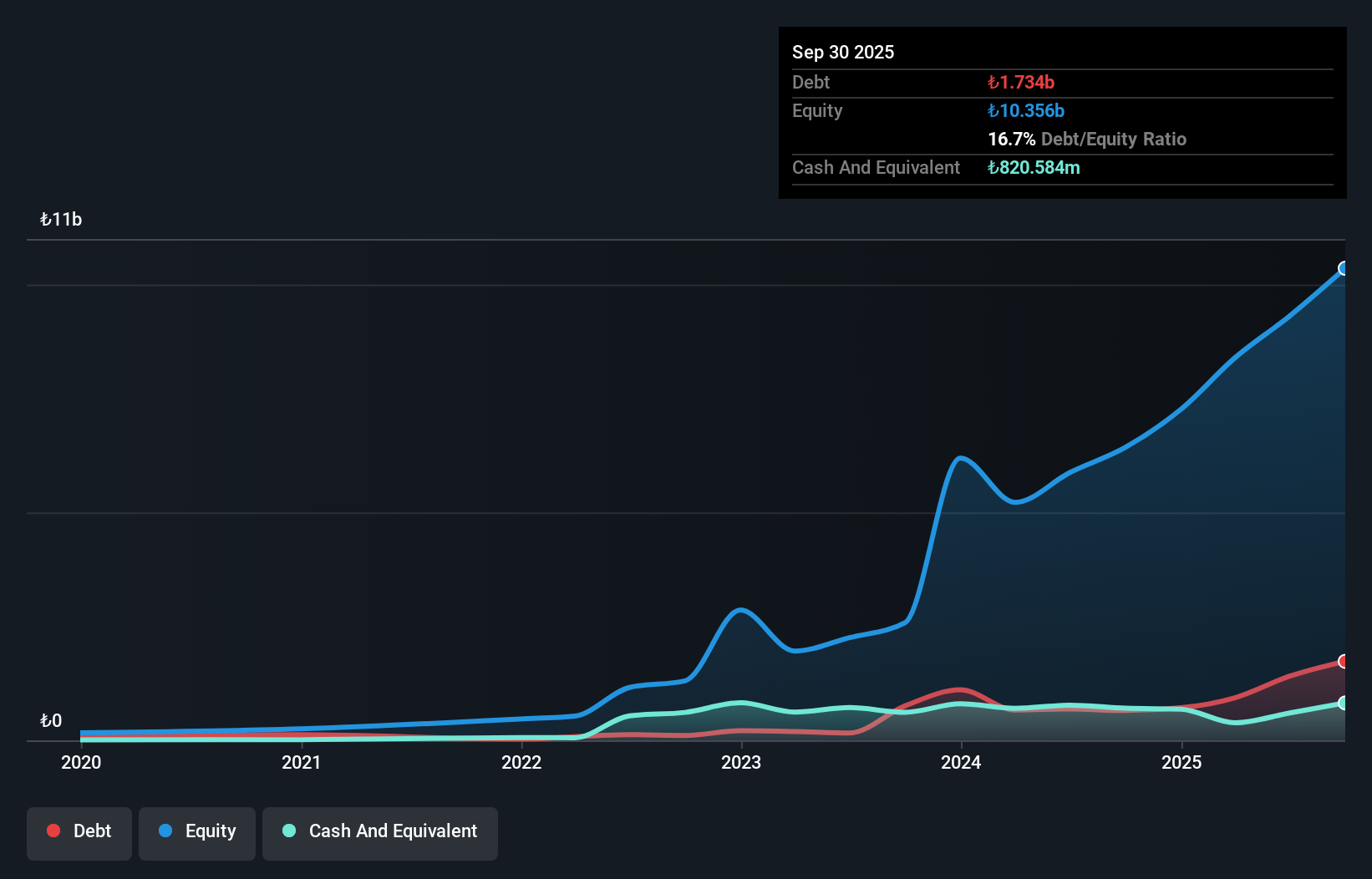

Europen Endustri Insaat Sanayi ve Ticaret, a small cap player in the Middle East, has shown promising financial health with its net debt to equity ratio dropping from 46.9% to 16.7% over five years, indicating prudent debt management. Recent earnings reports highlight robust growth; net income for Q3 soared to TRY 345 million from TRY 39 million last year, while basic earnings per share increased significantly. Despite high volatility in share price recently, the company trades at a slight discount to its fair value and demonstrates strong earnings growth of 57%, outpacing industry norms by a substantial margin.

Max Stock (TASE:MAXO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Max Stock Ltd. operates a chain of discount stores across Israel with a market cap of ₪3.52 billion.

Operations: Max Stock generates revenue primarily through its chain of discount stores in Israel, contributing to a market cap of ₪3.52 billion.

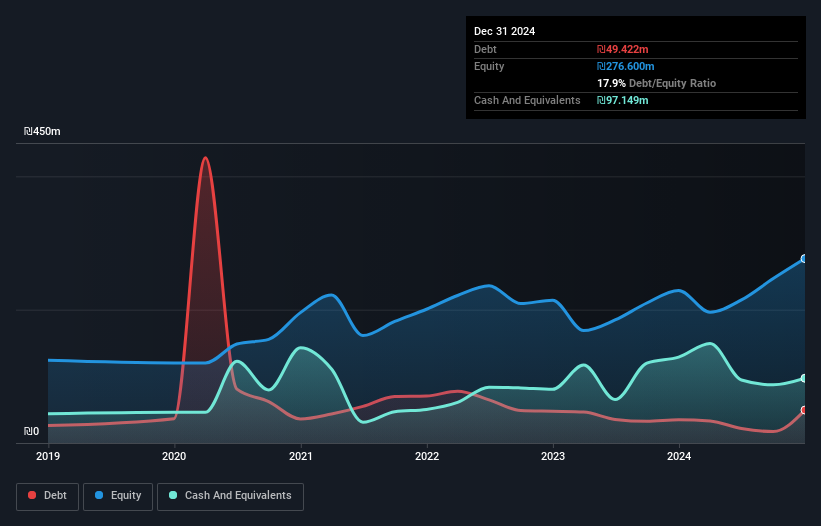

Max Stock, a notable player in the Middle East retail scene, has shown resilience despite recent challenges. Over the past year, its earnings grew by 5.2%, outpacing the industry average of 2.3%. The company's debt to equity ratio improved significantly from 39.9% to 17.9% over five years, reflecting prudent financial management. Although third-quarter sales dipped to ILS 373 million from ILS 399 million last year, net income was still a solid ILS 31 million compared to ILS 41 million previously. Notably, an undisclosed buyer acquired a significant stake for ILS 200 million at ILS 23 per share recently.

TSG IT Advanced Systems (TASE:TSG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TSG IT Advanced Systems Ltd specializes in delivering technological products and solutions to the security, civil service, and municipal sectors, with a market cap of ₪1.26 billion.

Operations: TSG IT Advanced Systems generates revenue primarily from its Defense Activity Sector, accounting for ₪312.51 million, while the Civil Activity Sector contributes ₪88.56 million.

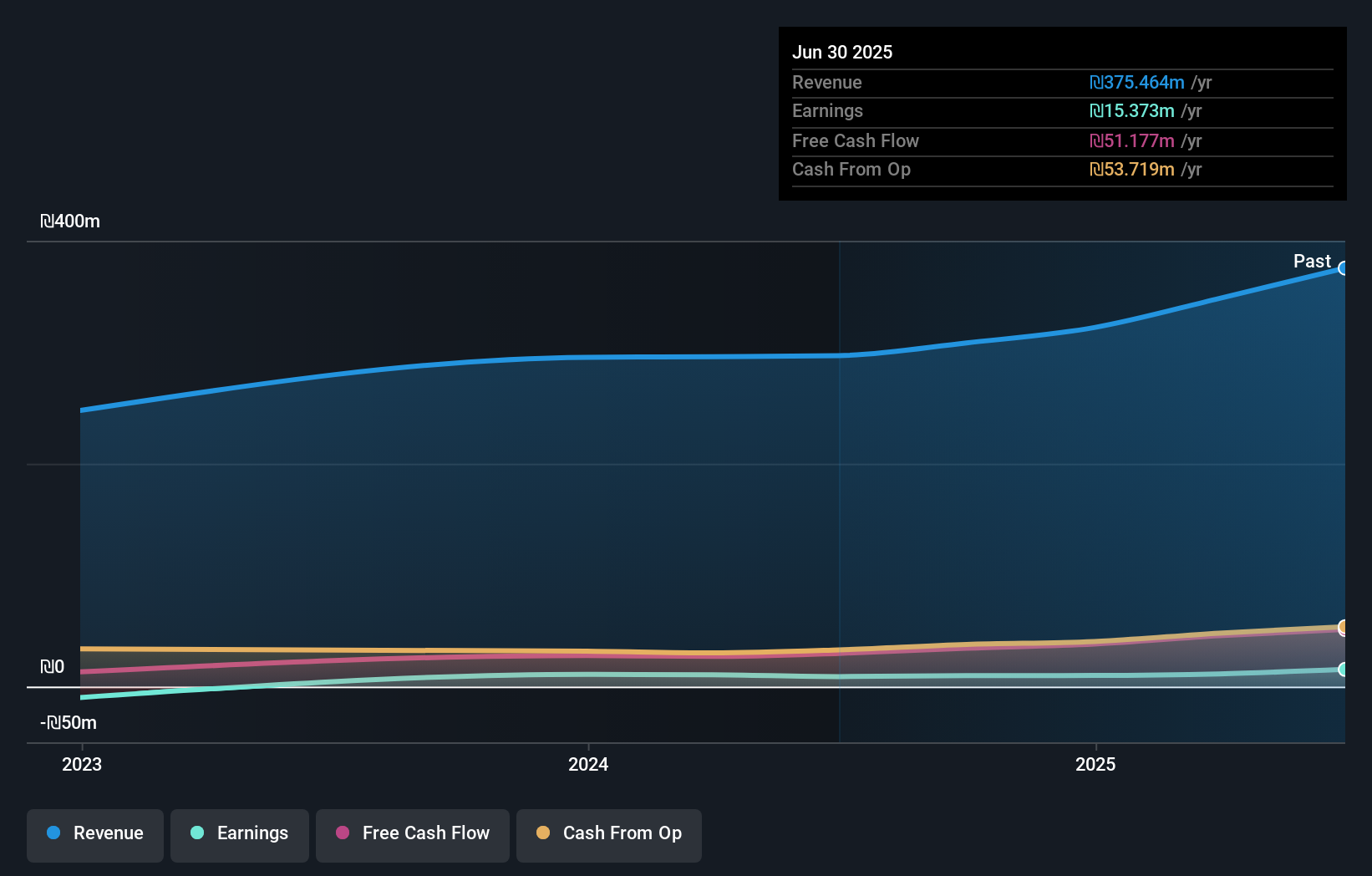

TSG IT Advanced Systems, a nimble player in the Middle East tech scene, has shown impressive earnings growth of 55.1% over the past year, outpacing the industry's 14.4%. Despite its high-quality earnings and satisfactory net debt to equity ratio of 11.5%, interest coverage remains a concern at just 2.8x EBIT. Recent financials reveal third-quarter sales climbed to ILS 109.81 million from ILS 84.2 million last year, though net income slightly dipped to ILS 4.58 million from ILS 4.85 million previously reported in Q3 last year, indicating some pressure on margins amidst volatile share price movements recently observed.

Seize The Opportunity

- Dive into all 181 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报