ASX Penny Stocks To Consider In December 2025

As the Australian market approaches the end of 2025, it is experiencing a slight dip, with some investors engaging in profit-taking ahead of the holiday season. Despite this minor downturn, opportunities remain for those interested in exploring smaller or newer companies. Penny stocks, though an outdated term, continue to highlight companies that can offer significant value when backed by strong financials and potential growth paths.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.39 | A$65.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.14 | A$3.59B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.825 | A$118.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cettire (ASX:CTT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cettire Limited operates as an online luxury goods retailer in Australia, the United States, and internationally, with a market cap of A$354.55 million.

Operations: The company generates its revenue from online retail sales amounting to A$742.11 million.

Market Cap: A$354.55M

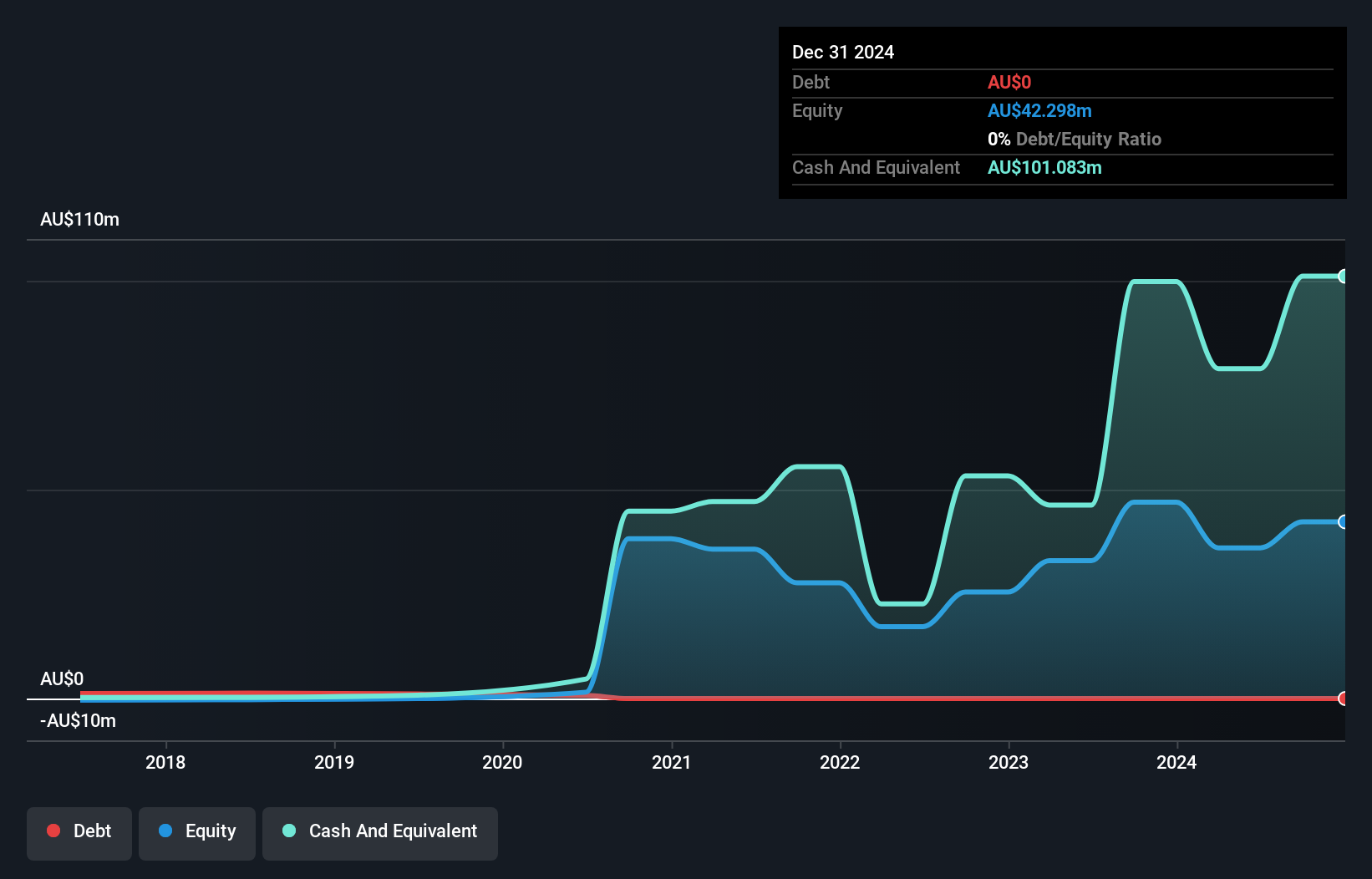

Cettire Limited, an online luxury goods retailer with a market cap of A$354.55 million, is currently unprofitable despite generating A$742.11 million in revenue. The company has reduced its losses over the past five years by 28.2% annually and forecasts earnings growth of 67.8% per year, highlighting potential for future profitability. Cettire operates debt-free and has not diluted shareholders recently, but its short-term assets fall short of covering liabilities by A$28.7 million. Despite stable weekly volatility, the share price remains highly volatile over recent months, reflecting investor uncertainty amid management's relatively inexperienced board tenure.

- Unlock comprehensive insights into our analysis of Cettire stock in this financial health report.

- Evaluate Cettire's prospects by accessing our earnings growth report.

Deep Yellow (ASX:DYL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Deep Yellow Limited, with a market cap of A$1.83 billion, focuses on acquiring, exploring, developing, and evaluating uranium properties in Australia and Namibia.

Operations: Deep Yellow Limited does not report distinct revenue segments.

Market Cap: A$1.83B

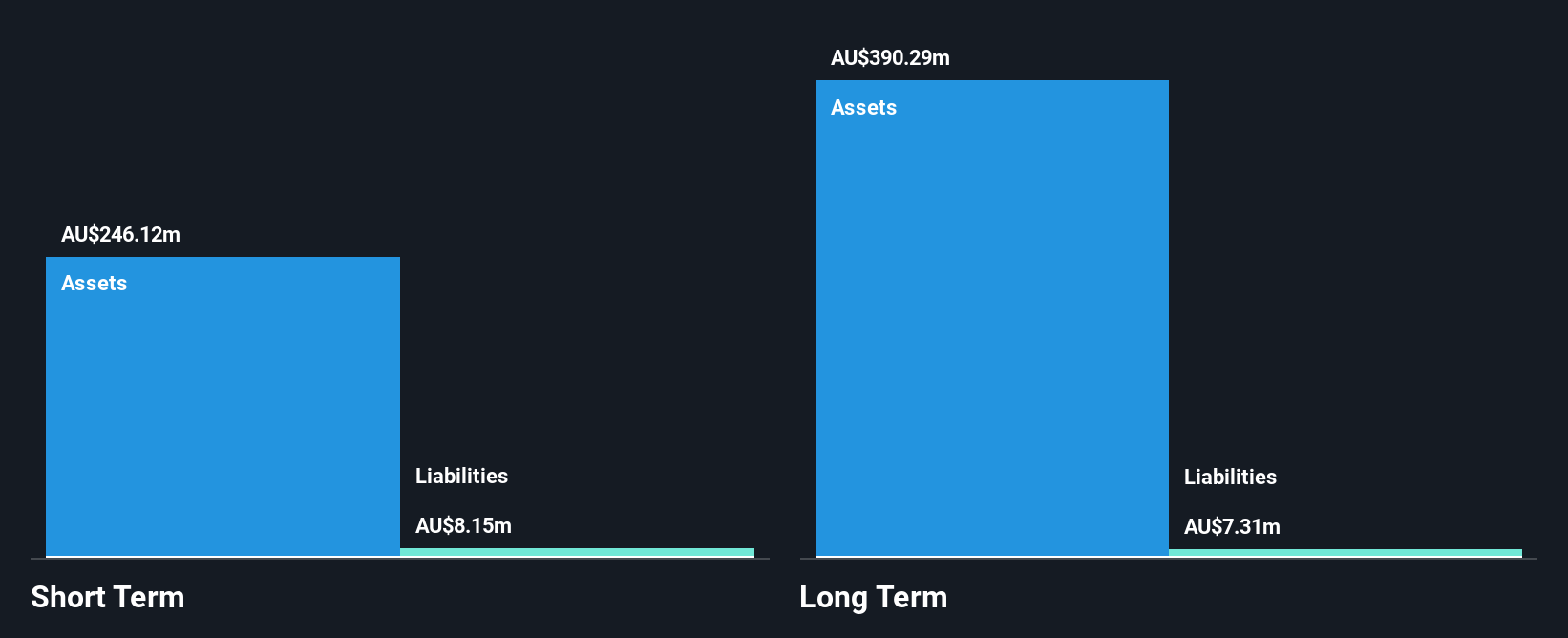

Deep Yellow Limited, with a market cap of A$1.83 billion, is pre-revenue and focuses on uranium properties in Australia and Namibia. The company is debt-free, with short-term assets of A$223.1 million exceeding liabilities significantly. Despite trading at 74.1% below estimated fair value, its Return on Equity remains low at 1.1%. Recent management changes include the appointment of Mr. Zebra Kasete as Managing Director - Namibia to support the Tumas Project's construction and operations post-construction. While earnings are forecast to decline by 3.7% annually over three years, Deep Yellow has recently become profitable with high-quality earnings reported.

- Dive into the specifics of Deep Yellow here with our thorough balance sheet health report.

- Gain insights into Deep Yellow's outlook and expected performance with our report on the company's earnings estimates.

MGX Resources (ASX:MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MGX Resources Limited, along with its subsidiaries, operates in the mining, processing, shipment, export, and sale of hematite iron ore in Australia and China with a market cap of A$513.49 million.

Operations: The company's revenue is primarily derived from its operations at Koolan Island, generating A$330.53 million.

Market Cap: A$513.49M

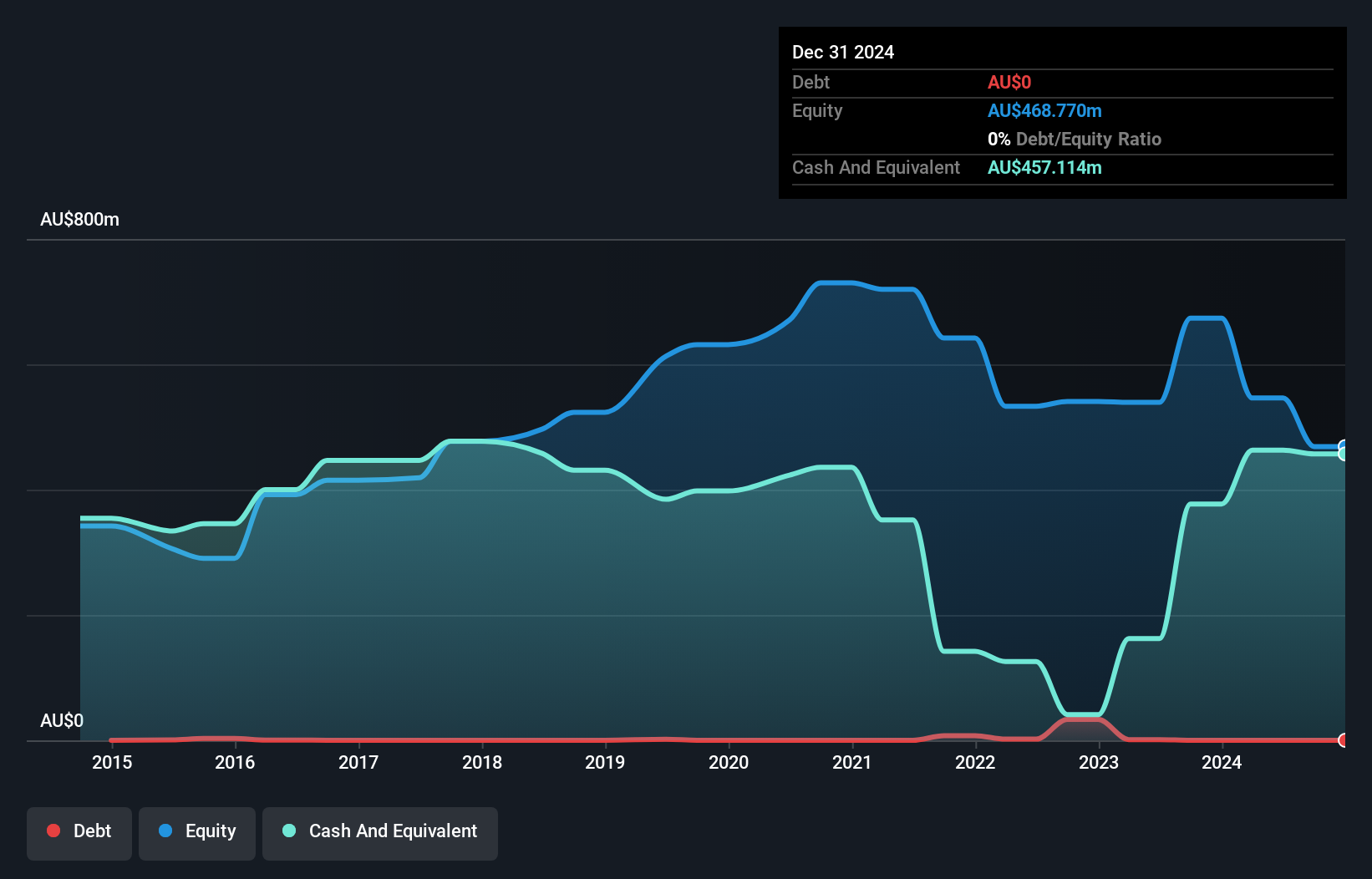

MGX Resources, with a market cap of A$513.49 million, operates in the hematite iron ore sector and faces challenges due to its current unprofitability. Despite this, it has no debt and maintains strong financial health with short-term assets of A$505.3 million surpassing both short-term and long-term liabilities significantly. The company has a seasoned management team averaging 10.4 years in tenure, supporting stability amidst volatility that remains stable at 10%. MGX is trading at 50% below estimated fair value while maintaining sufficient cash runway for over three years due to positive free cash flow growth.

- Take a closer look at MGX Resources' potential here in our financial health report.

- Learn about MGX Resources' historical performance here.

Next Steps

- Explore the 421 names from our ASX Penny Stocks screener here.

- Ready For A Different Approach? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报