Airtasker Leads The Charge With 2 ASX Penny Stocks

As the Australian market approaches the holiday season, it seems to be winding down with a slight dip, likely due to profit-taking before the break. In such a market landscape, investors often seek out stocks that combine potential growth with financial stability. Penny stocks, despite their old-school name, continue to offer opportunities for those interested in smaller or newer companies that might provide value and growth at lower price points.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.405 | A$116.07M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.39 | A$65.57M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.78 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.00 | A$461.07M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.14 | A$231.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.14 | A$3.59B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.26 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.825 | A$118.74M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Airtasker (ASX:ART)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Airtasker Limited operates a technology-enabled online marketplace for local services in Australia and has a market cap of A$160.68 million.

Operations: The company's revenue is derived from New Marketplaces, contributing A$3.47 million, and Established Marketplaces, which generate A$49.15 million.

Market Cap: A$160.68M

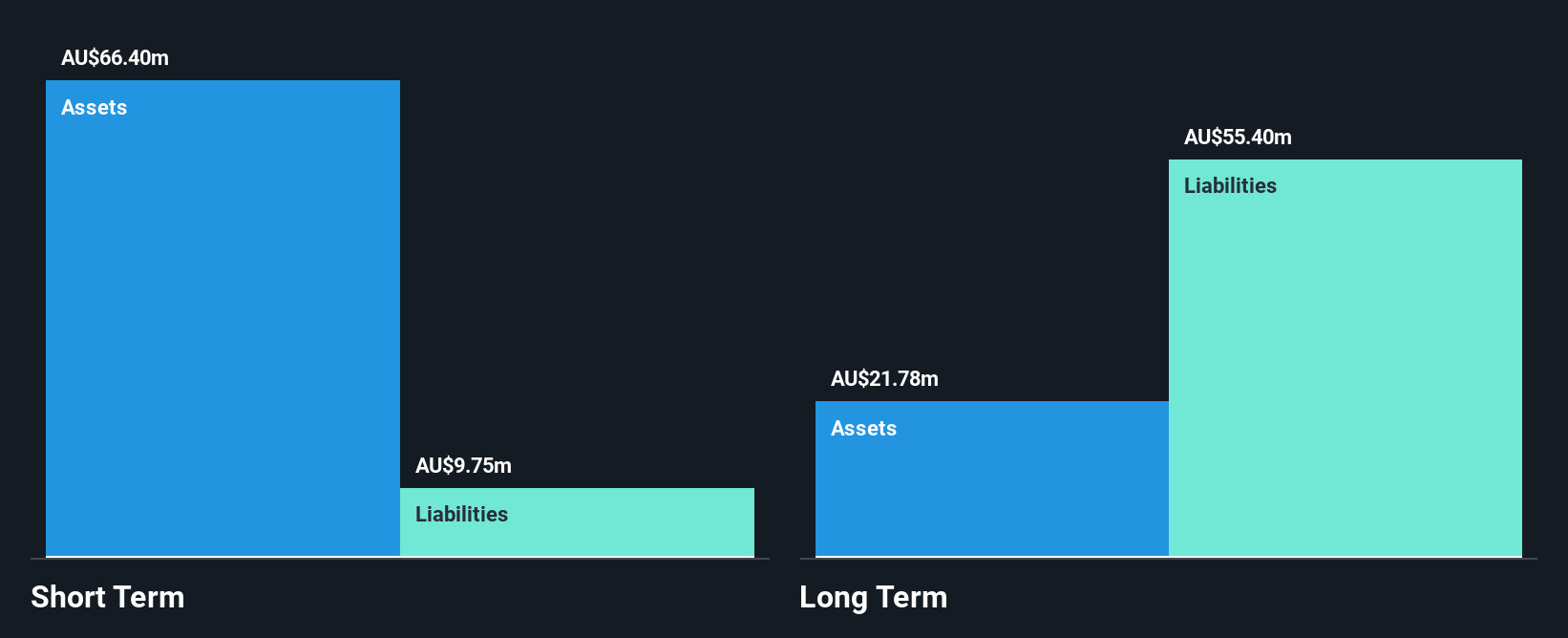

Airtasker Limited, with a market cap of A$160.68 million, is navigating the penny stock landscape by leveraging strategic partnerships and capital raises. Recent developments include a follow-on equity offering raising A$9.20 million and an expanded partnership with iHeartMedia, providing substantial advertising resources to boost its U.S. presence. Despite being unprofitable and having long-term liabilities exceeding short-term assets, Airtasker benefits from a strong cash runway exceeding three years due to positive free cash flow growth. The company's seasoned board adds stability while it continues focusing on revenue growth through its marketplace operations in Australia and beyond.

- Jump into the full analysis health report here for a deeper understanding of Airtasker.

- Assess Airtasker's future earnings estimates with our detailed growth reports.

Atturra (ASX:ATA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Atturra Limited, with a market cap of A$255.74 million, offers advisory and information technology solutions across Australia, New Zealand, Singapore, North America, and Hong Kong.

Operations: The company generates revenue of A$300.62 million from its Information Technology Solutions segment.

Market Cap: A$255.74M

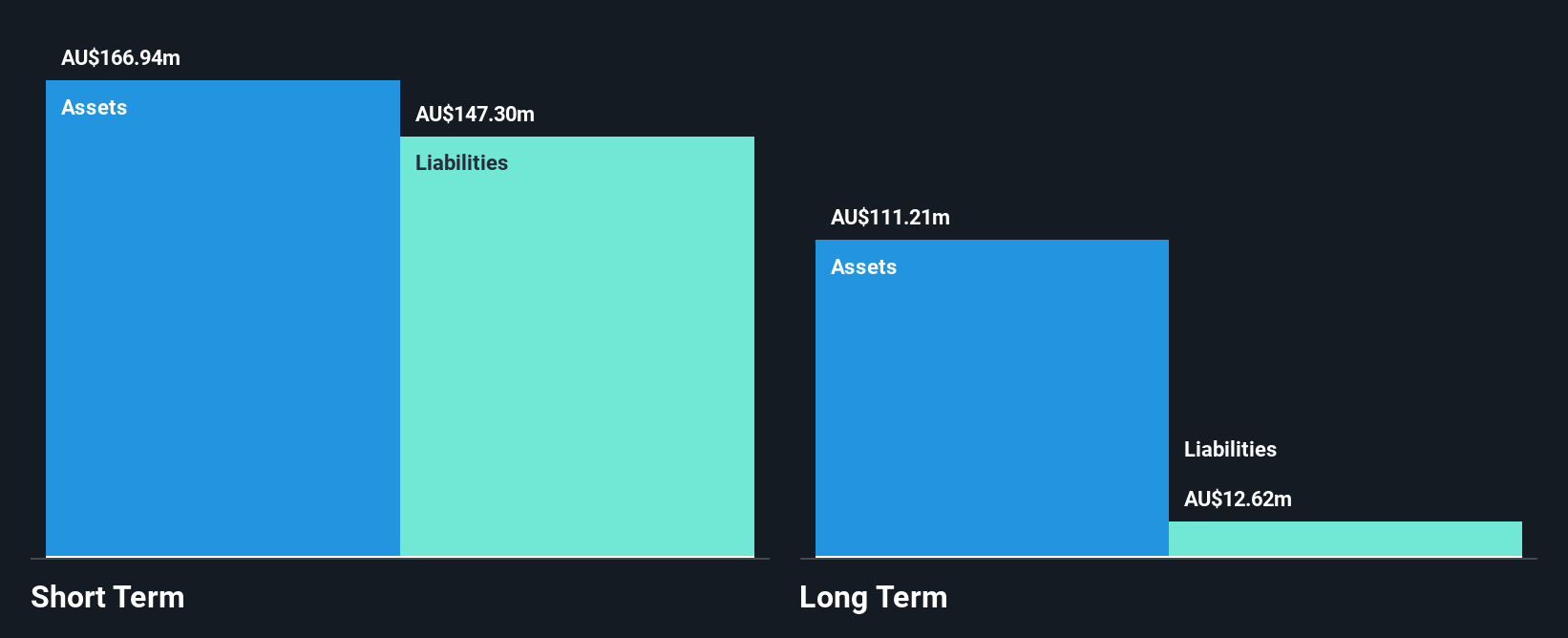

Atturra Limited, with a market cap of A$255.74 million, is navigating the penny stock realm by maintaining strong financial health, as its short-term assets surpass both short and long-term liabilities. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt. Although recent earnings growth has been negative and return on equity remains low at 4%, Atturra's earnings have grown by 14.9% annually over the past five years. Trading significantly below estimated fair value, it presents potential upside despite recent insider selling activity and stable weekly volatility at 7%.

- Click here to discover the nuances of Atturra with our detailed analytical financial health report.

- Evaluate Atturra's prospects by accessing our earnings growth report.

Kogan.com (ASX:KGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kogan.com Ltd is an online retailer based in Australia with a market capitalization of A$346.67 million.

Operations: The company's revenue segments include A$330.44 million from its Australian online retail operations, A$7.30 million from Mighty Ape in Australia, A$35.56 million from New Zealand online retail, and A$114.81 million from Mighty Ape in New Zealand.

Market Cap: A$346.67M

Kogan.com Ltd, with a market cap of A$346.67 million, operates in the penny stock sphere while facing profitability challenges. Despite being unprofitable and having increased losses over five years, the company maintains a robust cash runway exceeding three years due to positive free cash flow growth of 17.1% annually. Kogan's short-term assets (A$130.1M) surpass both its short and long-term liabilities, and it remains debt-free. Although trading at 49.2% below estimated fair value could suggest potential upside, the dividend is not well-covered by earnings, reflecting financial strain amidst stable weekly volatility at 4%.

- Unlock comprehensive insights into our analysis of Kogan.com stock in this financial health report.

- Explore Kogan.com's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Discover the full array of 421 ASX Penny Stocks right here.

- Curious About Other Options? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报