Buy and Hold: 5 Artificial Intelligence (AI) Stocks to Own Through 2035

Key Points

Ongoing AI investments lay the groundwork for a potential multi-trillion-dollar market by 2035.

These companies have a firm grasp on key AI niches, as well as stakes in privately owned AI companies.

Together, these five stocks offer exposure to AI opportunities in both hardware and software.

All of the aggressive investments into chips and data centers that you've read and heard about are about laying the groundwork for what's to come. Research by Roots Analysis estimates that the artificial intelligence (AI) market could grow from just over $270 billion today to more than $5.2 trillion over the next decade.

There's a good chance that some of the biggest AI winners will be companies that haven't emerged yet, are still privately owned, or are relatively unknown. That said, investors are starting to get a good look at which top AI stocks today have the brightest decade ahead of them.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Investors can have their cake and eat it, too. Feel free to keep an eye out for the next big thing. But in the meantime, it's wise to gravitate to proven winners. Here are five leading AI stocks to buy and hold from now through 2035 and potentially beyond.

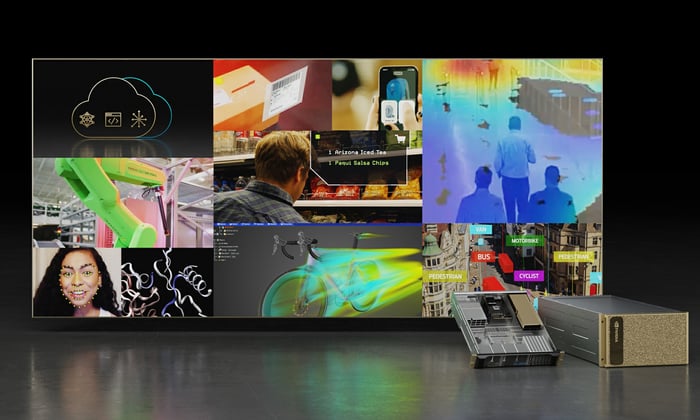

Image source: Nvidia

1. Nvidia

It's wise to begin with Nvidia (NASDAQ: NVDA). It dominates the market for accelerator chips, which operate as clusters to train AI models in data centers. You could think of Nvidia as the company supplying the raw compute power for AI, like horsepower in a car's engine. Analyst research estimates that Nvidia's GPU market share in data centers is as high as 92%, although the company may soon face more competition.

Nvidia's CUDA programming has established a competitive moat. Virtually all of the AI hyperscalers have already invested substantially in building out their infrastructure with Nvidia's GPUs. Thus far, hyperscalers have largely avoided going through the pains of switching off Nvidia amid this fast-paced AI arms race. Nvidia's $500 billion order backlog speaks to the company's ongoing momentum. All told, investing in Nvidia continues to look like a central player in AI.

2. Alphabet

Google's parent company, Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), has tremendous AI advantages. Its various consumer-facing products and services touch billions of worldwide Internet users. Its ecosystem includes Google apps, YouTube, and Android smartphone software. It also operates Google Cloud and the leading autonomous ride-hailing service. Lastly, Alphabet owns approximately 7% of SpaceX, so it's a clever way to invest in Starlink, its satellite Internet business.

If that weren't enough, Alphabet has emerged as a potential competitor to Nvidia in the AI chip field. It successfully designed a custom chip called a Tensor Processing Unit (TPU), then trained its own AI model, Gemini, on it. The company has since discussed selling them to other AI companies. It's hard to find a more complete AI and technology juggernaut on the market, making investing in Alphabet a no-brainer for the next decade.

3. Microsoft

Most investors are already familiar with Microsoft (NASDAQ: MSFT). The longtime tech giant remains a key player in AI moving forward, for two primary reasons. First, it operates Azure, the world's second-leading cloud services business. It also owns approximately 27% of OpenAI, the creator of the leading AI app, ChatGPT. So, if you want to invest in OpenAI, which isn't currently public, this is a way to do it.

Microsoft's Azure business is poised to grow as AI demand funnels through the cloud. With Microsoft, investors also get some peace of mind. The company has mature, yet wide-moat, software businesses centered on the Windows operating system and Microsoft 365 software. Investors also get a dividend that Microsoft has increased for 23 consecutive years. If you value stability, Microsoft could be the stock for you.

4. Amazon

If it wasn't apparent before, these tech giants also offer ways to invest in some of these emerging AI companies that aren't yet publicly traded. Amazon (NASDAQ: AMZN) is the last example on this list. The e-commerce giant also operates the world's leading cloud services business, Amazon Web Services (AWS). Amazon works closely with Anthropic, a competitor to OpenAI.

Amazon has an $8 billion stake in the company. Therefore, owning Amazon stock is a simple way to invest in Anthropic. Amazon's existing cloud, e-commerce, and digital advertising businesses can drive long-term growth, as these trends have considerable life left in them. Amazon arguably doesn't need AI to be a winning investment for the next decade. It's simply icing on the cake, and the Anthropic partnership and stake add a nice cherry on top.

5. Palantir Technologies

It's still very early for AI software, but Palantir Technologies (NASDAQ: PLTR) already stands out. The company specializes in developing custom software applications on its proprietary platforms, and its growth has continued to accelerate since launching its AI-focused platform, AIP, in mid-2023. Palantir is winning both government and corporate business in droves.

The stock's primary concern is its excessive valuation, which might limit the stock's future upside. Fortunately, Palantir still has fewer than 1,000 customers, so there is a tremendous runway for customer acquisition over the next decade, likely fueling Palantir's remarkable growth for some time to come. Investors should consider nibbling on shares, saving some cash for if the stock tumbles. If so, long-term investors should welcome the buying opportunity with open arms.

Justin Pope has positions in Alphabet and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq 华尔街日报

华尔街日报