3 TSX Penny Stocks With Market Caps Below CA$90M To Consider

As the Canadian market navigates a noisy end to 2025 with a constructive outlook for 2026, investors are keenly observing shifts in market leadership and potential opportunities beyond mega caps. In this context, penny stocks—often smaller or newer companies—remain relevant as they can offer unique value propositions that larger firms might miss. By focusing on those with strong financials and clear growth trajectories, investors can uncover promising opportunities among these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.48 | CA$263.31M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.145 | CA$115.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.20 | CA$162.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 391 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$50.37 million.

Operations: Eskay Mining Corp. does not report any revenue segments.

Market Cap: CA$50.37M

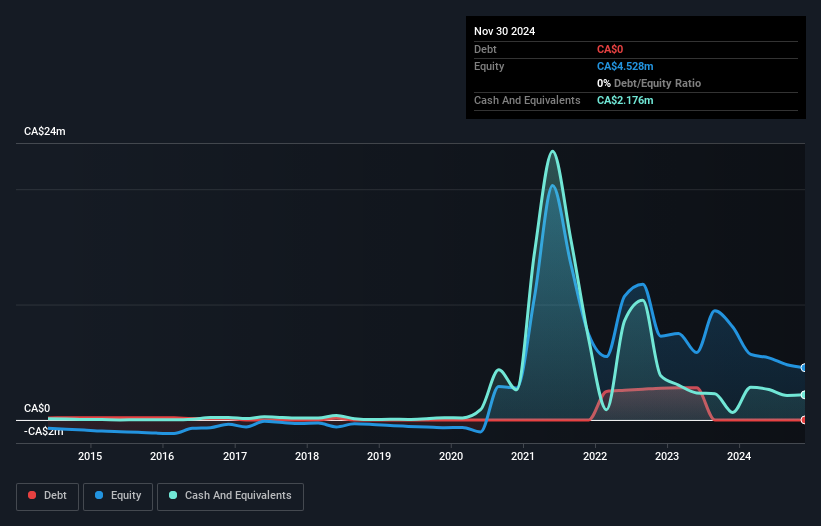

Eskay Mining Corp., with a market cap of CA$50.37 million, is pre-revenue and focused on mineral exploration in British Columbia. Recent assay results from the Consolidated Eskay Project highlight significant gold-silver mineralization, including high-grade samples such as 297 g/t Au and 790 g/t Ag at the TM zone. Despite being unprofitable, Eskay has reduced losses by 27.1% annually over five years and maintains a strong cash runway exceeding three years without debt obligations. The experienced management team supports its strategic exploration efforts aimed at advancing early-stage prospects into drill-ready targets for future development.

- Jump into the full analysis health report here for a deeper understanding of Eskay Mining.

- Understand Eskay Mining's track record by examining our performance history report.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and dealing with mineral properties in Canada, with a market cap of CA$81.85 million.

Operations: Teuton Resources Corp. does not currently report any revenue segments as it is in the exploration stage, concentrating on mineral property activities in Canada.

Market Cap: CA$81.85M

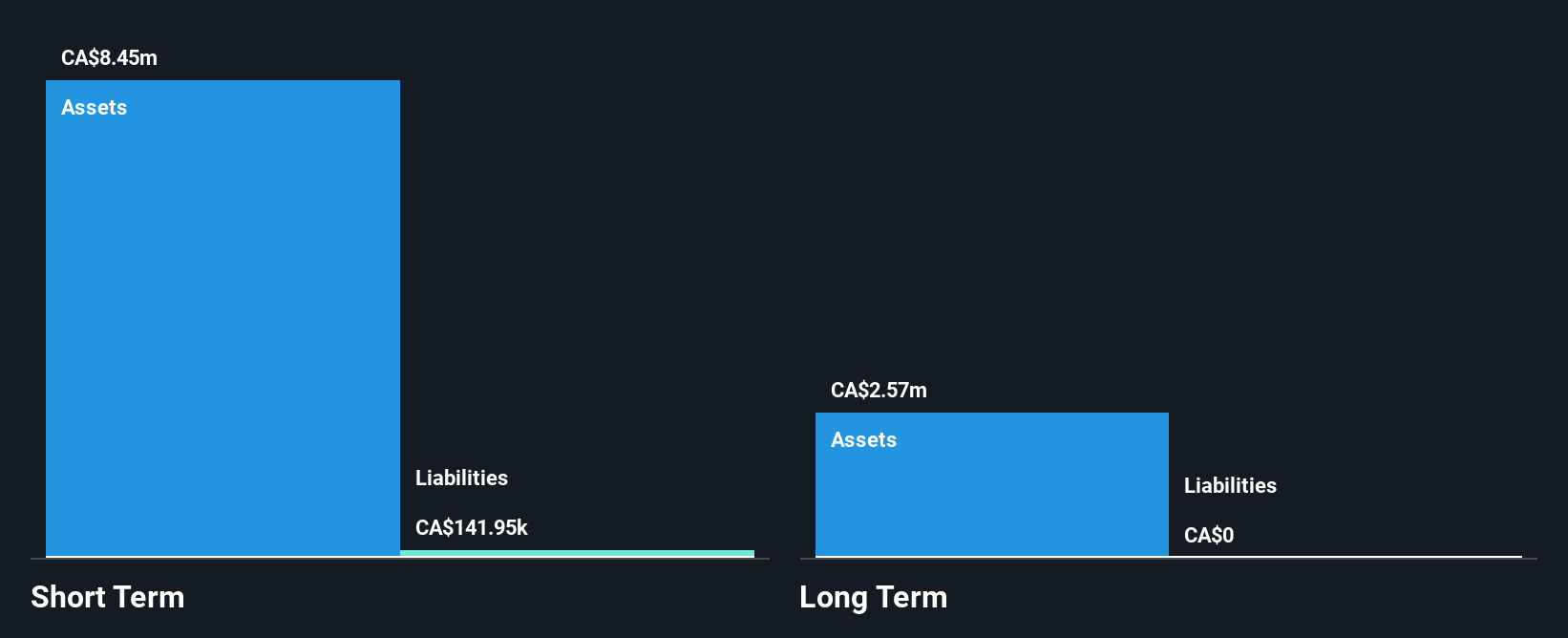

Teuton Resources Corp., with a market cap of CA$81.85 million, is pre-revenue and focused on mineral exploration in Canada's Golden Triangle. Recent developments include the completion of drilling at the Ram property and proposed spinouts of various mineral properties to optimize asset value. Despite being unprofitable, Teuton reported a net income increase for Q3 2025 compared to last year. The company holds no debt, boasts an experienced board with an average tenure of 5.4 years, and has sufficient cash runway exceeding three years, positioning it well for ongoing exploration activities without immediate financial strain.

- Unlock comprehensive insights into our analysis of Teuton Resources stock in this financial health report.

- Explore historical data to track Teuton Resources' performance over time in our past results report.

Yorbeau Resources (TSX:YRB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yorbeau Resources Inc. is involved in the acquisition, development, and exploration of mineral properties in Canada with a market cap of CA$30 million.

Operations: The company's revenue is derived entirely from mining exploration, amounting to CA$0.06 million.

Market Cap: CA$30M

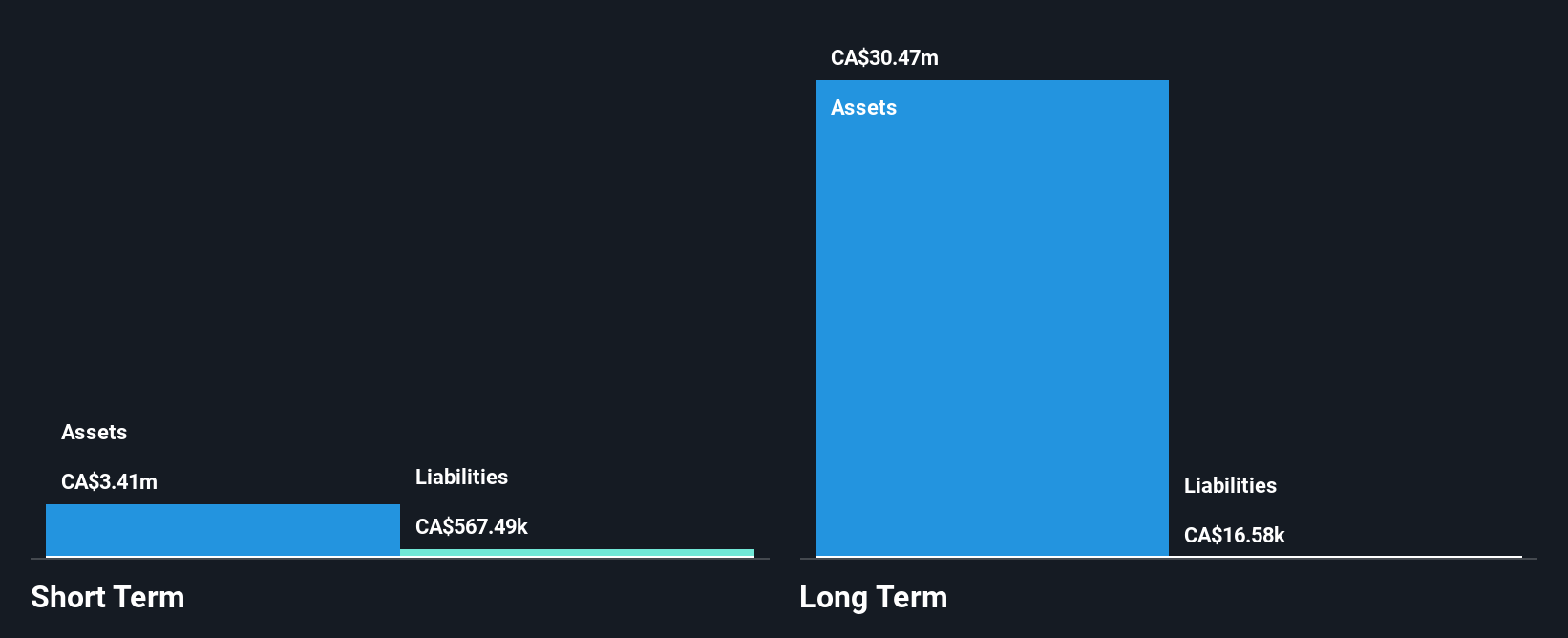

Yorbeau Resources Inc., with a market cap of CA$30 million, is pre-revenue but recently achieved profitability. The company has no debt and boasts high return on equity at 26.9%. Its short-term assets exceed both short and long-term liabilities, indicating financial stability. Recent developments include a private placement raising CA$1.1 million, with significant insider participation, enhancing its cash position for future exploration activities. Yorbeau's low price-to-earnings ratio of 3.3x suggests it may be undervalued compared to the broader Canadian market average of 16.5x, offering potential appeal to investors seeking value in the mining sector.

- Get an in-depth perspective on Yorbeau Resources' performance by reading our balance sheet health report here.

- Evaluate Yorbeau Resources' historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 391 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报