Three Prominent Dividend Stocks To Consider For Your Portfolio

As the U.S. stock market navigates a holiday-shortened week, with the S&P 500 reaching new all-time highs and major indexes poised for weekly gains, investors are keenly observing opportunities to bolster their portfolios. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive consideration for those looking to balance growth with consistent returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.69% | ★★★★★★ |

| Preferred Bank (PFBC) | 3.02% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.35% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.60% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.24% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.93% | ★★★★★★ |

| Ennis (EBF) | 5.52% | ★★★★★★ |

| Dillard's (DDS) | 4.94% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.03% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.42% | ★★★★★★ |

Click here to see the full list of 115 stocks from our Top US Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

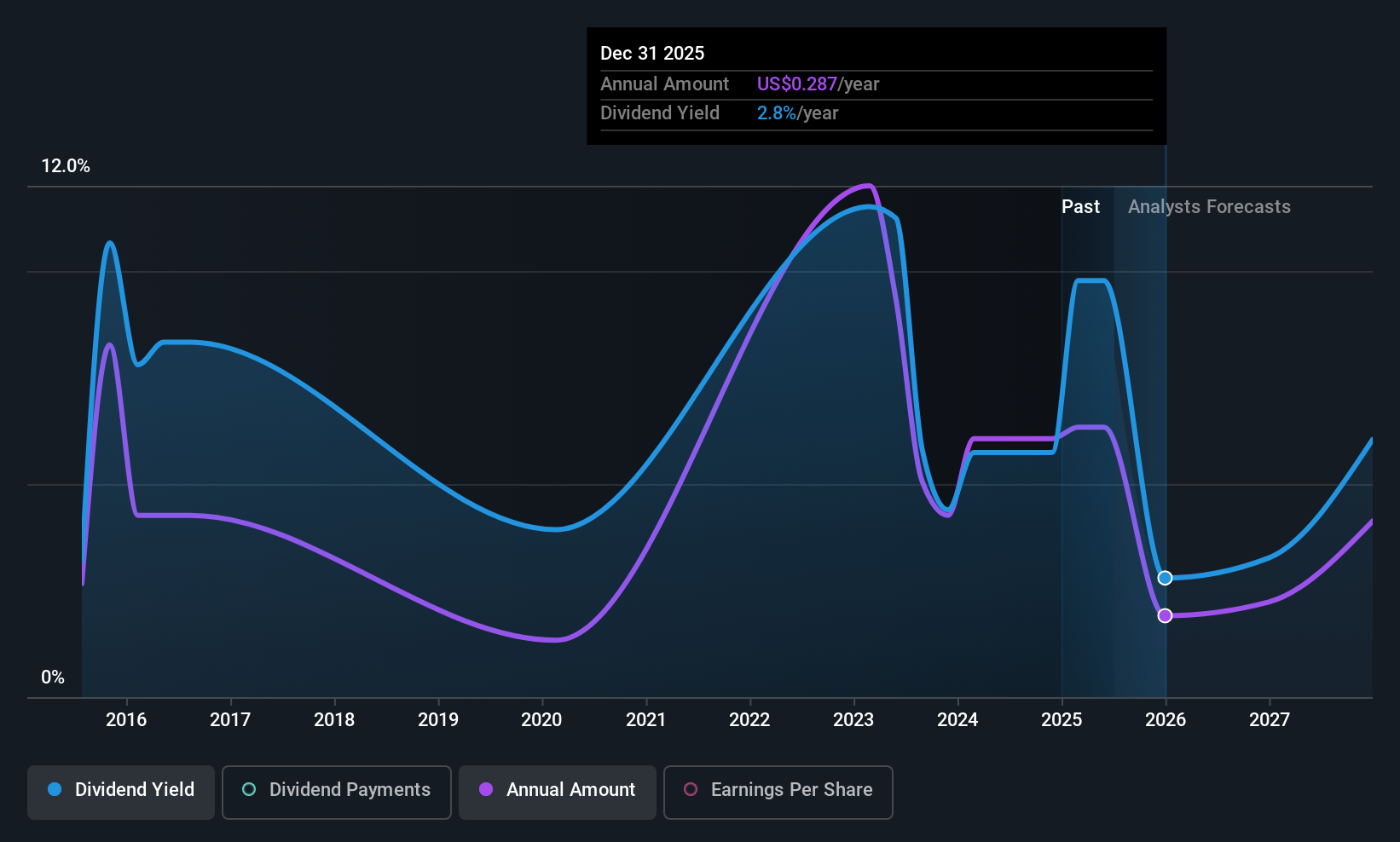

Northeast Community Bancorp (NECB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Northeast Community Bancorp, Inc. is the holding company for NorthEast Community Bank, offering financial services to individuals and businesses, with a market cap of $320.94 million.

Operations: Northeast Community Bancorp, Inc. generates revenue of $102.57 million from its Thrift / Savings and Loan Institutions segment.

Dividend Yield: 4.4%

Northeast Community Bancorp offers a stable dividend yield of 4.37%, though slightly below the top tier in the US market. With a low payout ratio of 22.6%, its dividends are well covered by earnings and expected to remain sustainable over the next three years. The company has maintained reliable and growing dividends over the past decade, despite recent insider selling and shareholder dilution, which may warrant cautious observation for potential investors.

- Navigate through the intricacies of Northeast Community Bancorp with our comprehensive dividend report here.

- Our expertly prepared valuation report Northeast Community Bancorp implies its share price may be lower than expected.

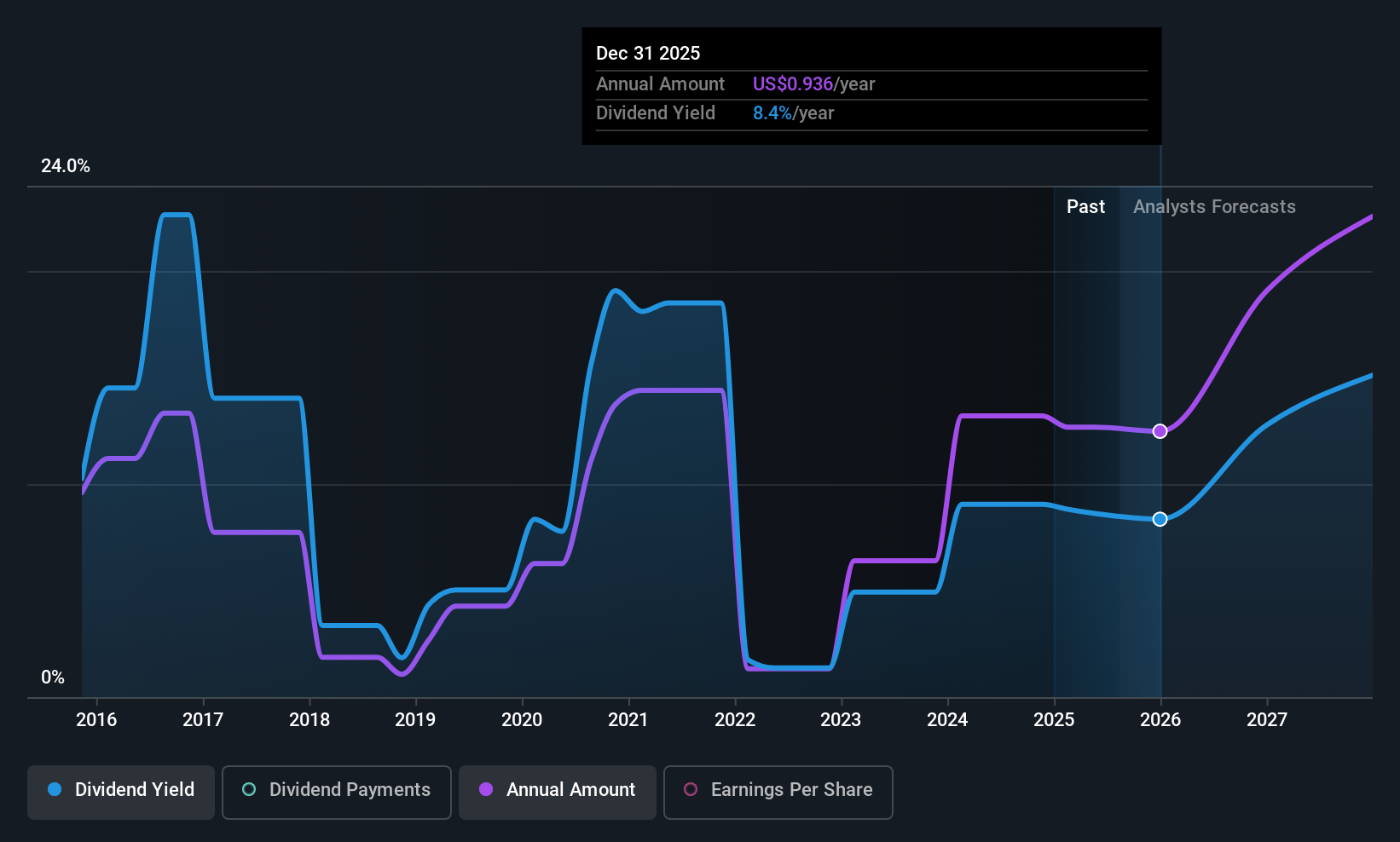

Ardmore Shipping (ASC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ardmore Shipping Corporation specializes in the global seaborne transportation of petroleum products and chemicals, with a market cap of $435.87 million.

Operations: Ardmore Shipping Corporation generates revenue of $309.33 million from transporting refined petroleum products and chemicals globally.

Dividend Yield: 8.9%

Ardmore Shipping's recent dividend declaration of US$0.10 per share reflects an increase, yet its dividends are not well covered by free cash flows, despite a low payout ratio of 38.5%. The company's profit margins have significantly declined to 10.3% from last year's 35.4%, affecting earnings coverage for dividends. Recent redemption of Series A Preferred Stock for US$30.6 million could impact future cash flow, raising concerns about the sustainability and reliability of its high dividend yield in the top 25% bracket at 8.87%.

- Take a closer look at Ardmore Shipping's potential here in our dividend report.

- Our expertly prepared valuation report Ardmore Shipping implies its share price may be too high.

DHT Holdings (DHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DHT Holdings, Inc. is a company that owns and operates crude oil tankers across Monaco, Singapore, Norway, and India with a market capitalization of approximately $1.95 billion.

Operations: DHT Holdings, Inc. generates its revenue primarily from its fleet of crude oil tankers, amounting to $538.57 million.

Dividend Yield: 7.8%

DHT Holdings' dividend yield is notable, ranking in the top 25% of US payers. However, its sustainability is questionable as dividends are not well covered by cash flows despite a reasonable payout ratio of 59.5%. Earnings have grown significantly, with net income reaching US$145.02 million for the first nine months of 2025. Recent developments include a secured credit agreement for vessel acquisition and leadership changes, potentially impacting future financial stability and dividend reliability.

- Unlock comprehensive insights into our analysis of DHT Holdings stock in this dividend report.

- Our comprehensive valuation report raises the possibility that DHT Holdings is priced lower than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 115 companies within our Top US Dividend Stocks screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报