3 TSX Penny Stocks With Market Caps Over CA$6M To Watch

As the year draws to a close, the Canadian market is navigating through a mix of encouraging economic signals, such as easing inflation and stabilizing labor markets, which set a constructive tone for 2026. In this context, penny stocks—though often seen as an outdated term—still hold significant potential for investors seeking opportunities in smaller or newer companies. By focusing on those with strong financials and clear growth prospects, these stocks can offer both affordability and potential upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.48 | CA$263.31M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.145 | CA$115.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$911.46M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.17 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.20 | CA$162.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 393 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Stock Trend Capital (CNSX:PUMP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stock Trend Capital Inc. is an investment company focusing on the crypto, Canadian cannabis, and artificial intelligence industries, with a market cap of CA$6.60 million.

Operations: The company's revenue segment is Corporate and Development, which reported CA$-0.22 million.

Market Cap: CA$6.6M

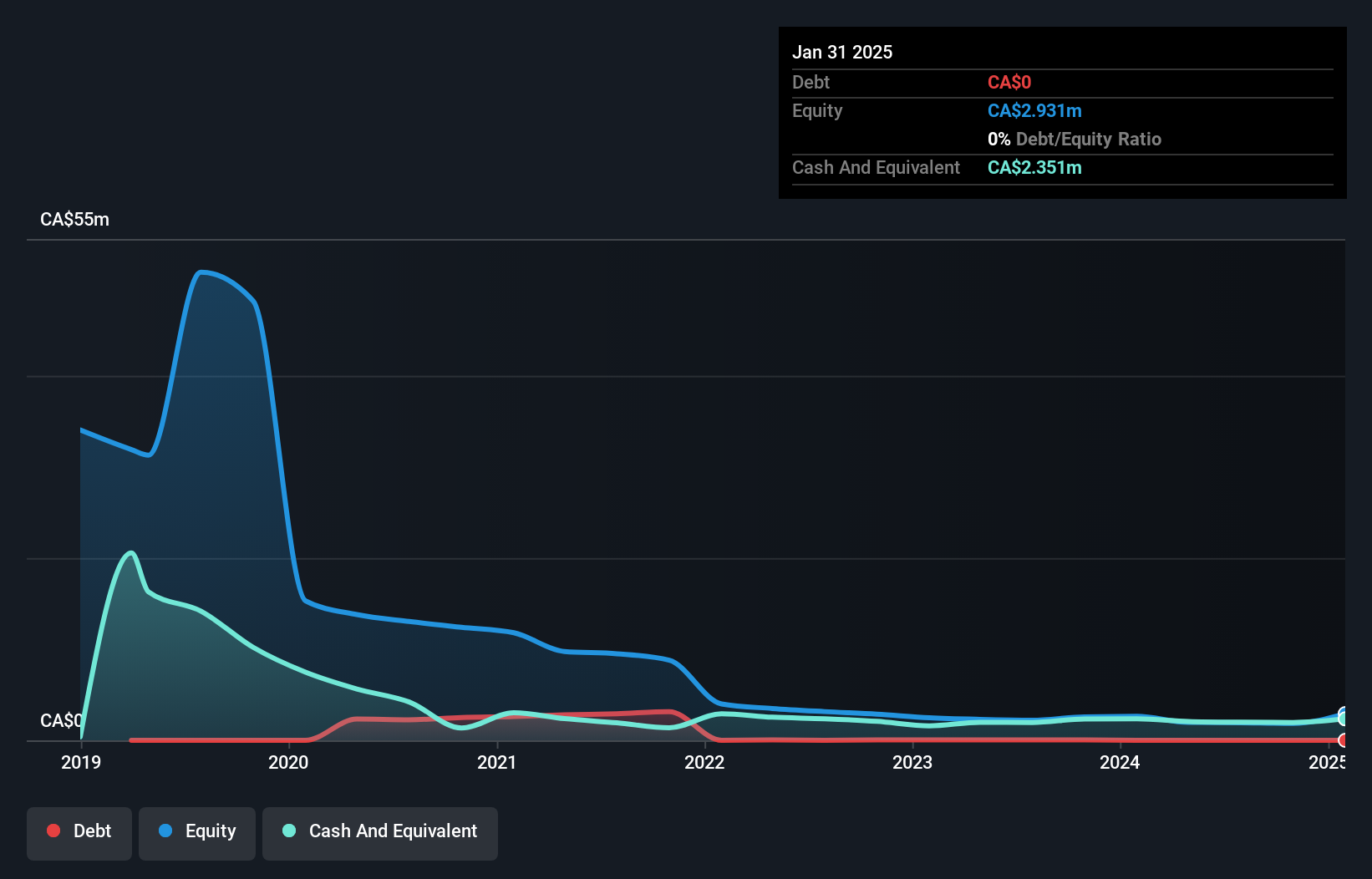

Stock Trend Capital Inc. operates in the crypto, Canadian cannabis, and artificial intelligence sectors with a market cap of CA$6.60 million. Despite being pre-revenue with reported earnings of CA$-0.22 million, the company has recently turned profitable, achieving high-quality earnings and a return on equity of 25.5%. It is debt-free and has strong short-term asset coverage over liabilities (CA$2.8M vs CA$197.2K). However, its share price remains highly volatile despite reduced weekly volatility from 94% to 77%. The management team is experienced with an average tenure of 2.8 years, supporting strategic stability amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Stock Trend Capital.

- Understand Stock Trend Capital's track record by examining our performance history report.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile, with a market cap of CA$710.04 million.

Operations: The company generates revenue of $198.32 million from the production of copper concentrates under a tolling agreement with DET.

Market Cap: CA$710.04M

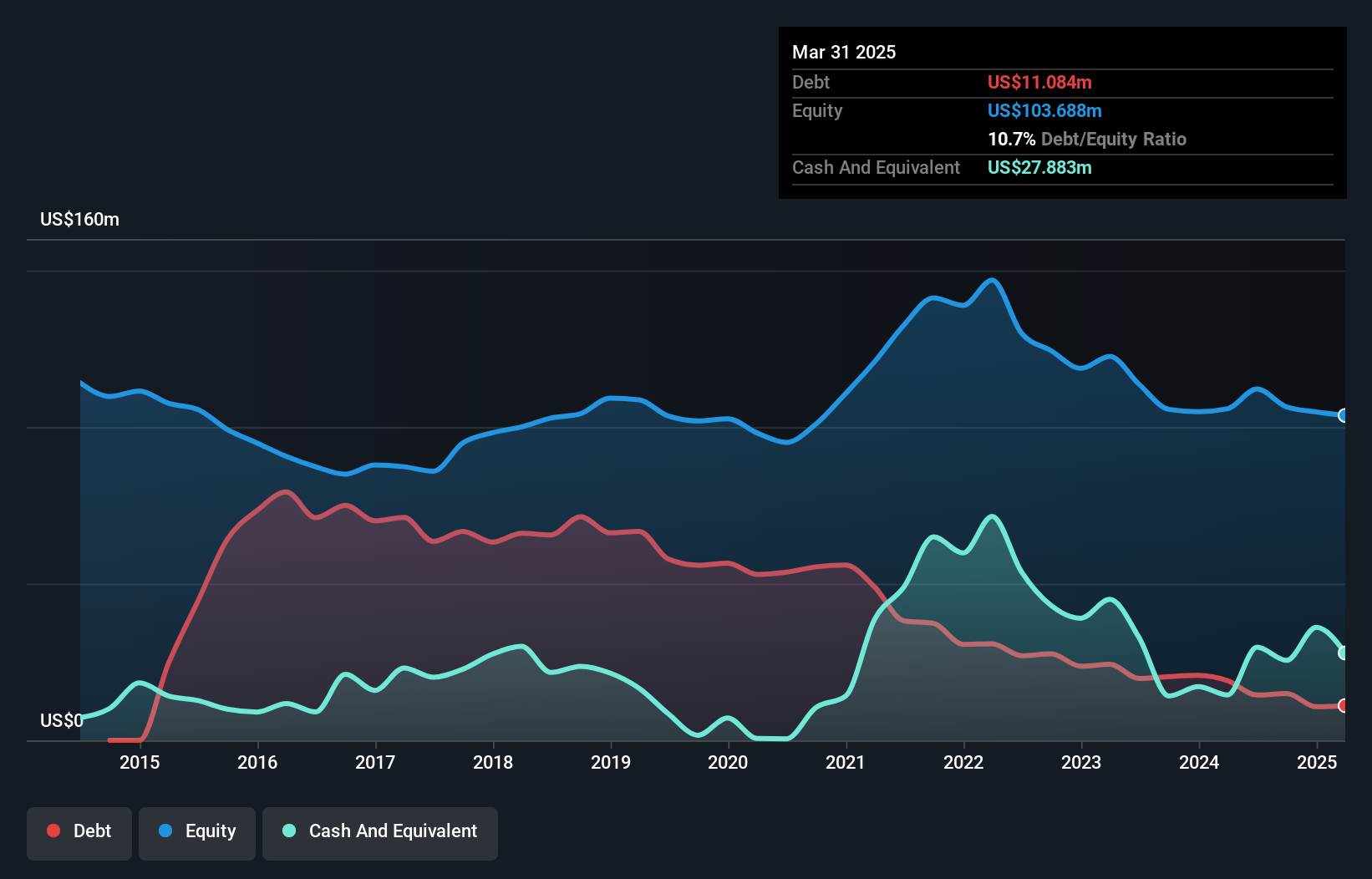

Amerigo Resources Ltd., with a market cap of CA$710.04 million, operates through Minera Valle Central S.A., producing copper and molybdenum concentrates in Chile. The company's financials reflect a stable position, with more cash than debt and operating cash flow well covering its obligations. Despite a low return on equity of 18.6% and declining profit margins, Amerigo's revenues are forecast to grow by 10.22% annually. Recent developments include being added to the S&P/TSX Global Mining Index and announcing a share repurchase program for up to 7.24% of outstanding shares, indicating confidence in its valuation strategy amidst industry volatility.

- Click here to discover the nuances of Amerigo Resources with our detailed analytical financial health report.

- Understand Amerigo Resources' earnings outlook by examining our growth report.

Rio2 (TSX:RIO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rio2 Limited is involved in the exploration, development, and mining of mineral properties across Canada, Peru, Bahamas, and Chile with a market cap of CA$1.41 billion.

Operations: There are no revenue segments reported for Rio2 Limited.

Market Cap: CA$1.41B

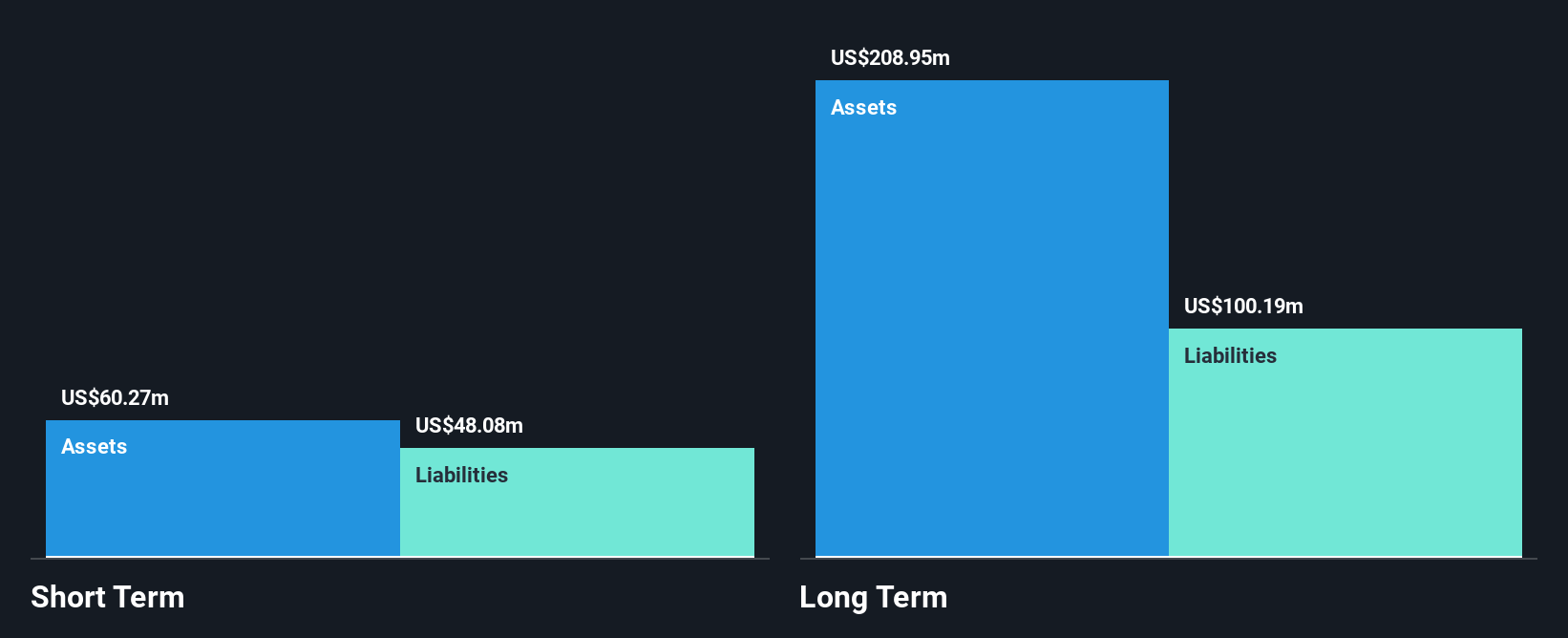

Rio2 Limited, with a market cap of CA$1.41 billion, is pre-revenue and debt-free, which simplifies its financial structure. The company has recently completed a follow-on equity offering and announced plans to acquire a significant interest in the Condestable mine in Peru, enhancing its portfolio with copper production potential. Additionally, Rio2's Fenix Gold Project is nearing completion with first gold production expected soon. Despite limited revenue streams currently, these strategic moves highlight Rio2's focus on expanding its mining operations and capitalizing on growth opportunities within established jurisdictions like Chile and Peru.

- Unlock comprehensive insights into our analysis of Rio2 stock in this financial health report.

- Gain insights into Rio2's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Navigate through the entire inventory of 393 TSX Penny Stocks here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报