Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

As the U.S. stock market continues to reach new heights, with the S&P 500 setting all-time records, investors are increasingly interested in exploring opportunities beyond large-cap stocks. Amidst this backdrop of strong market performance and economic indicators, identifying promising small-cap stocks can offer potential for growth, particularly when these companies demonstrate solid fundamentals and insider confidence through recent buying activity.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.8x | 2.6x | 48.74% | ★★★★★★ |

| First United | 10.2x | 3.1x | 42.96% | ★★★★★☆ |

| Shore Bancshares | 10.6x | 2.8x | 39.92% | ★★★★☆☆ |

| Union Bankshares | 9.5x | 2.1x | 21.74% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.4x | 6.2x | 43.79% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -90.27% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.6x | 5.2x | 34.92% | ★★★☆☆☆ |

| MVB Financial | 10.3x | 2.0x | -10.87% | ★★★☆☆☆ |

| Omega Flex | 18.4x | 3.0x | 0.99% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -9.73% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

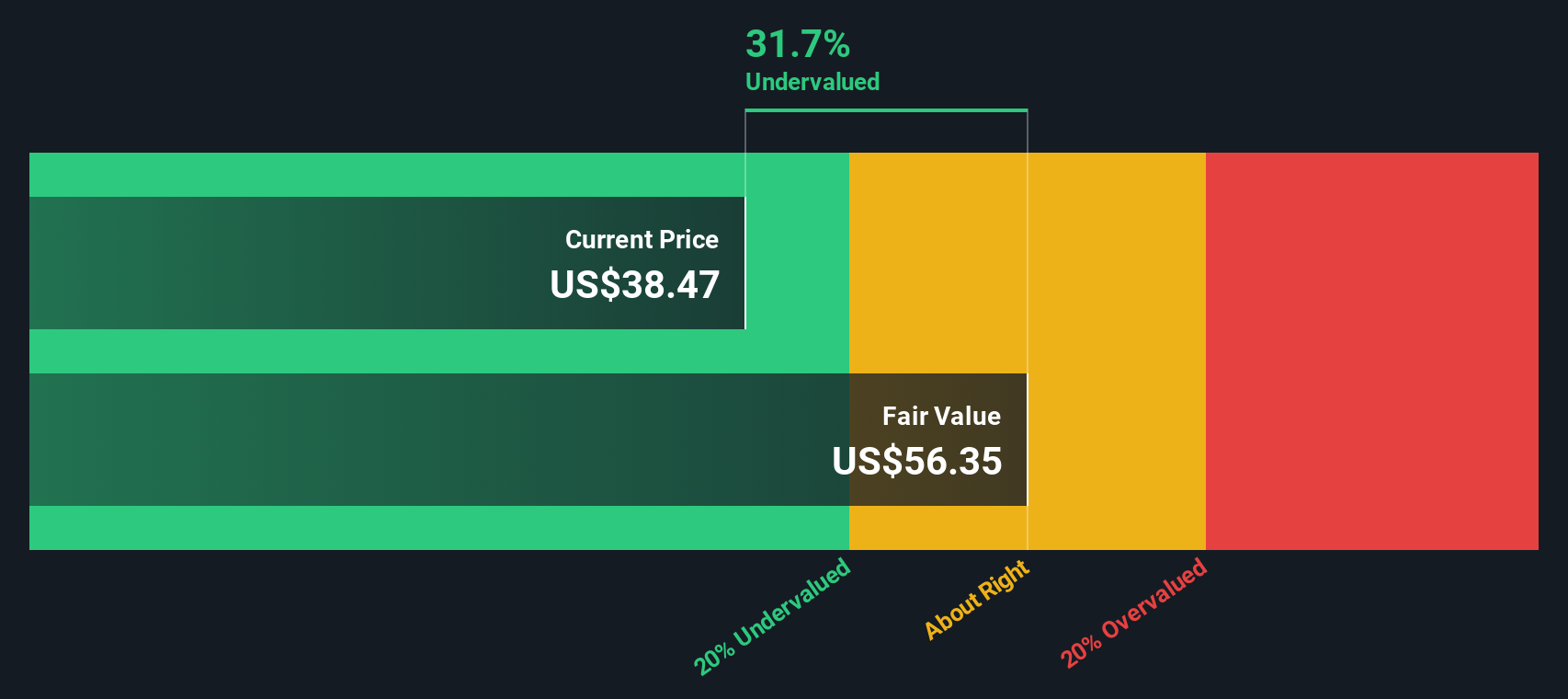

FMC (FMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: FMC is a global agricultural sciences company that provides innovative solutions for crop protection, with a market cap of $13.22 billion.

Operations: FMC's revenue is primarily derived from its Innovative Solutions segment, which amounted to $3.61 billion. The company's cost of goods sold (COGS) was $2.23 billion, resulting in a gross profit of $1.38 billion and a gross profit margin of 38.15%. Operating expenses include R&D costs, with recent figures showing an allocation of approximately $270.6 million towards research and development activities.

PE: -3.5x

FMC, a smaller player in the market, has seen its share price fluctuate significantly over the past three months. Despite this volatility, insider confidence is evident with recent purchases indicating potential value recognition. However, financial challenges persist as interest payments aren't well covered by earnings and liabilities are entirely funded through external borrowing. Recent amendments to their credit agreement aim to manage leverage and dividend constraints until December 2028. With projected earnings growth of 65.93% annually, FMC's future prospects remain intriguing despite current setbacks.

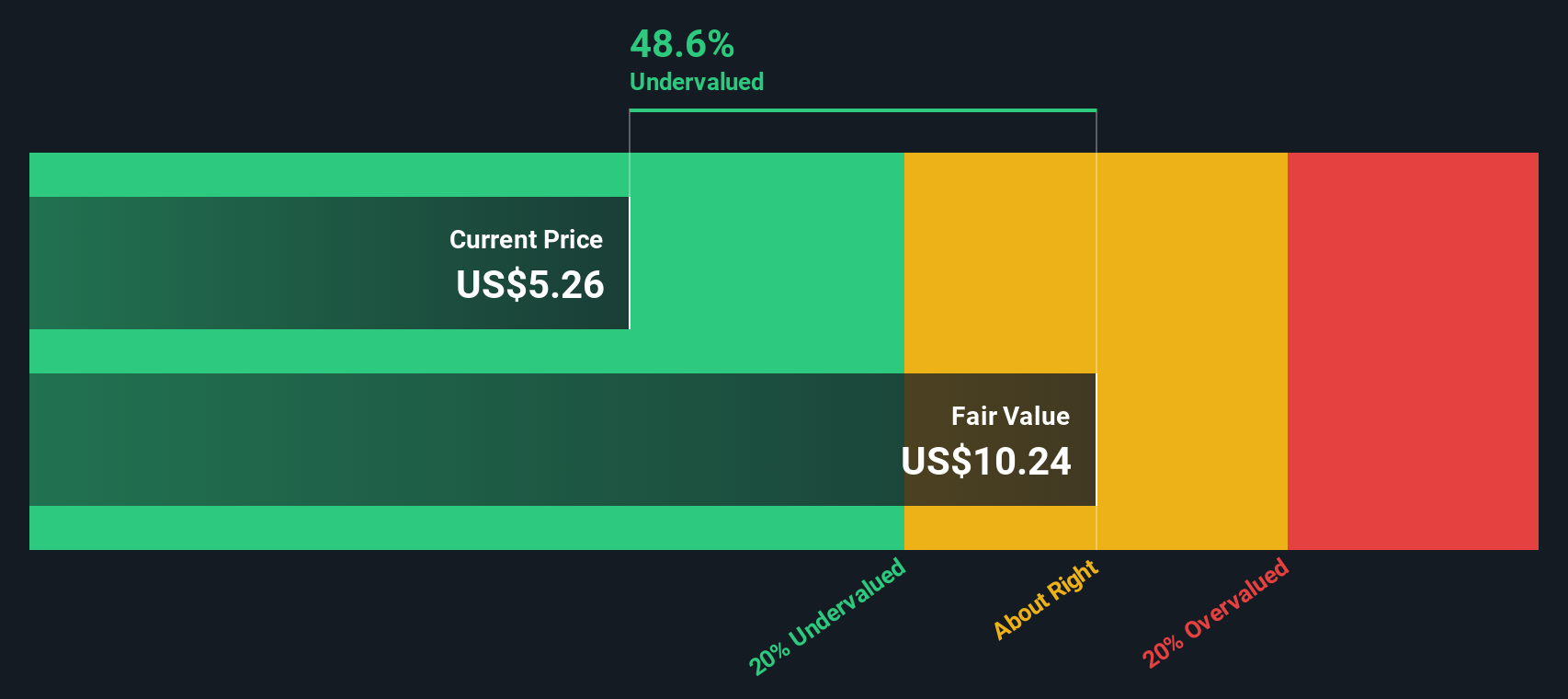

Granite Ridge Resources (GRNT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Granite Ridge Resources is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of $1.52 billion.

Operations: Granite Ridge Resources generates revenue primarily from oil and natural gas development, exploration, and production, with recent quarterly revenue reaching $427.83 million. The company's cost of goods sold (COGS) has increased to $80.33 million in the latest quarter, impacting its gross profit margin which stands at 81.22%. Operating expenses are substantial at $230.93 million, contributing to a net income of $37.49 million for the same period.

PE: 16.3x

Granite Ridge Resources, a small-cap company in the U.S., exhibits potential for value with insider confidence shown through recent share purchases. Despite facing financial challenges like high debt and reliance on external borrowing, Granite's earnings have improved, reporting US$14.52 million net income for Q3 2025 versus US$9.05 million a year ago. Their involvement in Conduit Power's natural gas project highlights strategic growth opportunities in Texas' energy sector, aiming to enhance grid reliability by 2026.

- Get an in-depth perspective on Granite Ridge Resources' performance by reading our valuation report here.

Assess Granite Ridge Resources' past performance with our detailed historical performance reports.

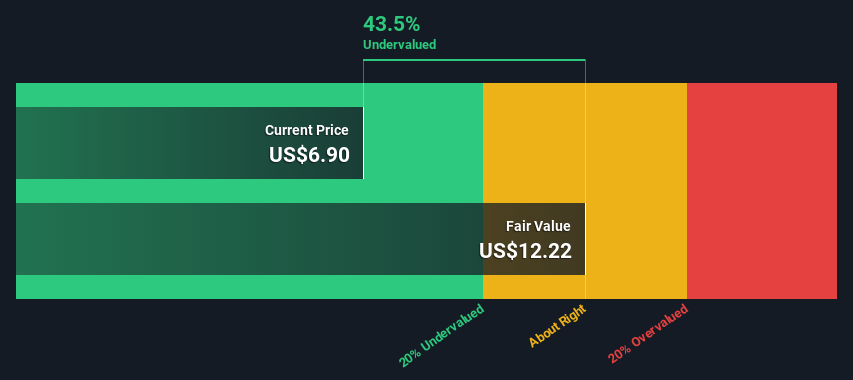

Herbalife (HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements, personal care products, and weight management solutions, with a market capitalization of approximately $1.27 billion.

Operations: India and the United States are key markets, contributing $857.70 million and $1.01 billion respectively to revenue, while Mexico adds $534 million. The gross profit margin has shown a range from 43.92% to 53.32% over recent periods, indicating variability in cost management relative to revenue generation. Operating expenses are primarily driven by general and administrative costs, with fluctuations impacting net income margins which have varied between 1.63% and 9.28%.

PE: 4.6x

Herbalife, a player in the nutrition industry, has seen insider confidence with recent share purchases. Despite a challenging financial position where interest payments aren't well-covered by earnings and forecasts suggest declining earnings over the next three years, the company continues to innovate. Their Liftoff energy line expansion taps into a growing US$41.4 billion energy drink market projected for 2033. Recent investments include a US$7 million Center of Excellence in California to bolster product development and quality assurance efforts.

- Delve into the full analysis valuation report here for a deeper understanding of Herbalife.

Gain insights into Herbalife's past trends and performance with our Past report.

Make It Happen

- Get an in-depth perspective on all 80 Undervalued US Small Caps With Insider Buying by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报