Three Companies Estimated To Be Trading Below Their Intrinsic Value

As the U.S. stock market continues to reach new heights, with major indices like the S&P 500 setting all-time records, investors are increasingly looking for opportunities that may be overlooked in this bullish environment. In such a climate, identifying stocks trading below their intrinsic value can offer potential avenues for growth and diversification amidst the prevailing optimism.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.86 | $52.57 | 48.9% |

| UMB Financial (UMBF) | $118.90 | $233.12 | 49% |

| Sportradar Group (SRAD) | $23.11 | $45.56 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $31.57 | $61.45 | 48.6% |

| Perfect (PERF) | $1.75 | $3.42 | 48.9% |

| Nicolet Bankshares (NIC) | $124.56 | $242.21 | 48.6% |

| Community West Bancshares (CWBC) | $22.74 | $44.11 | 48.4% |

| Columbia Banking System (COLB) | $28.62 | $56.93 | 49.7% |

| Clearfield (CLFD) | $29.43 | $58.37 | 49.6% |

| BioLife Solutions (BLFS) | $25.41 | $49.94 | 49.1% |

Let's dive into some prime choices out of the screener.

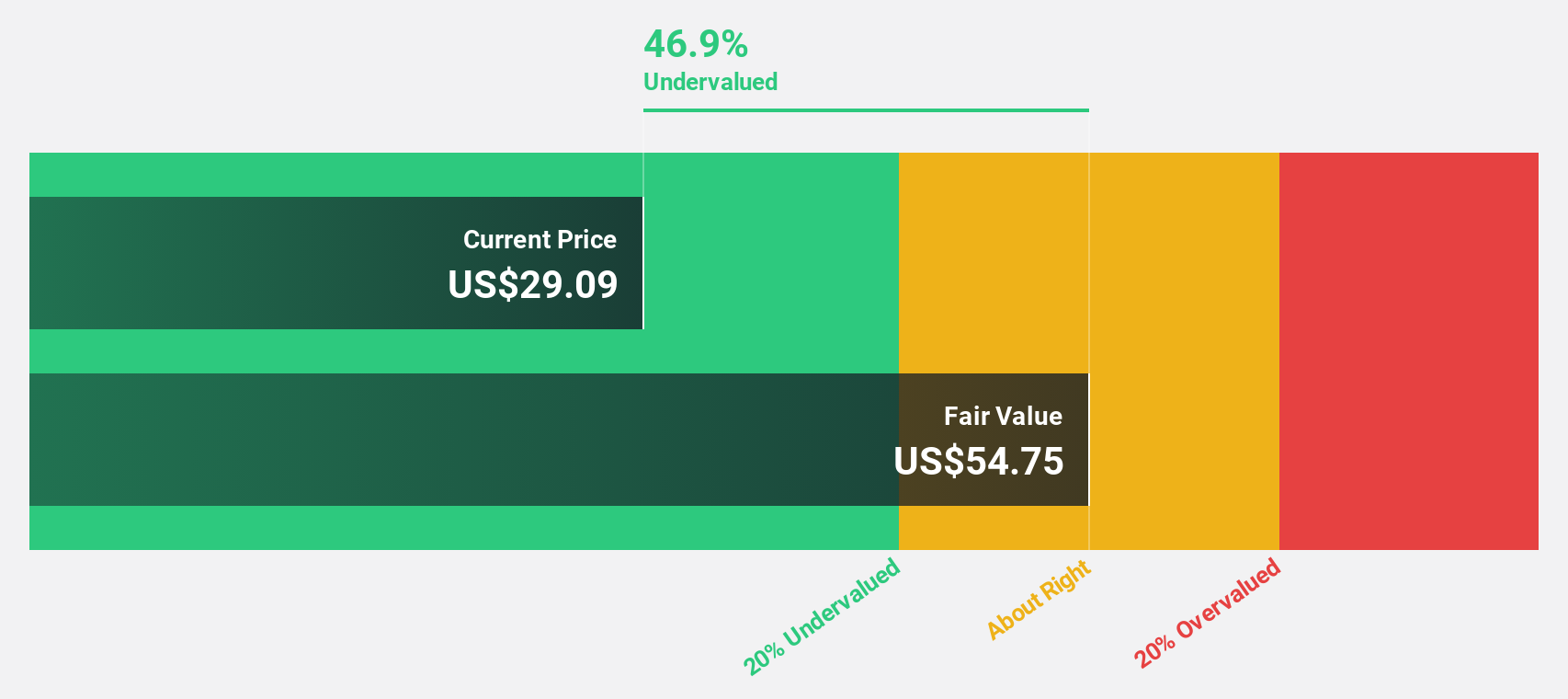

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic solar energy solutions across the United States, France, India, Chile, and other international markets with a market cap of approximately $29.21 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of CdTe solar modules, totaling $5.05 billion.

Estimated Discount To Fair Value: 42.6%

First Solar is trading at a significant discount to its estimated fair value of US$474.6, with shares priced at US$272.21. The company's earnings are projected to grow significantly over the next three years, outpacing the broader U.S. market's growth rate. Recent expansions include a $1.1 billion facility in Louisiana and a new South Carolina plant, enhancing its manufacturing capacity and supporting robust revenue growth forecasts of 11.5% annually, despite insider selling concerns.

- In light of our recent growth report, it seems possible that First Solar's financial performance will exceed current levels.

- Take a closer look at First Solar's balance sheet health here in our report.

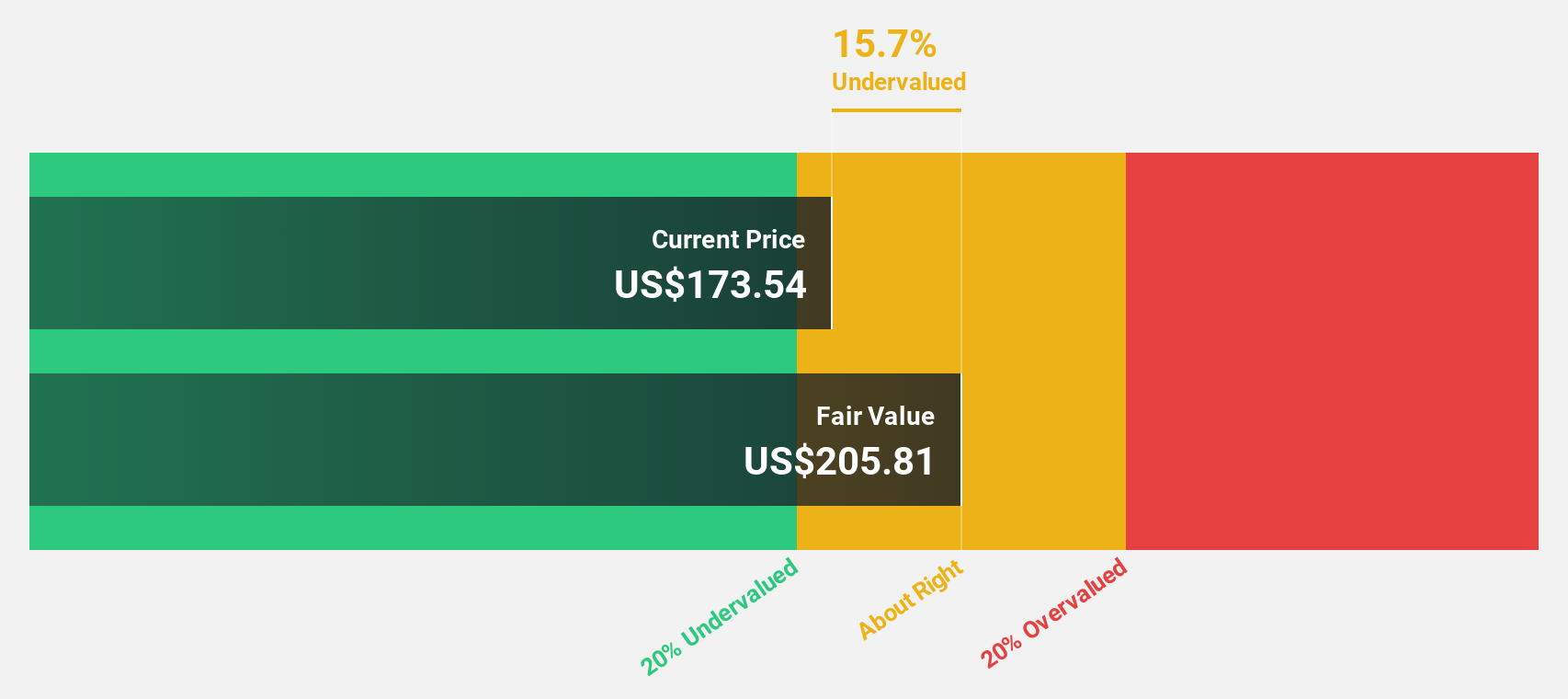

Royal Gold (RGLD)

Overview: Royal Gold, Inc. acquires and manages precious metal streams, royalties, and related interests, with a market cap of approximately $19.67 billion.

Operations: The company's revenue is primarily derived from stream interests amounting to $546.52 million and royalty interests totaling $302.74 million.

Estimated Discount To Fair Value: 13.4%

Royal Gold's shares, priced at US$233.11, are trading below the estimated fair value of US$269.28. The company's earnings grew 67% over the past year and are forecast to grow faster than the U.S. market at 21.2% annually over the next three years. Despite a recent dividend increase to $1.90 per share for 2026, shareholders faced dilution this year, and its return on equity is projected to be low in three years.

- Upon reviewing our latest growth report, Royal Gold's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Royal Gold's balance sheet by reading our health report here.

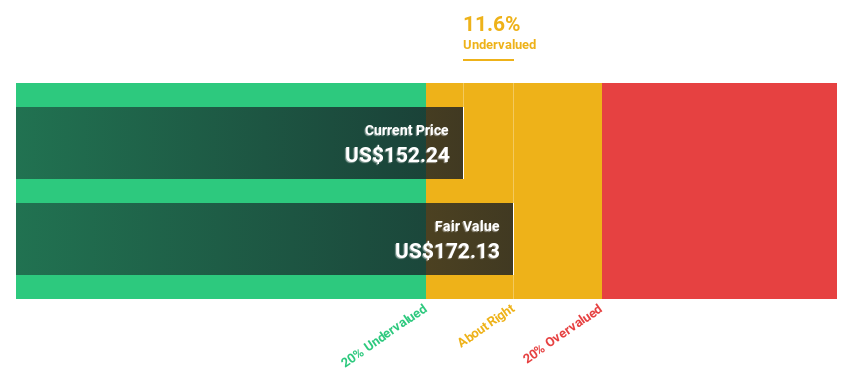

CareTrust REIT (CTRE)

Overview: CareTrust REIT is a self-administered, publicly-traded real estate investment trust focused on owning, acquiring, developing and leasing skilled nursing, senior housing and other healthcare-related properties in the U.S. and U.K., with a market cap of approximately $8.25 billion.

Operations: The company generates revenue from investments in healthcare-related real estate assets amounting to $428.48 million.

Estimated Discount To Fair Value: 37.1%

CareTrust REIT, trading at US$36.95, is significantly undervalued compared to its estimated fair value of US$58.76. Despite past shareholder dilution and a dividend not fully covered by earnings, the company shows strong growth potential with forecasted annual earnings growth of 21.6%. Recent acquisitions in Texas enhance its portfolio diversity and revenue streams, while substantial profit increases over the past year highlight robust operational performance amidst market expansion efforts.

- According our earnings growth report, there's an indication that CareTrust REIT might be ready to expand.

- Unlock comprehensive insights into our analysis of CareTrust REIT stock in this financial health report.

Summing It All Up

- Get an in-depth perspective on all 208 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报