Insider Confidence In December 2025's Leading Growth Companies

As the U.S. stock market continues to reach new heights, with the S&P 500 setting an all-time high and major indices logging consecutive gains, investors are increasingly attracted to companies that demonstrate robust growth potential and strong insider confidence. In this thriving environment, stocks with high insider ownership often signal a deep commitment from those who know the company best, suggesting alignment with shareholder interests and potential resilience in times of market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Let's explore several standout options from the results in the screener.

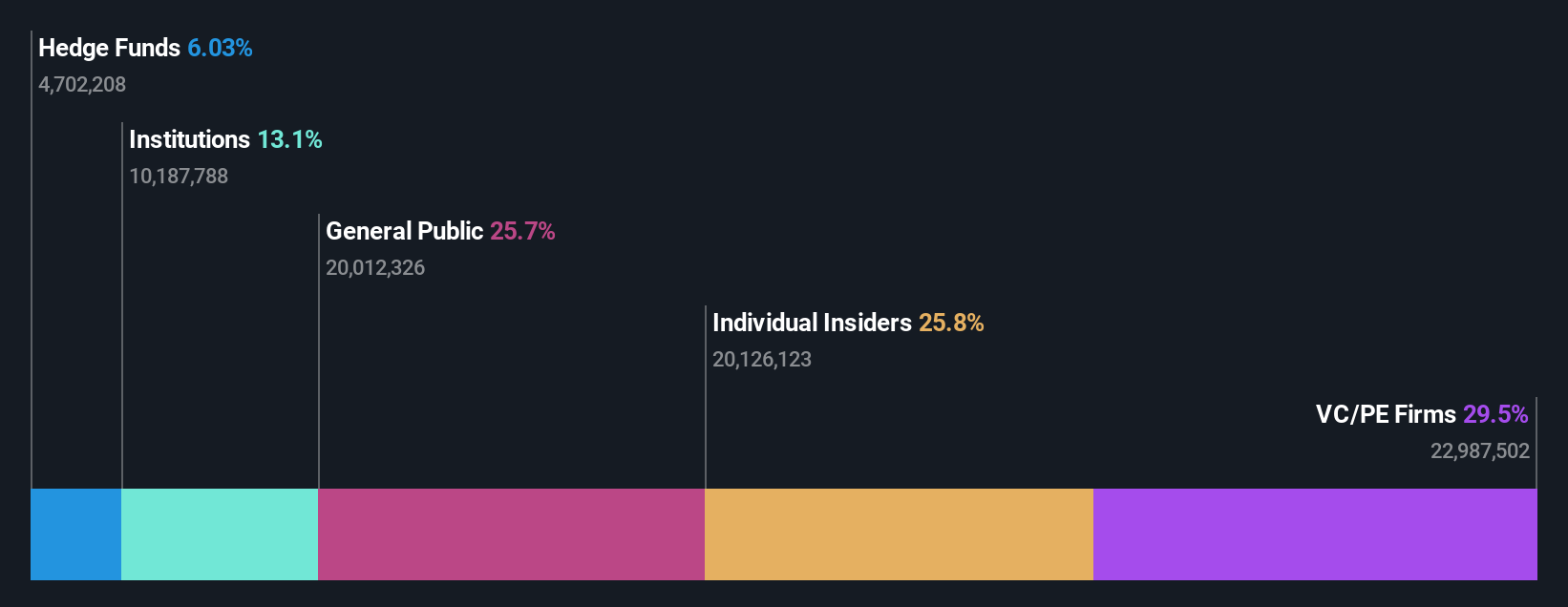

Roivant Sciences (ROIV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Roivant Sciences Ltd. is a clinical-stage biopharmaceutical company dedicated to the discovery, development, and commercialization of medicines and technologies, with a market cap of $15.65 billion.

Operations: The company generates $20.33 million in revenue from its focus on discovering, developing, and commercializing medicines and technologies.

Insider Ownership: 22.3%

Earnings Growth Forecast: 46.4% p.a.

Roivant Sciences, a growth-focused company with high insider ownership, is set to experience significant revenue growth at 58.5% annually, outpacing the US market average. Despite current unprofitability, it is expected to become profitable within three years. Recent updates include promising developments in key drug programs and ongoing litigation with major pharmaceutical companies. The company's second-quarter sales dropped to US$1.57 million from US$4.48 million a year ago, though net losses have narrowed significantly over the same period.

- Get an in-depth perspective on Roivant Sciences' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Roivant Sciences' share price might be too optimistic.

Hinge Health (HNGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hinge Health, Inc. specializes in scaling and automating healthcare service delivery with a market cap of $3.79 billion.

Operations: The company generates revenue of $534.39 million from its healthcare software segment.

Insider Ownership: 25.1%

Earnings Growth Forecast: 103% p.a.

Hinge Health, with high insider ownership, has seen substantial revenue growth of 46.1% over the past year and is forecast to outpace the US market with a 16.5% annual growth rate. Despite recent losses, it's expected to become profitable in three years. Recent additions to major indices and a US$250 million share buyback program highlight confidence in its future prospects. New AI-powered tools further enhance its competitive edge in musculoskeletal care solutions.

- Click here and access our complete growth analysis report to understand the dynamics of Hinge Health.

- The analysis detailed in our Hinge Health valuation report hints at an deflated share price compared to its estimated value.

Neptune Insurance Holdings (NP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Neptune Insurance Holdings Inc., with a market cap of $4.21 billion, operates through its subsidiary Neptune Flood Incorporated as an insurance agency selling residential and commercial flood insurance policies on behalf of carrier partners in the United States.

Operations: Neptune Flood Incorporated generates revenue of $147.29 million from its role as an insurance broker, focusing on residential and commercial flood insurance policies in the United States.

Insider Ownership: 38.4%

Earnings Growth Forecast: 42.7% p.a.

Neptune Insurance Holdings has experienced substantial insider buying over the past three months, reflecting confidence in its growth trajectory. The company is forecast to achieve above-market revenue growth of 15.8% annually and become profitable within three years, despite a recent dip in quarterly net income to US$11.51 million. Its addition to the S&P TMI Index and successful IPO raising US$368 million underscore strong market interest and potential for future expansion.

- Click to explore a detailed breakdown of our findings in Neptune Insurance Holdings' earnings growth report.

- Our valuation report here indicates Neptune Insurance Holdings may be overvalued.

Summing It All Up

- Embark on your investment journey to our 208 Fast Growing US Companies With High Insider Ownership selection here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报