3 European Penny Stocks With Market Caps Under €200M

The pan-European STOXX Europe 600 Index recently saw a rise of 1.60%, buoyed by signs of steady economic growth and looser monetary policy across the continent. As investors navigate these evolving market conditions, penny stocks—often representing smaller or newer companies—continue to capture interest due to their affordability and potential for growth. Despite being considered an outdated term, penny stocks remain relevant as they can offer compelling opportunities when backed by strong financials, providing a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.518 | €1.56B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.75 | €84.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €221.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.00 | SEK182.52M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0718 | €7.72M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 295 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) offers media network solutions globally and has a market cap of approximately SEK1.31 billion.

Operations: The company generates revenue primarily from its Media Networks segment, which accounts for SEK537.80 million.

Market Cap: SEK1.31B

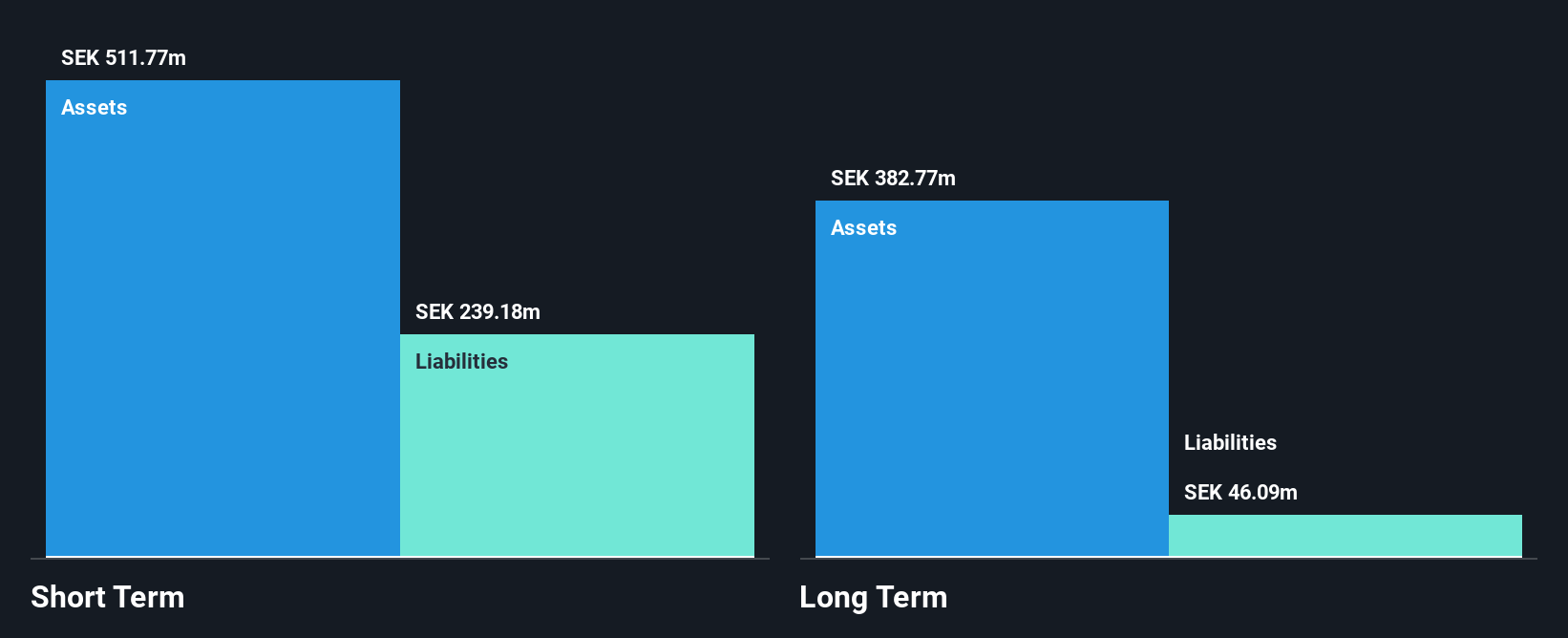

Net Insight AB has shown resilience as a penny stock with its recent strategic moves, including the first commercial deployment of its 400G IP solution for a major North American sports broadcaster. This supports the company's focus on high-capacity media transport solutions. Despite experiencing negative earnings growth over the past year, Net Insight remains debt-free and has not diluted shareholders recently. The management team is experienced, and short-term assets significantly outweigh liabilities. However, profit margins have declined from previous years, indicating potential challenges ahead despite forecasts of strong future earnings growth.

- Unlock comprehensive insights into our analysis of Net Insight stock in this financial health report.

- Examine Net Insight's earnings growth report to understand how analysts expect it to perform.

Precise Biometrics (OM:PREC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Precise Biometrics AB (publ) specializes in cybersecurity and biometric solutions across Sweden, Taiwan, China, the United States, and other international markets, with a market cap of SEK184.16 million.

Operations: The company's revenue segments include Digital Identity, generating SEK21.21 million, and Biometric Technologies, contributing SEK61.38 million.

Market Cap: SEK184.16M

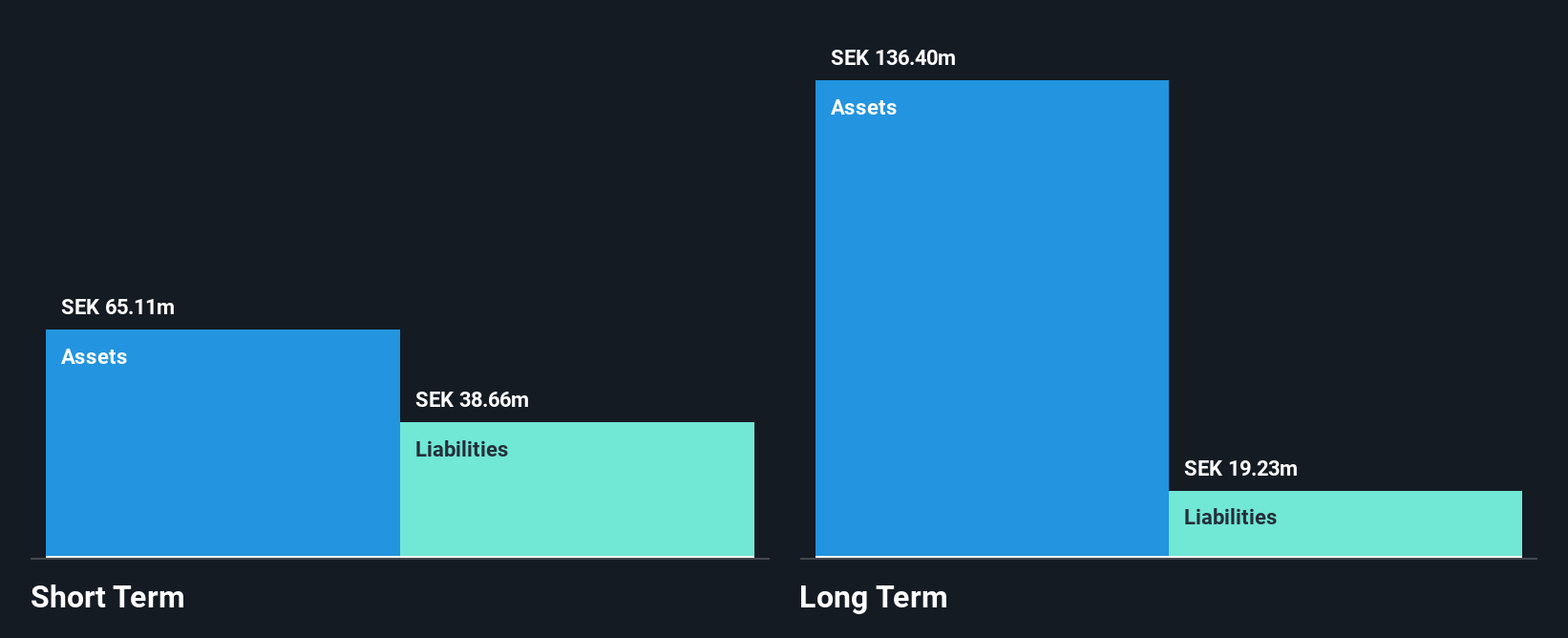

Precise Biometrics AB is actively enhancing its biometric solutions, highlighted by the introduction of BioMatch Vizo, which offers improved accuracy and security for fingerprint recognition. The company remains debt-free with a stable cash runway exceeding three years. Despite recent revenue declines and unprofitability, Precise's strategic partnerships and product innovations position it for potential growth in biometric authentication markets. Recent collaborations with SecuGen and Avigilon enhance its offerings in national ID programs and access control systems. While volatility remains high, the management team is experienced, ensuring adept navigation through market challenges while maintaining shareholder value without dilution.

- Click to explore a detailed breakdown of our findings in Precise Biometrics' financial health report.

- Learn about Precise Biometrics' historical performance here.

elumeo (XTRA:ELB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: elumeo SE, with a market cap of €13.51 million, is involved in the design, procurement, and distribution of gemstone jewelry through its subsidiaries.

Operations: The company's revenue is primarily generated from its Jewelry & Watches segment, amounting to €41.12 million.

Market Cap: €13.51M

elumeo SE, with a market cap of €13.51 million, is navigating challenges as it remains unprofitable and forecasts a revenue decline of 10% to 15% for 2025. Despite this, the company has sufficient cash runway for over three years, supported by positive free cash flow. Its short-term assets exceed both short and long-term liabilities, providing financial flexibility. While the debt to equity ratio has risen to 44.7% over five years, elumeo's cash reserves surpass total debt. The stock trades at a significant discount to its estimated fair value, though earnings growth remains elusive amidst industry pressures.

- Click here to discover the nuances of elumeo with our detailed analytical financial health report.

- Gain insights into elumeo's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Dive into all 295 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报