European Growth Stocks Insiders Are Banking On

The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 1.60%, supported by steady economic growth and a favorable monetary policy environment. As investors navigate this landscape, growth companies with high insider ownership often stand out as they suggest confidence from those closest to the business, potentially aligning well with market conditions that favor strategic long-term investments.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's uncover some gems from our specialized screener.

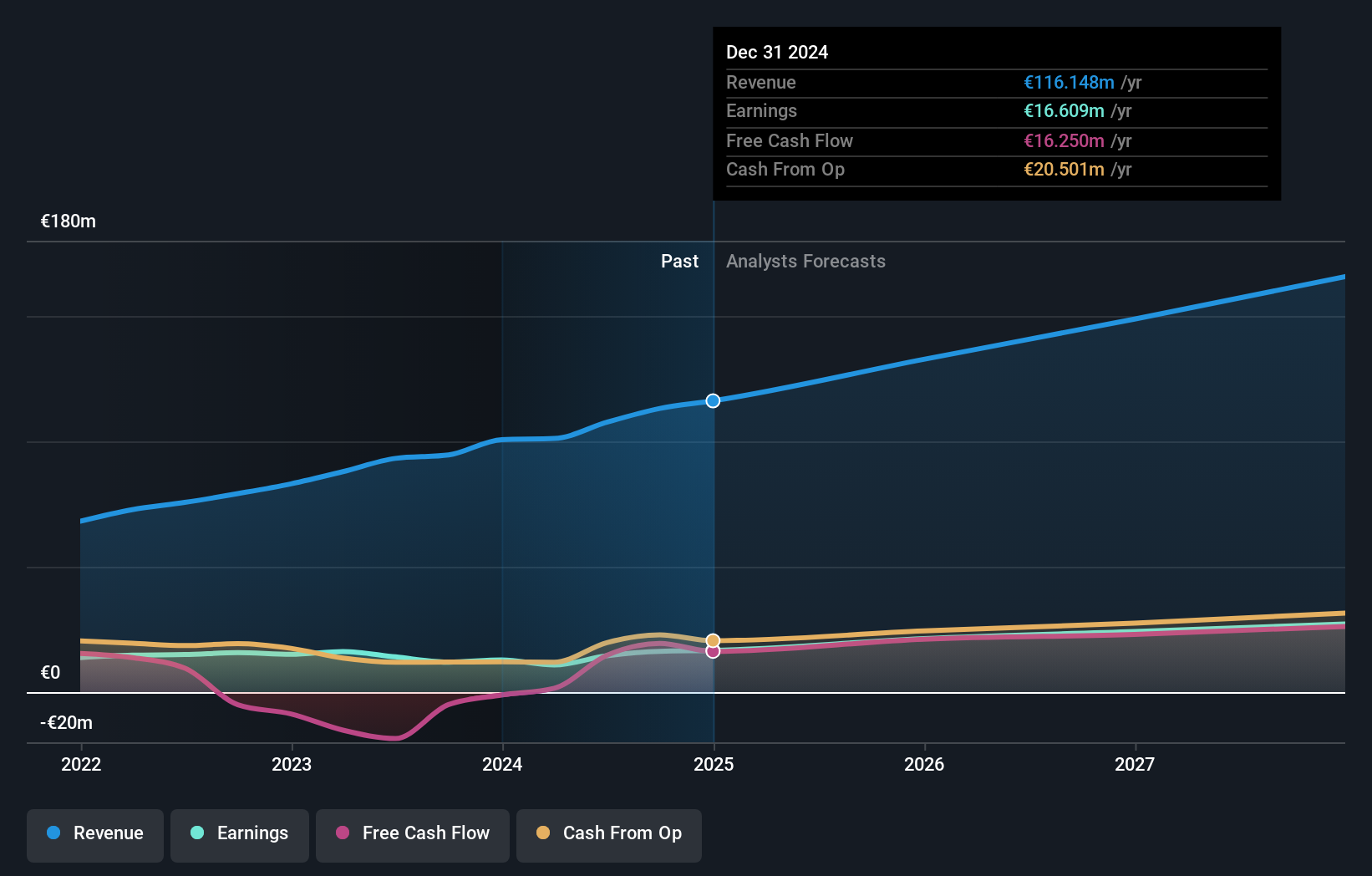

Pharmanutra (BIT:PHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on researching, designing, developing, and marketing nutritional supplements and medical devices across Italy, Europe, the Middle East, South America, the Far East, and internationally with a market cap of €515.69 million.

Operations: The company's revenue segments include €75.15 million from Italy, €44.66 million from the Rest of the World, and €6.82 million from Medical Instruments.

Insider Ownership: 10.8%

Pharmanutra shows strong growth potential, with earnings forecasted to grow significantly at 20.2% annually, outpacing the Italian market's 9.9%. Recent earnings results highlight a positive trajectory, with net income rising to €14.01 million for the nine months ended September 2025. Despite a volatile share price and a dividend not well covered by free cash flows, analysts agree on a potential stock price increase of over 50%. The company benefits from high insider ownership, aligning management interests with shareholders'.

- Click here and access our complete growth analysis report to understand the dynamics of Pharmanutra.

- Our expertly prepared valuation report Pharmanutra implies its share price may be too high.

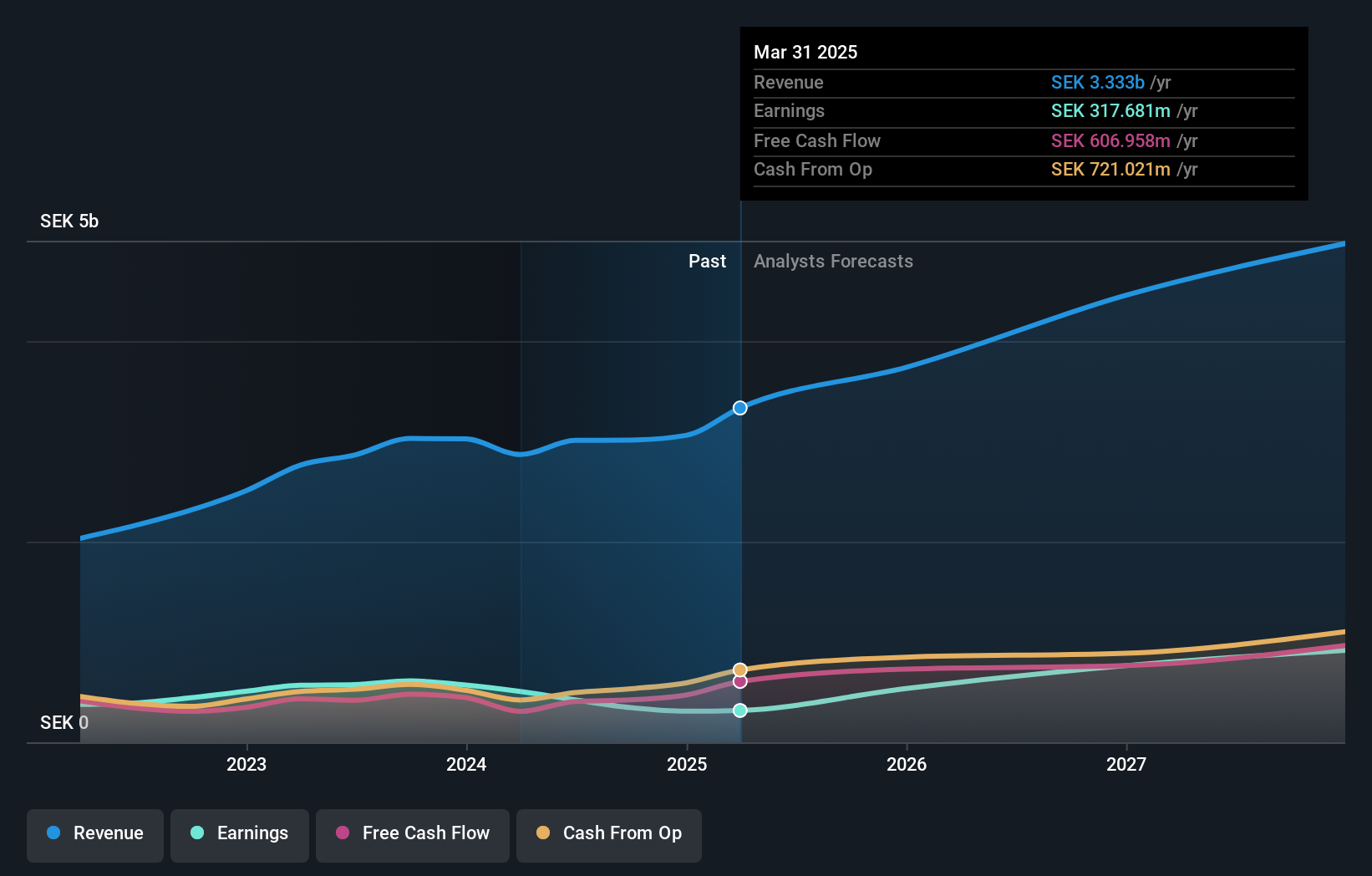

GomSpace Group (OM:GOMX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GomSpace Group AB (publ) operates through its subsidiaries to manufacture and sell nanosatellites, components, and turnkey satellite solutions across various regions including Europe, the United States, and Asia, with a market cap of SEK2.68 billion.

Operations: GomSpace Group generates revenue by manufacturing and selling nanosatellites, components, and comprehensive satellite solutions across Denmark, Sweden, France, the rest of Europe, the United States, Asia, and other international markets.

Insider Ownership: 27%

GomSpace Group is experiencing robust growth, with revenue projected to increase at 28.6% annually, surpassing the Swedish market's 3.9%. Recent contracts with the European Space Agency enhance its technological leadership and support its forecasted earnings growth of 120.89% per year. Despite past shareholder dilution and a volatile share price, GomSpace's valuation is attractive at 54.6% below estimated fair value, while raised revenue guidance for 2025 underscores strong performance expectations.

- Delve into the full analysis future growth report here for a deeper understanding of GomSpace Group.

- According our valuation report, there's an indication that GomSpace Group's share price might be on the expensive side.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing among industrial equipment globally, with a market cap of SEK20.73 billion.

Operations: HMS Networks generates revenue through its products that enable communication and information exchange among industrial equipment on a global scale.

Insider Ownership: 12.3%

HMS Networks is poised for growth, with earnings projected to rise 23% annually, outpacing the Swedish market's 13.6%. Recent earnings reports show strong performance, with Q3 sales at SEK 894 million and net income increasing significantly from the previous year. The company plans strategic acquisitions to bolster growth alongside organic expansion. Despite high debt levels and moderate insider buying, HMS maintains a solid position in the European market landscape.

- Unlock comprehensive insights into our analysis of HMS Networks stock in this growth report.

- In light of our recent valuation report, it seems possible that HMS Networks is trading beyond its estimated value.

Next Steps

- Get an in-depth perspective on all 211 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Contemplating Other Strategies? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报